|

市场调查报告书

商品编码

1665271

卫星模拟器市场机会、成长动力、产业趋势分析与 2025 - 2034 年预测Satellite Simulator Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

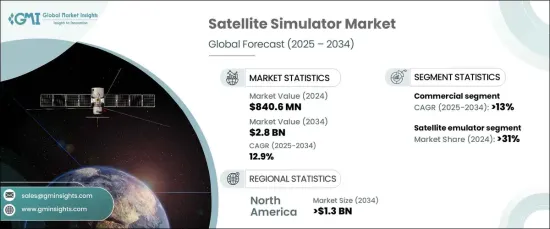

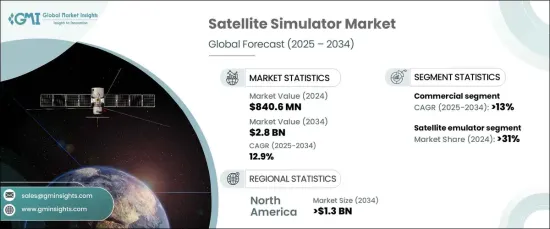

2024 年全球卫星模拟器市场规模达到 8.406 亿美元,预计 2025 年至 2034 年期间将以 12.9% 的强劲复合年增长率扩张。卫星模拟器透过提供真实的训练环境、严格的系统测试和全面的验证,在确保任务准备就绪方面发挥关键作用。这些工具不仅可以降低与卫星即时运行相关的成本和风险,还可以提高运作效率和确保通讯网路安全。国防机构始终依赖模拟系统来优化设备性能、改善人员培训并为多样化的任务场景做好准备。

卫星模拟器市场依类型分为电池模拟器、网路模拟器、雷达模拟器、卫星模拟器、讯号调节系统和太阳能模拟器。其中,卫星模拟器在2024年占据了31%的市场份额,预计在预测期内将大幅成长。现代卫星系统日益复杂,增加了精确模拟的需求。卫星模拟器使组织能够在卫星发射之前评估性能、验证系统弹性并改进设计,确保任务成功并减少误差。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 8.406 亿美元 |

| 预测值 | 28亿美元 |

| 复合年增长率 | 12.9% |

根据应用,卫星模拟器市场服务于军事和国防部门以及商业行业。到 2034 年,商业领域预计将以惊人的 13% 的复合年增长率成长,这得益于电信、广播和全球连接对卫星服务的日益依赖。公司正在大力投资模拟技术,以便在真实条件下严格测试卫星通讯链路、有效载荷和网路。这些模拟器有助于最大限度地降低操作风险,提高系统性能,并确保无缝验证过程,支援商业卫星应用中模拟工具的日益普及。

北美卫星模拟器市场规模预计在 2034 年达到 13 亿美元,由于太空技术的进步和致力于卫星开发的政府组织的强大影响力,其将继续保持主导地位。美国国家航空暨太空总署和国防部等机构正在积极投资先进的卫星测试和训练解决方案,以准确复製太空环境。这种需求在军事和国防应用中尤其明显,因为精度和可靠性对于这些应用至关重要。

目录

第 1 章:方法论与范围

- 市场范围和定义

- 基础估算与计算

- 预测计算

- 资料来源

- 基本的

- 次要

- 付费来源

- 公共资源

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 影响价值链的因素

- 利润率分析

- 中断

- 未来展望

- 製造商

- 经销商

- 供应商概况

- 利润率分析

- 重要新闻及倡议

- 监管格局

- 衝击力

- 成长动力

- 大型卫星星座快速发展与部署

- 太空探索和国防投资不断增加

- 卫星模拟器中人工智慧(AI)和机器学习的融合日益加深

- 基于云端的卫星模拟器的采用日益广泛

- 对强化培训项目的需求不断增长

- 产业陷阱与挑战

- 初期投资及维护成本高

- 模拟不同卫星系统的复杂性

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第 5 章:市场估计与预测:按类型,2021 年至 2034 年

- 主要趋势

- 电池模拟器

- 网路模拟器

- 雷达模拟器

- 卫星模拟器

- 讯号调节系统

- 太阳光模拟

第六章:市场估计与预测:依组件,2021-2034 年

- 主要趋势

- 模拟器内核

- 模拟器

- 太空船模组

- 地面模组

- 环境模组

- 动态模组

第 7 章:市场估计与预测:按应用,2021 年至 2034 年

- 主要趋势

- 军事与国防

- 商业的

第 8 章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 中东及非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第九章:公司简介

- Anritsu

- Atlantic Microwave

- GMV

- Hollis Electronics

- IFEN GmbH

- Indra

- Keysight Technologies

- Kratos

- Mitre

- NGC Aerospace

- Orolia

- Rohde & Schwarz

- Spectratime

- Spirent Communications

- Syntony

- Tampa Microwave

- Terma

- Thales

- VIAVI Solutions

The Global Satellite Simulator Market reached USD 840.6 million in 2024 and is projected to expand at a robust CAGR of 12.9% between 2025 and 2034. The increasing demand for advanced satellite communication systems in military and government sectors is driving the adoption of cutting-edge simulation technologies. Satellite simulators are pivotal in ensuring mission readiness by providing realistic training environments, rigorous system testing, and comprehensive validation. These tools not only reduce costs and mitigate risks associated with live satellite operations but also enhance operational efficiency and secure communication networks. Defense agencies consistently rely on simulation systems to optimize equipment performance, improve personnel training, and prepare for diverse mission scenarios.

The satellite simulator market is categorized by type into battery simulators, network simulators, radar simulators, satellite emulators, signal conditioning systems, and solar simulators. Among these, satellite emulators accounted for 31% of the market share in 2024 and are expected to grow significantly during the forecast period. The increasing complexity of modern satellite systems has amplified the need for precise simulations. Satellite emulators enable organizations to evaluate performance, validate system resilience, and refine designs before satellite launches, ensuring successful missions and reducing the margin for error.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $840.6 Million |

| Forecast Value | $2.8 Billion |

| CAGR | 12.9% |

By application, the satellite simulator market serves the military and defense sectors as well as commercial industries. The commercial segment is projected to grow at an impressive CAGR of 13% through 2034, driven by the growing reliance on satellite services for telecommunications, broadcasting, and global connectivity. Companies are heavily investing in simulation technologies to rigorously test satellite communication links, payloads, and networks under realistic conditions. These simulators help minimize operational risks, improve system performance, and ensure seamless verification processes, supporting the rising adoption of simulation tools in commercial satellite applications.

North America satellite simulator market is poised to reach USD 1.3 billion by 2034, maintaining its dominance due to advancements in space technologies and a strong presence of government organizations dedicated to satellite development. Agencies such as NASA and the Department of Defense are actively investing in advanced satellite testing and training solutions to accurately replicate space environments. This demand is particularly pronounced in military and defense applications, where precision and reliability are mission-critical.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Rapid development and deployment of large-scale satellite constellations

- 3.6.1.2 Rising space exploration and defense investments

- 3.6.1.3 Growing integration of Artificial Intelligence (AI) and machine learning in satellite simulators

- 3.6.1.4 Increasing adoption of cloud-based satellite simulators

- 3.6.1.5 Rising demand for enhanced training programs

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 High initial investment and maintenance costs

- 3.6.2.2 Complexity in simulating diverse satellite systems

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Type, 2021-2034 (USD Million)

- 5.1 Key trends

- 5.2 Battery simulator

- 5.3 Network simulator

- 5.4 Radar simulator

- 5.5 Satellite emulator

- 5.6 Signal conditioning systems

- 5.7 Solar simulation

Chapter 6 Market Estimates & Forecast, By Component, 2021-2034 (USD Million)

- 6.1 Key trends

- 6.2 Simulator kernel

- 6.3 Emulator

- 6.4 Spacecraft modules

- 6.5 Ground modules

- 6.6 Environment modules

- 6.7 Dynamic modules

Chapter 7 Market Estimates & Forecast, By Application, 2021-2034 (USD Million)

- 7.1 Key trends

- 7.2 Military & defense

- 7.3 Commercial

Chapter 8 Market Estimates & Forecast, By Region, 2021-2034 (USD Million)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 Germany

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Russia

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.4.5 Australia

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.6 MEA

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Anritsu

- 9.2 Atlantic Microwave

- 9.3 GMV

- 9.4 Hollis Electronics

- 9.5 IFEN GmbH

- 9.6 Indra

- 9.7 Keysight Technologies

- 9.8 Kratos

- 9.9 Mitre

- 9.10 NGC Aerospace

- 9.11 Orolia

- 9.12 Rohde & Schwarz

- 9.13 Spectratime

- 9.14 Spirent Communications

- 9.15 Syntony

- 9.16 Tampa Microwave

- 9.17 Terma

- 9.18 Thales

- 9.19 VIAVI Solutions