|

市场调查报告书

商品编码

1665177

持针器市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Needle Holders Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

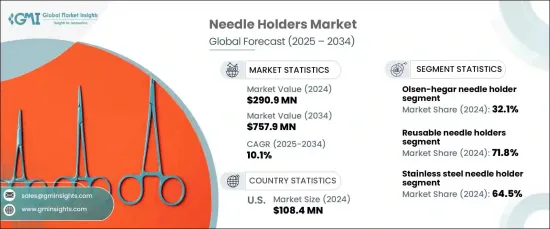

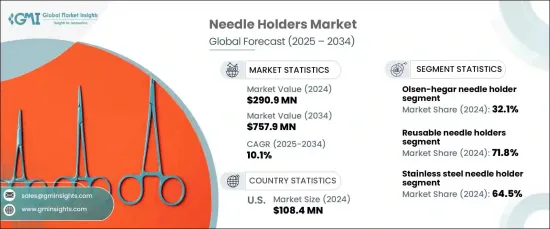

2024 年全球持针器市场价值为 2.909 亿美元,将经历强劲的成长轨迹,预计 2025 年至 2034 年的复合年增长率为 10.1%。此外,机器人辅助手术的进步也推动了对这些仪器的需求,因为它们为复杂的手术提供了必要的灵活性和稳定性。心血管疾病、糖尿病和癌症等需要手术介入的慢性病的增加也促进了市场的扩大。外科医生越来越依赖持针器等先进、高品质的仪器在手术过程中执行精细的任务,这使得它们在现代手术室中不可或缺。此外,生物相容性材料的创新提高了持针器的安全性和效率,并持续推动市场成长。

持针器市场多种多样,其类型多种多样,旨在满足不同外科专业的独特需求。其中,Olsen-Hegar 持针器占据领先地位,2024 年占据 32.1% 的市场份额。这种组合可以使程式更加高效,特别是在速度和准确性至关重要的环境中。外科医生欣赏该工具的易用性、成本效益和多功能设计,这有助于其广泛采用。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 2.909 亿美元 |

| 预测值 | 7.579 亿美元 |

| 复合年增长率 | 10.1% |

在应用方面,心血管领域脱颖而出,到 2024 年将占据 22.6% 的市场份额。随着心血管手术需求的增加,包括持针器在内的高品质精密器械市场也正在成长。这些手术要求极高的精确度,进一步刺激了对支持精细手术的持针器市场的需求。

美国仍然是全球持针器市场最大的贡献者之一,2024 年的市场规模为 1.084 亿美元。随着美国医疗保健产业采用更先进的技术,对持针器等专用仪器的需求持续激增,特别是那些设计用于需要高精度的机器人系统仪器的需求。全国持续采用尖端手术解决方案预计将进一步推动市场扩张。

目录

第 1 章:方法论与范围

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 微创手术需求不断成长

- 机器人辅助手术的出现

- 生物相容性和专用材料的进展

- 需要手术介入的慢性病数量增长

- 产业陷阱与挑战

- 存在严格的规定

- 仿冒品的供应

- 成长动力

- 成长潜力分析

- 专利分析

- 差距分析

- 监管格局

- 技术格局

- 未来市场趋势

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 战略展望

第 5 章:市场估计与预测:按类型,2021 年至 2034 年

- 主要趋势

- Olsen-Hegar持针器

- Mayo-hegar持针器

- 韦伯斯特持针器

- Mathieu 持针器

- Halsey 持针器

- 克里尔伍德持针器

- Derf 持针器

- 其他类型

第 6 章:市场估计与预测:按用途,2021 年至 2034 年

- 主要趋势

- 可重复使用持针器

- 免洗持针器

第 7 章:市场估计与预测:按材料,2021 年至 2034 年

- 主要趋势

- 不銹钢持针器

- 碳化钨持针器

- 其他材料

第 8 章:市场估计与预测:按应用,2021 年至 2034 年

- 主要趋势

- 心血管

- 胃肠道

- 胸椎

- 骨科

- 牙科

- 眼科

- 泌尿科

- 妇科

- 其他应用

第 9 章:市场估计与预测:依最终用途,2021 年至 2034 年

- 主要趋势

- 医院

- 门诊手术中心

- 其他最终用途

第 10 章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第 11 章:公司简介

- A. Schweickhardt

- August Reuchlen

- B. Braun Melsungen

- Baxter International

- Becton, Dickinson and Company

- Hologic (Somatex Medical Technologies)

- Hu-Friedy Mfg

- Johnson & Johnson

- KLS Martin Group

- MedGyn Products

- Medline Industries

- Nordent Manufacturing

- Olympus Corporation

- Sklar Instruments

- Towne Brothers

The Global Needle Holders Market, valued at USD 290.9 million in 2024, is set to experience a robust growth trajectory, with a projected CAGR of 10.1% from 2025 to 2034. The demand for needle holders is being significantly driven by the growing preference for minimally invasive surgeries, which require specialized tools to ensure precision and safety. Additionally, advancements in robotic-assisted procedures are fueling the need for these instruments, as they offer the necessary dexterity and stability for complex surgeries. The rise in chronic conditions that require surgical intervention, such as cardiovascular diseases, diabetes, and cancer, also contributes to the expanding market. Surgeons increasingly rely on advanced, high-quality instruments like needle holders to perform delicate tasks during procedures, making them indispensable in modern operating rooms. Furthermore, innovations in biocompatible materials, enhancing both the safety and efficiency of needle holders, continue to propel market growth.

The market for needle holders is diverse, with a wide array of types designed to meet the unique demands of different surgical specialties. Among these, the Olsen-Hegar needle holder is the leader, commanding a 32.1% share of the market in 2024. Its dual functionality, combining both a needle holder and scissors, makes it a popular choice for surgeries requiring precise suturing and cutting. This combination allows for more efficient procedures, especially in settings where speed and accuracy are crucial. Surgeons appreciate the tool's ease of use, cost-effectiveness, and versatile design, which contributes to its broad adoption.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $290.9 Million |

| Forecast Value | $757.9 Million |

| CAGR | 10.1% |

In terms of application, the cardiovascular segment stands out, holding a notable 22.6% share of the market in 2024. The surge in global cardiovascular diseases, such as heart disease and hypertension, directly impacts the demand for needle holders designed for these specialized surgeries. As the need for cardiovascular surgeries increases, the market for high-quality, precision instruments, including needle holders, also rises. These surgeries demand the utmost accuracy, further bolstering the market for needle holders that can support delicate operations.

The U.S. remains one of the largest contributors to the global needle holders market, generating USD 108.4 million in 2024. This growth is largely attributed to the rise in minimally invasive surgery and the increasing use of robotic-assisted surgical techniques. As the healthcare sector in the U.S. embraces more advanced technologies, the demand for specialized instruments like needle holders continues to surge, particularly those designed for use with robotic systems that require exceptional precision. The ongoing adoption of cutting-edge surgical solutions across the country is expected to further drive market expansion.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising demand for minimally invasive surgeries

- 3.2.1.2 Emergence of robot-assisted surgical procedures

- 3.2.1.3 Advancements in biocompatible and specialized materials

- 3.2.1.4 Growth in chronic diseases requiring surgical interventions

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Presence of stringent regulations

- 3.2.2.2 Availability of counterfeit products

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Patent analysis

- 3.5 Gap analysis

- 3.6 Regulatory landscape

- 3.7 Technological landscape

- 3.8 Future market trends

- 3.9 Porter’s analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy outlook

Chapter 5 Market Estimates and Forecast, By Type, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Olsen-hegar needle holder

- 5.3 Mayo-hegar needle holder

- 5.4 Webster needle holder

- 5.5 Mathieu needle holder

- 5.6 Halsey needle holder

- 5.7 Crilewood needle holder

- 5.8 Derf needle holder

- 5.9 Other types

Chapter 6 Market Estimates and Forecast, By Usage, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Reusable needle holder

- 6.3 Single-use needle holder

Chapter 7 Market Estimates and Forecast, By Material, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Stainless steel needle holder

- 7.3 Tungsten carbide needle holder

- 7.4 Other materials

Chapter 8 Market Estimates and Forecast, By Application, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Cardiovascular

- 8.3 Gastrointestinal

- 8.4 Thoracic

- 8.5 Orthopedic

- 8.6 Dental

- 8.7 Ophthalmic

- 8.8 Urology

- 8.9 Gynecology

- 8.10 Other applications

Chapter 9 Market Estimates and Forecast, By End Use, 2021 – 2034 ($ Mn)

- 9.1 Key trends

- 9.2 Hospitals

- 9.3 Ambulatory surgical centers

- 9.4 Other end use

Chapter 10 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 Japan

- 10.4.3 India

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 A. Schweickhardt

- 11.2 August Reuchlen

- 11.3 B. Braun Melsungen

- 11.4 Baxter International

- 11.5 Becton, Dickinson and Company

- 11.6 Hologic (Somatex Medical Technologies)

- 11.7 Hu-Friedy Mfg

- 11.8 Johnson & Johnson

- 11.9 KLS Martin Group

- 11.10 MedGyn Products

- 11.11 Medline Industries

- 11.12 Nordent Manufacturing

- 11.13 Olympus Corporation

- 11.14 Sklar Instruments

- 11.15 Towne Brothers