|

市场调查报告书

商品编码

1665277

羽绒替代床垫市场机会、成长动力、产业趋势分析与 2025 - 2034 年预测Down Alternative Mattresses Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

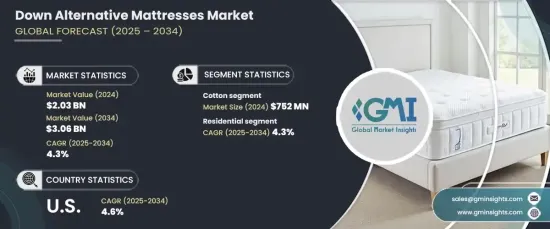

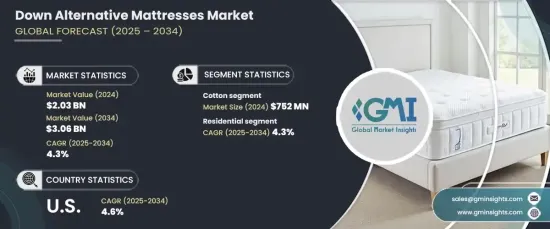

2024 年全球羽绒替代床垫市场价值 20.3 亿美元,预计 2025 年至 2034 年期间将以 4.3% 的复合年增长率稳步增长。 这一增长是由消费者对防过敏和可持续床上用品解决方案的偏好日益增长所推动的,尤其是对于患有过敏或敏感疾病的人群而言。随着越来越多的购物者寻求传统羽绒和羽毛材料的替代品,对羽绒替代床垫的需求持续激增。

按材料分类,市场包括羊毛、棉、聚酯纤维、竹、丝绸等。其中,棉花部分在 2024 年成为市场领导者,创造了 7.52 亿美元的收入,预计到 2034 年将以 4.5% 的复合年增长率增长。这使得它对于注重健康的购物者特别有吸引力。此外,人们对环保和永续产品的日益增长的追求也增强了棉质床垫的受欢迎程度。随着人们越来越重视来自永续农场的有机棉,消费者正在根据环保意识的购买行为来选择床上用品。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 20.3亿美元 |

| 预测值 | 30.6 亿美元 |

| 复合年增长率 | 4.3% |

根据最终用途,市场进一步细分为住宅和商业类别。 2024 年住宅领域将占据主导地位,占据 79% 的市场份额,预计在预测期内将保持 4.3% 的复合年增长率。许多家庭,尤其是有易过敏家庭成员的家庭,都开始使用羽绒替代床垫,以发挥其防过敏的功效。这些床垫是创造无过敏原睡眠环境的热门选择,满足了消费者日益关注个人化生活空间内的健康和奢华的需求。对高品质且价格实惠的床上用品解决方案的需求日益增长,推动了全球家庭采用羽绒替代床垫。

在美国,羽绒替代床垫市场在 2024 年创造了 6.15 亿美元的产值,预计在 2025 年至 2034 年期间将以 4.6% 的复合年增长率扩张。羽绒替代床垫具有传统材料的舒适性,且不含相关的动物过敏原,这种趋势凸显了人们更倾向于选择能够改善睡眠卫生和整体幸福感的床上用品。

目录

第 1 章:方法论与范围

- 市场范围和定义

- 基础估算与计算

- 预测计算。

- 资料来源

- 基本的

- 次要

- 付费来源

- 公共资源

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 影响价值链的因素。

- 利润率分析。

- 中断

- 未来展望

- 製造商

- 经销商

- 供应商概况

- 利润率分析。

- 重要新闻及倡议

- 监管格局

- 衝击力

- 成长动力

- 对低过敏性产品的需求不断增加

- 永续材料意识不断增强

- 产业陷阱与挑战

- 市场认知有限

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第 5 章:市场估计与预测:按材料,2021 年至 2034 年

- 主要趋势

- 羊毛

- 棉布

- 聚酯纤维

- 竹子

- 丝绸

- 其他(木棉等)

第六章:市场估计与预测:依规模,2021-2034 年

- 主要趋势

- 双人床或单人床

- 双人加大号

- 全尺寸或双倍尺寸

- 大号

- 其他的

第七章:市场估计与预测:依价格范围,2021-2034 年

- 主要趋势

- 低的

- 中等的

- 高的

第 8 章:市场估计与预测:依坚固程度,2021 年至 2034 年

- 主要趋势

- 柔软的

- 中等的

- 公司

第 9 章:市场估计与预测:依最终用途,2021 年至 2034 年

- 主要趋势

- 住宅

- 商业的

- 饭店

- 医院

- 其他(教育机构等)

第 10 章:市场估计与预测:按配销通路,2021-2034 年

- 主要趋势

- 在线的

- 电子商务网站

- 公司自有网站

- 离线

- 大卖场/超市

- 专卖店

- 其他零售店

第 11 章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 中东及非洲

- 阿联酋

- 沙乌地阿拉伯

- 南非

第 12 章:公司简介

- Avocado Green Mattress, LLC

- Brooklyn Bedding, LLC

- Casper Sleep Inc.

- DreamCloud (Resident Home LLC)

- Helix Sleep, Inc.

- Layla Sleep

- Nest Bedding, Inc.

- Puffy Mattress

- Purple Innovation, Inc.

- Saatva Inc.

- Serta Simmons Bedding, LLC

- Signature Sleep

- Sleep Number Corporation

- Tempur Sealy International, Inc.

- Tuft & Needle

The Global Down Alternative Mattresses Market was valued at USD 2.03 billion in 2024 and is projected to grow at a steady CAGR of 4.3% from 2025 to 2034. This growth is driven by a rising consumer preference for hypoallergenic and sustainable bedding solutions, particularly among individuals with allergies or sensitivities. As more shoppers seek alternatives to traditional down and feather materials, the demand for down alternative mattresses continues to surge.

When categorized by materials, the market includes wool, cotton, polyester, bamboo, silk, and others. Among these, the cotton segment emerged as the market leader in 2024, generating USD 752 million in revenue and projected to grow at a CAGR of 4.5% through 2034. Cotton's natural hypoallergenic properties make it a preferred choice for consumers with sensitivities, as it resists common allergens like dust mites. This makes it particularly appealing to health-conscious shoppers. Additionally, the growing trend toward eco-friendly and sustainable products has amplified the popularity of cotton-based mattresses. With an increasing emphasis on organic cotton sourced from sustainable farms, consumers are aligning their bedding choices with environmentally conscious purchasing behaviors.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.03 Billion |

| Forecast Value | $3.06 Billion |

| CAGR | 4.3% |

The market is further segmented by end-use into residential and commercial categories. The residential sector dominated in 2024, accounting for a 79% market share, and is expected to maintain a CAGR of 4.3% over the forecast period. Households, especially those with allergy-prone individuals, are turning to down alternative mattresses for their hypoallergenic benefits. These mattresses are a popular choice for creating allergen-free sleep environments, catering to the growing consumer focus on wellness and luxury within personalized living spaces. The increasing demand for high-quality yet affordable bedding solutions is propelling the adoption of down alternative mattresses in homes worldwide.

In the U.S., the down alternative mattress market generated USD 615 million in 2024 and is forecasted to expand at a CAGR of 4.6% between 2025 and 2034. Growing awareness of allergies and sensitivities is driving American consumers toward hypoallergenic bedding options. The shift to down alternative mattresses, which offer the comfort of traditional materials without the associated animal-based allergens, underscores a broader preference for bedding that enhances sleep hygiene and overall well-being.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations.

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain.

- 3.1.2 Profit margin analysis.

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis.

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Increasing demand for hypoallergenic products

- 3.6.1.2 Rising awareness of sustainable materials

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 Limited market awareness

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Material, 2021-2034 (USD Million) (Million Units)

- 5.1 Key trends

- 5.2 Wool

- 5.3 Cotton

- 5.4 Polyester

- 5.5 Bamboo

- 5.6 Silk

- 5.7 Others (kapok, etc.)

Chapter 6 Market Estimates & Forecast, By Size, 2021-2034 (USD Million) (Million Units)

- 6.1 Key trends

- 6.2 Twin or single size

- 6.3 Twin XL size

- 6.4 Full or double size

- 6.5 Queen size

- 6.6 Others

Chapter 7 Market Estimates & Forecast, By Price Range, 2021-2034 (USD Million) (Million Units)

- 7.1 Key trends

- 7.2 Low

- 7.3 Medium

- 7.4 High

Chapter 8 Market Estimates & Forecast, By Firmness Level, 2021-2034 (USD Million) (Million Units)

- 8.1 Key trends

- 8.2 Soft

- 8.3 Medium

- 8.4 Firm

Chapter 9 Market Estimates & Forecast, By End Use, 2021-2034 (USD Million) (Million Units)

- 9.1 Key trends

- 9.2 Residential

- 9.3 Commercial

- 9.3.1 Hotel

- 9.3.2 Hospital

- 9.3.3 Others (educational institutions, etc.)

Chapter 10 Market Estimates & Forecast, By Distribution Channel, 2021-2034 (USD Million) (Million Units)

- 10.1 Key trends

- 10.2 Online

- 10.2.1 E-commerce website

- 10.2.2 Company owned website

- 10.3 Offline

- 10.3.1 Hypermarket/supermarket

- 10.3.2 Specialized stores

- 10.3.3 Other retail stores

Chapter 11 Market Estimates & Forecast, By Region, 2021-2034 (USD Million) (Million Units)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 UK

- 11.3.2 Germany

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.3.6 Russia

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 South Korea

- 11.4.5 Australia

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.6 MEA

- 11.6.1 UAE

- 11.6.2 Saudi Arabia

- 11.6.3 South Africa

Chapter 12 Company Profiles

- 12.1 Avocado Green Mattress, LLC

- 12.2 Brooklyn Bedding, LLC

- 12.3 Casper Sleep Inc.

- 12.4 DreamCloud (Resident Home LLC)

- 12.5 Helix Sleep, Inc.

- 12.6 Layla Sleep

- 12.7 Nest Bedding, Inc.

- 12.8 Puffy Mattress

- 12.9 Purple Innovation, Inc.

- 12.10 Saatva Inc.

- 12.11 Serta Simmons Bedding, LLC

- 12.12 Signature Sleep

- 12.13 Sleep Number Corporation

- 12.14 Tempur Sealy International, Inc.

- 12.15 Tuft & Needle