|

市场调查报告书

商品编码

1665252

早产预防和管理市场机会、成长动力、行业趋势分析和 2025 - 2034 年预测Preterm Birth Prevention and Management Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

2024 年全球早产预防和管理市场价值为 18 亿美元,预计 2025 年至 2034 年期间的复合年增长率为 7.7%。 这一显着增长是由多种因素推动的,包括早产率上升、医疗技术的进步、产妇危险因素患病率增加以及对改善新生儿护理的高度重视。

市场涵盖一系列旨在预防和管理早产的治疗方法,包括子宫收缩抑制剂治疗、黄体酮治疗、抗生素治疗、皮质类固醇治疗、肝素预防治疗和其他治疗方案。其中,孕酮疗法预计将引领市场,年复合成长率为 8%,到 2034 年将产生 15 亿美元的市场价值。 孕酮已被广泛研究并被证明可以显着降低早产风险,特别是对于有自然早产史或高风险的女性。它已被证明能有效预防早产,特别是对于子宫颈短或多胎妊娠的妇女,因此被广泛采用作为主要预防措施。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 18亿美元 |

| 预测值 | 38亿美元 |

| 复合年增长率 | 7.7% |

市场也根据给药途径进行细分,包括肠外给药、口服给药和外用给药。预计肠外给药领域将经历强劲增长,预计复合年增长率为 7.6%,到 2034 年将达到 27 亿美元。这种方法对于高风险妊娠至关重要,因为它绕过了消化系统,确保了更一致和可控的剂量,这使其成为临床环境中的首选方案。

在美国,2024 年早产预防和管理市场价值为 6.716 亿美元,预计 2025 年至 2034 年期间的复合年增长率为 7.2%。这项挑战推动了对先进疗法、治疗方法和创新解决方案的需求。此外,美国在母胎医学研究领域仍然处于全球领先地位,为预防和管理早产的尖端技术和实践的发展做出了贡献。

目录

第 1 章:方法论与范围

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 早产盛行率不断上升

- 孕产妇和胎儿照护的进步

- 提高对早产危险因子的认识

- 政府措施和资金不断增加

- 产业陷阱与挑战

- 副作用和安全问题

- 来自仿製药的潜在竞争

- 成长动力

- 成长潜力分析

- 监管格局

- 技术格局

- 管道分析

- 差距分析

- 波特的分析

- PESTEL 分析

- 未来市场趋势

- 价值链分析

第四章:竞争格局

- 介绍

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

第 5 章:市场估计与预测:按治疗类型,2021 – 2034 年

- 主要趋势

- 黄体素治疗

- 皮质类固醇治疗

- 子宫收缩抑制剂治疗

- 抗生素治疗

- 肝素预防治疗

- 其他治疗类型

第 6 章:市场估计与预测:按管理路线,2021 年至 2034 年

- 主要趋势

- 肠外

- 口服

- 主题

第 7 章:市场估计与预测:按配销通路,2021 年至 2034 年

- 主要趋势

- 实体店面

- 电子商务

第 8 章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第九章:公司简介

- AbbVie

- AMAG Pharmaceuticals

- Ferring Pharmaceutical

- Merck

- Obseva

- Pfizer

- Takeda Pharmaceutical

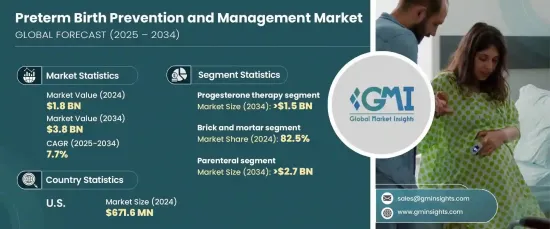

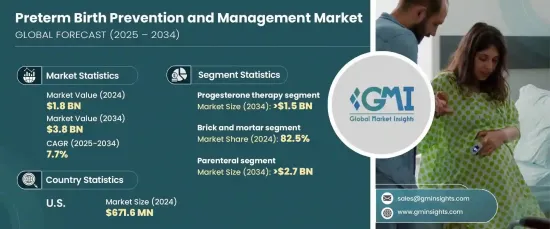

The Global Preterm Birth Prevention And Management Market was valued at USD 1.8 billion in 2024 and is projected to expand at a CAGR of 7.7% from 2025 to 2034. This remarkable growth is driven by several factors, including rising rates of preterm births, advancements in medical technology, an increasing prevalence of maternal risk factors, and a heightened focus on improving neonatal care.

The market encompasses a range of therapies designed to prevent and manage preterm births, including tocolytic therapy, progesterone therapy, antibiotics therapy, corticosteroid therapy, heparin prophylaxis therapy, and other treatment options. Among these, progesterone therapy is expected to lead the market, growing at a CAGR of 8% and generating USD 1.5 billion by 2034. Progesterone has been extensively studied and proven to significantly reduce the risk of preterm births, particularly in women with a history of spontaneous preterm deliveries or those at high risk. Its proven effectiveness in preventing early labor, especially for women with a short cervix or multiple pregnancies, contributes to its widespread adoption as a primary preventative measure.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.8 Billion |

| Forecast Value | $3.8 Billion |

| CAGR | 7.7% |

The market is also segmented by the route of administration, which includes parenteral, oral, and topical options. The parenteral administration segment is anticipated to experience robust growth, with a projected CAGR of 7.6%, reaching USD 2.7 billion by 2034. Parenteral administration, especially via intravenous (IV) or intramuscular (IM) routes, offers more rapid and efficient delivery of critical drugs like progesterone or tocolytics. This method is essential for high-risk pregnancies, as it bypasses the digestive system, ensuring more consistent and controlled dosing, which makes it a preferred option in clinical settings.

In the U.S., the preterm birth prevention and management market was valued at USD 671.6 million in 2024 and is expected to grow at a CAGR of 7.2% between 2025 and 2034. The U.S. faces a relatively high rate of preterm births compared to other developed nations, creating a pressing need for effective strategies to prevent and manage these early deliveries. This challenge drives the demand for advanced therapies, remedies, and innovative solutions. Furthermore, the U.S. remains a global leader in maternal-fetal medicine research, contributing to the development of cutting-edge technologies and practices designed to prevent and manage preterm births.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing prevalence of preterm birth

- 3.2.1.2 Advancements in maternal and fetal care

- 3.2.1.3 Increased awareness of preterm birth risk factors

- 3.2.1.4 Rising government initiatives and funding

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Side effects and safety concerns

- 3.2.2.2 Potential competition from generic drugs

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technology landscape

- 3.6 Pipeline analysis

- 3.7 Gap analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

- 3.10 Future market trends

- 3.11 Value chain analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Therapy Type, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Progesterone therapy

- 5.3 Corticosteroid therapy

- 5.4 Tocolytic therapy

- 5.5 Antibiotics therapy

- 5.6 Heparin prophylaxis therapy

- 5.7 Other therapy types

Chapter 6 Market Estimates and Forecast, By Route of Administration, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Parenteral

- 6.3 Oral

- 6.4 Topical

Chapter 7 Market Estimates and Forecast, By Distribution Channel, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Brick and mortar

- 7.3 E-commerce

Chapter 8 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 AbbVie

- 9.2 AMAG Pharmaceuticals

- 9.3 Ferring Pharmaceutical

- 9.4 Merck

- 9.5 Obseva

- 9.6 Pfizer

- 9.7 Takeda Pharmaceutical