|

市场调查报告书

商品编码

1665058

食品和饮料包装机市场机会、成长动力、产业趋势分析与预测 2024 - 2032Food and Beverages Packaging Machine Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2024 - 2032 |

||||||

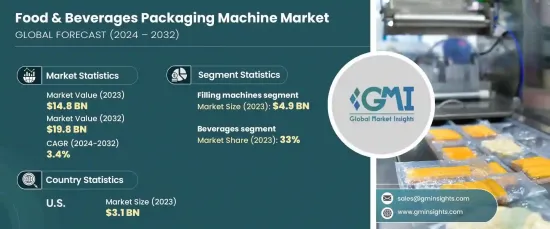

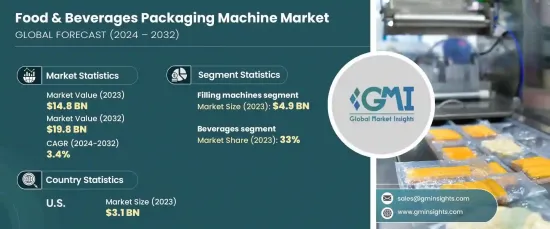

2023 年全球食品和饮料包装机市场规模达到 148 亿美元,预计 2024 年至 2032 年期间将实现 3.4% 的复合年增长率。随着消费者倾向于环保替代品,製造商面临着采用可回收和可生物降解材料的压力,从而推动了对用于加工这些新材料的机械的需求。这种向永续发展的转变正在刺激行业的创新和技术进步,使包装机更加高效和多功能。

就产品类型而言,市场分为封口机、灌装机、贴标机、小袋包装机、包裹机和其他类别。光是灌装机一项,在 2023 年就创造了 49 亿美元的收入,预计在预测期内将以 3.7% 的复合年增长率成长。这些机器对于提高生产速度和提高效率同时减少对体力劳动的依赖至关重要。他们能够满足食品和饮料行业的大批量生产需求,同时最大限度地降低营运成本,这使他们成为市场扩张的关键参与者。

| 市场范围 | |

|---|---|

| 起始年份 | 2023 |

| 预测年份 | 2024-2032 |

| 起始值 | 148亿美元 |

| 预测值 | 198亿美元 |

| 复合年增长率 | 3.4% |

市场的应用涵盖饮料、加工食品、烘焙产品、糖果、肉类、家禽和海鲜、水果和蔬菜等。 2023 年,饮料行业占据了 33% 的市场份额,预计到 2032 年将以 3.8% 的复合年增长率增长。随着消费者越来越重视便利性和便携性,对能够处理多种容器类型和高产量的包装机械的需求变得更加迫切。

在美国,2023 年食品和饮料包装机市场价值为 31 亿美元,预计 2024 年至 2032 年的复合年增长率为 3.5%。美国製造商越来越多地转向能够处理瓶子、袋子和纸箱等各种包装形式的大容量机械,这对于满足该行业消费者和生产者的需求至关重要。美国仍然是推动技术进步和推动全球包装机械产业成长的主导力量。

目录

第 1 章:方法论与范围

- 市场范围和定义

- 基础估算与计算

- 预测计算

- 资料来源

- 基本的

- 次要

- 付费来源

- 公共资源

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 影响价值链的因素

- 利润率分析

- 中断

- 未来展望

- 製造商

- 经销商

- 供应商概况

- 利润率分析

- 重要新闻及倡议

- 监管格局

- 衝击力

- 成长动力

- 加工食品需求不断增加

- 自动化和技术进步

- 产业陷阱与挑战

- 初期成本高

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第 5 章:市场估计与预测:按产品类型,2021-2032 年

- 主要趋势

- 灌装机

- 封口机

- 贴标机

- 包装机

- 袋装包装机

- 其他(装箱机等)

第六章:市场估计与预测:依封装类型,2021-2032

- 主要趋势

- 软包装

- 硬包装

- 半硬质包装

第 7 章:市场估计与预测:按自动化,2021 年至 2032 年

- 主要趋势

- 手动包装机

- 半自动包装机

- 自动包装机

第 8 章:市场估计与预测:按应用,2021 年至 2032 年

- 主要趋势

- 饮料

- 加工食品

- 烘焙产品

- 糖果

- 肉类、家禽和海鲜

- 水果和蔬菜

- 其他(保健食品及营养品等)

第 9 章:市场估计与预测:按配销通路,2021-2032 年

- 主要趋势

- 直接的

- 间接

第 10 章:市场估计与预测:按地区,2021-2032 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 中东及非洲

- 阿联酋

- 沙乌地阿拉伯

- 南非

第 11 章:公司简介

- Bosch Packaging Technology

- Coesia SpA

- FLSmidth A/S

- GEA Group AG

- IMA Group SpA

- Krones AG

- Marel hf.

- Mitsubishi Heavy Industries, Ltd.

- Multivac Sepp Haggenmüller SE & Co. KG

- Nestlé SA

- ProMach, Inc.

- Schubert GmbH

- Shibaura Machine Co., Ltd.

- Sidel Group SAS

- Tetra Pak International SA

The Global Food And Beverages Packaging Machine Market reached USD 14.8 billion in 2023 and is projected to experience a steady growth rate of 3.4% CAGR from 2024 to 2032. This growth is driven by the increasing demand for sustainable packaging solutions. As consumers lean toward eco-friendly alternatives, manufacturers are under pressure to adopt recyclable and biodegradable materials, fueling the need for machinery designed to process these new materials. This shift toward sustainability is spurring innovation and technological advancements within the industry, making packaging machines more efficient and versatile.

In terms of product type, the market is divided into sealing machines, filling machines, labeling machines, pouch packaging machines, wrapping machines, and other categories. Filling machines alone generated USD 4.9 billion in revenue in 2023 and are expected to grow at a rate of 3.7% CAGR over the forecast period. These machines are essential for increasing production speed and improving efficiency while reducing the reliance on manual labor. Their ability to handle high-volume production requirements in the food and beverage industry while minimizing operational costs makes them a key player in the market's expansion.

| Market Scope | |

|---|---|

| Start Year | 2023 |

| Forecast Year | 2024-2032 |

| Start Value | $14.8 Billion |

| Forecast Value | $19.8 Billion |

| CAGR | 3.4% |

The market's applications span across beverages, processed food, bakery products, confectionery, meat, poultry and seafood, fruits and vegetables, and more. In 2023, the beverages segment held a substantial 33% market share and is projected to grow at a 3.8% CAGR through 2032. This growth is primarily fueled by the rising demand for ready-to-drink products, including bottled water, soft drinks, and health-focused beverages. As consumers increasingly prioritize convenience and portability, the need for packaging machinery capable of handling a variety of container types and high production volumes has become more critical.

In the U.S., the food and beverages packaging machine market was valued at USD 3.1 billion in 2023 and is expected to grow at a CAGR of 3.5% from 2024 to 2032. The country's diverse consumer base and the growing demand for packaged foods and beverages, including ready-to-eat meals and health drinks, are driving investments in advanced packaging technologies. U.S. manufacturers are increasingly turning to high-capacity machinery that can handle various packaging formats like bottles, pouches, and cartons, which is essential for meeting the needs of both consumers and producers in the sector. The U.S. remains a leading force in driving technological advancements and fueling the growth of the global packaging machine industry.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2032

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Increasing demand for processed foods

- 3.6.1.2 Automation and technological advancements

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 High initial cost

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2023

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Product Type, 2021-2032 (USD Million) (Thousand Units)

- 5.1 Key trends

- 5.2 Filling machines

- 5.3 Sealing machines

- 5.4 Labeling machines

- 5.5 Wrapping machines

- 5.6 Pouch packaging machines

- 5.7 Others (case packing machines, etc)

Chapter 6 Market Estimates & Forecast, By Packaging Type, 2021-2032 (USD Million) (Thousand Units)

- 6.1 Key trends

- 6.2 Flexible packaging

- 6.3 Rigid packaging

- 6.4 Semi-rigid packaging

Chapter 7 Market Estimates & Forecast, By Automation, 2021-2032 (USD Million) (Thousand Units)

- 7.1 Key trends

- 7.2 Manual packaging machines

- 7.3 Semi-automatic packaging machines

- 7.4 Automatic packaging machines

Chapter 8 Market Estimates & Forecast, By Application, 2021-2032 (USD Million) (Thousand Units)

- 8.1 Key trends

- 8.2 Beverages

- 8.3 Processed food

- 8.4 Bakery products

- 8.5 Confectionery

- 8.6 Meat, poultry, and seafood

- 8.7 Fruits & vegetables

- 8.8 Others (health foods & nutritional products, etc)

Chapter 9 Market Estimates & Forecast, By Distribution Channel, 2021-2032 (USD Million) (Thousand Units)

- 9.1 Key trends

- 9.2 Direct

- 9.3 Indirect

Chapter 10 Market Estimates & Forecast, By Region, 2021-2032 (USD Million) (Thousand Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 Australia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.6 MEA

- 10.6.1 UAE

- 10.6.2 Saudi Arabia

- 10.6.3 South Africa

Chapter 11 Company Profiles

- 11.1 Bosch Packaging Technology

- 11.2 Coesia S.p.A.

- 11.3 FLSmidth A/S

- 11.4 GEA Group AG

- 11.5 IMA Group S.p.A.

- 11.6 Krones AG

- 11.7 Marel hf.

- 11.8 Mitsubishi Heavy Industries, Ltd.

- 11.9 Multivac Sepp Haggenmüller SE & Co. KG

- 11.10 Nestlé S.A.

- 11.11 ProMach, Inc.

- 11.12 Schubert GmbH

- 11.13 Shibaura Machine Co., Ltd.

- 11.14 Sidel Group S.A.S.

- 11.15 Tetra Pak International S.A.