|

市场调查报告书

商品编码

1665181

瓦斯调峰电力租赁市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Gas Fueled Peak Shaving Power Rental Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

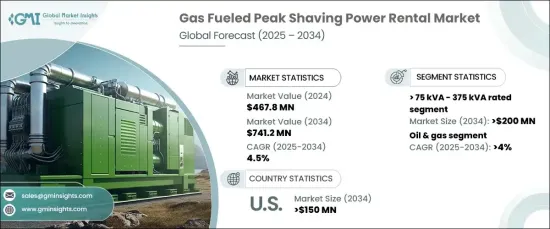

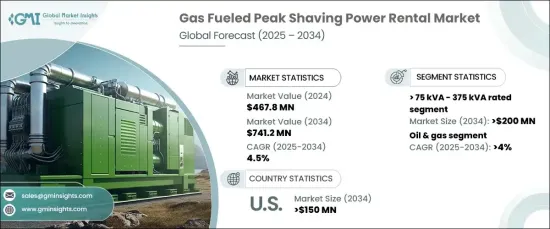

2024 年全球燃气燃料调峰电力租赁市场价值为 4.678 亿美元,预计 2025 年至 2034 年期间将稳步增长,复合年增长率为 4.5%。 市场主要受更严格的环境法规和对高效可靠电力解决方案日益增长的需求驱动。随着全球范围内涌现越来越多的基础设施项目,对能够满足尖峰负载需求的灵活电力系统的需求日益增加,从而进一步推动市场成长。临时电源解决方案,特别是能够有效管理尖峰电力负荷的解决方案,已成为各行业必不可少的解决方案。此外,向永续发展和减碳措施的转变正在促使各行各业采用天然气等更清洁的燃料替代品,以符合全球环境目标。发电技术的创新和对按需租赁系统日益增长的偏好正在重塑市场,使得燃气电力租赁成为众多商业和工业应用的首选。

该市场的一个重要部分是额定功率在 75 kVA 至 375 kVA 之间的燃气调峰电力租赁系统的需求,预计到 2034 年将产生 2 亿美元的收入。为了满足这些需求,专注于减少噪音排放和提高租赁单位安静运行的技术进步正在获得发展动力,从而提高市场接受度。这些创新与有利的监管框架相结合,正在鼓励各行各业采用天然气租赁解决方案来满足临时能源需求。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 4.678 亿美元 |

| 预测值 | 7.412亿美元 |

| 复合年增长率 | 4.5% |

在石油和天然气领域,预计到 2034 年,调峰电力租赁市场将以 4% 的速度成长。减少碳排放的努力和对天然气燃料的日益增长的偏好也助长了这一趋势。此外,包括更高效的燃气引擎和增强的远端监控能力在内的技术改进正在提高燃油效率、降低营运成本并提供即时追踪以实现更好的性能管理。

预计到 2034 年,美国燃气调峰电力租赁市场将创收 1.5 亿美元。随着联邦和州法规推动使用更清洁的能源替代品,预计采用燃气租赁系统的人数将会增加。此外,对电网现代化和再生能源整合的投资正加剧对能够确保电网稳定性和运行弹性的灵活电力系统的需求。这一趋势将推动各行业对高效、可靠的燃气电力租赁的需求。

目录

第 1 章:方法论与范围

- 市场范围和定义

- 市场估计和预测参数

- 预测计算

- 资料来源

- 基本的

- 次要

- 有薪资的

- 民众

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 监管格局

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 成长潜力分析

- 波特的分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- PESTEL 分析

第四章:竞争格局

- 介绍

- 战略展望

- 创新与永续发展格局

第五章:市场规模及预测:依功率等级,2021 – 2034 年

- 主要趋势

- ≤ 75 千伏安

- > 75 千伏安 - 375 千伏安

- > 375 千伏安 - 750 千伏安

- >750千伏安

第 6 章:市场规模与预测:依最终用途,2021 – 2034 年

- 主要趋势

- 电信

- 资料中心

- 卫生保健

- 石油和天然气

- 电力设施

- 海上

- 製造业

- 建造

- 矿业

- 海洋

- 其他的

第 7 章:市场规模及预测:按地区,2021 – 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 俄罗斯

- 英国

- 德国

- 法国

- 西班牙

- 奥地利

- 义大利

- 亚太地区

- 中国

- 澳洲

- 印度

- 日本

- 韩国

- 印尼

- 马来西亚

- 泰国

- 越南

- 菲律宾

- 中东

- 沙乌地阿拉伯

- 阿联酋

- 卡达

- 土耳其

- 伊朗

- 阿曼

- 非洲

- 埃及

- 奈及利亚

- 阿尔及利亚

- 南非

- 安哥拉

- 肯亚

- 莫三比克

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 智利

第八章:公司简介

- Aggreko

- Al Faris

- Atlas Copco

- BPC Power Rentals

- Bredenoord

- Caterpillar

- Cummins

- GEN-TECH

- Global Power Supply

- Modern Hiring Service

- Pon Energy Rental

- PowerLink

- Prime Power Rentals

- Teksan

- Unicel Autotech

The Global Gas Fueled Peak Shaving Power Rental Market, valued at USD 467.8 million in 2024, is projected to experience steady growth with a CAGR of 4.5% from 2025 to 2034. The market is primarily driven by stricter environmental regulations and an increasing demand for efficient and reliable power solutions. As more infrastructure projects emerge worldwide, there is a rising need for flexible power systems capable of addressing peak load demands, further fueling market growth. Temporary power solutions, particularly those capable of efficiently managing peak electricity loads, have become essential across various industries. Additionally, the shift towards sustainability and carbon reduction initiatives is prompting industries to adopt cleaner fuel alternatives, such as natural gas, to align with global environmental goals. Innovations in power generation technologies and the growing preference for on-demand rental systems are reshaping the market, making gas-fueled power rentals a preferred choice for numerous commercial and industrial applications.

A significant segment within this market is the demand for gas-fueled peak shaving power rental systems rated between 75 kVA and 375 kVA, which is expected to generate USD 200 million by 2034. Weather-related disruptions like storms and cyclones have made reliable power systems more critical than ever for maintaining operational continuity. To meet these demands, technological advancements focused on reducing noise emissions and enhancing the quiet operation of rental units are gaining traction, improving market acceptance. These innovations, combined with favorable regulatory frameworks, are encouraging industries to adopt gas-powered rental solutions for temporary energy needs.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $467.8 Million |

| Forecast Value | $741.2 Million |

| CAGR | 4.5% |

In the oil and gas sector, the peak shaving power rental market is expected to grow at a rate of 4% through 2034. The increasing need for temporary power, particularly in remote drilling and production activities, is driving adoption. Efforts to minimize carbon emissions and a growing preference for natural gas-based fuels are also contributing to this trend. Moreover, technological improvements, including more efficient gas engines and enhanced remote monitoring capabilities, are improving fuel efficiency, reducing operational costs, and offering real-time tracking for better performance management.

The U.S. gas-fueled peak shaving power rental market is projected to generate USD 150 million by 2034. With a growing demand for electricity during peak hours and a strong focus on cost-effective energy management solutions, the market is expected to gain significant traction. As federal and state regulations push for cleaner energy alternatives, the adoption of gas-fueled rental systems is expected to rise. Furthermore, investments in grid modernization and renewable energy integration are intensifying the need for flexible power systems capable of ensuring grid stability and operational resilience. This trend will drive the demand for efficient, dependable gas-fueled power rentals across various sectors.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Market estimates & forecast parameters

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's Analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL Analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Strategic outlook

- 4.3 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Power Rating, 2021 – 2034 (USD Million)

- 5.1 Key trends

- 5.2 ≤ 75 kVA

- 5.3 > 75 kVA - 375 kVA

- 5.4 > 375 kVA - 750 kVA

- 5.5 > 750 kVA

Chapter 6 Market Size and Forecast, By End Use, 2021 – 2034 (USD Million)

- 6.1 Key trends

- 6.2 Telecom

- 6.3 Data center

- 6.4 Healthcare

- 6.5 Oil & gas

- 6.6 Electric utilities

- 6.7 Offshore

- 6.8 Manufacturing

- 6.9 Construction

- 6.10 Mining

- 6.11 Marine

- 6.12 Others

Chapter 7 Market Size and Forecast, By Region, 2021 – 2034 (USD Million)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Russia

- 7.3.2 UK

- 7.3.3 Germany

- 7.3.4 France

- 7.3.5 Spain

- 7.3.6 Austria

- 7.3.7 Italy

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 Australia

- 7.4.3 India

- 7.4.4 Japan

- 7.4.5 South Korea

- 7.4.6 Indonesia

- 7.4.7 Malaysia

- 7.4.8 Thailand

- 7.4.9 Vietnam

- 7.4.10 Philippines

- 7.5 Middle East

- 7.5.1 Saudi Arabia

- 7.5.2 UAE

- 7.5.3 Qatar

- 7.5.4 Turkey

- 7.5.5 Iran

- 7.5.6 Oman

- 7.6 Africa

- 7.6.1 Egypt

- 7.6.2 Nigeria

- 7.6.3 Algeria

- 7.6.4 South Africa

- 7.6.5 Angola

- 7.6.6 Kenya

- 7.6.7 Mozambique

- 7.7 Latin America

- 7.7.1 Brazil

- 7.7.2 Mexico

- 7.7.3 Argentina

- 7.7.4 Chile

Chapter 8 Company Profiles

- 8.1 Aggreko

- 8.2 Al Faris

- 8.3 Atlas Copco

- 8.4 BPC Power Rentals

- 8.5 Bredenoord

- 8.6 Caterpillar

- 8.7 Cummins

- 8.8 GEN-TECH

- 8.9 Global Power Supply

- 8.10 Modern Hiring Service

- 8.11 Pon Energy Rental

- 8.12 PowerLink

- 8.13 Prime Power Rentals

- 8.14 Teksan

- 8.15 Unicel Autotech