|

市场调查报告书

商品编码

1665032

装袋机市场机会、成长动力、产业趋势分析与 2024 - 2032 年预测Bagging Machines Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2024 - 2032 |

||||||

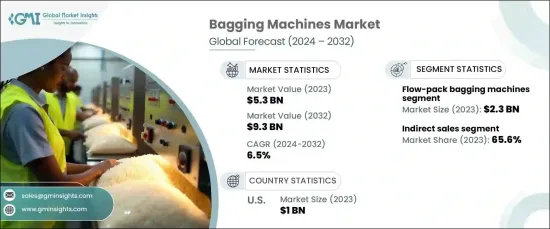

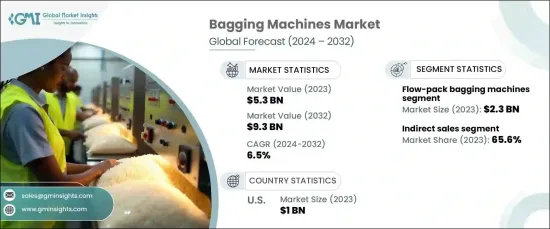

2023 年全球装袋机市场价值为 53 亿美元,预计在 2024 年至 2032 年期间将以 6.5% 的强劲复合年增长率增长。市场依产品类型细分,包括流动包装袋装机、条状包装袋装机、重量包装袋装机、真空包装袋装机等。

2023 年,流动包装袋装机引领市场,为总市场价值贡献了 23 亿美元。预计到 2032 年,这一领域的复合年增长率将达到 6.6%,这得益于其在处理不同包装需求方面的适应性和效率。这些机器对于包装从食品到医疗设备等各种产品至关重要,它们使用可实现客製化设计的灵活材料。它们的高速和可靠性使其成为大规模生产的理想选择,而自动化和物联网整合的进步进一步增强了它们的功能,满足了对智慧包装解决方案日益增长的需求。

| 市场范围 | |

|---|---|

| 起始年份 | 2023 |

| 预测年份 | 2024-2032 |

| 起始值 | 53亿美元 |

| 预测值 | 93亿美元 |

| 复合年增长率 | 6.5% |

市场也按分销管道分类,包括直接销售和间接销售。 2023年,间接销售领域占据主导地位,占约65.6%的市场。预计预测期内该部分的复合年增长率为 6.6%。分销商、经销商和第三方供应商等中间商在弥合製造商和最终用户之间的差距方面发挥关键作用,尤其是在新兴市场。透过管理物流、提供在地化专业知识和客户支持,这些管道使製造商能够专注于生产和创新,同时接触更广泛的客户群。

2023 年,美国装袋机市场规模达 10 亿美元,预计到 2032 年复合年增长率将达到 6.6%。自动化程度的不断提高,加上对客製化、高效和永续包装解决方案的需求不断增长,推动了这一成长。物联网机械的引入和环保材料的使用进一步增强了市场的发展轨迹。作为全球装袋机领域的领导者,美国不断提供不同应用的创新解决方案,确保符合监管标准和不断变化的消费者偏好。

目录

第 1 章:方法论与范围

- 市场范围和定义

- 基础估算与计算

- 预测参数

- 资料来源

- 基本的

- 次要

- 付费来源

- 公共资源

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 影响价值链的因素

- 利润率分析

- 中断

- 未来展望

- 製造商

- 经销商

- 供应商概况

- 利润率分析

- 重要新闻及倡议

- 监管格局

- 衝击力

- 成长动力

- 自动化和工业 4.0 集成

- 包装商品需求不断成长

- 机器效率和客製化的进步

- 产业陷阱与挑战

- 初期资本投入高

- 维护和停机问题

- 成长动力

- 成长潜力分析

- 技术概览

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第 5 章:市场估计与预测:按产品类型,2021 年至 2032 年

- 主要趋势

- 流动包装袋装机

- 条形袋装机

- 称重装袋机

- 真空袋装机

- 其他的

第六章:市场估计与预测:依资料,2021 – 2032 年

- 主要趋势

- 塑胶袋

- 纸袋

- 聚丙烯袋

- 编织袋

第 7 章:市场估计与预测:按自动化,2021 年至 2032 年

- 主要趋势

- 手动装袋机

- 半自动装袋机

- 全自动装袋机

第 8 章:市场估计与预测:按应用,2021 年至 2032 年

- 主要趋势

- 食品和饮料

- 药品

- 化学品

- 建造

- 消费品

- 其他的

第 9 章:市场估计与预测:按配销通路,2021 年至 2032 年

- 主要趋势

- 直接销售

- 间接销售

第 10 章:市场估计与预测:按地区,2021 年至 2032 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 中东及非洲

- 沙乌地阿拉伯

- 阿联酋

- 南非

第 11 章:公司简介

- BEUMER Group GmbH & Co. KG

- Cemen Tech, Inc.

- CFT SpA

- Duravant LLC

- FLSmidth & Co. A/S

- Haver & Boecker OHG

- Meyer Industries, Inc.

- MULTIVAC Sepp Haggenmüller SE & Co. KG

- Niverplast BV

- Pakona Engineers (I) Pvt. Ltd.

- Premier Tech Ltd.

- Robatech AG

- Schneider Packaging Equipment Co., Inc.

- Tetra Pak International SA

- Waldner Holding GmbH & Co. KG

The Global Bagging Machines Market, valued at USD 5.3 billion in 2023, is poised to grow at a robust CAGR of 6.5% from 2024 to 2032. This growth is fueled by increasing demand for automation and efficiency in packaging processes across various industries. The market is segmented by product type, encompassing flow-pack bagging machines, stick pack bagging machines, weight bagging machines, vacuum bagging machines, and others.

Flow-pack bagging machines led the market in 2023, contributing USD 2.3 billion to the total market value. This segment is projected to grow at a CAGR of 6.6% through 2032, driven by its adaptability and efficiency in handling diverse packaging needs. These machines are essential for packaging a wide range of products, from food items to medical equipment, using flexible materials that enable customized designs. Their high speed and reliability make them ideal for large-scale production, while advancements in automation and IoT integration have further enhanced their functionality, meeting the growing demand for intelligent packaging solutions.

| Market Scope | |

|---|---|

| Start Year | 2023 |

| Forecast Year | 2024-2032 |

| Start Value | $5.3 Billion |

| Forecast Value | $9.3 Billion |

| CAGR | 6.5% |

The market is also categorized by distribution channels, including direct and indirect sales. In 2023, the indirect sales segment dominated, capturing approximately 65.6% of the market share. This segment is expected to grow at a CAGR of 6.6% over the forecast period. Intermediaries such as distributors, resellers, and third-party vendors play a pivotal role in bridging the gap between manufacturers and end-users, particularly in emerging markets. By managing logistics, providing localized expertise, and offering customer support, these channels enable manufacturers to focus on production and innovation while reaching a broader customer base.

The U.S. bagging machines market accounted for USD 1 billion in 2023 and is set to expand at an estimated CAGR of 6.6% through 2032. The market thrives on strong demand from industrial and consumer goods sectors, particularly in the food, beverage, pharmaceutical, and e-commerce industries. Increasing adoption of automation, coupled with a growing need for customized, efficient, and sustainable packaging solutions, drives this growth. The incorporation of IoT-enabled machinery and the use of eco-friendly materials further bolster the market's trajectory. As a leader in the global bagging machines sector, the U.S. continues to deliver innovative solutions tailored to diverse applications, ensuring compliance with regulatory standards and evolving consumer preferences.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definition

- 1.2 Base estimates & calculations

- 1.3 Forecast parameters

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2032

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factors affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Automation and industry 4.0 integration

- 3.6.1.2 Rising demand for packaged goods

- 3.6.1.3 Advancements in machine efficiency and customization

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 High initial capital investment

- 3.6.2.2 Maintenance and downtime issues

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Technological overview

- 3.9 Porter’s analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2023

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Product Type, 2021 – 2032, (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Flow-pack bagging machines

- 5.3 Stick pack bagging machines

- 5.4 Weight bagging machines

- 5.5 Vacuum bagging machines

- 5.6 Others

Chapter 6 Market Estimates & Forecast, By Material, 2021 – 2032, (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Plastic bags

- 6.3 Paper bags

- 6.4 Polypropylene bags

- 6.5 Woven bags

Chapter 7 Market Estimates & Forecast, By Automation, 2021 – 2032, (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 Manual bagging machines

- 7.3 Semi-automatic bagging machines

- 7.4 Fully automatic bagging machines

Chapter 8 Market Estimates & Forecast, By Application, 2021 – 2032, (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Food & beverage

- 8.3 Pharmaceuticals

- 8.4 Chemicals

- 8.5 Construction

- 8.6 Consumer goods

- 8.7 Others

Chapter 9 Market Estimates & Forecast, By Distribution Channel, 2021 – 2032, (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 Direct sales

- 9.3 Indirect sales

Chapter 10 Market Estimates & Forecast, By Region, 2021 – 2032, (USD Billion) (Thousand Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 Australia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.6 MEA

- 10.6.1 Saudi Arabia

- 10.6.2 UAE

- 10.6.3 South Africa

Chapter 11 Company Profiles

- 11.1 BEUMER Group GmbH & Co. KG

- 11.2 Cemen Tech, Inc.

- 11.3 CFT S.p.A.

- 11.4 Duravant LLC

- 11.5 FLSmidth & Co. A/S

- 11.6 Haver & Boecker OHG

- 11.7 Meyer Industries, Inc.

- 11.8 MULTIVAC Sepp Haggenmüller SE & Co. KG

- 11.9 Niverplast B.V.

- 11.10 Pakona Engineers (I) Pvt. Ltd.

- 11.11 Premier Tech Ltd.

- 11.12 Robatech AG

- 11.13 Schneider Packaging Equipment Co., Inc.

- 11.14 Tetra Pak International S.A.

- 11.15 Waldner Holding GmbH & Co. KG