|

市场调查报告书

商品编码

1665225

非骨水泥全膝关节系统 (TKS) 市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Cementless Total Knee Systems (TKS) Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

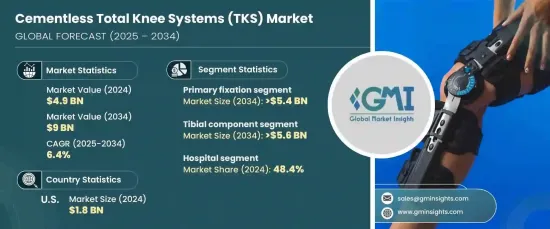

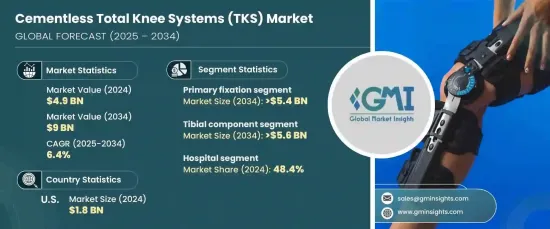

2024 年全球无骨水泥全膝关节系统市场价值为 49 亿美元,预计 2025 年至 2034 年期间将以 6.4% 的复合年增长率强劲增长。与传统的骨水泥植入物相比,非骨水泥膝关节系统因其出色的耐用性、更快的恢復时间和更低的併发症风险而越来越受到青睐。

骨关节炎的发生率不断上升,尤其是在老年族群中,这持续推动全膝关节置换术的需求。随着全球人口老化,对非骨水泥系统等先进、微创解决方案的需求日益增加。这些植入物具有促进更快的骨整合、增强长期稳定性和最大限度地降低术后风险的优势,成为外科医生和患者的首选。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 49亿美元 |

| 预测值 | 90亿美元 |

| 复合年增长率 | 6.4% |

市场根据注视类型分为主要注视和混合注视。其中,初级固定由于其无需使用骨水泥就能提供增强的初始稳定性和改善的骨整合而处于领先地位。这种方法可以使植入物直接与骨头结合,促进更快癒合并确保长期耐用性。手术工具和技术的技术创新进一步推动了初级固定係统的采用。

就零件而言,市场分为胫骨部件和股骨部件。胫骨组件占有相当大的市场份额,预计在预测期内将稳定成长。它在支撑体重和维持关节稳定性方面发挥着至关重要的作用,使其成为膝关节置换系统中必不可少的元素。模组化设计的最新进展提高了胫骨部件的性能,减少了植入物鬆动并改善了患者的治疗效果。

2024 年,美国非骨水泥全膝关节系统市场产值达到 18 亿美元。对实现更好的手术结果和减少恢復时间的关注继续推动全国非骨水泥系统的应用。

目录

第 1 章:方法论与范围

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 全球骨关节炎和类风湿性关节炎盛行率上升

- 微创手术技术的应用日益广泛

- 非骨水泥固定方法的技术进步

- 老年人口不断增长,易患关节疾病

- 产业陷阱与挑战

- 非骨水泥膝关节系统成本高

- 成长动力

- 成长潜力分析

- 监管格局

- 报销场景

- 技术格局

- 差距分析

- 波特的分析

- PESTEL 分析

- 未来市场趋势

第四章:竞争格局

- 介绍

- 公司矩阵分析

- 公司市占率分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

第 5 章:市场估计与预测:按固定方法,2021 年至 2034 年

- 主要趋势

- 初级注视

- 混合固定

第六章:市场估计与预测:按组件,2021 – 2034 年

- 主要趋势

- 胫骨组件

- 股骨假体

第 7 章:市场估计与预测:依最终用途,2021 年至 2034 年

- 主要趋势

- 医院

- 骨科中心

- 其他最终用途

第 8 章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第九章:公司简介

- Aesculap

- Conformis

- Corin Group

- Dentsply Sirona

- DePuy Synthes

- Enovis

- Episurf Medical

- Exactech

- Medacta International

- MicroPort Orthopedics

- Smith & Nephew

- Stryker

- United Orthopedic

- Waldemar Link

- Zimmer Biomet

The Global Cementless Total Knee Systems Market was valued at USD 4.9 billion in 2024 and is projected to experience robust growth at a CAGR of 6.4% from 2025 to 2034. This growth is fueled by the rising prevalence of osteoarthritis and rheumatoid arthritis alongside an aging population worldwide. Cementless knee systems are increasingly favored due to their exceptional durability, faster recovery times, and reduced risk of complications compared to traditional cemented implants.

The growing incidence of osteoarthritis, particularly among older adults, continues to drive the demand for total knee replacements. As the global population ages, there is an escalating need for advanced and minimally invasive solutions such as cementless systems. These implants offer the advantage of promoting faster bone integration, enhancing long-term stability, and minimizing post-operative risks, making them the preferred choice for both surgeons and patients.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $4.9 Billion |

| Forecast Value | $9 Billion |

| CAGR | 6.4% |

The market is segmented by fixation type into primary fixation and hybrid fixation. Among these, primary fixation leads the segment due to its ability to provide enhanced initial stability and improved osseointegration without the need for bone cement. This approach allows the implant to bond directly with the bone, fostering faster healing and ensuring long-term durability. Technological innovations in surgical tools and techniques have further boosted the adoption of primary fixation systems.

In terms of components, the market is categorized into tibial and femoral components. The tibial component holds a significant market share and is expected to witness steady growth over the forecast period. Its vital role in supporting body weight and maintaining joint stability makes it an essential element in knee replacement systems. Recent advancements in modular designs have enhanced the performance of tibial components, reducing implant loosening and improving patient outcomes.

The U.S. cementless total knee systems market generated USD 1.8 billion in 2024. This growth is driven by a large aging population, an increasing number of knee replacement surgeries, and advancements in healthcare infrastructure. The focus on achieving better surgical outcomes and reducing recovery times continues to fuel the adoption of cementless systems across the country.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising prevalence of osteoarthritis and rheumatoid arthritis globally

- 3.2.1.2 Increasing adoption of minimally invasive surgical techniques

- 3.2.1.3 Technological advancements in cementless fixation methods

- 3.2.1.4 Growing geriatric population prone to joint disorders

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost associated with cementless knee systems

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Reimbursement scenario

- 3.6 Technology landscape

- 3.7 Gap analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

- 3.10 Future market trends

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Fixation Method, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Primary fixation

- 5.3 Hybrid fixation

Chapter 6 Market Estimates and Forecast, By Component, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Tibial component

- 6.3 Femoral component

Chapter 7 Market Estimates and Forecast, By End Use, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Hospitals

- 7.3 Orthopedic centers

- 7.4 Other End Use

Chapter 8 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Aesculap

- 9.2 Conformis

- 9.3 Corin Group

- 9.4 Dentsply Sirona

- 9.5 DePuy Synthes

- 9.6 Enovis

- 9.7 Episurf Medical

- 9.8 Exactech

- 9.9 Medacta International

- 9.10 MicroPort Orthopedics

- 9.11 Smith & Nephew

- 9.12 Stryker

- 9.13 United Orthopedic

- 9.14 Waldemar Link

- 9.15 Zimmer Biomet