|

市场调查报告书

商品编码

1665205

汽车智慧天线模组市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Automotive Intelligent Antenna Module Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

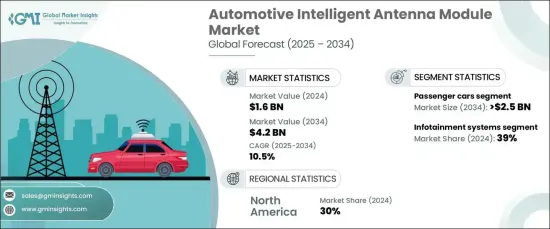

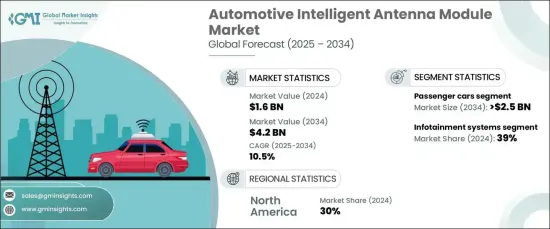

2024 年全球汽车智慧天线模组市场价值为 16 亿美元,预计在 2025 年至 2034先进驾驶辅助系统期间将以 10.5% 的强劲复合年增长率增长。随着这些技术成为现代行动解决方案不可或缺的一部分,智慧天线模组成为关键组件,促进下一代汽车所需的无缝通讯和强大的资料传输能力。

对车载连接和资讯娱乐解决方案的不断增长的需求进一步推动了市场的发展。当今的消费者希望汽车能够作为互联枢纽运行,配备即时导航、语音控制功能以及透过蓝牙和 Wi-Fi 轻鬆实现智慧型手机整合等功能。智慧天线模组是这些先进系统的支柱,可确保不间断的连接并满足精通技术的驾驶员的期望。随着汽车逐渐朝着智慧互联方向发展,这些模组在提供卓越车内体验、满足不断变化的消费者偏好方面发挥着重要作用。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 16亿美元 |

| 预测值 | 42亿美元 |

| 复合年增长率 | 10.5% |

市场依车辆类型分为乘用车和商用车。 2024 年,乘用车占据市场主导地位,占有 65% 的份额,预计到 2034 年将创造 25 亿美元的市场价值。消费者对个人化和沈浸式车载体验的需求不断增长,这继续推动这些模组在乘用车中的应用,巩固了它们作为现代汽车关键功能的作用。

根据应用,市场包括车对车 (V2V)、远端资讯处理、资讯娱乐系统、ADAS 和车对基础设施 (V2I) 通讯。 2024 年,资讯娱乐系统占据 39% 的市场份额,这得益于语音助理和基于云端的功能日益融合。智慧天线模组提供免持操作、无缝媒体串流和持续更新所需的可靠连接,使其成为先进资讯娱乐解决方案不可或缺的一部分。

在自动驾驶汽车技术进步的推动下,北美市场到 2024 年将占据全球份额的 30%。该地区在自动驾驶汽车的测试和部署方面处于领先地位,从而扩大了对智慧天线模组的需求。这些模组支援关键的车对车 (V2X) 通讯、GPS、雷达系统和无缝资料传输,确保北美自动驾驶系统的安全性、效率和可靠性。该地区的持续创新使其成为智慧天线技术应用的领导者。

目录

第 1 章:方法论与范围

- 研究设计

- 研究方法

- 资料收集方法

- 基础估算与计算

- 基准年计算

- 市场估计的主要趋势

- 预测模型

- 初步研究和验证

- 主要来源

- 资料探勘来源

- 市场范围和定义

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 一级供应商

- 电信业者

- 科技公司和软体供应商

- 汽车连接和基础设施提供商

- 经销商

- 最终用户

- 供应商概况

- 利润率分析

- 技术与创新格局

- 专利分析

- 重要新闻及倡议

- 监管格局

- 定价分析

- 衝击力

- 成长动力

- 连网和自动驾驶汽车的普及率不断提高

- 部署5G网路和V2X通讯技术

- 消费者对资讯娱乐和远端资讯处理功能的需求不断增加

- 促进车辆安全和连通性的严格法规

- 产业陷阱与挑战

- 成本高、整合复杂

- 讯号干扰与网路可靠性问题

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:按模组,2021 - 2034 年

- 主要趋势

- 5G

- V2X 通信

- 多频带

- 多输入多输出

- 无线网路/蓝牙

第六章:市场估计与预测:按组件,2021 - 2034 年

- 主要趋势

- 天线

- 讯号处理器

- 控制单元

- 射频 (RF) 单元

- 筛选器

第 7 章:市场估计与预测:按应用,2021 - 2034 年

- 主要趋势

- 远端资讯处理

- 资讯娱乐系统

- 高级驾驶辅助系统

- 车对车 (V2V)

- 车辆到基础设施 (V2I)

第 8 章:市场估计与预测:按推进方式,2021 - 2034 年

- 主要趋势

- 冰

- 电的

- 纯电动车 (BEV)

- 插电式混合动力车 (PHEV)

- 混合动力电动车 (HEV)

第 9 章:市场估计与预测:按车型,2021 - 2034 年

- 主要趋势

- 搭乘用车

- 轿车

- 掀背车

- SUV

- 其他的

- 商用车

- 轻型商用车 (LCV)

- 重型商用车 (HCV)

第 10 章:市场估计与预测:按销售管道,2021 - 2034 年

- 主要趋势

- OEM

- 售后市场

第 11 章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 北欧

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 东南亚

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东及非洲

- 阿联酋

- 南非

- 沙乌地阿拉伯

第 12 章:公司简介

- Antenova

- Aptiv

- Autotalks

- Continental

- Denso

- Ficosa

- Harman International

- Harxon

- Hella GmbH

- Hirschmann Car Communication

- Laird Connectivity

- Magna

- Mikros Technologies

- Pulse Electronics

- Robert Bosch

- Taoglas

- TE Connectivity

- Texas Instruments

- Valeo

The Global Automotive Intelligent Antenna Module Market, valued at USD 1.6 billion in 2024, is forecasted to grow at a robust CAGR of 10.5% between 2025 and 2034. This remarkable growth aligns with the increasing deployment of autonomous vehicles and advanced driver assistance systems (ADAS). As these technologies become integral to modern mobility solutions, intelligent antenna modules emerge as a critical component, facilitating seamless communication and robust data transfer capabilities required for next-generation vehicles.

The growing demand for in-car connectivity and infotainment solutions further propels the market. Today's consumers expect vehicles to operate as connected hubs equipped with features like real-time navigation, voice-controlled functionalities, and effortless smartphone integration via Bluetooth and Wi-Fi. Intelligent antenna modules are the backbone of these advanced systems, ensuring uninterrupted connectivity and meeting the expectations of tech-savvy drivers. The ongoing shift toward smart, connected vehicles underscores the role of these modules in delivering superior in-car experiences, keeping pace with evolving consumer preferences.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.6 Billion |

| Forecast Value | $4.2 Billion |

| CAGR | 10.5% |

The market is segmented by vehicle type into passenger cars and commercial vehicles. In 2024, passenger cars dominated the market with a 65% share and are projected to generate USD 2.5 billion by 2034. Passenger vehicles increasingly rely on intelligent antenna modules for enhanced connectivity, offering smart navigation, media streaming, and real-time traffic updates. Rising consumer demand for personalized and immersive in-car experiences continues to fuel the adoption of these modules in passenger cars, solidifying their role as a key feature in modern vehicles.

By application, the market includes vehicle-to-vehicle (V2V), telematics, infotainment systems, ADAS, and vehicle-to-infrastructure (V2I) communication. In 2024, infotainment systems accounted for 39% of the market share, driven by the growing integration of voice assistants and cloud-based features. Intelligent antenna modules provide the reliable connectivity required for hands-free operations, seamless media streaming, and continuous updates, making them indispensable for advanced infotainment solutions.

The North American market accounted for 30% of the global share in 2024, underpinned by advancements in autonomous vehicle technology. The region leads in the testing and deployment of self-driving cars, amplifying the demand for intelligent antenna modules. These modules enable critical vehicle-to-everything (V2X) communication, GPS, radar systems, and seamless data transfer, ensuring the safety, efficiency, and reliability of autonomous systems in North America. The continued innovation in this region positions it as a leader in the adoption of intelligent antenna technologies.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market scope & definition

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Tier 1 suppliers

- 3.1.2 Telecommunications providers

- 3.1.3 Tech companies and software providers

- 3.1.4 Automotive connectivity & infrastructure provider

- 3.1.5 Distributors

- 3.1.6 End users

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Technology & innovation landscape

- 3.5 Patent analysis

- 3.6 Key news & initiatives

- 3.7 Regulatory landscape

- 3.8 Pricing analysis

- 3.9 Impact forces

- 3.9.1 Growth drivers

- 3.9.1.1 Rising adoption of connected and autonomous vehicles

- 3.9.1.2 Deployment of 5G networks and V2X communication technologies

- 3.9.1.3 Increasing consumer demand for infotainment and telematics features

- 3.9.1.4 Stringent regulations promoting vehicle safety and connectivity

- 3.9.2 Industry pitfalls & challenges

- 3.9.2.1 High costs and complexity of integration

- 3.9.2.2 Signal interference and network reliability issues

- 3.9.1 Growth drivers

- 3.10 Growth potential analysis

- 3.11 Porter’s analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Module, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 5G

- 5.3 V2X communication

- 5.4 Multiband

- 5.5 MIMO

- 5.6 Wi-Fi/Bluetooth

Chapter 6 Market Estimates & Forecast, By Component, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Antennas

- 6.3 Signal processors

- 6.4 Control units

- 6.5 Radio Frequency (RF) Units

- 6.6 Filters

Chapter 7 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 Telematics

- 7.3 Infotainment systems

- 7.4 ADAS

- 7.5 Vehicle-to-Vehicle (V2V)

- 7.6 Vehicle-to-Infrastructure (V2I)

Chapter 8 Market Estimates & Forecast, By Propulsion, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 ICE

- 8.3 Electric

- 8.3.1 Battery Electric Vehicles (BEV)

- 8.3.2 Plug-in Hybrid Electric Vehicles (PHEV)

- 8.3.3 Hybrid Electric Vehicles (HEV)

Chapter 9 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 Passenger cars

- 9.2.1 Sedans

- 9.2.2 Hatchbacks

- 9.2.3 SUVs

- 9.2.4 Others

- 9.3 Commercial vehicles

- 9.3.1 Light Commercial Vehicles (LCVs)

- 9.3.2 Heavy Commercial Vehicles (HCVs)

Chapter 10 Market Estimates & Forecast, By Sales Channel, 2021 - 2034 ($Bn, Units)

- 10.1 Key trends

- 10.2 OEM

- 10.3 Aftermarket

Chapter 11 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 UK

- 11.3.2 Germany

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.3.6 Russia

- 11.3.7 Nordics

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 Australia

- 11.4.5 South Korea

- 11.4.6 Southeast Asia

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.6 MEA

- 11.6.1 UAE

- 11.6.2 South Africa

- 11.6.3 Saudi Arabia

Chapter 12 Company Profiles

- 12.1 Antenova

- 12.2 Aptiv

- 12.3 Autotalks

- 12.4 Continental

- 12.5 Denso

- 12.6 Ficosa

- 12.7 Harman International

- 12.8 Harxon

- 12.9 Hella GmbH

- 12.10 Hirschmann Car Communication

- 12.11 Laird Connectivity

- 12.12 Magna

- 12.13 Mikros Technologies

- 12.14 Pulse Electronics

- 12.15 Robert Bosch

- 12.16 Taoglas

- 12.17 TE Connectivity

- 12.18 Texas Instruments

- 12.19 Valeo