|

市场调查报告书

商品编码

1665049

纺纱机市场机会、成长动力、产业趋势分析及 2024 - 2032 年预测Spinning Machines Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2024 - 2032 |

||||||

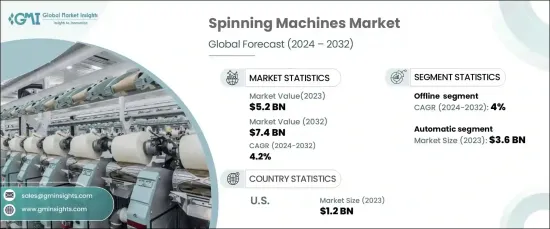

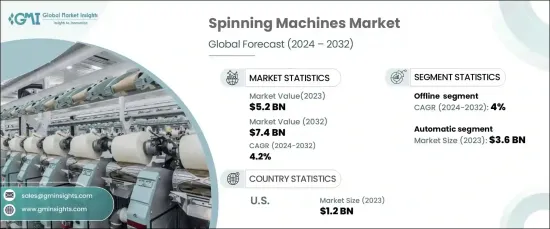

2023 年全球纺纱机市场价值达到 52 亿美元,预计 2024 年至 2032 年期间将以 4.2% 的复合年增长率稳步增长。技术进步正在产业中发挥变革作用,自动化、能源效率和数位解决方案的创新使製造商能够提高生产力并降低营运成本。

从技术方面来看,市场包括自动和手动纺纱机。自动纺纱机在 2023 年占据主导地位,价值 36 亿美元,预计在预测期内以 4.4% 的复合年增长率增长。这些机器越来越受到青睐,因为它们能够简化生产流程、最大限度地减少人为干预并显着减少错误。这些机器具有即时监控、自动纱线处理和预测性维护等功能,可优化製造流程并降低营运费用。此外,对永续和节能生产的日益重视,加上劳动成本的上升,加速了纺纱业采用自动化技术。

| 市场范围 | |

|---|---|

| 起始年份 | 2023 |

| 预测年份 | 2024-2032 |

| 起始值 | 52亿美元 |

| 预测值 | 74亿美元 |

| 复合年增长率 | 4.2% |

根据分销管道分类,市场包括线上和线下销售。线下通路在 2023 年占据了 69.3% 的市场份额,预计到 2032 年将以 4% 的复合年增长率增长。买家通常更喜欢亲自检查设备以评估性能并确保其满足特定的生产要求。线下管道还提供谈判、融资和售后支援(如安装和操作员培训)等关键服务,使其成为交易的首选。

在美国,纺纱机市场在 2023 年创造了 12 亿美元的产值,这得益于服装、家居装饰和工业应用对纺织品的强劲需求。采用自动化、物联网整合和人工智慧流程等尖端纺纱技术,显着提高了该地区的製造效率和生产力。这些进步凸显了美国在全球纺纱机械市场的重要地位,以及对创新和卓越营运的重视。

目录

第 1 章:方法论与范围

- 市场范围和定义

- 基础估算与计算

- 预测参数

- 资料来源

- 基本的

- 次要

- 付费来源

- 公共资源

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 影响价值链的因素

- 利润率分析

- 中断

- 未来展望

- 製造商

- 经销商

- 零售商

- 衝击力

- 成长动力

- 纺织品和服装需求不断增长

- 越来越重视永续性和环保生产

- 新兴经济体快速工业化

- 纺纱技术的快速进步

- 产业陷阱与挑战

- 初期投资及维护成本高

- 原物料价格波动

- 成长动力

- 技术与创新格局

- 消费者购买行为分析

- 人口趋势

- 影响购买决策的因素

- 消费者产品采用

- 首选配销通路

- 成长潜力分析

- 监管格局

- 定价分析

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第 5 章:市场估计与预测:按类型,2021 年至 2032 年

- 主要趋势

- 环锭纺纱机

- 自由端纺纱机

- 喷射纺纱机

- 摩擦纺丝机

- 其他的

第六章:市场估计与预测:依技术,2021 – 2032 年

- 主要趋势

- 自动纺纱机

- 手动纺纱机

第 7 章:市场估计与预测:按主轴类型,2021 年至 2032 年

- 主要趋势

- 低速主轴

- 中速主轴

- 高速主轴

第 8 章:市场估计与预测:按配销通路,2021 年至 2032 年

- 主要趋势

- 在线的

- 离线

第 9 章:市场估计与预测:按地区,2021 年至 2032 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 马来西亚

- 印尼

- 拉丁美洲

- 巴西

- 墨西哥

- 中东及非洲

- 沙乌地阿拉伯

- 阿联酋

- 南非

第十章:公司简介

- Jingwei Textile Machinery

- Juki

- Lakshmi Machine Works

- Marzoli Machines Textile

- Muratec

- Picanol

- Rieter

- Saurer

- Savio Macchine Tessili

- Schlafhorst

- Shima Seiki

- TMT Machinery

- Toyota Industries

- Trutzschler

- Zinser

The Global Spinning Machines Market reached a valuation of USD 5.2 billion in 2023 and is anticipated to grow at a steady CAGR of 4.2% from 2024 to 2032. This growth is primarily driven by the rising demand for textiles across diverse sectors, including fashion, home decor, and industrial applications. Technological advancements are playing a transformative role in the industry, with innovations in automation, energy efficiency, and digital solutions enabling manufacturers to enhance productivity while reducing operational costs.

In terms of technology, the market comprises automatic and manual spinning machines. Automatic spinning machines dominated in 2023, valued at USD 3.6 billion, and are projected to grow at a CAGR of 4.4% over the forecast period. The increasing preference for these machines stems from their ability to streamline production, minimize human intervention, and significantly reduce errors. Enhanced with features like real-time monitoring, automated yarn handling, and predictive maintenance, these machines optimize manufacturing processes and cut down operational expenses. Additionally, the growing emphasis on sustainable and energy-efficient production, combined with rising labor costs, is accelerating the adoption of automation in the spinning industry.

| Market Scope | |

|---|---|

| Start Year | 2023 |

| Forecast Year | 2024-2032 |

| Start Value | $5.2 Billion |

| Forecast Value | $7.4 Billion |

| CAGR | 4.2% |

When categorized by distribution channels, the market includes online and offline sales. Offline channels captured a commanding 69.3% market share in 2023 and are expected to grow at a CAGR of 4% through 2032. Offline avenues such as direct sales, showrooms, and authorized distributors are pivotal in the spinning machines market due to the technical complexity and high investment involved. Buyers often prefer inspecting equipment firsthand to assess performance and ensure it meets their specific production requirements. Offline channels also facilitate key services, including negotiations, financing, and post-sale support, such as installation and operator training, making them the favored choice for transactions.

In the United States, the spinning machines market generated USD 1.2 billion in 2023, driven by robust demand for textiles across apparel, home furnishings, and industrial applications. The adoption of cutting-edge spinning technologies featuring automation, IoT integration, and AI-powered processes has significantly boosted manufacturing efficiency and productivity in the region. These advancements underscore the U.S.'s position as a critical player in the global spinning machines market, with its focus on innovation and operational excellence.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definition

- 1.2 Base estimates & calculations

- 1.3 Forecast parameters

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2032

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factors affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.1.7 Retailers

- 3.2 Impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising demand for textiles and apparel

- 3.2.1.2 Growing emphasis on sustainability and eco-friendly production

- 3.2.1.3 Rapid industrialization in emerging economies

- 3.2.1.4 Rapid advancements in spinning technology

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High initial investment and maintenance costs

- 3.2.2.2 Fluctuations in the prices of raw materials

- 3.2.1 Growth drivers

- 3.3 Technology & innovation landscape

- 3.4 Consumer buying behavior analysis

- 3.4.1 Demographic trends

- 3.4.2 Factors affecting buying decision

- 3.4.3 Consumer product adoption

- 3.4.4 Preferred distribution channel

- 3.5 Growth potential analysis

- 3.6 Regulatory landscape

- 3.7 Pricing analysis

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2023

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Type, 2021 – 2032, (USD Billion)

- 5.1 Key trends

- 5.2 Ring spinning machines

- 5.3 Open-end spinning machines

- 5.4 Air-jet spinning machines

- 5.5 Friction spinning machines

- 5.6 Others

Chapter 6 Market Estimates & Forecast, By Technology, 2021 – 2032, (USD Billion)

- 6.1 Key trends

- 6.2 Automatic spinning machines

- 6.3 Manual spinning machines

Chapter 7 Market Estimates & Forecast, By Spindle Type, 2021 – 2032, (USD Billion)

- 7.1 Key trends

- 7.2 Low speed spindles

- 7.3 Medium speed spindles

- 7.4 High speed spindles

Chapter 8 Market Estimates & Forecast, By Distribution Channel, 2021 – 2032, (USD Billion)

- 8.1 Key trends

- 8.2 Online

- 8.3 Offline

Chapter 9 Market Estimates & Forecast, By Region, 2021 – 2032, (USD Billion)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.4.6 Malaysia

- 9.4.7 Indonesia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.6 MEA

- 9.6.1 Saudi Arabia

- 9.6.2 UAE

- 9.6.3 South Africa

Chapter 10 Company Profiles (Business Overview, Financial Data, Product Landscape, Strategic Outlook, SWOT Analysis)

- 10.1 Jingwei Textile Machinery

- 10.2 Juki

- 10.3 Lakshmi Machine Works

- 10.4 Marzoli Machines Textile

- 10.5 Muratec

- 10.6 Picanol

- 10.7 Rieter

- 10.8 Saurer

- 10.9 Savio Macchine Tessili

- 10.10 Schlafhorst

- 10.11 Shima Seiki

- 10.12 TMT Machinery

- 10.13 Toyota Industries

- 10.14 Trutzschler

- 10.15 Zinser