|

市场调查报告书

商品编码

1665218

在轨卫星服务市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测On-orbit Satellite Servicing Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

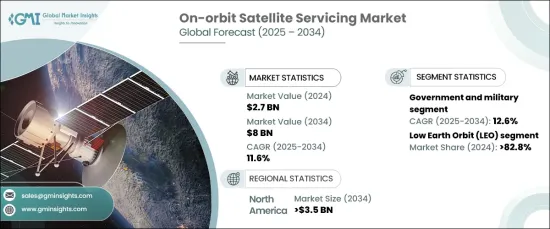

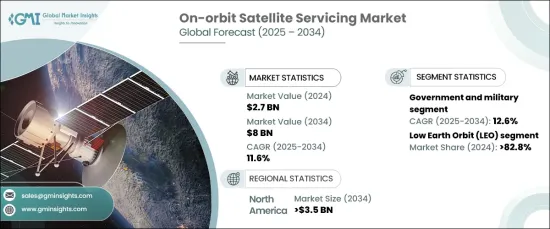

全球在轨卫星服务市场预计将大幅成长,到 2024 年将达到 27 亿美元,预计 2025 年至 2034 年的复合年增长率将达到惊人的 11.6%。卫星在通讯、地球观测和防御等关键应用领域的部署不断增加,进一步加速了市场的成长轨迹。

按轨道类型分析市场时,低地球轨道 (LEO) 占据领先地位,到 2024 年将占据 82.8% 的市场份额。该轨道上卫星密集,需要创新的解决方案,包括机器人加油、维修和清除碎片。此外,低地球轨道与地球的距离使其更容易进行频繁且经济高效的维修任务,确保卫星运作的可持续性和效率。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 27亿美元 |

| 预测值 | 80亿美元 |

| 复合年增长率 | 11.6% |

就最终用户而言,在轨卫星服务市场分为政府和军事实体以及商业营运商。政府和军事领域预计将经历最快的成长,2025-2034 年期间的复合年增长率预计为 12.6%。由于各国政府寻求保留关键太空资产的功能、加强国家安全并降低更换成本,对卫星基础设施的投资增加正在推动这一需求。此外,公共和私营部门之间的合作正在推动技术进步,这将在加速该领域的成长方面发挥关键作用。

北美将主导全球在轨卫星服务市场,预计到 2034 年将达到 35 亿美元。政府支持创新的计划,加上对卫星通讯和国防解决方案日益增长的需求,正在巩固北美在这一领域的领导地位。此外,该地区对永续太空实践的承诺和在轨服务技术的突破进一步增强了其市场地位。

目录

第 1 章:方法论与范围

- 市场范围和定义

- 基础估算与计算

- 预测计算

- 资料来源

- 基本的

- 次要

- 付费来源

- 公共资源

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 影响价值链的因素

- 利润率分析

- 中断

- 未来展望

- 製造商

- 经销商

- 供应商概况

- 利润率分析

- 重要新闻及倡议

- 监管格局

- 衝击力

- 成长动力

- 卫星星座和太空交通激增

- 透过延长卫星生命週期节省成本

- 太空机器人和自动化领域的突破

- 政府和私营部门投资不断成长

- 更加重视空间垃圾管理

- 产业陷阱与挑战

- 开发和营运成本高

- 技术复杂性与营运风险

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第 5 章:市场估计与预测:按服务,2021 - 2034 年

- 主要趋势

- 主动碎片清除(ADR)和轨道调整

- 机器人服务

- 加油

- 集会

第六章:市场估计与预测:依轨道类型,2021 – 2034 年

- 主要趋势

- 低地球轨道(LEO)

- 中地球轨道(MEO)

- 地球静止轨道(GEO)

第 7 章:市场估计与预测:按卫星类型,2021 年至 2034 年

- 主要趋势

- 小型卫星(<500 公斤)

- 中型卫星(501-1,000 公斤)

- 大型卫星(>1,000 公斤)

第 8 章:市场估计与预测:依最终用途,2021 年至 2034 年

- 主要趋势

- 政府和军队

- 商业营运商

第 9 章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 中东及非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十章:公司简介

- Airbus SE

- Altius Space Machines, Inc.

- Astroscale Holdings Inc.

- Atomos Space

- ClearSpace

- Future Space Industries

- High Earth Orbit Robotics

- Hyoristic Innovations

- Infinite Orbits

- Lúnasa Ltd.

- Maxar Technologies

- Momentus, Inc.

- Nanoracks (Voyager Space)

- Obruta Space Solutions Corp

- Orbit Fab, Inc.

- Orbitaid Aerospace Private Limited

- Orion AST

- Rogue Space Systems

- Scout Aerospace LLC

- Space Machines Company Pty Ltd

- Tethers Unlimited, Inc.

- Thales Alenia Space

- Turion Space

The Global On-Orbit Satellite Servicing Market is poised for significant growth, reaching USD 2.7 billion in 2024, with projections pointing to an impressive CAGR of 11.6% from 2025 to 2034. This rapid expansion is driven by the increasing demand for satellite maintenance, repair, and upgrades aimed at extending operational lifespans, cutting launch costs, and boosting performance. The rising deployment of satellites for key applications such as communications, Earth observation, and defense further accelerates the market's growth trajectory.

When analyzing the market by orbit type, Low Earth Orbit (LEO) takes the lead, commanding 82.8% of the market share in 2024. LEO's dominance can be attributed to the explosion of satellite constellations, particularly those focused on global broadband coverage and remote sensing. The dense satellite presence in this orbit necessitates innovative solutions, including robotic refueling, repair, and debris removal. Additionally, the proximity of LEO to Earth makes it easier to conduct frequent and cost-effective servicing missions, ensuring the sustainability and efficiency of satellite operations.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.7 Billion |

| Forecast Value | $8 Billion |

| CAGR | 11.6% |

In terms of end users, the on-orbit satellite servicing market is segmented into government and military entities and commercial operators. The government and military segment is expected to experience the fastest growth, with a forecasted CAGR of 12.6% during the 2025-2034 period. Increased investments in satellite infrastructure are fueling this demand as governments seek to preserve the functionality of critical space assets, enhance national security, and reduce replacement costs. Furthermore, collaborations between the public and private sectors are driving technological advancements, which will play a crucial role in accelerating the growth of this segment.

North America is set to dominate the global on-orbit satellite servicing market, with expectations to reach USD 3.5 billion by 2034. The region's strong position stems from substantial investments in space technologies and a well-established presence of key players in the industry. Government programs supporting innovation, coupled with increasing demand for satellite communication and defense solutions, are solidifying North America's leadership in this space. Additionally, the region's commitment to sustainable space practices and breakthroughs in in-orbit servicing technologies further enhances its market position.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Surge in satellite constellations and space traffic

- 3.6.1.2 Cost savings through satellite lifecycle extension

- 3.6.1.3 Breakthroughs in space robotics and automation

- 3.6.1.4 Growing government and private sector investment

- 3.6.1.5 Enhanced focus on space debris management

- 3.6.2 Industry pitfalls & challenges

- 3.6.3 High development and operational costs

- 3.6.4 Technical complexity and operational risks

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Service, 2021 - 2034 (USD Million)

- 5.1 Key trends

- 5.2 Active Debris Removal (ADR) and Orbit Adjustment

- 5.3 Robotic servicing

- 5.4 Refueling

- 5.5 Assembly

Chapter 6 Market Estimates & Forecast, By Orbit Type, 2021 – 2034 (USD Million)

- 6.1 Key trends

- 6.2 Low Earth Orbit (LEO)

- 6.3 Medium Earth Orbit (MEO)

- 6.4 Geostationary Orbit (GEO)

Chapter 7 Market Estimates & Forecast, By Satellite Type, 2021 – 2034 (USD Million)

- 7.1 Key trends

- 7.2 Small satellite (<500 Kg)

- 7.3 Medium satellite (501-1,000 Kg)

- 7.4 Large satellite (>1,000 Kg)

Chapter 8 Market Estimates & Forecast, By End Use, 2021 – 2034 (USD Million)

- 8.1 Key trends

- 8.2 Government and military

- 8.3 Commercial operators

Chapter 9 Market Estimates & Forecast, By Region, 2021-2034 (USD Million)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Airbus SE

- 10.2 Altius Space Machines, Inc.

- 10.3 Astroscale Holdings Inc.

- 10.4 Atomos Space

- 10.5 ClearSpace

- 10.6 Future Space Industries

- 10.7 High Earth Orbit Robotics

- 10.8 Hyoristic Innovations

- 10.9 Infinite Orbits

- 10.10 Lúnasa Ltd.

- 10.11 Maxar Technologies

- 10.12 Momentus, Inc.

- 10.13 Nanoracks (Voyager Space)

- 10.14 Obruta Space Solutions Corp

- 10.15 Orbit Fab, Inc.

- 10.16 Orbitaid Aerospace Private Limited

- 10.17 Orion AST

- 10.18 Rogue Space Systems

- 10.19 Scout Aerospace LLC

- 10.20 Space Machines Company Pty Ltd

- 10.21 Tethers Unlimited, Inc.

- 10.22 Thales Alenia Space

- 10.23 Turion Space