|

市场调查报告书

商品编码

1665077

医疗保健电子资料交换市场机会、成长动力、产业趋势分析与 2025 - 2034 年预测Healthcare Electronic Data Interchange Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

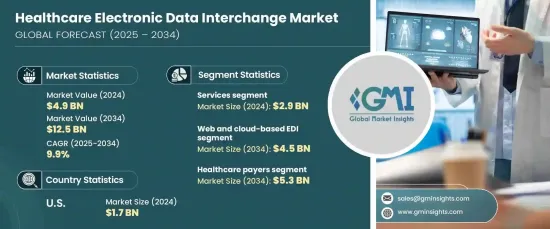

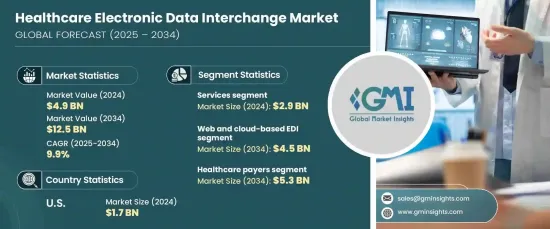

全球医疗保健电子资料交换市场在 2024 年的价值为 49 亿美元,将经历显着增长,预计 2025 年至 2034 年期间的复合年增长率为 9.9%。

随着医疗保健产业拥抱数位转型,EDI 平台成为付款人、提供者和利害关係人之间安全、标准化和高效资料交换不可或缺的工具。这些平台消除了手动流程的低效率,确保遵守不断变化的法规并保护敏感的患者资讯。此外,云端运算和人工智慧分析的进步引入了先进、经济高效的解决方案,扩大了 EDI 系统对各种规模组织的吸引力。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 49亿美元 |

| 预测值 | 125亿美元 |

| 复合年增长率 | 9.9% |

政府法规和行业标准在加速医疗保健 EDI 系统的采用方面发挥关键作用。监管框架强调了安全资料交换的必要性,促使医疗保健组织实现工作流程的现代化。自动化 EDI 解决方案可确保无缝遵守隐私和安全标准,同时促进整个医疗保健生态系统的有效沟通。在医疗保健提供者努力应对优化性能和降低成本日益增大的压力之际,数位化的推动尤为重要,从而进一步推动了市场的扩张。

从组件方面来看,医疗保健 EDI 市场分为服务和解决方案,其中服务在创造收入方面占据主导地位。 2024 年服务业规模将达到 29 亿美元,反映了该行业对系统整合、客製化、培训和技术支援的依赖。随着组织从传统系统过渡到现代化 EDI 平台,这些服务可确保顺利、高效的整合流程。对专业服务的需求不断增长,凸显了医疗保健产业对实现互通性和遵守严格的合规性要求的重视。预计这一趋势将获得发展动力,与医疗保健提供者对卓越营运的优先事项保持一致。

市场还根据部署类型进行细分,包括 EDI 增值网路 (VAN)、直接(点对点)EDI、基于 Web 和云端的 EDI 以及行动 EDI。其中,基于网路和云端的 EDI 解决方案在 2024 年占据主导地位,预计到 2034 年该领域将产生 45 亿美元的收入。这些系统对于寻求使用先进工具但又无需承担维护内部基础设施负担的中小型供应商尤其有吸引力。基于云端的 EDI 的灵活性、可靠性和可负担性使其成为市场成长轨蹟的基石。

2024 年,北美占据了 17 亿美元的医疗保健 EDI 市场,这得益于严格的监管要求(要求标准化交易)和美国强劲的医疗保健支出。随着产业优先考虑数据驱动的创新,对数位基础设施和人工智慧驱动的分析的投资继续推动先进 EDI 解决方案的采用,从而重塑医疗保健资料交换的全球格局。

目录

第 1 章:方法论与范围

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 监管支持和合规要求

- 互通性需求不断成长

- 技术进步

- 降低成本、提高效率

- 产业陷阱与挑战

- 实施成本高

- 成长动力

- 成长潜力分析

- 监管格局

- 我们

- 欧洲

- 技术格局

- 未来市场趋势

- 创新格局

- 差距分析

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

第 5 章:市场估计与预测:按组件,2021 年至 2034 年

- 主要趋势

- 服务

- 解决方案

第 6 章:市场估计与预测:按部署类型,2021 年至 2034 年

- 主要趋势

- 基于 Web 和云端的 EDI

- EDI加值网路(VAN)

- 直接(点对点)EDI

- 移动EDI

第 7 章:市场估计与预测:依最终用途,2021 年至 2034 年

- 主要趋势

- 医疗支付者

- 医疗保健提供者

- 製药和医疗器材产业

- 其他最终用户

第 8 章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第九章:公司简介

- Boomi

- Cleo

- DataTrans Solutions

- Effective Data

- Epicor Software Corporation

- GE Healthcare

- MCKESSON CORPORATION

- NXGN Management

- OpenText

- Optum

- Oracle

- OSP

- SPS Commerce

- SSI Group

- TrueCommerce

The Global Healthcare Electronic Data Interchange Market, valued at USD 4.9 billion in 2024, is set to experience remarkable growth with a projected CAGR of 9.9% between 2025 and 2034. This expansion is driven by the increasing adoption of automated EDI solutions, propelled by stringent regulatory mandates, growing demand for seamless interoperability, and the rising need to streamline administrative operations in healthcare systems.

As the healthcare industry embraces digital transformation, EDI platforms emerge as indispensable tools for secure, standardized, and efficient data exchange between payers, providers, and stakeholders. These platforms eliminate the inefficiencies of manual processes, ensuring compliance with evolving regulations and safeguarding sensitive patient information. Furthermore, advancements in cloud computing and AI-powered analytics have introduced sophisticated, cost-effective solutions, broadening the appeal of EDI systems to organizations of all sizes.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $4.9 Billion |

| Forecast Value | $12.5 Billion |

| CAGR | 9.9% |

Government regulations and industry standards play a pivotal role in accelerating the adoption of healthcare EDI systems. Regulatory frameworks emphasize the necessity for secure data exchange, prompting healthcare organizations to modernize their workflows. Automated EDI solutions ensure seamless compliance with privacy and security standards while fostering efficient communication across the healthcare ecosystem. This push toward digitization is particularly significant as healthcare providers grapple with mounting pressures to optimize performance and reduce costs, further driving the market's expansion.

In terms of components, the healthcare EDI market is segmented into services and solutions, with services leading the charge in revenue generation. Services reached USD 2.9 billion in 2024, reflecting the industry's reliance on system integration, customization, training, and technical support. As organizations transition from legacy systems to modern EDI platforms, these services ensure a smooth and efficient integration process. The rising demand for professional services underscores the healthcare sector's focus on achieving interoperability and adhering to stringent compliance requirements. This trend is expected to gain momentum, aligning with healthcare providers' priorities for operational excellence.

The market also segments based on deployment type, including EDI value-added networks (VANs), direct (point-to-point) EDI, web and cloud-based EDI, and mobile EDI. Among these, web and cloud-based EDI solutions dominated in 2024, and this segment is forecasted to generate USD 4.5 billion by 2034. Cloud-based solutions offer unmatched scalability and cost-efficiency, allowing healthcare organizations to expand operations without heavy hardware investments. These systems are particularly attractive to small and medium-sized providers seeking access to advanced tools without the burden of maintaining on-premises infrastructure. The flexibility, reliability, and affordability of cloud-based EDI make it a cornerstone of the market's growth trajectory.

North America accounted for USD 1.7 billion of the healthcare EDI market in 2024, fueled by strict regulatory requirements mandating standardized transactions and robust healthcare spending in the United States. As the industry prioritizes data-driven innovations, investments in digital infrastructure and AI-driven analytics continue to drive the adoption of advanced EDI solutions, reshaping the global landscape of healthcare data exchange.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Regulatory support and compliance requirements

- 3.2.1.2 Rising demand for interoperability

- 3.2.1.3 Technological advancements

- 3.2.1.4 Cost reduction and efficiency

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High implementation cost

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 U.S.

- 3.4.2 Europe

- 3.5 Technology landscape

- 3.6 Future market trends

- 3.7 Innovation landscape

- 3.8 Gap analysis

- 3.9 Porter’s analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Component, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Services

- 5.3 Solutions

Chapter 6 Market Estimates and Forecast, By Deployment Type, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Web and cloud-based EDI

- 6.3 EDI value added network (VAN)

- 6.4 Direct (point-to-point) EDI

- 6.5 Mobile EDI

Chapter 7 Market Estimates and Forecast, By End Use, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Healthcare payers

- 7.3 Healthcare providers

- 7.4 Pharmaceutical and medical device industries

- 7.5 Other end users

Chapter 8 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Boomi

- 9.2 Cleo

- 9.3 DataTrans Solutions

- 9.4 Effective Data

- 9.5 Epicor Software Corporation

- 9.6 GE Healthcare

- 9.7 MCKESSON CORPORATION

- 9.8 NXGN Management

- 9.9 OpenText

- 9.10 Optum

- 9.11 Oracle

- 9.12 OSP

- 9.13 SPS Commerce

- 9.14 SSI Group

- 9.15 TrueCommerce