|

市场调查报告书

商品编码

1665287

太空最后一哩交付市场机会、成长动力、产业趋势分析和 2025 - 2034 年预测Space Last-Mile Delivery Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

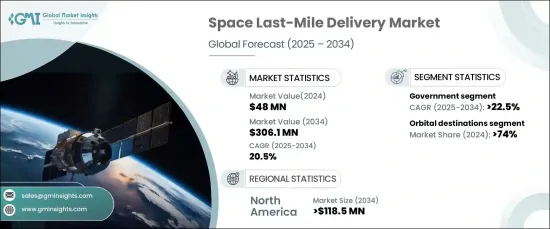

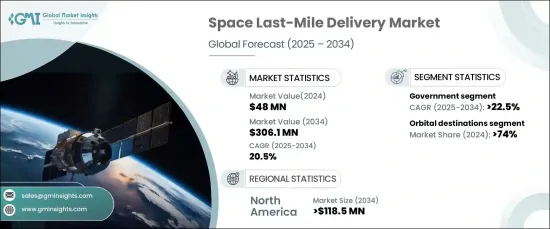

2024 年全球太空最后一哩交付市场价值 4,800 万美元,并将经历令人瞩目的成长,预计 2025 年至 2034 年的年复合成长率(CAGR) 为 20.5%。轨道转移飞行器和先进推进系统的创新使得有效载荷的放置和重新定位更加高效,从而使卫星网路、太空探索和商业运营比以往任何时候都更加有效。随着太空商业化的不断发展和可重复使用技术的进步,这些服务变得更具成本效益,并可被更广泛的行业所使用。

太空最后一哩交付市场主要分为两类:轨道目标和行星或地面目的地。 2024 年,轨道目的地领域占据了 74% 的市场份额,预计未来几年将实现强劲成长。为了实现全球宽频覆盖、地球观测和通讯服务,卫星星座的持续部署极大地推动了对轨道传输解决方案的需求。各组织更加重视实现精确的轨道定位以优化卫星性能,并更加依赖最后一哩的运载系统和轨道转移技术来满足不断变化的太空任务需求。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 4800万美元 |

| 预测值 | 3.061亿美元 |

| 复合年增长率 | 20.5% |

就最终用户而言,市场分为商业和政府部门。政府部门预计将经历最高的成长,到 2034 年预计复合年增长率为 22.5%。精确轨道定位的需求引发了人们对轨道转移飞行器和在轨服务能力的更大兴趣,这反过来又增强了国家安全并优化了卫星网路效率。

预计北美将引领太空最后一英里交付市场,到 2034 年规模将达到 1.185 亿美元。用于地球观测和通讯的卫星星座的持续部署进一步加剧了对先进的在轨物流系统的需求。各公司正专注于开发可重复使用的转运飞行器和自动运载技术,以增强任务灵活性并降低成本,使太空作业更有效率、经济实惠。

目录

第 1 章:方法论与范围

- 市场范围和定义

- 基础估算与计算

- 预测计算

- 资料来源

- 基本的

- 次要

- 付费来源

- 公共资源

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 影响价值链的因素

- 利润率分析

- 中断

- 未来展望

- 製造商

- 经销商

- 供应商概况

- 利润率分析

- 重要新闻及倡议

- 监管格局

- 衝击力

- 成长动力

- 卫星部署数量不断增加

- 商业太空企业的兴起以及私营部门越来越多地参与太空探索

- 增加共乘和二次有效载荷发射

- 越来越关注永续性和减少太空垃圾

- 增加政府投资和太空计划

- 产业陷阱与挑战

- 开发和营运成本高

- 技术限制和可靠性

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第 5 章:市场估计与预测:按目的地,2021-2034 年

- 主要趋势

- 轨道目的地

- 低地球轨道(LEO)

- 中地球轨道(MEO)

- 地球静止轨道(GEO)

- 高地球轨道(GEO 以外)

- 行星/地面目的地

- 月球表面

- 火星表面

- 小行星表面

第六章:市场估计与预测:依交付酬载,2021-2034 年

- 主要趋势

- 科学设备

- 基础设施组件

- 太空站模组

- 卫星零件

- 耗材

- 推进剂/燃料

- 其他的

第 7 章:市场估计与预测:按交付技术,2021 年至 2034 年

- 主要趋势

- 自主系统

- 载人送货

- 混合系统

第 8 章:市场估计与预测:依最终用途,2021 年至 2034 年

- 主要趋势

- 商业的

- 政府

第 9 章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 中东及非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十章:公司简介

- AAC Clyde Space

- Aliena

- Astro Digital

- D-Orbit

- Exotrail

- Impulse Space

- Momentus Space

- Orbit Fab

- Rocket Lab

- SEOPS (Space Exploration and Orbital Solutions)

- Spaceflight Industries

- SpaceLink

- TransAstra

The Global Space Last-Mile Delivery Market was valued at USD 48 million in 2024 and is set to experience impressive growth, with a projected compound annual growth rate (CAGR) of 20.5% from 2025 to 2034. This growth is being driven by an increasing demand for cutting-edge in-orbit logistics solutions and precise satellite deployment. Innovations in orbital transfer vehicles and advanced propulsion systems enable more efficient payload placement and repositioning, making satellite networks, space exploration, and commercial operations more effective than ever. With the growing commercialization of space and advancements in reusable technologies, these services are becoming more cost-effective and accessible to a broader range of industries.

The space last-mile delivery market is primarily divided into two categories: orbital targets and planetary or surface destinations. The orbital destinations segment held a dominant 74% market share in 2024 and is expected to see robust growth in the coming years. The expanding deployment of satellite constellations for global broadband coverage, Earth observation, and communication services is significantly boosting the demand for orbital delivery solutions. Organizations are placing greater emphasis on achieving precise orbital placement to optimize satellite performance, driving increased reliance on last-mile delivery systems and orbital transfer technologies to meet the evolving needs of space missions.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $48 million |

| Forecast Value | $306.1 million |

| CAGR | 20.5% |

In terms of end users, the market is segmented into commercial and government sectors. The government segment is expected to experience the highest growth, with a projected CAGR of 22.5% through 2034. Governments worldwide are ramping up investments in last-mile delivery infrastructure to deploy critical defense satellites for surveillance, communications, and missile detection. The need for exact orbital positioning is fueling greater interest in orbital transfer vehicles and in-orbit servicing capabilities, which in turn enhances national security and optimizes satellite network efficiency.

North America is anticipated to lead the space last-mile delivery market, reaching USD 118.5 million by 2034. The United States is at the forefront of this growth, driven by its technological expertise in space exploration and commercialization. The escalating deployment of satellite constellations for Earth observation and communication is further intensifying the demand for advanced in-orbit logistics systems. Companies are focusing on developing reusable transfer vehicles and autonomous delivery technologies, which enhance mission flexibility and reduce costs, making space operations more efficient and affordable.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Growing number of satellite deployment

- 3.6.1.2 Rise of commercial space ventures and the growing private sector involvement in space exploration

- 3.6.1.3 Increasing ride-sharing and secondary payload launches

- 3.6.1.4 Growing focus on sustainability and mitigating space debris

- 3.6.1.5 Increasing governmental investments and space programs

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 High development and operational costs

- 3.6.2.2 Technological limitations and reliability

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Destination, 2021-2034 (USD Million)

- 5.1 Key trends

- 5.2 Orbital destinations

- 5.2.1 Low earth orbit (LEO)

- 5.2.2 Medium earth orbit (MEO)

- 5.2.3 Geostationary orbit (GEO)

- 5.2.4 High earth orbit (Beyond GEO)

- 5.3 Planetary/surface destinations

- 5.3.1 Lunar surface

- 5.3.2 Martian surface

- 5.3.3 Asteroids surface

Chapter 6 Market Estimates & Forecast, By Delivery Payload, 2021-2034 (USD Million)

- 6.1 Key trends

- 6.2 Scientific equipment

- 6.3 Infrastructure components

- 6.3.1 Space station modules

- 6.3.2 Satellite components

- 6.4 Consumables

- 6.5 Propellants/fuel

- 6.6 Others

Chapter 7 Market Estimates & Forecast, By Delivery Technology, 2021-2034 (USD Million)

- 7.1 Key trends

- 7.2 Autonomous systems

- 7.3 Manned delivery

- 7.4 Hybrid systems

Chapter 8 Market Estimates & Forecast, By End Use, 2021-2034 (USD Million)

- 8.1 Key trends

- 8.2 Commercial

- 8.3 Government

Chapter 9 Market Estimates & Forecast, By Region, 2021-2034 (USD Million)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 AAC Clyde Space

- 10.2 Aliena

- 10.3 Astro Digital

- 10.4 D-Orbit

- 10.5 Exotrail

- 10.6 Impulse Space

- 10.7 Momentus Space

- 10.8 Orbit Fab

- 10.9 Rocket Lab

- 10.10 SEOPS (Space Exploration and Orbital Solutions)

- 10.11 Spaceflight Industries

- 10.12 SpaceLink

- 10.13 TransAstra