|

市场调查报告书

商品编码

1665249

压片机市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Tablet Press Machines Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

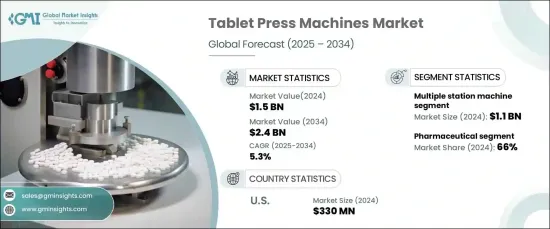

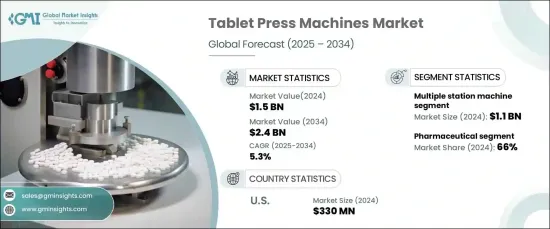

2024 年全球压片机市场规模达到 15 亿美元,预计 2025 年至 2034 年期间将以 5.3% 的强劲复合年增长率增长。膳食补充剂行业的不断扩大、合约製造的兴起以及对提高成本效率和生产率的高度重视也在推动市场向前发展方面发挥着关键作用。

技术的进步大大提高了压片机的性能,特别是自动化系统的整合提高了生产效率和产品品质。现代压片机配备了最先进的监控系统、更高的处理速度以及与其他生产过程的无缝集成,对製药商具有极大的吸引力。此外,品牌药物专利到期,导致仿製药产量激增,需要更大的生产量,从而进一步推动了对压片机的需求。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 15亿美元 |

| 预测值 | 24亿美元 |

| 复合年增长率 | 5.3% |

市场按机器类型细分,其中多工位机器细分市场的收入领先,到 2024 年将达到 11 亿美元。这些机器透过同时压制多个药片而具有卓越的效率,使其成为大规模生产的理想选择。对大规模药片生产的需求不断增长,以及智慧感测器、即时监控和预测性维护等自动化技术的不断进步,使得这些机器能够实现更高的生产速度,同时确保药片品质的一致性。

製药业仍然是压片机的主要终端使用领域,到 2024 年将占据 66% 的份额。製药公司越来越多地采用融合工业 4.0 技术的智慧压片机,这种技术可以实现即时监控、自动资料收集和预测性维护。这些进步有助于提高生产效率并最大限度地减少停机时间。此外,食品和饮料行业也越来越多地使用压片机,特别是用于大规模生产膳食补充剂、维生素和功能性食品。

在美国,2024 年压晶片市场价值为 3.3 亿美元,预计 2025 年至 2034 年期间的复合年增长率为 5.3%。营养保健食品和功能性食品产量的激增,以及对生物製药的投资增加,也推动了美国对压片机的需求。

目录

第 1 章:方法论与范围

- 市场范围和定义

- 基础估算与计算

- 预测计算。

- 资料来源

- 基本的

- 次要

- 付费来源

- 公共资源

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 影响价值链的因素。

- 利润率分析。

- 中断

- 未来展望

- 製造商

- 经销商

- 供应商概况

- 利润率分析。

- 重要新闻及倡议

- 监管格局

- 衝击力

- 成长动力

- 增加药品製造

- 膳食补充剂产业的扩张

- 产业陷阱与挑战

- 初始成本高且营运复杂

- 供应链中断

- 成长动力

- 技术概览

- 成长潜力分析

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第 5 章:市场估计与预测:按机器类型,2021 年至 2034 年

- 主要趋势

- 单工位机

- 多工位机

第六章:市场估计与预测:依营运模式,2021-2034 年

- 主要趋势

- 手动的

- 半自动

- 全自动

第 7 章:市场估计与预测:按产能,2021-2034 年

- 主要趋势

- 50,000 件/小时以下

- 50,000 - 100,000 件/小时

- 100,000 - 200,000 件/小时

- 20万件/小时以上

第 8 章:市场估计与预测:按最终用途产业,2021 年至 2034 年

- 主要趋势

- 製药

- 食品和饮料

- 化妆品和个人护理

- 其他(营养保健品等)

第 9 章:市场估计与预测:按配销通路,2021-2034 年

- 主要趋势

- 直接销售

- 间接销售

第 10 章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 中东及非洲

- 阿联酋

- 沙乌地阿拉伯

- 南非

第 11 章:公司简介

- CECLE Machine

- Fette Compacting

- GEA

- IMA Group

- Korsch

- LFA

- Lodha International

- Natoli Engineering

- RIVA

- Romaco

- SaintyCo

- SED Pharma

- Stokes Tablet Presses

- Syntegon Technology

- Tablet Press Company

The Global Tablet Press Machines Market reached USD 1.5 billion in 2024 and is projected to grow at a robust CAGR of 5.3% from 2025 to 2034. This impressive growth is driven by several key factors, including the increasing pharmaceutical production, rising healthcare expenditures, technological innovations, and the growing demand for generic drugs. The expanding dietary supplement sector, the rise in contract manufacturing, and a strong focus on enhancing cost-efficiency and productivity also play crucial roles in driving the market forward.

Advancements in technology have significantly enhanced the performance of tablet press machines, particularly with the integration of automated systems that improve both production efficiency and product quality. Modern tablet press machines are equipped with state-of-the-art monitoring systems, higher processing speeds, and seamless integration with other production processes, making them highly attractive to pharmaceutical manufacturers. Additionally, the expiration of patents for branded drugs has fueled a surge in the production of generic drugs, which requires larger manufacturing volumes, further driving the demand for tablet press machines.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.5 Billion |

| Forecast Value | $2.4 Billion |

| CAGR | 5.3% |

The market is segmented by machine type, with the multiple station machine segment leading in revenue, accounting for USD 1.1 billion in 2024. This segment is expected to grow at an impressive CAGR of 5.4% through 2034. Multi-station or rotary tablet presses, which typically feature 10-30 stations, are designed for high-volume tablet production. These machines offer exceptional efficiency by pressing multiple tablets simultaneously, making them ideal for large-scale manufacturing. The growing demand for mass tablet production and continuous advancements in automation technologies, such as smart sensors, real-time monitoring, and predictive maintenance, are enabling these machines to achieve higher production speeds while ensuring consistent tablet quality.

The pharmaceutical industry remains the dominant end-use sector for tablet press machines, holding a 66% share in 2024. This segment is expected to grow at a steady CAGR of 5.6% between 2025 and 2034, driven by the increasing preference for tablets as a dosage form. Pharmaceutical companies are increasingly adopting smart tablet press machines that incorporate Industry 4.0 technologies, which allow for real-time monitoring, automated data collection, and predictive maintenance. These advancements help improve production efficiency and minimize downtime. Additionally, the food and beverage industry is increasingly turning to tablet press machines, particularly for the mass production of dietary supplements, vitamins, and functional foods.

In the U.S., the tablet press machines market was valued at USD 330 million in 2024 and is expected to grow at a CAGR of 5.3% from 2025 to 2034. This growth can be attributed to the expanding pharmaceutical sector, ongoing technological advancements, and the rising production of over-the-counter medications. The surge in the production of nutraceuticals and functional foods, along with increased investment in biopharmaceuticals, is also driving the demand for tablet press machines in the U.S. Furthermore, the rise in generic drug production and consumption has intensified the need for cost-effective solutions to produce affordable medications, further boosting the market for tablet press machines.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations.

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain.

- 3.1.2 Profit margin analysis.

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis.

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Increased pharmaceutical manufacturing

- 3.6.1.2 Expansion of the dietary supplement industry

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 high initial costs and operational complexities

- 3.6.2.2 Disruptions in supply chains

- 3.6.1 Growth drivers

- 3.7 Technological overview

- 3.8 Growth potential analysis

- 3.9 Porter’s analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Machine Type, 2021-2034 (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Single station machine

- 5.3 Multiple station machine

Chapter 6 Market Estimates & Forecast, By Mode of Operation, 2021-2034 (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Manual

- 6.3 Semi-automatic

- 6.4 Fully automatic

Chapter 7 Market Estimates & Forecast, By Capacity, 2021-2034 (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 Below 50,000 pcs/hr

- 7.3 50,000 - 100,000 pcs/hr

- 7.4 100,000 - 200,000 pcs/hr

- 7.5 Above 200,000 pcs/hr

Chapter 8 Market Estimates & Forecast, By End Use Industry, 2021-2034 (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Pharmaceutical

- 8.3 Food and beverages

- 8.4 Cosmetics and personal care

- 8.5 Others (nutraceuticals etc.)

Chapter 9 Market Estimates & Forecast, By Distribution Channel, 2021-2034 (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 Direct sales

- 9.3 Indirect sales

Chapter 10 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion) (Thousand Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 Australia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.6 MEA

- 10.6.1 UAE

- 10.6.2 Saudi Arabia

- 10.6.3 South Africa

Chapter 11 Company Profiles

- 11.1 CECLE Machine

- 11.2 Fette Compacting

- 11.3 GEA

- 11.4 IMA Group

- 11.5 Korsch

- 11.6 LFA

- 11.7 Lodha International

- 11.8 Natoli Engineering

- 11.9 RIVA

- 11.10 Romaco

- 11.11 SaintyCo

- 11.12 SED Pharma

- 11.13 Stokes Tablet Presses

- 11.14 Syntegon Technology

- 11.15 Tablet Press Company