|

市场调查报告书

商品编码

1665194

汽车电动压缩机市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Automotive E-Compressor Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

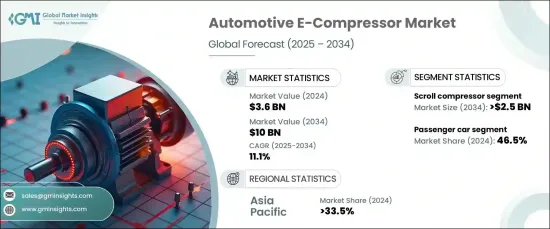

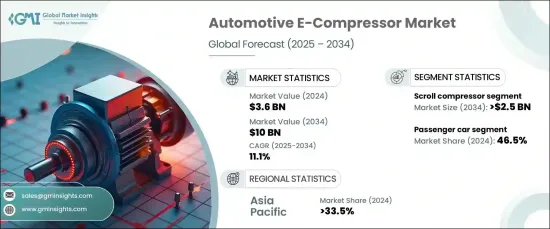

2024 年全球汽车电动压缩机市场价值为 36 亿美元,将经历显着增长,预计 2025 年至 2034 年的复合年增长率为 11.1%。 这一增长主要得益于对先进热管理系统日益增长的需求,而热管理系统正成为现代电动汽车 (EV) 和混合动力汽车的重要组成部分。随着这些车辆的不断发展,管理电池、电动马达、驾驶室和电力电子设备等关键零件的温度对于实现最佳性能变得越来越重要。汽车电动压缩机在该系统中发挥关键作用,因其能源效率以及显着减少对内燃机 (ICE) 驱动的传统机械压缩机的依赖的能力而受到高度重视。这种技术转变与汽车产业对永续和节能解决方案的更广泛推动相一致,进一步加速了市场成长。

汽车电动压缩机市场按压缩机类型细分,包括涡旋式、旋转式、往復式、螺桿式等。 2024 年,涡旋压缩机占据了 33% 的市场份额,预计到 2034 年将创造 25 亿美元的产值。这些特性使它们特别适合用于空间效率和性能至关重要的电动和混合动力汽车。涡旋压缩机背后的技术涉及两个螺旋形涡旋,其中一个保持静止,而另一个以圆週运动移动以压缩冷媒。这个过程可确保高效率和降低噪音水平,这是提高电动车和混合动力车的舒适性和功能性的关键因素。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 36亿美元 |

| 预测值 | 100亿美元 |

| 复合年增长率 | 11.1% |

从车型角度来看,汽车电子压缩机市场分为乘用车、商用车和非公路用车。 2024 年,乘用车占据最大的市场份额,为 46.5%。这种主导地位很大程度上是由于电动和混合动力汽车越来越受欢迎,其中乘用车引领了向更环保的交通解决方案的转变。在这些车辆中,电子压缩机比传统的皮带驱动压缩机更节能,可确保更好的热管理,同时最大限度地降低能耗。与内燃机汽车(由引擎驱动空调)不同,电动车依靠由车辆电池和电动马达供电的电子压缩机。

受该地区电动车产业快速扩张的推动,亚太地区将在 2024 年占据全球汽车电动压缩机市场的 33.5%。尤其是在中国,在政府补贴、税收优惠和减少碳排放政策等强力措施的支持下,中国已成为最大的电动车生产国和消费国。随着比亚迪、蔚来、小鹏、吉利等中国主要汽车製造商在电动车开发和销售方面处于领先地位,该地区的汽车电动压缩机市场将在未来几年继续成长。

目录

第 1 章:方法论与范围

- 研究设计

- 研究方法

- 资料收集方法

- 基础估计和计算

- 基准年计算

- 市场估计的主要趋势

- 预测模型

- 初步研究与验证

- 主要来源

- 资料探勘来源

- 市场定义

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 供应商概况

- 原物料供应商

- 零件製造商

- 技术提供者

- 最终用户

- 利润率分析

- 技术与创新格局

- 成本明细

- 重要新闻及倡议

- 监管格局

- 定价分析

- 衝击力

- 成长动力

- 电动车普及率激增

- 压缩机技术的进步

- 消费者对高阶功能的需求

- 更加关注热管理系统

- 产业陷阱与挑战

- 电动压缩机的初始成本高

- 技术和整合挑战

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第 5 章:市场估计与预测:按压缩机,2021 - 2034 年

- 主要趋势

- 捲动

- 旋转

- 往復式

- 拧紧

- 其他的

第 6 章:市场估计与预测:按冷冻能力,2021 - 2034 年

- 主要趋势

- 低容量(5kW以下)

- 中等容量(5-10 kW)

- 高容量(10kW以上)

第 7 章:市场估计与预测:按应用,2021 - 2034 年

- 主要趋势

- 客舱空调

- 电池热管理

- 动力传动系统冷却

- 电动传动系统冷却

- 其他的

第 8 章:市场估计与预测:按推进方式,2021 - 2034 年

- 主要趋势

- 电的

- 杂交种

第 9 章:市场估计与预测:按车型,2021 - 2034 年

- 主要趋势

- 搭乘用车

- 轿车

- 越野车

- 掀背车

- 商用车

- 轻型商用车

- 丙型肝炎病毒

- 越野车

第 10 章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 西班牙

- 义大利

- 俄罗斯

- 北欧

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳新银行

- 东南亚

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东及非洲

- 阿联酋

- 南非

- 沙乌地阿拉伯

第 11 章:公司简介

- Bosch

- Boyard Compressor

- Denso

- Elgi Equipment

- Gardner Denver

- Garrett

- Guchen Industry

- Hanon Systems

- Highly Marelli

- Infineon

- Mahle

- Mitsubishi

- Novosense

- Sanden

- Siroco

- TCCI

- Toyota

- Valeo

- Vikas Group

- ZF Friedrichshafen

The Global Automotive E-Compressor Market, valued at USD 3.6 billion in 2024, is set to experience remarkable growth, with an expected CAGR of 11.1% from 2025 to 2034. This growth is largely driven by the increasing demand for advanced thermal management systems, which are becoming an essential component in modern electric vehicles (EVs) and hybrids. As these vehicles continue to evolve, managing the temperature of critical components such as batteries, electric motors, cabins, and power electronics has become increasingly important for optimal performance. Automotive e-compressors, which play a pivotal role in this system, are highly valued for their energy efficiency and their ability to significantly reduce reliance on traditional mechanical compressors powered by internal combustion engines (ICEs). This shift in technology aligns with the broader push towards sustainable and energy-efficient solutions in the automotive industry, further accelerating market growth.

The market for automotive e-compressors is segmented by compressor type, including scroll, rotary, reciprocating, screw, and others. In 2024, the scroll compressor segment commanded a substantial 33% market share and is projected to generate USD 2.5 billion by 2034. Scroll compressors are particularly favored for their reliability, quiet operation, and compact design, making them ideal for modern automotive applications. These features make them especially suitable for use in electric and hybrid vehicles, where space efficiency and performance are paramount. The technology behind scroll compressors involves two spiral-shaped scrolls, one of which remains stationary while the other moves in a circular motion to compress refrigerant. This process ensures high efficiency and reduced noise levels, critical factors for improving the comfort and functionality of EVs and hybrids.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.6 Billion |

| Forecast Value | $10 Billion |

| CAGR | 11.1% |

Looking at the market from a vehicle type perspective, the automotive e-compressor market is divided into passenger cars, commercial vehicles, and off-highway vehicles. In 2024, passenger cars represented the largest segment with a 46.5% market share. This dominance is largely due to the increasing popularity of electric and hybrid vehicles, with passenger cars leading the transition to more eco-friendly transportation solutions. In these vehicles, e-compressors offer a more energy-efficient alternative to traditional belt-driven compressors, ensuring better thermal management while minimizing energy consumption. Unlike ICE-powered vehicles, where the engine drives the air conditioning, electric vehicles rely on e-compressors powered by the vehicle's battery and electric motor.

Asia Pacific held a 33.5% share of the global automotive e-compressor market in 2024, driven by rapid expansion in the region's electric vehicle industry. China, in particular, has become the largest producer and consumer of electric vehicles, supported by strong government initiatives including subsidies, tax incentives, and policies aimed at reducing carbon emissions. With major Chinese automakers like BYD, NIO, XPeng, and Geely leading the charge in EV development and sales, the region's automotive e-compressor market is poised for continued growth in the coming years.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 360º synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 Raw material suppliers

- 3.2.2 Component manufacturers

- 3.2.3 Technology providers

- 3.2.4 End users

- 3.3 Profit margin analysis

- 3.4 Technology & innovation landscape

- 3.5 Cost breakdown

- 3.6 Key news & initiatives

- 3.7 Regulatory landscape

- 3.8 Pricing analysis

- 3.9 Impact forces

- 3.9.1 Growth drivers

- 3.9.1.1 Surge in EV adoption

- 3.9.1.2 Advancements in compressor technology

- 3.9.1.3 Consumer demand for advanced features

- 3.9.1.4 Increased focus on thermal management systems

- 3.9.2 Industry pitfalls & challenges

- 3.9.2.1 High initial cost of electric compressors

- 3.9.2.2 Technological and integration challenges

- 3.9.1 Growth drivers

- 3.10 Growth potential analysis

- 3.11 Porter’s analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Compressor, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Scroll

- 5.3 Rotary

- 5.4 Reciprocating

- 5.5 Screw

- 5.6 Others

Chapter 6 Market Estimates & Forecast, By Cooling Capacity, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Low capacity (Below 5 kW)

- 6.3 Medium capacity (5-10 kW)

- 6.4 High capacity (Above 10 kW)

Chapter 7 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 Cabin air conditioning

- 7.3 Battery thermal management

- 7.4 Powertrain cooling

- 7.5 Electric drivetrain cooling

- 7.6 Others

Chapter 8 Market Estimates & Forecast, By Propulsion, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 Electric

- 8.3 Hybrid

Chapter 9 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 Passenger cars

- 9.2.1 Sedan

- 9.2.2 SUV

- 9.2.3 Hatchback

- 9.3 Commercial vehicle

- 9.3.1 LCV

- 9.3.2 HCV

- 9.4 Off highway vehicle

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Russia

- 10.3.7 Nordics

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 ANZ

- 10.4.6 Southeast Asia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 UAE

- 10.6.2 South Africa

- 10.6.3 Saudi Arabia

Chapter 11 Company Profiles

- 11.1 Bosch

- 11.2 Boyard Compressor

- 11.3 Denso

- 11.4 Elgi Equipment

- 11.5 Gardner Denver

- 11.6 Garrett

- 11.7 Guchen Industry

- 11.8 Hanon Systems

- 11.9 Highly Marelli

- 11.10 Infineon

- 11.11 Mahle

- 11.12 Mitsubishi

- 11.13 Novosense

- 11.14 Sanden

- 11.15 Siroco

- 11.16 TCCI

- 11.17 Toyota

- 11.18 Valeo

- 11.19 Vikas Group

- 11.20 ZF Friedrichshafen