|

市场调查报告书

商品编码

1665015

莱姆病检测市场机会、成长动力、产业趋势分析与预测 2025 - 2034Lyme Disease Testing Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

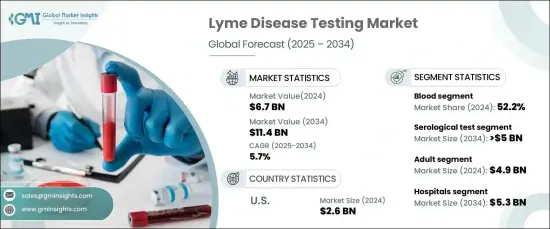

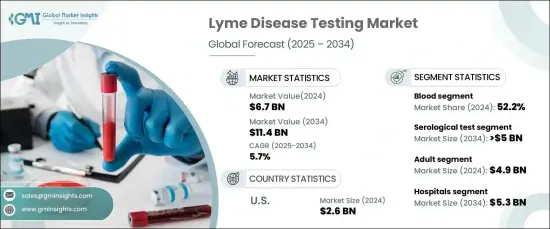

预计全球莱姆病检测市场规模将在 2024 年达到 67 亿美元,预计 2025 年至 2034 年期间的复合年增长率为 5.7%。人们越来越意识到未经治疗的莱姆病会产生严重的长期影响,例如神经系统和肌肉骨骼併发症,这推动了对早期诊断和及时治疗的需求,从而进一步扩大了市场。

诊断技术的重大进步,包括即时诊断(POC)测试和家用测试套件的广泛采用,正在重塑市场。这些创新的解决方案提供了快速、方便的诊断选项,促进早期发现和干预,并鼓励个人儘早采取行动。政府和卫生组织支持的公共卫生措施和教育活动对于提高人们的认识和提倡定期检测至关重要。此外,蜱传疾病研究资金的不断增加也推动了创新并促进了市场进一步成长。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 67亿美元 |

| 预测值 | 114亿美元 |

| 复合年增长率 | 5.7% |

在诊断技术方面,市场分为几个部分,包括血清学检测、核酸检测、淋巴细胞转化检测、尿液抗原检测和免疫萤光染色。血清学测试领域预计将经历最高的成长,预计复合年增长率为 6.2%,到 2034 年将产生 50 亿美元的产值。酵素连结免疫吸附试验 (ELISA) 和蛋白质印迹法等测试对检测伯氏疏螺旋体抗体非常有效,确保其作为莱姆病检测最广泛使用和最值得信赖的方法的地位。

市场也按样本类型分类,包括血液、尿液、脑脊髓液 (CSF) 和其他基于血液的样本。 2024 年,血液样本部分占据 52.2% 的市场份额,预计在整个预测期内将保持其主导地位。血液样本被认为是莱姆病检测的黄金标准,因为它们在检测抗体和细菌 DNA 方面具有很高的准确度。这使得它们成为临床和实验室环境的首选,提供简单、非侵入性的诊断方法。

在美国,莱姆病检测市场价值将于 2024 年达到 26 亿美元,预测期内将强劲成长。莱姆病发生率高,加上气候变迁和蜱虫活动增加导致的地理分布广泛,推动了对检测服务的需求。在卫生组织的支持下,公众意识的不断增强正在鼓励人们采取更积极主动的方式进行莱姆病筛检。因此,医疗保健提供者越来越重视莱姆病检测,特别是在高风险地区,从而促进该地区市场的持续成长。

目录

第 1 章:方法论与范围

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 莱姆病患病率不断上升

- 诊断技术的进步

- 家庭检测试剂盒的采用率不断上升

- 即时诊断检测的成长

- 人工智慧(AI)集成

- 产业陷阱与挑战

- 进阶诊断测试成本高昂

- 缺乏标准化测验指南

- 成长动力

- 成长潜力分析

- 监管格局

- 报销场景

- 技术格局

- 差距分析

- 波特的分析

- PESTEL 分析

- 价值链分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

第 5 章:市场估计与预测:按诊断技术,2021 年至 2034 年

- 主要趋势

- 血清学检测

- 酵素连结免疫吸附试验

- 蛋白质印迹法

- 核酸检测

- 尿液抗原检测

- 淋巴球转化试验

- 免疫萤光染色

第六章:市场估计与预测:依样本类型,2021 – 2034 年

- 主要趋势

- 血

- 尿

- 脑脊髓液

- 其他血液样本

第 7 章:市场估计与预测:按病患类型,2021 – 2034 年

- 主要趋势

- 成人

- 儿科

第 8 章:市场估计与预测:依最终用途,2021 年至 2034 年

- 主要趋势

- 医院

- 诊断实验室

- 其他最终用途

第 9 章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十章:公司简介

- bioMérieux

- Bio-Rad Laboratories

- Ceres Nanosciences

- DiaSorin

- Galaxy Diagnostics

- Gold Standard Diagnostics

- IGeneX

- Oxford Immunotec

- T2 Biosystems

- Thermo Fisher Scientific

- Trinity Biotech

- ZEUS Scientific

The Global Lyme Disease Testing Market is expected to reach USD 6.7 billion in 2024 and is projected to grow at a CAGR of 5.7% from 2025 to 2034. This growth is primarily driven by the increasing prevalence of Lyme disease in regions like North America and parts of Europe, where the infection is most common. Rising awareness of the serious long-term effects of untreated Lyme disease, such as neurological and musculoskeletal complications, has fueled the demand for early diagnosis and prompt treatment, further expanding the market.

Significant advancements in diagnostic technologies, including the widespread adoption of point-of-care (POC) tests and at-home testing kits, are reshaping the market. These innovative solutions offer quick and convenient diagnostic options that promote early detection and intervention, encouraging individuals to take action sooner. Public health initiatives and educational campaigns supported by government and health organizations have been crucial in raising awareness and advocating for regular testing. Additionally, the growing funding for research on tick-borne diseases is driving innovation and fueling further growth within the market.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $6.7 Billion |

| Forecast Value | $11.4 Billion |

| CAGR | 5.7% |

In terms of diagnostic technology, the market is divided into several segments, including serological tests, nucleic acid tests, lymphocytic transformation tests, urine antigen testing, and immunofluorescent staining. The serological test segment is poised to experience the highest growth, with a projected CAGR of 6.2%, generating USD 5 billion by 2034. This growth is primarily attributed to the increasing adoption of serological tests, driven by technological advancements that have enhanced their reliability and effectiveness. Tests such as enzyme-linked immunosorbent assay (ELISA) and Western blot are highly effective at detecting Borrelia burgdorferi antibodies, securing their position as the most widely used and trusted method for Lyme disease detection.

The market is also categorized by sample type, including blood, urine, cerebrospinal fluid (CSF), and other blood-based samples. In 2024, the blood sample segment accounted for a 52.2% share of the market and is expected to maintain its dominant position throughout the forecast period. Blood samples are considered the gold standard for Lyme disease testing due to their high accuracy in detecting both antibodies and bacterial DNA. This makes them the preferred choice in clinical and laboratory settings, offering a simple and non-invasive diagnostic method.

In the U.S., the Lyme disease testing market, valued at USD 2.6 billion in 2024, is poised for strong growth during the forecast period. The high incidence of Lyme disease, combined with its geographical spread due to climate change and increased tick activity, is driving demand for testing services. Growing public awareness, supported by health organizations, is encouraging more proactive approaches to Lyme disease screening. As a result, healthcare providers are increasingly prioritizing Lyme disease testing, especially in high-risk areas, contributing to sustained market growth in the region.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing prevalence of Lyme disease

- 3.2.1.2 Advancements in diagnostic technologies

- 3.2.1.3 Rising adoption of at-home test kits

- 3.2.1.4 Growth in point-of-care testing

- 3.2.1.5 Integration of artificial intelligence (AI)

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of advanced diagnostic tests

- 3.2.2.2 Lack of standardized testing guidelines

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Reimbursement scenario

- 3.6 Technology landscape

- 3.7 Gap analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

- 3.10 Value chain analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Diagnostic Technology, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Serological test

- 5.2.1 ELISA

- 5.2.2 Western blot

- 5.3 Nucleic acid test

- 5.4 Urine antigen testing

- 5.5 Lymphocytic transformation test

- 5.6 Immunofluorescent staining

Chapter 6 Market Estimates and Forecast, By Sample Type, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Blood

- 6.3 Urine

- 6.4 CSF

- 6.5 Other blood samples

Chapter 7 Market Estimates and Forecast, By Patient Type, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Adult

- 7.3 Pediatric

Chapter 8 Market Estimates and Forecast, By End Use, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Hospitals

- 8.3 Diagnostic laboratories

- 8.4 Other end use

Chapter 9 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 bioMérieux

- 10.2 Bio-Rad Laboratories

- 10.3 Ceres Nanosciences

- 10.4 DiaSorin

- 10.5 Galaxy Diagnostics

- 10.6 Gold Standard Diagnostics

- 10.7 IGeneX

- 10.8 Oxford Immunotec

- 10.9 T2 Biosystems

- 10.10 Thermo Fisher Scientific

- 10.11 Trinity Biotech

- 10.12 ZEUS Scientific