|

市场调查报告书

商品编码

1665242

频闪灯市场机会、成长动力、产业趋势分析与 2025 - 2034 年预测Strobe Lighting Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

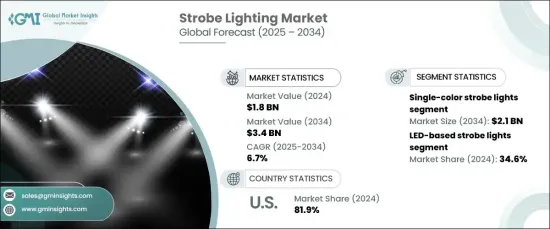

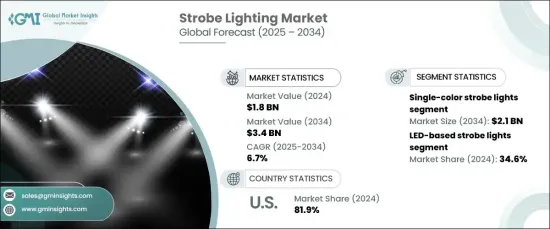

2024 年全球频闪灯市场规模达到 18 亿美元,预计 2025 年至 2034 年期间复合年增长率为 6.7%。 LED 频闪灯因其出色的能源效率、更长的使用寿命和低维护需求而越来越受欢迎。这些先进的灯光可以对亮度、色彩输出和闪光频率进行出色的控制,使其用途广泛且高度可自订。它们能够适应各种环境并可靠地运行,这使它们成为精度和灵活性至关重要的行业的首选。

市场按光源细分,包括 LED、氙气、卤素和其他频闪灯。其中,基于 LED 的频闪灯在全球市场占据主导地位,到 2024 年将占有 34.6% 的份额。它们耐用且稳定的性能使其非常适合要求苛刻的应用,而其提供高品质照明的能力进一步推动了它们的广泛应用。这种成长在需要可靠、持久照明解决方案的行业中尤其显着。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 18亿美元 |

| 预测值 | 34亿美元 |

| 复合年增长率 | 6.7% |

依照色彩输出,市场分为单色频闪灯和多色频闪灯。预计到 2034 年单色市场将创收 21 亿美元,反映出整个预测期内需求保持稳定。单色频闪灯通常用于需要高强度闪光来发出讯号和警报的环境。它们的成本效益、可靠性和简单性使其成为优先考虑功能的应用程式的首选。这些灯通常发出白色、红色或蓝色等原色,满足聚焦照明是关键的行业的需求。

在美国,频闪灯市场在 2024 年占据了令人印象深刻的 81.9% 的份额。 LED 技术的广泛应用已显着取代老旧、效率较低的照明系统,具有更高的节能效果、更高的亮度和可编程的功能。这些技术进步使 LED 频闪灯成为广泛应用的首选解决方案,从工业安全讯号到娱乐环境中的动态视觉效果。

目录

第 1 章:方法论与范围

- 市场范围和定义

- 基础估算与计算

- 预测计算

- 资料来源

- 基本的

- 次要

- 付费来源

- 公共资源

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 影响价值链的因素

- 利润率分析

- 中断

- 未来展望

- 製造商

- 经销商

- 供应商概况

- 利润率分析

- 重要新闻及倡议

- 监管格局

- 衝击力

- 成长动力

- 传统氙气频闪灯逐渐转向 LED 系统

- 扩大工业环境中的应用

- 安全和紧急照明的采用率不断提高

- 智慧城市的发展与物联网的快速融合

- 产业陷阱与挑战

- 替代照明技术的竞争

- 严格的监管环境

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第 5 章:市场估计与预测:按光源,2021 年至 2034 年

- 主要趋势

- LED 频闪灯

- 氙气频闪灯

- 卤素频闪灯

- 其他光源

第六章:市场估计与预测:依颜色输出,2021-2034 年

- 主要趋势

- 单色频闪灯

- 多色频闪灯

第 7 章:市场估计与预测:依最终用途,2021 年至 2034 年

- 主要趋势

- 商业的

- 工业的

- 住宅

- 政府和公共部门

第 8 章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 中东及非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第九章:公司简介

- ADJ (American DJ)

- Astera LED Technology

- ChamSys

- Chauvet Professional

- Claypaky

- Eternal Lighting

- Elation Professional

- GLP (German Light Products)

- Jands

- Klarna

- Lightbar UK

- Martin

- PR Lighting

- Prolights

- ROBE Lighting

- SpeedTechLights

- Strands

- SGM Lighting

- TRUEMODS

- VSHOW

The Global Strobe Lighting Market reached USD 1.8 billion in 2024 and is expected to expand at a CAGR of 6.7% from 2025 to 2034. A major driver of this growth is the ongoing shift from traditional xenon strobe lights to cutting-edge LED-based systems. LED strobes are gaining popularity for their impressive energy efficiency, longer lifespan, and low maintenance needs. These advanced lights offer exceptional control over brightness, color output, and flash frequency, making them versatile and highly customizable. Their ability to adapt and perform reliably in diverse environments has made them a preferred choice in industries where precision and flexibility are crucial.

The market is segmented by light source, including LED-based, xenon, halogen, and other strobe lights. Among these, LED-based strobe lights dominate the global market, holding a 34.6% share in 2024. These lights are increasingly favored for their compact design, superior brightness, and customizable features. Their durable and consistent performance makes them well-suited for demanding applications, and their ability to deliver high-quality lighting further fuels their widespread adoption. This growth is particularly notable in industries that require reliable, long-lasting lighting solutions.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.8 billion |

| Forecast Value | $3.4 billion |

| CAGR | 6.7% |

In terms of color output, the market is divided into single-color and multicolor strobe lights. The single-color segment is projected to generate USD 2.1 billion by 2034, reflecting consistent demand throughout the forecast period. Single-color strobe lights are commonly used in environments where high-intensity flashes are essential for signaling and alerting. Their cost-effectiveness, reliability, and simplicity make them the go-to choice for applications that prioritize functionality. These lights often emit primary colors such as white, red, or blue, meeting the needs of industries where focused illumination is key.

In the United States, the strobe lighting market held an impressive 81.9% share in 2024. Market growth in the U.S. is being driven by increased demand across various industries, including emergency services, entertainment, construction, and public safety. The widespread adoption of LED technology has significantly replaced older, less efficient lighting systems, delivering enhanced energy savings, superior brightness, and programmable features. These technological advancements have made LED strobes the preferred solution for a wide range of applications, from industrial safety signals to dynamic visual effects in entertainment settings.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 The rising shift from traditional xenon strobe lights to LED-based systems

- 3.6.1.2 Expanding applications in industrial settings

- 3.6.1.3 Increasing adoption in safety and emergency lighting

- 3.6.1.4 Growth of smart cities and rapid IoT integration

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 Competition of alternative lighting technologies

- 3.6.2.2 Stringent regulatory environment

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Light Source, 2021-2034 (USD Billion)

- 5.1 Key trends

- 5.2 LED-based strobe lights

- 5.3 Xenon strobe lights

- 5.4 Halogen strobe lights

- 5.5 Other light sources

Chapter 6 Market Estimates & Forecast, By Color Output, 2021-2034 (USD Billion)

- 6.1 Key trends

- 6.2 Single color strobe lights

- 6.3 Multicolor strobe lights

Chapter 7 Market Estimates & Forecast, By End Use, 2021-2034 (USD Billion)

- 7.1 Key trends

- 7.2 Commercial

- 7.3 Industrial

- 7.4 Residential

- 7.5 Government & public sector

Chapter 8 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 Germany

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Russia

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.4.5 Australia

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.6 MEA

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 ADJ (American DJ)

- 9.2 Astera LED Technology

- 9.3 ChamSys

- 9.4 Chauvet Professional

- 9.5 Claypaky

- 9.6 Eternal Lighting

- 9.7 Elation Professional

- 9.8 GLP (German Light Products)

- 9.9 Jands

- 9.10 Klarna

- 9.11 Lightbar UK

- 9.12 Martin

- 9.13 PR Lighting

- 9.14 Prolights

- 9.15 ROBE Lighting

- 9.16 SpeedTechLights

- 9.17 Strands

- 9.18 SGM Lighting

- 9.19 TRUEMODS

- 9.20 VSHOW