|

市场调查报告书

商品编码

1665102

遗传检测市场机会、成长动力、产业趋势分析与 2025 - 2034 年预测Hereditary Testing Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

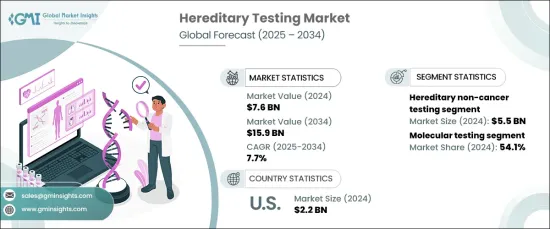

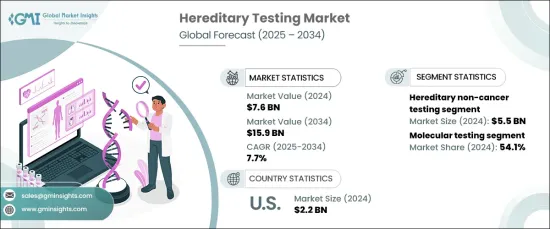

2024 年全球遗传检测市场价值为 76 亿美元,预计 2025 年至 2034 年期间将以 7.7% 的强劲复合年增长率增长。这项革命性的技术在识别遗传疾病、早期诊断、评估风险因素和为个人制定个人化治疗方案方面发挥着越来越重要的作用。市场的快速成长可归因于基因组研究和技术的进步,这使得基因检测变得更实惠且可供更广泛的人使用。随着遗传检测越来越深入融入日常医疗保健实践,并得到政府优惠政策和日益增强的健康意识的支持,遗传检测的需求达到了前所未有的高度。

随着个人化医疗的发展,遗传检测被定位为精准医疗的基石,帮助医生根据基因资讯客製化治疗方案。这一趋势使得基因检测在产前筛检、疾病预测和癌症风险评估等不同领域的应用日益广泛。这些应用正在改变现代医疗保健,强调了进行基因检测以促进早期干预和改善长期健康结果的必要性。此外,人们对遗传疾病的认识不断提高,加上保险支持和报销政策带来的可及性提高,大大促进了市场的扩张。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 76亿美元 |

| 预测值 | 159亿美元 |

| 复合年增长率 | 7.7% |

根据疾病类型,市场分为遗传性癌症检测和遗传性非癌症检测。 2024年,遗传性非癌症检测占据市场主导地位,创造55亿美元的收入。需求激增是由于人们对遗传疾病认识的提高以及早期检测的重要性日益增加。患者和医疗保健提供者都更加重视主动的基因筛检和咨询,从而导致向预防性医疗保健策略的转变。

从技术上讲,市场分为细胞遗传学、生化和分子检测,其中分子检测占据最大的市场份额,到 2024 年将达到 54.1%。这些先进的技术能够同时检测多种基因变异,进而降低成本和周转时间。此外,分子检测平台中人工智慧和机器学习的整合正在简化资料解释、增强基因变异分类并进一步推动市场成长。

光是在美国,遗传检测市场规模在2024年就达到了22亿美元,预计将维持上升趋势。国内遗传疾病和遗传性癌症的发生率不断上升,刺激了基因检测服务的需求。保险覆盖范围的扩大和优惠的报销政策使得基因检测更加容易获得,从而加速了其普及。随着基因组研究的不断进步和对个人化医疗的日益关注,遗传检测市场有望持续成长,并在改善全球健康状况方面发挥关键作用。

目录

第 1 章:方法论与范围

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 遗传性疾病盛行率不断上升

- 基因组技术的进步

- 个人化医疗需求不断成长

- 非侵入性产前检测的采用率不断提高

- 产业陷阱与挑战

- 高级基因检测费用高昂

- 成长动力

- 成长潜力分析

- 监管格局

- 我们

- 欧洲

- 技术格局

- 未来市场趋势

- 重要新闻和倡议

- 差距分析

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

第 5 章:市场估计与预测:按疾病类型,2021 – 2034 年

- 主要趋势

- 遗传性癌症检测

- 肺癌

- 乳癌

- 大肠直肠癌

- 子宫颈癌

- 卵巢癌

- 摄护腺癌

- 胃癌

- 黑色素瘤

- 肉瘤

- 子宫癌

- 胰腺癌

- 其他遗传性癌症

- 遗传性非癌症检测

- 基因检测

- 心臟疾病

- 罕见疾病

- 其他疾病

- 植入前基因诊断与筛检

- 非侵入性产前检测 (NIPT) 和携带者筛检测试

- 新生儿基因筛检

- 基因检测

第六章:市场估计与预测:按技术,2021 – 2034 年

- 主要趋势

- 细胞遗传学

- 生化

- 分子检测

第 7 章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第八章:公司简介

- Agilent Technologies

- Centogene

- CooperSurgical

- F. Hoffmann-La Roche

- Fulgent Genetics

- Illumina

- Invitae Corporation

- Laboratory Corporation of America Holdings

- MedGenome

- Myriad Genetics

- Natera

- Quest Diagnostics

- Sophia Genetics

- Thermo Fisher Scientific

- Twist Bioscience

The Global Hereditary Testing Market, valued at USD 7.6 billion in 2024, is projected to grow at a robust CAGR of 7.7% from 2025 to 2034. Hereditary testing, often referred to as genetic testing, analyzes an individual's DNA to detect gene, chromosome, or protein mutations inherited from parents. This revolutionary technology plays an increasingly pivotal role in identifying genetic conditions, enabling early diagnoses, assessing risk factors, and tailoring personalized treatment plans for individuals. The market's rapid growth can be attributed to advancements in genomic research and technology, which have made genetic testing more affordable and accessible to a wider population. With greater integration into everyday healthcare practices and supported by favorable government policies and increasing health awareness, the demand for hereditary testing is at an all-time high.

As personalized medicine gains momentum, hereditary testing is positioned as a cornerstone of precision healthcare, helping doctors customize treatments based on genetic information. This trend has led to the growing use of genetic tests in diverse areas like prenatal screening, disease prediction, and cancer risk evaluation. These applications are transforming modern healthcare, emphasizing the need for genetic testing to facilitate early interventions and improve long-term health outcomes. Additionally, growing awareness of genetic conditions, combined with improved accessibility due to insurance support and reimbursement policies, has contributed significantly to the market's expansion.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $7.6 Billion |

| Forecast Value | $15.9 Billion |

| CAGR | 7.7% |

By disease type, the market is divided into hereditary cancer testing and hereditary non-cancer testing. In 2024, hereditary non-cancer testing dominated the market, generating USD 5.5 billion in revenue. This surge in demand is driven by increased awareness of genetic disorders and the growing importance of early detection. Patients and healthcare providers alike are placing more emphasis on proactive genetic screening and counseling, leading to a shift toward preventive healthcare strategies.

Technologically, the market is categorized into cytogenetic, biochemical, and molecular testing, with molecular testing holding the largest market share at 54.1% in 2024. This segment is expected to experience substantial growth during the forecast period, thanks to innovations like multiplex PCR assays that have improved testing accuracy and efficiency. These advanced technologies enable the simultaneous detection of multiple genetic variants, reducing both costs and turnaround times. Additionally, the integration of artificial intelligence and machine learning in molecular testing platforms is streamlining data interpretation, enhancing genetic variant classification, and further driving market growth.

In the U.S. alone, the hereditary testing market reached USD 2.2 billion in 2024 and is expected to maintain its upward trajectory. The rising prevalence of genetic disorders and hereditary cancers in the country is fueling the demand for genetic testing services. Enhanced insurance coverage and favorable reimbursement policies are making genetic testing more accessible, accelerating adoption. With ongoing advancements in genomic research and a growing focus on personalized medicine, the hereditary testing market is poised for continued growth, playing a crucial role in improving health outcomes worldwide.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing prevalence of hereditary diseases

- 3.2.1.2 Advancements in genomic technologies

- 3.2.1.3 Rising demand for personalized medicine

- 3.2.1.4 Increasing adoption of non-invasive prenatal testing

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of advanced genetic tests

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 U.S.

- 3.4.2 Europe

- 3.5 Technology landscape

- 3.6 Future market trends

- 3.7 Key news and initiatives

- 3.8 Gap analysis

- 3.9 Porter’s analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Disease Type, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Hereditary cancer testing

- 5.2.1 Lung cancer

- 5.2.2 Breast cancer

- 5.2.3 Colorectal cancer

- 5.2.4 Cervical cancer

- 5.2.5 Ovarian cancer

- 5.2.6 Prostate cancer

- 5.2.7 Stomach/gastric cancer

- 5.2.8 Melanoma

- 5.2.9 Sarcoma

- 5.2.10 Uterine cancer

- 5.2.11 Pancreatic cancer

- 5.2.12 Other hereditary cancers

- 5.3 Hereditary non-cancer testing

- 5.3.1 Genetic tests

- 5.3.1.1 Cardiac diseases

- 5.3.1.2 Rare diseases

- 5.3.1.3 Other diseases

- 5.3.2 Preimplantation genetic diagnosis & screening

- 5.3.3 Non-invasive prenatal testing (NIPT) & carrier screening tests

- 5.3.4 Newborn genetic screening

- 5.3.1 Genetic tests

Chapter 6 Market Estimates and Forecast, By Technology, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Cytogenetic

- 6.3 Biochemical

- 6.4 Molecular testing

Chapter 7 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 UK

- 7.3.3 France

- 7.3.4 Spain

- 7.3.5 Italy

- 7.3.6 Netherlands

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 Japan

- 7.4.3 India

- 7.4.4 Australia

- 7.4.5 South Korea

- 7.5 Latin America

- 7.5.1 Brazil

- 7.5.2 Mexico

- 7.5.3 Argentina

- 7.6 Middle East and Africa

- 7.6.1 South Africa

- 7.6.2 Saudi Arabia

- 7.6.3 UAE

Chapter 8 Company Profiles

- 8.1 Agilent Technologies

- 8.2 Centogene

- 8.3 CooperSurgical

- 8.4 F. Hoffmann-La Roche

- 8.5 Fulgent Genetics

- 8.6 Illumina

- 8.7 Invitae Corporation

- 8.8 Laboratory Corporation of America Holdings

- 8.9 MedGenome

- 8.10 Myriad Genetics

- 8.11 Natera

- 8.12 Quest Diagnostics

- 8.13 Sophia Genetics

- 8.14 Thermo Fisher Scientific

- 8.15 Twist Bioscience