|

市场调查报告书

商品编码

1665050

汽车 PTC 加热器市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Automotive PTC Heater Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

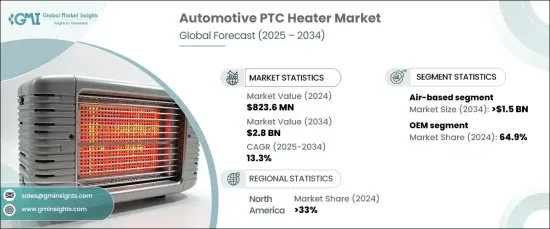

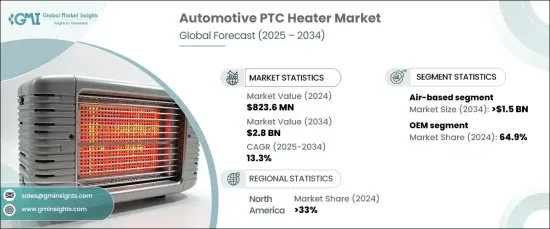

2024 年全球汽车 PTC 加热器市场价值为 8.236 亿美元,预计将实现显着增长,预计 2025 年至 2034 年的复合年增长率为 13.3%。与利用引擎废热来加热车厢的内燃机汽车不同,电动车完全依靠 PTC 加热器等电加热系统。电动车的普及率越来越高,尤其是在寒冷地区,这凸显了对紧凑、节能的解决方案的需求,这种解决方案既能提高乘客的舒适度,又不影响行驶里程。

根据产品类型细分,市场包括空气基系统和水基系统。 2024 年,空气基 PTC 加热器占据了 50% 的市场份额,预计到 2034 年将创造 15 亿美元的产值。空气加热器重量轻、经济高效、易于整合到车辆设计中,非常适合大规模实施。与水基系统不同,空气基系统不需要复杂的冷却机制,因此可灵活安装且易于使用。它们能够即时提供温暖,同时最大限度地减少电池消耗,使其成为现代电动车的最佳选择。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 8.236 亿美元 |

| 预测值 | 28亿美元 |

| 复合年增长率 | 13.3% |

市场也根据销售管道进行分类,涵盖OEM和售后市场。 2024 年,OEM 将占据 64.9% 的份额,预计这一趋势将在整个预测期内持续下去。原始设备製造商重视性能、耐用性和成本效益,在汽车生产过程中无缝整合 PTC 加热器。这种方法提高了可靠性,确保符合严格的品质标准,并最大限度地减少了售后调整的需要。製造过程中的简化安装也能提高营运效率和客户满意度,使 OEM 成为市场成长的主要驱动力。

从地区来看,受先进汽车产业和不断扩大的电动车产量的推动,北美将在 2024 年占据汽车 PTC 加热器市场的 33%。该地区对技术创新的重视、高汽车拥有率以及严格的监管框架极大地推动了对先进座舱加热解决方案的需求。此外,北美气候较冷进一步增加了对高效可靠供暖系统的需求,从而推动了市场成长。

受技术进步、电动车普及率上升和消费者偏好变化的推动,汽车 PTC 加热器市场正呈现大幅成长的轨迹。随着产业持续关注能源效率和永续性,加热解决方案的创新正在塑造汽车设计的未来。 PTC 加热器正在成为现代车辆中不可或缺的部件,满足了人们对舒适性、性能和环保解决方案日益增长的需求。

目录

第 1 章:方法论与范围

- 研究设计

- 研究方法

- 资料收集方法

- 基础估算与计算

- 基准年计算

- 市场估计的主要趋势

- 预测模型

- 初步研究和验证

- 主要来源

- 资料探勘来源

- 市场范围和定义

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 供应商概况

- 原物料供应商

- 零件供应商

- 製造商

- 技术提供者

- 经销商

- 最终用户

- 利润率分析

- 技术与创新格局

- 专利分析

- 监管格局

- 定价分析

- 衝击力

- 成长动力

- 电动汽车座舱加热需求不断增加

- 与先进的气候控制系统集成

- 更加重视安全性和耐用性

- 产业陷阱与挑战

- 初期成本高

- 极寒环境下运作效率有限

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第 5 章:市场估计与预测:按产品,2021 - 2034 年

- 主要趋势

- 空基

- 水性

第六章:市场估计与预测:依结构,2021 - 2034 年

- 主要趋势

- 鳍

- 蜂巢

第 7 章:市场估计与预测:按销售管道,2021 - 2034 年

- 主要趋势

- OEM

- 空基

- 水性

- 售后市场

- 空基

- 水性

第 8 章:市场估计与预测:按车型,2021 - 2034 年

- 主要趋势

- 内燃机

- 纯电动车 (BEV)

- 插电式混合动力车 (PHEV)

- 混合动力电动车 (HEV)

第 9 章:市场估计与预测:按应用,2021 - 2034 年

- 主要趋势

- 暖通空调系统

- 电池热管理系统

- 座椅加热

- 其他的

第 10 章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 北欧

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 东南亚

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东及非洲

- 阿联酋

- 南非

- 沙乌地阿拉伯

第 11 章:公司简介

- Anhui Ankai Electric

- BorgWarner

- Calix AB

- DBK Group

- Dongfeng Motor Parts and Components Group

- Dongguan Sanyou Electrical Appliances

- Eberspächer Group

- Gentherm Incorporated

- Hebei Yingtong Technology

- KLC

- LG Electronics

- Mahle GmbH

- Pelonis Technologies

- Rheinmetall Automotive

- Shanghai Xinye Electronics

- Thermik Geratebau

The Global Automotive PTC Heater Market, valued at USD 823.6 million in 2024, is poised for remarkable growth with a projected CAGR of 13.3% from 2025 to 2034. This growth is largely driven by the surging demand for energy-efficient heating systems in electric vehicles. Unlike internal combustion engine vehicles that utilize waste engine heat for cabin warming, EVs rely entirely on electric heating systems such as PTC heaters. The increasing adoption of EVs, particularly in colder regions, emphasizes the need for compact, energy-saving solutions that enhance passenger comfort without compromising driving range.

Segmented by product type, the market comprises air-based and water-based systems. In 2024, air-based PTC heaters held a commanding 50% market share and are forecasted to generate USD 1.5 billion by 2034. These systems are highly preferred for their ability to provide rapid and efficient cabin heating. Lightweight, cost-effective, and easy to integrate into vehicle designs, air-based heaters are well-suited for large-scale implementation. Unlike their water-based counterparts, air-based systems eliminate the need for complex cooling mechanisms, allowing for flexible installation and ease of use. Their capability to deliver immediate warmth while minimizing battery drain makes them an optimal choice for modern EVs.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $823.6 Million |

| Forecast Value | $2.8 Billion |

| CAGR | 13.3% |

The market is also categorized by sales channels, encompassing OEM and aftermarket segments. In 2024, OEMs dominated with a 64.9% share, a trend expected to continue throughout the forecast period. Original equipment manufacturers value performance, durability, and cost-efficiency, integrating PTC heaters seamlessly during vehicle production. This approach enhances reliability, ensures compliance with stringent quality standards, and minimizes the need for aftermarket adjustments. Streamlined installation during manufacturing also improves operational efficiency and customer satisfaction, making OEMs a key driver of market growth.

Regionally, North America represented 33% of the automotive PTC heater market in 2024, driven by its advanced automotive sector and expanding EV production. The region's emphasis on technological innovation, high vehicle ownership rates, and stringent regulatory frameworks significantly fuel demand for advanced cabin heating solutions. Additionally, colder climates in North America further amplify the need for efficient and reliable heating systems, propelling the market growth.

The automotive PTC heater market is on a trajectory of substantial growth, fueled by technological advancements, rising EV adoption, and evolving consumer preferences. As the industry continues to focus on energy efficiency and sustainability, innovations in heating solutions are shaping the future of vehicle design. PTC heaters are emerging as indispensable components in modern vehicles, addressing the increasing demand for comfort, performance, and eco-friendly solutions.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market scope & definition

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 Raw material suppliers

- 3.2.2 Component suppliers

- 3.2.3 Manufacturers

- 3.2.4 Technology providers

- 3.2.5 Distributors

- 3.2.6 End users

- 3.3 Profit margin analysis

- 3.4 Technology & innovation landscape

- 3.5 Patent analysis

- 3.6 Regulatory landscape

- 3.7 Pricing analysis

- 3.8 Impact forces

- 3.8.1 Growth drivers

- 3.8.1.1 Increasing demand for cabin heating in EVs

- 3.8.1.2 Integration with advanced climate control systems

- 3.8.1.3 Rise in focus on safety and durability

- 3.8.2 Industry pitfalls & challenges

- 3.8.2.1 High initial cost

- 3.8.2.2 Limited operating efficiency in extremely cold environments

- 3.8.1 Growth drivers

- 3.9 Growth potential analysis

- 3.10 Porter’s analysis

- 3.11 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Product, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Air-based

- 5.3 Water-based

Chapter 6 Market Estimates & Forecast, By Structure, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Fin

- 6.3 Honeycomb

Chapter 7 Market Estimates & Forecast, By Sales Channel, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 OEM

- 7.2.1 Air-based

- 7.2.2 Water-based

- 7.3 Aftermarket

- 7.3.1 Air-based

- 7.3.2 Water-based

Chapter 8 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 IC Engines

- 8.3 Battery electric vehicles (BEVs)

- 8.4 Plug-in hybrid electric vehicles (PHEVs)

- 8.5 Hybrid electric vehicles (HEVs)

Chapter 9 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 HVAC systems

- 9.3 Battery thermal management systems

- 9.4 Seat heating

- 9.5 Others

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.3.7 Nordics

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.4.6 Southeast Asia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 UAE

- 10.6.2 South Africa

- 10.6.3 Saudi Arabia

Chapter 11 Company Profiles

- 11.1 Anhui Ankai Electric

- 11.2 BorgWarner

- 11.3 Calix AB

- 11.4 DBK Group

- 11.5 Dongfeng Motor Parts and Components Group

- 11.6 Dongguan Sanyou Electrical Appliances

- 11.7 Eberspächer Group

- 11.8 Gentherm Incorporated

- 11.9 Hebei Yingtong Technology

- 11.10 KLC

- 11.11 LG Electronics

- 11.12 Mahle GmbH

- 11.13 Pelonis Technologies

- 11.14 Rheinmetall Automotive

- 11.15 Shanghai Xinye Electronics

- 11.16 Thermik Geratebau