|

市场调查报告书

商品编码

1665227

卫星电缆和组件市场机会、成长动力、产业趋势分析和 2025 - 2034 年预测Satellite Cables and Assemblies Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

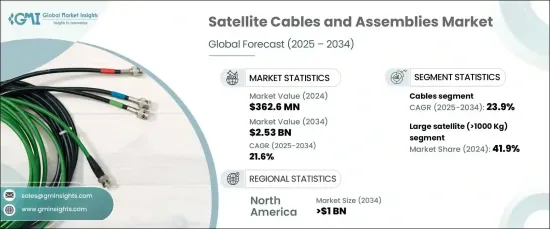

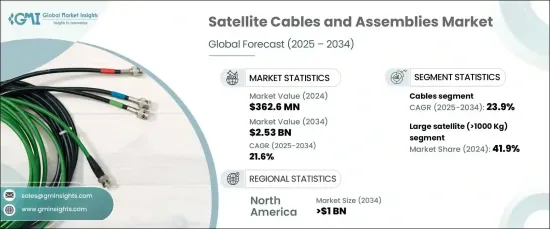

2024 年全球卫星电缆和组件市场价值为 3.626 亿美元,预计将实现显着增长,2025 年至 2034 年的复合年增长率预计为 21.6%。随着卫星宽频服务的扩展,偏远和服务不足地区对可靠、高速互联网的需求不断增长,推动了这一增长。电信、媒体和国防等关键产业越来越依赖先进的卫星通讯网络,因此需要复杂的电缆和组装组件。卫星网路服务的兴起,尤其是在农村地区,凸显了对能够支援高速资料传输的坚固电缆和连接器的迫切需求。

根据卫星类型,市场分为小型卫星(重量不超过 500 公斤)、中型卫星(重量 501-1000 公斤)和大型卫星(重量超过 1000 公斤)。 2024年,大型卫星将占41.9%的市占率。这些卫星通常重量超过 1,000 公斤,对于复杂的通讯、地球观测和科学研究任务至关重要。他们需要高性能电缆和组件来管理配电、资料传输和通讯子系统。大型卫星的不断增加的部署推动了对能够承受恶劣太空条件的耐用、轻型电缆的需求。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 3.626 亿美元 |

| 预测值 | 25.3亿美元 |

| 复合年增长率 | 21.6% |

根据组件,卫星电缆和组件市场分为电缆、连接器和其他。预计电缆产业将成为成长最快的产业,预测期内复合年增长率将达到惊人的 23.9%。电缆在确保卫星系统内可靠的电力和资料传输方面发挥关键作用。该产业专注于开发符合严格性能标准的产品,包括耐辐射、耐极端温度和耐机械应力。卫星技术的进步增加了对灵活、轻巧、耐用的电缆的需求,这些电缆能够支援高速资料传输,同时保持在太空中的运作完整性。

北美卫星电缆和组件市场预计到 2034 年将达到 10 亿美元,其中美国将处于这一成长的前沿。对太空通讯、探索和卫星服务的投资增加,推动了对支援高性能卫星网路的先进电缆系统的需求。美国政府的措施和私营部门的参与正在推动创新卫星技术的发展。卫星星座和宽频计画的扩张进一步凸显了这个充满活力且快速发展的市场对可靠、高效和耐用电缆的需求。

目录

第 1 章:方法论与范围

- 市场范围和定义

- 基础估算与计算

- 预测计算

- 资料来源

- 基本的

- 次要

- 付费来源

- 公共资源

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 影响价值链的因素

- 利润率分析

- 中断

- 未来展望

- 製造商

- 经销商

- 供应商概况

- 利润率分析

- 重要新闻及倡议

- 监管格局

- 衝击力

- 成长动力

- 卫星宽频和通讯系统需求不断成长

- 增加卫星发射活动和太空探索计划

- 卫星小型化和降低成本技术的进步

- 对高性能、轻型卫星电缆和组件的需求日益增长

- 扩大卫星系统在物联网和人工智慧应用的使用

- 产业陷阱与挑战

- 先进电缆和组装材料成本高昂

- 在极端环境条件下维持品质标准的挑战

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第 5 章:市场估计与预测:按卫星类型,2021-2034 年

- 主要趋势

- 小型卫星(<500 公斤)

- 中型卫星(501-1000 公斤)

- 大型卫星(>1000 公斤)

第 6 章:市场估计与预测:按导体材料,2021 年至 2034 年

- 主要趋势

- 金属合金

- 纤维

第 7 章:市场估计与预测:按组件,2021 年至 2034 年

- 主要趋势

- 电缆

- 圆形电缆

- 扁平/带状电缆

- 连接器

- 其他的

第 8 章:市场估计与预测:按绝缘类型,2021-2034 年

- 主要趋势

- 热固性

- 热塑性塑料

第 9 章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 中东及非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十章:公司简介

- Amphenol Corporation

- Axon' Cable SAS

- Cicoil Flat Cables

- Cinch Connectivity Solutions

- Eaton Corporation

- Huber+Suhner

- Meggitt PLC

- Nexans SA

- Prysmian Group

- Smiths Group PLC

- TE Connectivity

- WL Gore & Associates, Inc.

The Global Satellite Cables And Assemblies Market, valued at USD 362.6 million in 2024, is poised for remarkable growth with an estimated CAGR of 21.6% from 2025 to 2034. This surge is driven by the growing demand for reliable, high-speed internet in remote and underserved regions, fueled by the expansion of satellite broadband services. Key industries such as telecommunications, media, and defense increasingly rely on advanced satellite communication networks, necessitating sophisticated cable and assembly components. The rise of satellite-based internet services, particularly in rural areas, underscores the critical need for robust cables and connectors capable of supporting high data transfer speeds.

The market is segmented by satellite type into small satellites (up to 500 kg), medium satellites (501-1000 kg), and large satellites (over 1000 kg). In 2024, large satellites dominated the market with a 41.9% share. These satellites, often weighing over 1,000 kg, are vital for complex communication, Earth observation, and scientific research missions. They require high-performance cables and assemblies to manage power distribution, data transmission, and communication subsystems. The increasing deployment of large satellites drives demand for durable, lightweight cables engineered to withstand the harsh conditions of space.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $362.6 Million |

| Forecast Value | $2.53 Billion |

| CAGR | 21.6% |

By component, the satellite cables and assemblies market is categorized into cables, connectors, and others. The cables segment is projected to be the fastest-growing, with an impressive CAGR of 23.9% during the forecast period. Cables play a pivotal role in ensuring reliable power and data transmission within satellite systems. The industry is focused on developing products that meet stringent performance standards, including resistance to radiation, temperature extremes, and mechanical stress. Advances in satellite technology have amplified the need for flexible, lightweight, and durable cables capable of supporting high-speed data transfer while maintaining operational integrity in space.

North America satellite cables and assemblies market is expected to reach USD 1 billion by 2034, with the United States at the forefront of this growth. Increased investments in space communication, exploration, and satellite-based services are driving demand for advanced cable systems that support high-performance satellite networks. U.S. government initiatives and private sector participation in satellite launches are boosting the development of innovative satellite technologies. The expansion of satellite constellations and broadband initiatives further underscores the need for reliable, efficient, and durable cables in this dynamic and rapidly evolving market.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Rising demand for satellite broadband and communication systems

- 3.6.1.2 Increasing satellite launch activities and space exploration initiatives

- 3.6.1.3 Advancements in satellite miniaturization and cost reduction technologies

- 3.6.1.4 Growing need for high-performance, lightweight satellite cables and assemblies

- 3.6.1.5 Expanding use of satellite systems in IoT and AI applications

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 High costs associated with advanced cable and assembly materials

- 3.6.2.2 Challenges in maintaining quality standards under extreme environmental conditions

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Satellite Type, 2021-2034 (USD Million)

- 5.1 Key trends

- 5.2 Small satellite (<500 Kg)

- 5.3 Medium satellite (501-1000 Kg)

- 5.4 Large satellite (>1000 Kg)

Chapter 6 Market Estimates & Forecast, By Conductor Material, 2021-2034 (USD Million)

- 6.1 Key trends

- 6.2 Metal alloys

- 6.3 Fibers

Chapter 7 Market Estimates & Forecast, By Component, 2021-2034 (USD Million)

- 7.1 Key trends

- 7.2 Cables

- 7.2.1 Round cables

- 7.2.2 Flat/ ribbon cables

- 7.3 Connectors

- 7.4 Others

Chapter 8 Market Estimates & Forecast, By Insulation Type, 2021-2034 (USD Million)

- 8.1 Key trends

- 8.2 Thermosetting

- 8.3 Thermoplastic

Chapter 9 Market Estimates & Forecast, By Region, 2021-2034 (USD Million)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Amphenol Corporation

- 10.2 Axon' Cable SAS

- 10.3 Cicoil Flat Cables

- 10.4 Cinch Connectivity Solutions

- 10.5 Eaton Corporation

- 10.6 Huber+Suhner

- 10.7 Meggitt PLC

- 10.8 Nexans SA

- 10.9 Prysmian Group

- 10.10 Smiths Group PLC

- 10.11 TE Connectivity

- 10.12 W.L. Gore & Associates, Inc.