|

市场调查报告书

商品编码

1665103

数位射线成像市场机会、成长动力、产业趋势分析和 2025 - 2034 年预测Digital Radiography Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

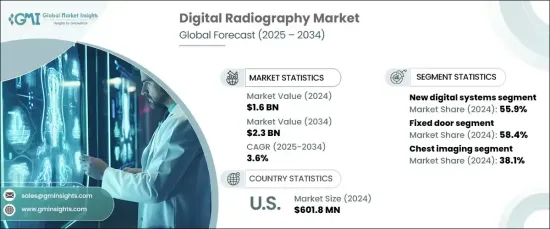

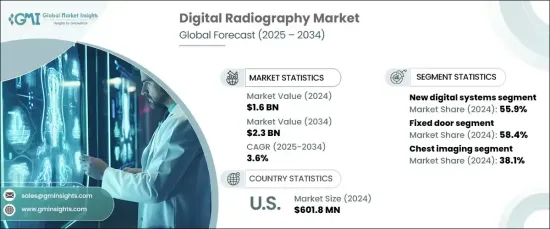

2024 年全球数位放射市场规模达到 16 亿美元,预计将呈现稳定成长的轨迹,2025 年至 2034 年的复合年增长率为 3.6%。随着医院和诊断中心面临越来越大的压力,需要提供更快、更准确的诊断结果,对数位放射系统的需求显着增加。这些系统提高了成像品质并减少了产生结果所需的时间,使得它们在快节奏的医疗保健环境中不可或缺。此外,随着对以患者为中心的护理和简化的工作流程的日益重视,医疗保健提供者正在转向能够实现更高效和更精确诊断的数位放射解决方案。

从传统的基于胶片的放射线照相术向数位系统的转变是该市场成长的最重要驱动力之一。医疗保健提供者正在大力投资对其成像基础设施进行现代化改造,以提高营运效率、增强诊断准确性并在日益技术驱动的行业中保持竞争力。这种转变在那些寻求采用最新技术来满足不断变化的医疗保健需求的机构中尤其明显。作为这种转变的一部分,数位放射系统提供了广泛的好处,从更快的影像处理时间到与电子健康记录 (EHR) 和医院管理系统更好地整合。随着医疗保健需求的不断发展,数位放射成像将在推动诊断成像的未来发展中发挥关键作用。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 16亿美元 |

| 预测值 | 23亿美元 |

| 复合年增长率 | 3.6% |

根据产品,市场分为固定门和便携式数位放射成像系统。固定门系统占据市场主导地位,到 2024 年将占据 58.4% 的份额。便携式数位放射成像系统(如行动和手持设备)也因其在不同医疗保健环境中的便利性和多功能性而越来越受欢迎。

就係统类型而言,市场分为新数位系统和改造系统。 2024 年,新型数位系统将占据 55.9% 的市场份额,这得益于先进平板探测器、人工智慧成像工具以及与医院管理系统的无缝整合等尖端技术。这些先进技术以具有竞争力的价格提供,再加上对医疗设备製造商的支持性补贴,促进了该领域的成长。

2024 年,北美数位放射学市场创收 6.018 亿美元,这得益于公共和私营部门对医疗保健基础设施的大量投资。旨在增强诊断成像能力和整合健康 IT 系统的政策持续推动市场成长。美国凭藉其完善的医疗保健网络和快速采用创新医疗技术,仍然是区域市场扩张的关键参与者。

目录

第 1 章:方法论与范围

- 市场范围和定义

- 研究设计

- 研究方法

- 资料收集方法

- 基础估算与计算

- 基准年计算

- 市场估计的主要趋势

- 预测模型

- 初步研究和验证

- 主要来源

- 资料探勘来源

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 诊断领域数位化趋势日益增强

- 数位放射摄影系统的技术进步

- 医疗机构对降低营运成本的需求日益增加

- 诊断环境中的负担不断增加

- 产业陷阱与挑战

- 数位放射成像系统成本高

- 与资料隐私和安全相关的担忧

- 成长动力

- 成长潜力分析

- 专利分析

- 监管格局

- 技术格局

- 未来市场趋势

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 战略展望

第 5 章:市场估计与预测:按产品,2021 年至 2034 年

- 主要趋势

- 固定门数位射线摄影系统

- 天花板安装系统

- 落地式安装系统

- 便携式数位放射摄影系统

- 移动系统

- 手持系统

第六章:市场估计与预测:按类型,2021 – 2034 年

- 主要趋势

- 新的数位系统

- 改造数位系统

第 7 章:市场估计与预测:按应用,2021 年至 2034 年

- 主要趋势

- 胸部影像学

- 心血管影像

- 骨科成像

- 儿科影像

- 其他应用

第 8 章:市场估计与预测:依最终用途,2021 年至 2034 年

- 主要趋势

- 医院

- 诊断影像中心

- 骨科诊所

- 其他最终用户

第 9 章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十章:公司简介

- AGFA- Gevaert Group

- BPL Medical Technologies

- Canon

- Carestream Health

- Fujifilm Holdings Corporation

- GE Healthcare

- Konica Minolta

- Koninklijke Phillips NV

- MinXray

- Samsung Medison

- Shanghai United Imaging Healthcare

- Shenzhen Mindray Bio-medical Electronics

- Shimadzu Corporation

- Siemens Healthineers AG

- SternMed GmbH

The Global Digital Radiography Market reached USD 1.6 billion in 2024 and is projected to experience a steady growth trajectory, expanding at a CAGR of 3.6% from 2025 to 2034. Several critical factors are contributing to this growth, including the rapid adoption of digital technologies in diagnostic settings, continuous advancements in imaging technologies, and the drive to reduce operational costs within healthcare facilities. With hospitals and diagnostic centers under increasing pressure to provide faster, more accurate diagnostic results, the demand for digital radiography systems has risen significantly. These systems enhance imaging quality and reduce the time needed to produce results, making them indispensable in a fast-paced healthcare environment. Furthermore, with an increasing emphasis on patient-centered care and streamlined workflows, healthcare providers are turning to digital radiography solutions that enable more efficient and precise diagnoses.

The transition from traditional film-based radiography to digital systems represents one of the most significant drivers of growth in this market. Healthcare providers are investing heavily in modernizing their imaging infrastructure to improve operational efficiency, enhance diagnostic accuracy, and stay competitive in an increasingly technology-driven industry. This shift is particularly evident in facilities that seek to embrace the latest technologies to address evolving healthcare demands. As part of this transformation, digital radiography systems offer a wide range of benefits, from faster image processing times to better integration with electronic health records (EHR) and hospital management systems. As healthcare needs continue to evolve, digital radiography will play a pivotal role in driving the future of diagnostic imaging.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.6 Billion |

| Forecast Value | $2.3 Billion |

| CAGR | 3.6% |

By product, the market is divided into fixed-door and portable digital radiography systems. Fixed-door systems dominate the market, accounting for a substantial share of 58.4% in 2024. This is largely due to their widespread use in large hospitals, imaging centers, and trauma care units, where they handle high patient volumes and enable rapid image processing. Portable digital radiography systems, such as mobile and handheld devices, are also gaining traction for their convenience and versatility in diverse healthcare environments.

In terms of system type, the market is segmented into new digital systems and retrofit systems. New digital systems made up 55.9% of the market in 2024, driven by cutting-edge technologies like advanced flat-panel detectors, artificial intelligence-powered imaging tools, and seamless integration with hospital management systems. The availability of these advanced technologies at competitive prices, coupled with supportive subsidies for medical equipment manufacturers, has contributed to the growth of this segment.

North America digital radiography market generated USD 601.8 million in 2024, fueled by substantial investments in healthcare infrastructure from both the public and private sectors. Policies aimed at enhancing diagnostic imaging capabilities and integrating health IT systems continue to bolster market growth. The United States, with its well-established healthcare network and rapid adoption of innovative medical technologies, remains a key player in regional market expansion.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates & calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing digitalization trends across diagnostic settings

- 3.2.1.2 Technological advancements in digital radiography systems

- 3.2.1.3 Rising demand for reducing operational cost across healthcare facilities

- 3.2.1.4 Growing burden across diagnostic settings

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High cost of digital radiography systems

- 3.2.2.2 Concerns related to data privacy and security

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Patent analysis

- 3.5 Regulatory landscape

- 3.6 Technological landscape

- 3.7 Future market trends

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy outlook

Chapter 5 Market Estimates and Forecast, By Product, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Fixed door digital radiography systems

- 5.2.1 Ceiling-mounted systems

- 5.2.2 Floor-to-ceiling mounted systems

- 5.3 Portable digital radiography systems

- 5.3.1 Mobile systems

- 5.3.2 Handheld systems

Chapter 6 Market Estimates and Forecast, By Type, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 New digital systems

- 6.3 Retrofit digital systems

Chapter 7 Market Estimates and Forecast, By Application, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Chest imaging

- 7.3 Cardiovascular imaging

- 7.4 Orthopedic imaging

- 7.5 Pediatric imaging

- 7.6 Other applications

Chapter 8 Market Estimates and Forecast, By End Use, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Hospitals

- 8.3 Diagnostic imaging centers

- 8.4 Orthopedic clinics

- 8.5 Other end users

Chapter 9 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 AGFA- Gevaert Group

- 10.2 BPL Medical Technologies

- 10.3 Canon

- 10.4 Carestream Health

- 10.5 Fujifilm Holdings Corporation

- 10.6 GE Healthcare

- 10.7 Konica Minolta

- 10.8 Koninklijke Phillips N.V.

- 10.9 MinXray

- 10.10 Samsung Medison

- 10.11 Shanghai United Imaging Healthcare

- 10.12 Shenzhen Mindray Bio-medical Electronics

- 10.13 Shimadzu Corporation

- 10.14 Siemens Healthineers AG

- 10.15 SternMed GmbH