|

市场调查报告书

商品编码

1665261

眼科放大镜市场机会、成长动力、产业趋势分析与 2025 - 2034 年预测Ophthalmic Loupes Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

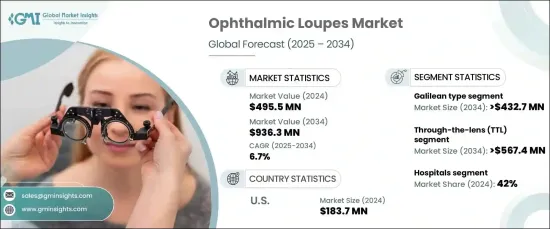

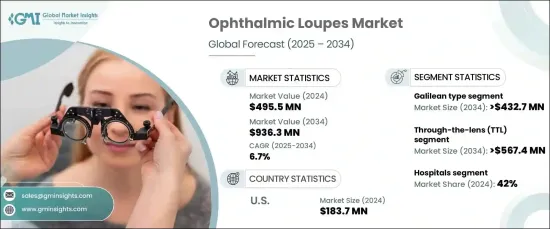

2024 年全球眼科放大镜市场价值为 4.955 亿美元,预计 2025 年至 2034 年期间复合年增长率将达到 6.7%。随着眼部护理程序变得越来越复杂,医疗保健专业人员正在转向使用眼科放大镜等高精度仪器来提高手术准确性并降低风险。

人们对微创手术的日益青睐也大大促进了眼科放大镜的普及。这些程式需要卓越的清晰度和精确度,现代放大镜透过先进的放大技术可以提供这些功能。 LED 照明、轻质材料和人体工学设计等创新进一步提高了舒适性和可用性,巩固了其作为医疗专业人员必备工具的地位。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 4.955亿美元 |

| 预测值 | 9.363 亿美元 |

| 复合年增长率 | 6.7% |

根据产品类型,市场包括伽利略放大镜、棱镜放大镜和板式放大镜。其中,伽利略式预计将以 6.8% 的复合年增长率实现显着增长,到 2034 年将产生 4.327 亿美元的市场价值。伽利略放大镜具有两个或三个镜头的简单光学结构,可提供清晰的放大效果,同时确保使用者在长时间使用时的舒适度。

市场还根据设计类型进行分类,包括镜头透照 (TTL) 设计和翻转设计。 TTL 放大镜预计将以 6.4% 的复合年增长率稳步增长,到 2034 年将达到 5.674 亿美元。它们的人体工学特点可最大限度地减少延长手术过程中的压力,从而提高效率和使用者满意度。对精密工具的需求不断增长,特别是微创眼科手术的需求,持续推动TTL领域的扩张。

2024 年美国眼科放大镜市场规模为 1.837 亿美元,预计 2025 年至 2034 年期间的复合年增长率为 6.2%。这些情况需要精确的诊断和手术干预,从而增加了对眼科放大镜等专用工具的需求。此外,人口老化以及糖尿病和慢性病发病率的上升进一步凸显了美国对先进眼科解决方案的需求

目录

第 1 章:方法论与范围

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 眼科疾病盛行率不断上升

- 眼科手术数量不断增加

- 放大镜的技术进步

- 微创手术需求不断成长

- 转向符合人体工学和可自订的设计

- 产业陷阱与挑战

- 高级放大镜成本高

- 客製化和适配方面的挑战

- 成长动力

- 成长潜力分析

- 监管格局

- 技术格局

- 差距分析

- 波特的分析

- PESTEL 分析

- 未来市场趋势

- 价值链分析

第四章:竞争格局

- 介绍

- 公司矩阵分析

- 公司市占率分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

第 5 章:市场估计与预测:按产品类型,2021 年至 2034 年

- 主要趋势

- 伽利略型

- 棱柱型

- 平板放大镜类型

第六章:市场估计与预测:依设计类型,2021 – 2034 年

- 主要趋势

- 镜头拍摄 (TTL)

- 向上翻转

第 7 章:市场估计与预测:依最终用途,2021 年至 2034 年

- 主要趋势

- 医院

- 眼科诊所

- 门诊手术中心 (ASC)

- 其他最终用户

第 8 章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第九章:公司简介

- DentLight

- Designs for Vision

- ErgonoptiX

- Heine Optotechnik

- Keeler

- Lumadent

- NEITZ

- Ocutech

- Orascoptic

- Q-Optics

- Rudolf Riester

- SHEERVISION

- SurgiTel

- Univet

- ZEISS

The Global Ophthalmic Loupes Market was valued at USD 495.5 million in 2024 and is forecasted to grow at an impressive CAGR of 6.7% from 2025 to 2034. This robust growth is fueled by the rising demand for precision tools in ophthalmic surgeries. As eye care procedures become increasingly intricate, healthcare professionals are turning to high-precision instruments like ophthalmic loupes to enhance surgical accuracy and reduce risks.

The growing preference for minimally invasive surgeries has also significantly contributed to the adoption of ophthalmic loupes. These procedures demand exceptional clarity and precision, which modern loupes provide through advanced magnification technologies. Innovations such as LED lighting, lightweight materials, and ergonomic designs have further enhanced comfort and usability, solidifying their position as essential tools for medical professionals.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $495.5 Million |

| Forecast Value | $ 936.3 Million |

| CAGR | 6.7% |

By product type, the market includes galilean, prismatic, and plate loupes. Among these, the galilean type is expected to witness remarkable growth at a CAGR of 6.8%, generating USD 432.7 million by 2034. Its widespread appeal lies in its affordability, ease of use, and lightweight design, making it an excellent choice for routine ophthalmic tests and surgeries. Featuring a straightforward optical structure with two or three lenses, galilean loupes provide clear magnification while ensuring user comfort during prolonged use.

The market is also categorized by design type, including through-the-lens (TTL) and flip-up designs. TTL loupes are projected to experience steady growth at a CAGR of 6.4%, reaching USD 567.4 million by 2034. Renowned for their custom-built design, TTL loupes offer unparalleled optical clarity tailored to individual needs. Their ergonomic features minimize strain during extended procedures, enhancing both efficiency and user satisfaction. The rising demand for precision tools, particularly in minimally invasive eye surgeries, continues to propel the expansion of the TTL segment.

The U.S. ophthalmic loupes market accounted for USD 183.7 million in 2024 and is anticipated to grow at a CAGR of 6.2% between 2025 and 2034. Factors driving this growth include the increasing prevalence of ophthalmic conditions such as cataracts, glaucoma, diabetic retinopathy, and macular degeneration. These conditions require precise diagnostic and surgical interventions, elevating the demand for specialized tools like ophthalmic loupes. Additionally, an aging population and the growing incidence of diabetes and chronic diseases further underscore the need for advanced ophthalmic solutions in the U.S.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing prevalence of ophthalmic disorders

- 3.2.1.2 Rising number of ophthalmic surgeries

- 3.2.1.3 Technological advancements in loupes

- 3.2.1.4 Growing demand for minimally invasive procedures

- 3.2.1.5 Shift toward ergonomic and customizable designs

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of advanced loupes

- 3.2.2.2 Challenges in customization and fit

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technology landscape

- 3.6 Gap analysis

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

- 3.9 Future market trends

- 3.10 Value chain analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Galilean type

- 5.3 Prismatic type

- 5.4 Plate loupe type

Chapter 6 Market Estimates and Forecast, By Design Type, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Through-the-lens (TTL)

- 6.3 Flip up

Chapter 7 Market Estimates and Forecast, By End Use, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Hospitals

- 7.3 Ophthalmic clinics

- 7.4 Ambulatory surgical centers (ASCs)

- 7.5 Other end users

Chapter 8 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 DentLight

- 9.2 Designs for Vision

- 9.3 ErgonoptiX

- 9.4 Heine Optotechnik

- 9.5 Keeler

- 9.6 Lumadent

- 9.7 NEITZ

- 9.8 Ocutech

- 9.9 Orascoptic

- 9.10 Q-Optics

- 9.11 Rudolf Riester

- 9.12 SHEERVISION

- 9.13 SurgiTel

- 9.14 Univet

- 9.15 ZEISS