|

市场调查报告书

商品编码

1665085

组合扳手组市场机会、成长动力、产业趋势分析与 2024 - 2032 年预测Combination Spanner Set Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2024 - 2032 |

||||||

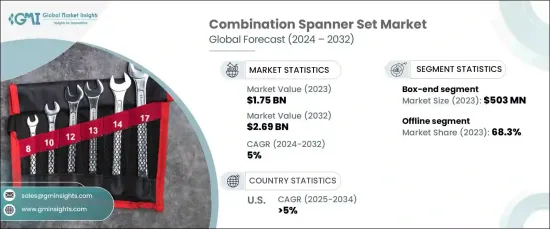

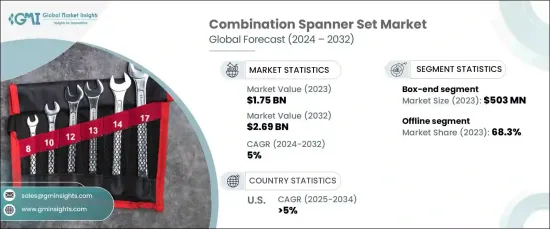

2023 年全球组合扳手套装市场价值为 17.5 亿美元,预计 2024 年至 2032 年期间的复合年增长率为 5%。疫情期间,各行各业都适应了新的营运挑战,组合扳手套件变得不可或缺。随着安全法规的收紧和对营运效率的更加重视,对这些工具的投资显着增加。随着製造业和服务业中出现越来越多的中小型企业,对高效能、高性能扳手套件的需求也日益增长。越来越多的专业人士和 DIY 爱好者选择这些工具,因为它们能够处理多种类型的紧固件,从而提高维护和维修效率。

组合扳手套件现在被视为工业和住宅环境中的必需品,为使用者提供了使用各种紧固件的灵活性。它们能够快速、准确地完成任务,因此成为希望提高生产力的专业人士的首选。这种不断增长的需求也与向兼具可靠性和易用性的工具的转变有关。自动化和高精度工具需求的增加进一步推动了对组合扳手的需求,特别是在汽车、製造和建筑等行业。

| 市场范围 | |

|---|---|

| 起始年份 | 2023 |

| 预测年份 | 2024-2032 |

| 起始值 | 17.5亿美元 |

| 预测值 | 26.9 亿美元 |

| 复合年增长率 | 5% |

盒式组合扳手在 2023 年的收入约为 5.03 亿美元,预计到 2032 年将以约 5.5% 的复合年增长率增长。它们越来越受欢迎,这是由各个行业,特别是汽车和製造业对维护和维修的持续需求所推动的。设计上的创新,例如符合人体工学的特性和增强的耐用性,使得开口扳手成为需要可靠性和精确度的专业人士的首选。

2023 年,组合扳手套装的线下销售占据市场主导地位,份额约为 68.3%,预计这一趋势将在 2024 年至 2032 年期间继续保持,年增长率为 4.4%。店内购物还提供即时可用性和个人化帮助,从而提升客户体验。知识渊博的销售代表提供客製化建议,确保客户选择最适合其需求的工具。维修、保养等售后服务的附加价值提升了离线购物的吸引力,培养了顾客忠诚度并鼓励回头客。

在美国,组合扳手套装市场规模在 2023 年超过 3.803 亿美元,预计在 2024 年至 2032 年期间的复合年增长率将超过 5%。美国市场受益于强劲的製造业、尖端的产品创新以及先进技术的整合。这种向先进工具的转变是由对更高精度的需求和对严格安全法规的遵守所推动的。随着行业的不断发展,对兼具耐用性、精确性和易用性的组合扳手套件的需求预计会增加。

目录

第 1 章:方法论与范围

- 市场范围和定义

- 基础估算与计算

- 预测计算

- 资料来源

- 基本的

- 次要

- 付费来源

- 公共资源

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 影响价值链的因素

- 利润率分析

- 中断

- 未来展望

- 製造商

- 经销商

- 供应商概况

- 利润率分析

- 技术概览

- 重要新闻及倡议

- 监管格局

- 衝击力

- 成长动力

- 汽车和工业应用对多功能工具的需求不断增长

- DIY 文化的兴起促进了工具的销售

- 技术进步提高了工具的耐用性和效率

- 产业陷阱与挑战

- 竞争市场中的价格敏感度

- 来自电动和自动化工具的竞争

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第 5 章:市场估计与预测:按类型,2021-2032 年

- 主要趋势

- 盒端组合扳手

- Flex-Head 组合扳手

- 开口组合扳手

- 棘轮组合扳手

第六章:市场估计与预测:依规模,2021-2032 年

- 主要趋势

- 大型组合扳手

- 中型组合扳手

- 小组合扳手

第 7 章:市场估计与预测:按材料,2021 年至 2032 年

- 主要趋势

- 碳钢

- 铬钒

- 不銹钢

第 8 章:市场估计与预测:按最终用途,2021-2032 年

- 主要趋势

- 汽车产业

- 建筑业

- 家庭使用/DIY

- 製造业

第 9 章:市场估计与预测:按配销通路,2021-2032 年

- 主要趋势

- 在线的

- 离线

第 10 章:市场估计与预测:按地区,2021-2032 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 澳洲

- 马来西亚

- 印尼

- 拉丁美洲

- 巴西

- 墨西哥

- 中东及非洲

- 阿联酋

- 沙乌地阿拉伯

- 南非

第 11 章:公司简介

- Apex Tool Group LLC

- Bondhus Corporation

- Cromwell Group Holdings Ltd.

- Facom SAS

- Hillman Group Inc.

- Klein Tools Inc.

- Mac Tools

- Matco Tools Corporation

- Proto Industrial Tools

- Snap-on Inc.

- Stanley Black & Decker Inc.

- Sunex Tools Inc.

- Wera Werkzeuge GmbH

- Wiha Tools Ltd.

- Wright Tool Company

The Global Combination Spanner Set Market was valued at USD 1.75 billion in 2023 and is projected to grow at a CAGR of 5% between 2024 and 2032. The surge in demand for these tools comes as both industries and individual users increasingly rely on them for their versatility and efficiency in various tasks. During the pandemic, industries adapted to new operational challenges, making combination spanner sets indispensable. With safety regulations tightening and a greater focus on operational efficiency, there has been a significant increase in investments in these tools. As more small and medium-sized businesses emerge in the manufacturing and service sectors, the need for efficient and high-performing spanner sets has grown. Professionals and DIY enthusiasts alike are increasingly choosing these tools due to their capability to handle multiple types of fasteners, improving maintenance and repair efficiency.

Combination spanner sets are now considered essential in both industrial and residential environments, providing users with the flexibility to work with a wide range of fasteners. Their efficiency in completing tasks quickly and accurately has made them a preferred choice for professionals looking to enhance productivity. This growing demand is also linked to the shift toward tools that combine reliability with ease of use. The rise in automation and high-precision tool needs further drives the demand for combination spanners, particularly in industries such as automotive, manufacturing, and construction.

| Market Scope | |

|---|---|

| Start Year | 2023 |

| Forecast Year | 2024-2032 |

| Start Value | $1.75 Billion |

| Forecast Value | $2.69 Billion |

| CAGR | 5% |

Box-end combination spanners, accounting for approximately USD 503 million in revenue in 2023, are forecasted to grow at a CAGR of about 5.5% through 2032. These tools are essential for tightening or loosening fasteners, offering unmatched versatility. Their increasing popularity is driven by the ongoing demand for maintenance and repair across various sectors, particularly automotive and manufacturing. Innovations in design, such as ergonomic features and enhanced durability, are making box-end spanners the go-to choice for professionals who require reliability and precision.

The offline sales segment for combination spanner sets led the market with a share of around 68.3% in 2023, and this trend is expected to continue with a growth rate of 4.4% annually from 2024 to 2032. Consumers increasingly prefer purchasing tools from physical stores where they can inspect product quality in person, ensuring satisfaction with their purchase. In-store shopping also offers immediate availability and personalized assistance, which enhances the customer experience. Knowledgeable sales representatives provide tailored recommendations, ensuring customers select the best tools for their needs. The added value of after-sales services, such as repairs and maintenance, boosts the appeal of offline shopping, fostering loyalty and encouraging repeat business.

In the U.S., the combination spanner set market exceeded USD 380.3 million in 2023 and is projected to grow at a CAGR of over 5% between 2024 and 2032. This growth is driven by the demand for versatile and efficient tools within the country's large consumer base. The U.S. market benefits from a robust manufacturing sector, cutting-edge product innovations, and the integration of advanced technology. This shift towards advanced tools is fueled by the need for higher precision and the adherence to stringent safety regulations. As industries continue to evolve, the demand for combination spanner sets that combine durability, precision, and ease of use is expected to rise.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2032

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Technological overview

- 3.5 Key news & initiatives

- 3.6 Regulatory landscape

- 3.7 Impact forces

- 3.7.1 Growth drivers

- 3.7.1.1 Rising demand for versatile tools in automotive and industrial applications

- 3.7.1.2 Increased DIY culture boosting tool sales

- 3.7.1.3 Technological advancements improving tool durability and efficiency

- 3.7.2 Industry pitfalls & challenges

- 3.7.2.1 Price sensitivity in a competitive market

- 3.7.2.2 Competition from electric and automated tools

- 3.7.1 Growth drivers

- 3.8 Growth potential analysis

- 3.9 Porter’s analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2023

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Type, 2021-2032 (USD Million) (Thousand Units)

- 5.1 Key trends

- 5.2 Box-End combination spanners

- 5.3 Flex-Head combination spanners

- 5.4 Open-End combination spanners

- 5.5 Ratchet combination spanners

Chapter 6 Market Estimates & Forecast, By Size, 2021-2032 (USD Million) (Thousand Units)

- 6.1 Key trends

- 6.2 Large combination spanners

- 6.3 Medium combination spanners

- 6.4 Small combination spanners

Chapter 7 Market Estimates & Forecast, By Material, 2021-2032 (USD Million) (Thousand Units)

- 7.1 Key trends

- 7.2 Carbon steel

- 7.3 Chrome vanadium

- 7.4 Stainless steel

Chapter 8 Market Estimates & Forecast, By End Use, 2021-2032 (USD Million) (Thousand Units)

- 8.1 Key trends

- 8.2 Automotive industry

- 8.3 Construction industry

- 8.4 Home Use/DIY

- 8.5 Manufacturing industry

Chapter 9 Market Estimates & Forecast, By Distribution Channel, 2021-2032 (USD Million) (Thousand Units)

- 9.1 Key trends

- 9.2 Online

- 9.3 Offline

Chapter 10 Market Estimates & Forecast, By Region, 2021-2032 (USD Million) (Thousand Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 Japan

- 10.4.3 India

- 10.4.4 South Korea

- 10.4.5 Australia

- 10.4.6 Malaysia

- 10.4.7 Indonesia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.6 MEA

- 10.6.1 UAE

- 10.6.2 Saudi Arabia

- 10.6.3 South Africa

Chapter 11 Company Profiles

- 11.1 Apex Tool Group LLC

- 11.2 Bondhus Corporation

- 11.3 Cromwell Group Holdings Ltd.

- 11.4 Facom SAS

- 11.5 Hillman Group Inc.

- 11.6 Klein Tools Inc.

- 11.7 Mac Tools

- 11.8 Matco Tools Corporation

- 11.9 Proto Industrial Tools

- 11.10 Snap-on Inc.

- 11.11 Stanley Black & Decker Inc.

- 11.12 Sunex Tools Inc.

- 11.13 Wera Werkzeuge GmbH

- 11.14 Wiha Tools Ltd.

- 11.15 Wright Tool Company