|

市场调查报告书

商品编码

1665297

神经痛治疗市场机会、成长动力、产业趋势分析与预测 2025 - 2034Neuralgia Treatment Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

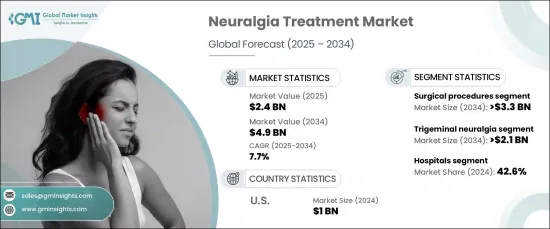

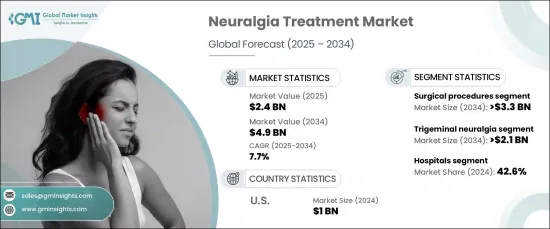

2024 年全球神经痛治疗市场价值为 24 亿美元,将经历大幅增长,预计 2025 年至 2034 年的复合年增长率为 7.7%。

神经系统疾病,特别是各种形式的神经痛发生率的上升是推动市场扩张的关键因素。随着对这些疾病的认识不断提高,越来越多的人开始寻求早期诊断和治疗。公众意识运动和改进的诊断能力在早期发现神经痛方面发挥了重要作用,推动了针对三叉神经痛、带状疱疹后神经痛和其他形式的神经相关疼痛的治疗需求。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 24亿美元 |

| 预测值 | 49亿美元 |

| 复合年增长率 | 7.7% |

市场依各种神经痛病症进行细分,包括三叉神经痛、带状疱疹后神经痛、枕神经痛等。其中,三叉神经痛预计成长最快,预计复合年增长率为 7.9%,到 2034 年将达到 21 亿美元。这导致对更好治疗方案的需求增加,进一步推动市场成长。

从最终用户的角度来看,医院预计将推动神经痛治疗市场的大幅成长。凭藉 MRI 和 CT 扫描等先进的诊断工具,医院仍然是进行全面诊断和治疗的首选场所。这些尖端技术使医疗保健提供者能够准确识别不同类型的神经痛,确保患者接受最有效和最有针对性的治疗。提供精准诊断能力的能力使医院成为治疗复杂神经系统疾病最值得信赖和最可靠的环境,从而确保了其在市场上的主导地位。

在美国,神经痛治疗市场预计将在预测期内实现强劲成长。该国先进的医疗保健基础设施,包括最先进的影像技术、手术技术和药理创新,继续支持其市场领导地位。随着人口老化,人们特别容易患上三叉神经痛和带状疱疹后神经痛等疾病,对有效治疗的需求日益增加。此外,优惠的报销政策和主要製药公司在研发方面的大量投入也促进了市场的扩张,确保美国在全球神经痛治疗领域仍占有重要地位。

目录

第 1 章:方法论与范围

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 神经系统疾病盛行率上升

- 疼痛管理技术的进步

- 提高认识和诊断率

- 产业陷阱与挑战

- 先进疗法成本高昂

- 成长动力

- 成长潜力分析

- 监管格局

- 技术格局

- 报销场景

- 差距分析

- 波特的分析

- PESTEL 分析

- 未来市场趋势

第四章:竞争格局

- 介绍

- 公司矩阵分析

- 公司市占率分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

第 5 章:市场估计与预测:按治疗类型,2021 - 2034 年

- 主要趋势

- 外科手术

- 射频热损伤

- 立体定位放射外科

- 显微血管减压术

- 其他外科手术

- 药物

- 抗惊厥药

- 抗忧郁药

- 其他药物

第 6 章:市场估计与预测:按应用,2021 - 2034 年

- 主要趋势

- 三叉神经痛

- 带状疱疹后神经痛

- 枕神经痛

- 其他应用

第 7 章:市场估计与预测:按最终用途,2021 - 2034 年

- 主要趋势

- 医院

- 诊所

- 门诊手术中心

- 其他最终用户

第 8 章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第九章:公司简介

- AA pharma

- astellas

- Biogen

- Eli Lilly

- Johnson & Johnson

- Medtronic

- NOVARTIS

- PACIRA BIOSCIENCES

- Pfizer

- Siemens Healthineers

The Global Neuralgia Treatment Market, valued at USD 2.4 billion in 2024, is set to experience substantial growth, with a projected CAGR of 7.7% from 2025 to 2034. This growth is primarily driven by the increasing prevalence of neurological disorders and advancements in awareness, diagnosis, and treatment options.

The rising incidence of neurological conditions, particularly various forms of neuralgia, is a key factor fueling market expansion. As awareness surrounding these disorders grows, more individuals are seeking early diagnosis and treatment. Public awareness campaigns and improved diagnostic capabilities have played a significant role in detecting neuralgia at earlier stages, driving demand for therapies that target conditions like trigeminal neuralgia, postherpetic neuralgia, and other forms of nerve-related pain.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.4 Billion |

| Forecast Value | $4.9 Billion |

| CAGR | 7.7% |

The market is segmented by various neuralgia conditions, including trigeminal neuralgia, postherpetic neuralgia, occipital neuralgia, and others. Among these, trigeminal neuralgia is expected to see the highest growth, with a projected CAGR of 7.9%, reaching USD 2.1 billion by 2034. Trigeminal neuralgia, one of the most common types of neuralgia, especially affects older populations and can severely impact daily activities and overall quality of life. This has led to increased demand for better treatment options, further propelling market growth.

From the perspective of end-users, hospitals are projected to drive substantial growth in the neuralgia treatment market. With advanced diagnostic tools like MRI and CT scans, hospitals remain the preferred setting for comprehensive diagnosis and treatment. These cutting-edge technologies enable healthcare providers to accurately identify different types of neuralgia, ensuring that patients receive the most effective and targeted treatments. The ability to offer precise diagnostic capabilities makes hospitals the most trusted and reliable environments for treating complex neurological conditions, thus securing their dominance in the market.

In the U.S., the neuralgia treatment market is expected to see robust growth during the forecast period. The country's advanced healthcare infrastructure, featuring state-of-the-art imaging technologies, surgical techniques, and pharmacological innovations, continues to support its market leadership. With an aging population that is particularly vulnerable to conditions like trigeminal and postherpetic neuralgia, the demand for effective treatments is escalating. Furthermore, favorable reimbursement policies and significant investments in research and development by major pharmaceutical companies are contributing to the market's expansion, ensuring that the U.S. remains a key player in the global neuralgia treatment landscape.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising prevalence of neurological disorders

- 3.2.1.2 Advancements in pain management technologies

- 3.2.1.3 Increase in awareness and diagnosis rates

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of advanced therapies

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technology landscape

- 3.6 Reimbursement scenario

- 3.7 Gap analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

- 3.10 Future market trends

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Treatment Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Surgical procedures

- 5.2.1 Radiofrequency thermal lesioning

- 5.2.2 Stereotactic radiosurgery

- 5.2.3 Microvascular decompression

- 5.2.4 Other surgical procedures

- 5.3 Medications

- 5.3.1 Anticonvulsants

- 5.3.2 Antidepressants

- 5.3.3 Other medications

Chapter 6 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Trigeminal neuralgia

- 6.3 Postherpetic neuralgia

- 6.4 Occipital neuralgia

- 6.5 Other applications

Chapter 7 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Hospitals

- 7.3 Clinics

- 7.4 Ambulatory surgical centers

- 7.5 Other end users

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 AA pharma

- 9.2 astellas

- 9.3 Biogen

- 9.4 Eli Lilly

- 9.5 Johnson & Johnson

- 9.6 Medtronic

- 9.7 NOVARTIS

- 9.8 PACIRA BIOSCIENCES

- 9.9 Pfizer

- 9.10 Siemens Healthineers