|

市场调查报告书

商品编码

1665257

射频滤波器市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测RF Filter Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

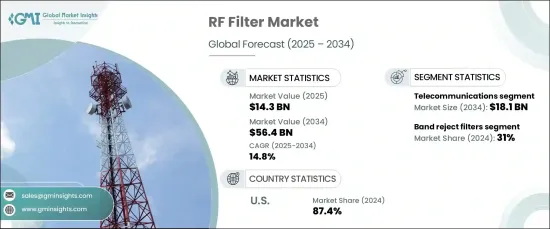

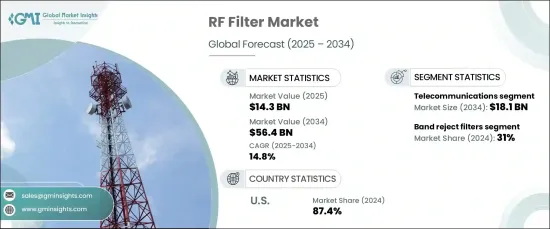

2024 年全球射频滤波器市场规模达到 143 亿美元,并有望实现显着增长,预计 2025 年至 2034 年的复合年增长率为 14.8%。这一增长可归因于对先进通信系统日益增长的需求、物联网 (IoT) 应用的快速扩展以及对有效频率管理解决方案的需求。这些关键驱动因素正在加速各行业采用射频滤波器,使其成为现代技术不可或缺的。

RF 滤波器有多种类型,包括带通滤波器、带阻滤波器、低通滤波器和高通滤波器。 2024 年,带阻滤波器部分将占据市场主导地位,占据总市场份额的 31%。带阻滤波器也称为陷波滤波器,旨在阻止特定频率范围,同时允许其他频率范围通过。这使得它们在必须消除特定频带的不必要的讯号或杂讯的环境中至关重要。它们的使用可确保更清晰的通讯和最佳的讯号完整性,特别是在高干扰环境中,这使得它们对于许多通讯系统而言是不可或缺的。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 143亿美元 |

| 预测值 | 564亿美元 |

| 复合年增长率 | 14.8% |

射频滤波器市场进一步按终端用户产业细分,例如电信、航太和国防、汽车、工业、消费性电子等。电信业预计将成为主要的收入来源,资料2034 年预计市场价值将达到 181 亿美元。这些滤波器对于行动网路、卫星系统和宽频频道的性能和效率至关重要,使其成为现代通讯基础设施的基石。

2024 年,美国射频滤波器市场占有令人印象深刻的 87.4% 的市场。这种主导地位可归因于 5G 技术的广泛采用、物联网应用的快速扩展以及对国防和航太技术的大量投资。美国电信业正在进行大规模基础设施升级以支援5G,对尖端射频滤波器的需求强劲。此外,中国蓬勃发展的消费性电子市场严重依赖行动装置的射频滤波器,这继续推动该产业的成长。随着行动装置变得越来越先进,频段的复杂性不断增加,射频滤波器对于确保高效的讯号传输和维持高效能标准至关重要。

目录

第 1 章:方法论与范围

- 市场范围和定义

- 基础估算与计算

- 预测计算

- 资料来源

- 基本的

- 次要

- 付费来源

- 公共资源

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 影响价值链的因素

- 利润率分析

- 中断

- 未来展望

- 製造商

- 经销商

- 供应商概况

- 利润率分析

- 重要新闻及倡议

- 监管格局

- 衝击力

- 成长动力

- 物联网设备和智慧连接的普及

- 5G 技术的应用日益广泛

- 射频滤波器技术的进步

- 连网汽车系统的采用率不断提高

- 产业陷阱与挑战

- 先进的射频滤波技术成本高

- 易受干扰和频宽限制

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第 5 章:市场估计与预测:按类型,2021 年至 2034 年

- 主要趋势

- 带通滤波器

- 带阻滤波器

- 低通滤波器

- 高通滤波器

第六章:市场估计与预测:依组件类型,2021-2034 年

- 主要趋势

- 模拟

- 数位的

第 7 章:市场估计与预测:按频率,2021 年至 2034 年

- 主要趋势

- 高达 1 GHz

- 1 GHz 至 6 GHz

- 6 GHz 至 30 GHz

- 超过 30 GHz

第 8 章:市场估计与预测:按应用,2021 年至 2034 年

- 主要趋势

- 导航

- 无线电广播

- 电视广播

- 行动电话通讯

- 卫星通讯

- 雷达

- 其他的

第 9 章:市场估计与预测:按最终用途产业,2021-2034 年

- 主要趋势

- 电信

- 航太和国防

- 汽车

- 工业的

- 消费性电子产品

第 10 章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 中东及非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第 11 章:公司简介

- Abracon LLC

- Analog Devices, Inc.

- Anatech Electronics, Inc.

- Avnet, Inc.

- Benchmark Lark Technology

- BLOCK Transformatoren-Elektronik GmbH

- Broadcom Inc.

- Epcos AG

- KR Electronics

- Kyocera Corporation

- Microwave Filter Company, Inc.

- MTE Corporation

- Murata Manufacturing Co., Ltd.

- PCB Piezotronics, Inc.

- Qorvo, Inc.

- RS Microwave Company, Inc.

- RTX Technology

- Skyworks Solutions, Inc.

- TDK Corporation

The Global RF Filter Market reached USD 14.3 billion in 2024 and is poised for remarkable growth, with an estimated CAGR of 14.8% from 2025 to 2034. This surge can be attributed to the growing demand for advanced communication systems, the rapid expansion of Internet of Things (IoT) applications, and the need for effective frequency management solutions. These key drivers are accelerating the adoption of RF filters across various industries, making them essential for modern technologies.

RF filters come in various types, including band pass filters, band reject filters, low pass filters, and high pass filters. In 2024, the band reject filter segment dominated the market, accounting for 31% of the total market share. Also known as notch filters, band reject filters are designed to block specific frequency ranges while allowing others to pass through. This makes them crucial in environments where it is vital to eliminate unwanted signals or noise from a particular frequency band. Their use ensures clearer communication and optimal signal integrity, especially in high-interference environments, making them indispensable for many communication systems.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $14.3 Billion |

| Forecast Value | $56.4 Billion |

| CAGR | 14.8% |

The RF filter market is further segmented by end-user industries such as telecommunications, aerospace and defense, automotive, industrial, consumer electronics, and others. The telecommunications sector is expected to be a major revenue generator, with a projected market value of USD 18.1 billion by 2034. In telecommunications, RF filters play a vital role in managing frequency bands, minimizing interference, and ensuring seamless data transmission across communication systems. These filters are essential to the performance and efficiency of mobile networks, satellite systems, and broadband channels, making them a cornerstone of modern communication infrastructure.

In 2024, the U.S. RF filter market held an impressive 87.4% market share. This dominance can be attributed to the widespread adoption of 5G technology, the rapid expansion of IoT applications, and significant investments in defense and aerospace technologies. The U.S. telecommunications industry is undergoing substantial infrastructure upgrades to support 5G, creating a strong demand for cutting-edge RF filters. Additionally, the country's thriving consumer electronics market, which heavily relies on RF filters for mobile devices, continues to drive growth in this sector. As mobile devices become more advanced and the complexity of frequency bands increases, RF filters are critical for ensuring efficient signal transmission and maintaining high-performance standards.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Proliferation of IoT devices and smart connectivity

- 3.6.1.2 Rising adoption of 5G technology

- 3.6.1.3 Advancements in RF filter technology

- 3.6.1.4 Increased adoption of connected automotive systems

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 High cost of advanced RF filter technologies

- 3.6.2.2 Susceptibility to interference and bandwidth limitations

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Type, 2021-2034 (USD Million & Unit)

- 5.1 Key trends

- 5.2 Band pass filters

- 5.3 Band reject filters

- 5.4 Low pass filters

- 5.5 High pass filters

Chapter 6 Market Estimates & Forecast, By Component Type, 2021-2034 (USD Million & Unit)

- 6.1 Key trends

- 6.2 Analog

- 6.3 Digital

Chapter 7 Market Estimates & Forecast, By Frequency, 2021-2034 (USD Million & Unit)

- 7.1 Key trends

- 7.2 Up to 1 GHz

- 7.3 1 GHz to 6 GHz

- 7.4 6 GHz to 30 GHz

- 7.5 More than 30 GHz

Chapter 8 Market Estimates & Forecast, By Application, 2021-2034 (USD Million & Unit)

- 8.1 Key trends

- 8.2 Navigation

- 8.3 Radio broadcast

- 8.4 TV Broadcast

- 8.5 Mobile phone communication

- 8.6 Satellite communication

- 8.7 RADAR

- 8.8 Others

Chapter 9 Market Estimates & Forecast, By End Use Industry, 2021-2034 (USD Million & Unit)

- 9.1 Key trends

- 9.2 Telecommunications

- 9.3 Aerospace & defense

- 9.4 Automotive

- 9.5 Industrial

- 9.6 Consumer electronics

Chapter 10 Market Estimates & Forecast, By Region, 2021-2034 (USD Million & Unit)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 Australia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.6 MEA

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Abracon LLC

- 11.2 Analog Devices, Inc.

- 11.3 Anatech Electronics, Inc.

- 11.4 Avnet, Inc.

- 11.5 Benchmark Lark Technology

- 11.6 BLOCK Transformatoren-Elektronik GmbH

- 11.7 Broadcom Inc.

- 11.8 Epcos AG

- 11.9 KR Electronics

- 11.10 Kyocera Corporation

- 11.11 Microwave Filter Company, Inc.

- 11.12 MTE Corporation

- 11.13 Murata Manufacturing Co., Ltd.

- 11.14 PCB Piezotronics, Inc.

- 11.15 Qorvo, Inc.

- 11.16 RS Microwave Company, Inc.

- 11.17 RTX Technology

- 11.18 Skyworks Solutions, Inc.

- 11.19 TDK Corporation