|

市场调查报告书

商品编码

1665090

捆扎机市场机会、成长动力、产业趋势分析与 2024 - 2032 年预测Strapping Machine Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2024 - 2032 |

||||||

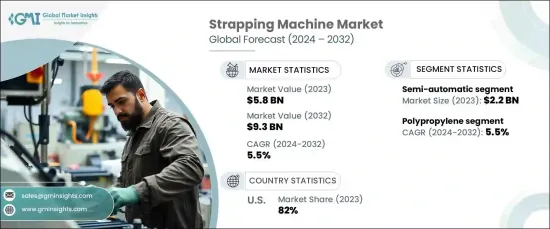

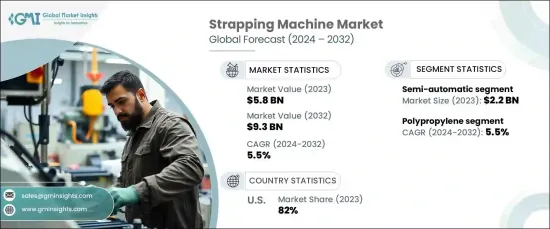

2023 年全球捆扎机市场价值达到 58 亿美元,预计 2024 年至 2032 年期间将以 5.5% 的复合年增长率稳步增长。随着企业努力提高效率、降低营运成本,自动化包装系统成为重中之重。

电子商务的日益突出在这一需求中发挥着关键作用,因为企业必须处理大批量包装以满足快节奏的线上零售环境的需求。大型配送中心和仓库的兴起引发了对自动化和半自动化系统的需求,以确保产品快速安全地包装和运输。随着产业规模扩大和多样化,企业选择捆扎机来简化包装作业并提高生产力。

| 市场范围 | |

|---|---|

| 起始年份 | 2023 |

| 预测年份 | 2024-2032 |

| 起始值 | 58亿美元 |

| 预测值 | 93亿美元 |

| 复合年增长率 | 5.5% |

半自动捆扎机在 2023 年创造了 22 亿美元的收入,预计在 2024-2032 年期间该领域将经历 5.9% 的强劲复合年增长率。物流、製造和仓储等行业对多功能、高速解决方案的需求不断增长是推动这一成长的关键因素。这些机器在手动和全自动系统之间提供了理想的中间地带,使企业能够优化营运、降低劳动成本并提高包装效率。在速度和准确性至关重要的高吞吐量环境中,半自动机器正在加速应用。它们的易用性和成本效益使它们成为那些希望在不增加预算的情况下提高生产力的行业的首选。

按材料类型划分,聚丙烯 (PP) 占据了 2023 年 40% 的市场份额,预计到 2032 年将以 5.5% 的复合年增长率增长。 PP 捆扎带重量轻且耐用,非常适合轻型和中型产品。消费品、零售和电子商务等行业都严重依赖 PP 捆扎带在包装作业中实现成本效益和耐用性的平衡。由于企业希望在不牺牲包装强度的情况下降低成本,PP 仍然是众多包装应用的首选材料。

受电子商务活动激增的推动,美国捆扎机市场在 2023 年占据了令人印象深刻的 82% 的市场份额。网上购物的增加导致包装需求激增,对自动化、可扩展的包装解决方案的需求强烈。作为回应,捆扎机(自动和半自动)在全国各地的仓库、配送中心和配送中心变得越来越普遍。随着电子商务的不断扩大,对于能够以最少的人工处理大量产品的高效捆扎机的需求预计将会增长。

目录

第 1 章:方法论与范围

- 市场范围和定义

- 基础估算与计算

- 预测计算

- 资料来源

- 基本的

- 次要

- 付费来源

- 公共资源

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 影响价值链的因素

- 利润率分析

- 中断

- 未来展望

- 製造商

- 经销商

- 供应商概况

- 利润率分析

- 重要新闻及倡议

- 监管格局

- 衝击力

- 成长动力

- 电子商务产业蓬勃发展

- 纺织业蓬勃发展

- 产业陷阱与挑战

- 市场饱和且竞争激烈

- 永续性问题

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第 5 章:市场估计与预测:按类型,2021-2032 年

- 主要趋势

- 自动的

- 半自动

- 手动的

第六章:市场估计与预测:依资料,2021-2032 年

- 主要趋势

- 聚丙烯

- 钢

- 聚酯纤维

- 其他(复合材料等)

第 7 章:市场估计与预测:按应用,2021 年至 2032 年

- 主要趋势

- 物流与运输

- 包装

- 电子商务

- 製造业

- 建筑材料

- 纺织品

- 食品和饮料

- 其他(医药等)

第 8 章:市场估计与预测:按配销通路,2021-2032 年

- 主要趋势

- 直接的

- 间接

第 9 章:市场估计与预测:按地区,2021-2032 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 中东及非洲

- 阿联酋

- 沙乌地阿拉伯

- 南非

第十章:公司简介

- Beumer Group

- Dynaric

- Fromm Packaging Systems

- Ishida

- MJ Maillis Group

- Mosca

- Packway

- Polychem

- Samuel Strapping Systems

- Samuel Strapping Systems

- Signode

- Solinear

- StraPack

- Transpak

- Wexxar Bel

The Global Strapping Machine Market reached a value of USD 5.8 billion in 2023 and is expected to expand at a steady CAGR of 5.5% from 2024 to 2032. This market growth is being driven by the increasing demand for secure, efficient, and cost-effective packaging solutions across various industries. As companies strive for greater efficiency and reduced operational costs, automated packaging systems have become a top priority.

The rising prominence of e-commerce plays a pivotal role in this demand, as businesses must handle high-volume packaging to meet the needs of fast-paced online retail environments. The rise of large fulfillment centers and warehouses has sparked the need for automated and semi-automated systems that ensure products are packed and shipped swiftly and securely. As industries scale and diversify, businesses are opting for strapping machines to streamline their packaging operations and enhance productivity.

| Market Scope | |

|---|---|

| Start Year | 2023 |

| Forecast Year | 2024-2032 |

| Start Value | $5.8 Billion |

| Forecast Value | $9.3 Billion |

| CAGR | 5.5% |

Semi-automatic strapping machines generated USD 2.2 billion in revenue in 2023, and this segment is forecasted to experience a robust CAGR of 5.9% during the 2024-2032 period. The growing demand for versatile, high-speed solutions in industries such as logistics, manufacturing, and warehousing is a key factor driving this growth. These machines offer an ideal middle ground between manual and fully automated systems, giving businesses the ability to optimize their operations, cut labor costs, and improve packaging efficiency. In high-throughput environments, where speed and accuracy are critical, semi-automatic machines are accelerating adoption. Their ease of use and cost-effectiveness make them a go-to choice for sectors looking to boost productivity without overwhelming budgets.

By material type, the polypropylene (PP) segment accounted for 40% of the market share in 2023, and it is expected to grow at a CAGR of 5.5% through 2032. PP strapping remains a popular option due to its affordability and versatility, making it ideal for industries with high-volume packaging needs. With its lightweight yet durable nature, PP strapping is well-suited for light- and medium-weight products. Sectors like consumer goods, retail, and e-commerce rely heavily on PP strapping to offer a balance of cost-effectiveness and durability in their packaging operations. As businesses look to cut costs without sacrificing the strength of their packaging, PP continues to be the material of choice for numerous packaging applications.

The U.S. strapping machine market held an impressive 82% market share in 2023, driven by the surge in e-commerce activities. The increase in online shopping has led to a surge in packaging requirements, creating a strong need for automated, scalable packaging solutions. In response, strapping machines-both automated and semi-automatic-are becoming increasingly common in warehouses, fulfillment centers, and distribution hubs across the country. As e-commerce continues to expand, the demand for efficient strapping machines capable of handling large volumes of products with minimal manual labor is expected to grow.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2032

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Growing e-commerce industry

- 3.6.1.2 Growing textile industry

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 Market saturation and intense competition

- 3.6.2.2 Sustainability concerns

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2023

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Type, 2021-2032 (USD Million) (Thousand Units)

- 5.1 Key trends

- 5.2 Automatic

- 5.3 Semi-automatic

- 5.4 Manual

Chapter 6 Market Estimates & Forecast, By Material, 2021-2032 (USD Million) (Thousand Units)

- 6.1 Key trends

- 6.2 Polypropylene

- 6.3 Steel

- 6.4 Polyester

- 6.5 Others (composite, etc.)

Chapter 7 Market Estimates & Forecast, By Application, 2021-2032 (USD Million) (Thousand Units)

- 7.1 Key trends

- 7.2 Logistics & transportation

- 7.3 Packaging

- 7.4 E-commerce

- 7.5 Manufacturing

- 7.6 Construction materials

- 7.7 Textiles

- 7.8 Food and beverage

- 7.9 Others (pharmaceutical, etc.)

Chapter 8 Market Estimates & Forecast, By Distribution Channel, 2021-2032 (USD Million) (Thousand Units)

- 8.1 Key trends

- 8.2 Direct

- 8.3 Indirect

Chapter 9 Market Estimates & Forecast, By Region, 2021-2032 (USD Million) (Thousand Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 Saudi Arabia

- 9.6.3 South Africa

Chapter 10 Company Profiles

- 10.1 Beumer Group

- 10.2 Dynaric

- 10.3 Fromm Packaging Systems

- 10.4 Ishida

- 10.5 M.J. Maillis Group

- 10.6 Mosca

- 10.7 Packway

- 10.8 Polychem

- 10.9 Samuel Strapping Systems

- 10.10 Samuel Strapping Systems

- 10.11 Signode

- 10.12 Solinear

- 10.13 StraPack

- 10.14 Transpak

- 10.15 Wexxar Bel