|

市场调查报告书

商品编码

1665292

子宫托市场机会、成长动力、产业趋势分析与 2025 - 2034 年预测Pessary Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

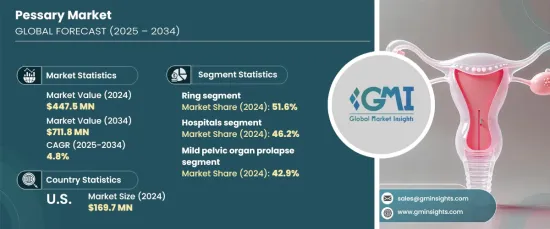

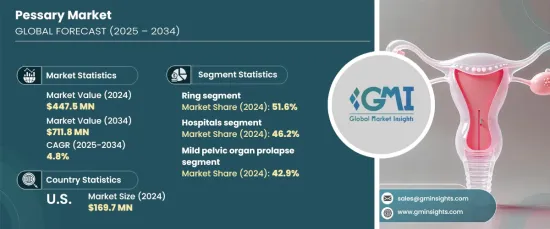

2024 年全球子宫托市场价值为 4.475 亿美元,预计 2025 年至 2034 年期间将以 4.8% 的复合年增长率稳步增长。 这一增长主要得益于盆腔器官脱垂 (POP) 和尿失禁患病率的不断上升、 这一增长主要得益于盆腔器官脱垂 (POP) 和尿失禁患病率的不断上升、对治疗和治疗这一重要性的非持续性提高对政府的重要影响方案。

市场按类型细分,其中环形子宫托占据领先地位,在 2024 年占据 51.6% 的市场份额。它的设计减少了刺激并允许长时间使用,使其成为临床环境中的首选,并有助于其广泛接受。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 4.475亿美元 |

| 预测值 | 7.118亿美元 |

| 复合年增长率 | 4.8% |

按最终用户划分,医院成为领先细分市场,到 2024 年占据了 46.2% 的市场份额。这些机构提供手术和非手术子宫托治疗,以满足不同严重程度患者的需求。他们处理复杂病例和提供必要后续护理的能力进一步巩固了他们在子宫托市场的主导地位。

在美国,子宫托市场价值在 2024 年达到 1.697 亿美元,并持续展现出强劲的成长潜力。骨盆腔疾病的增多,以及肥胖等与生活方式相关的健康状况,推动了对子宫托作为有效、非侵入性治疗方案的需求不断增加。医疗保健管道的扩大和不断提高人们对骨盆健康问题的认识的努力正在促进全国市场的持续成长。

目录

第 1 章:方法论与范围

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 骨盆腔器官脱垂及尿失禁盛行率不断上升

- 对及时诊断和治疗的认识不断提高

- 非侵入性治疗方案的采用率不断提高

- 政府对妇女健康计画的支持不断增加

- 产业陷阱与挑战

- 社会耻辱与心理障碍

- 担心长期使用会导致感染风险

- 成长动力

- 成长潜力分析

- 专利分析

- 差距分析

- 监管格局

- 技术格局

- 未来市场趋势

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略展望

第 5 章:市场估计与预测:按类型,2021 年至 2034 年

- 主要趋势

- 戒指

- 油炸圈饼

- 盖尔霍恩

- 其他类型

第 6 章:市场估计与预测:按应用,2021 年至 2034 年

- 主要趋势

- 轻度骨盆腔器官脱垂

- 压力性尿失禁

- 严重骨盆腔器官脱垂

- 其他应用

第 7 章:市场估计与预测:依最终用途,2021 年至 2034 年

- 主要趋势

- 医院

- 门诊手术中心

- 诊所

- 其他最终用户

第 8 章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第九章:公司简介

- Artisan Medical

- Bioteque America

- Bliss GVS Pharma

- Bray Group (Ethos Partners)

- Coloplast Group

- Contiform International

- CooperSurgical

- Dr. Arabin

- Integra Lifesciences

- MedGyn Products

- Novomed group (Gyneas)

- Panpac Medical

- Personal Medical

- Smiths Group

- Sugar International

The Global Pessary Market was valued at USD 447.5 million in 2024 and is projected to experience steady growth at a CAGR of 4.8% from 2025 to 2034. This growth is primarily driven by the increasing prevalence of pelvic organ prolapse (POP) and urinary incontinence, heightened awareness about the importance of timely diagnosis and treatment, growing preference for non-invasive therapy options, and strengthened government initiatives supporting women's health programs.

The market is segmented by type, with the ring pessary leading the way, accounting for 51.6% of the market share in 2024. The ring pessary's continued dominance can be attributed to its versatility, ease of use, and lightweight comfort, making it ideal for individuals suffering from mild to moderate prolapse and stress urinary incontinence. Its design reduces irritation and allows for prolonged use, making it a favored choice in clinical settings and contributing to its widespread acceptance.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $447.5 Million |

| Forecast Value | $711.8 Million |

| CAGR | 4.8% |

By end user, hospitals emerged as the leading segment, capturing 46.2% of the market share in 2024. Hospitals play a pivotal role in diagnosing, managing, and treating pelvic floor disorders such as POP and stress urinary incontinence. These institutions offer both surgical and non-surgical pessary treatments, catering to patients with varying levels of severity. Their ability to handle complex cases and provide essential follow-up care further reinforces their dominance in the pessary market.

In the United States, the pessary market was valued at USD 169.7 million in 2024 and continues to show strong growth potential. The rise in pelvic disorders, alongside lifestyle-related health conditions like obesity, is driving the increasing demand for pessaries as effective, non-invasive treatment solutions. The expansion of healthcare access and ongoing efforts to raise awareness about pelvic health issues are contributing to the continued market growth across the country.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing prevalence of pelvic organ prolapse and urinary incontinence

- 3.2.1.2 Growing awareness towards timely diagnosis and treatment

- 3.2.1.3 Increasing adoption of non-invasive treatment options

- 3.2.1.4 Growing government support in women health programs

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Social stigma and psychological barrier

- 3.2.2.2 Concerns related to risk of infections due to prolonged use

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Patent analysis

- 3.5 Gap analysis

- 3.6 Regulatory landscape

- 3.7 Technological landscape

- 3.8 Future market trends

- 3.9 Porter’s analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy outlook

Chapter 5 Market Estimates and Forecast, By Type, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Ring

- 5.3 Donut

- 5.4 Gellhorn

- 5.5 Other types

Chapter 6 Market Estimates and Forecast, By Application, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Mild pelvic organ prolapse

- 6.3 Stress urinary incontinence

- 6.4 Severe pelvic organ prolapse

- 6.5 Other applications

Chapter 7 Market Estimates and Forecast, By End Use, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Hospitals

- 7.3 Ambulatory surgical centers

- 7.4 Clinics

- 7.5 Other end users

Chapter 8 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Artisan Medical

- 9.2 Bioteque America

- 9.3 Bliss GVS Pharma

- 9.4 Bray Group (Ethos Partners)

- 9.5 Coloplast Group

- 9.6 Contiform International

- 9.7 CooperSurgical

- 9.8 Dr. Arabin

- 9.9 Integra Lifesciences

- 9.10 MedGyn Products

- 9.11 Novomed group (Gyneas)

- 9.12 Panpac Medical

- 9.13 Personal Medical

- 9.14 Smiths Group

- 9.15 Sugar International