|

市场调查报告书

商品编码

1665309

门铰链市场机会、成长动力、产业趋势分析与 2025 - 2034 年预测Door Hinges Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

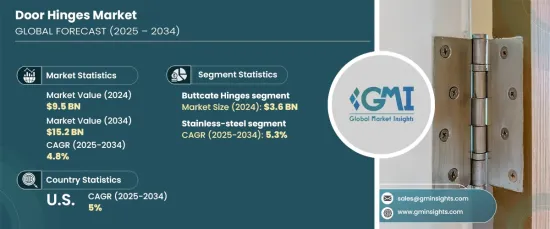

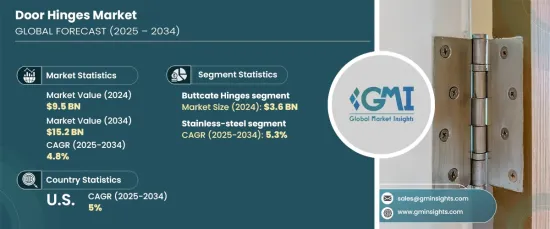

2024 年全球门铰链市场价值为 95 亿美元,预计 2025 年至 2034 年期间将以 4.8% 的强劲复合年增长率增长。 这一增长得益于隐藏铰链、软关闭机制和耐腐蚀材料的重大进步,满足了现代建筑设计对增强耐用性、无缝美观度和功能性的日益增长的需求。

在各种类型的门铰链中,对接铰链在 2024 年占据市场主导地位,创造了 36 亿美元的收入。预计该领域将继续保持成长轨迹,预测期内复合年增长率为 4.5%。对接铰链因其多功能性而受到青睐,适用于住宅、商业和工业应用。它们耐用的结构和简单的设计使其成为内门和外门的理想选择,确保了其在市场上的主导地位。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 95亿美元 |

| 预测值 | 152亿美元 |

| 复合年增长率 | 4.8% |

就材质而言,门铰链市场分为不銹钢、铝、黄铜、碳钢和其他材质,包括塑胶和锌合金。不銹钢在 2024 年成为主导材料,占据 40% 的市场。预计到 2034 年,其复合年增长率将达到 5.3%。不銹钢门铰链在沿海和工业区等恶劣环境中尤其可靠,可确保长期耐用性并减少维护,巩固其在市场上的领先地位。

美国门铰链市场的价值在 2024 年将达到 18 亿美元,预计在 2025 年至 2034 年期间的复合年增长率将达到 5%。此外,可支配收入的增加和对高端产品的日益偏好进一步促进了市场的扩张。强劲的製造业和持续的产品创新也增强了美国市场在北美的领导地位,使该地区成为全球门铰链市场的关键参与者。

目录

第 1 章:方法论与范围

- 市场范围和定义

- 基础估算与计算

- 预测参数

- 资料来源

- 基本的

- 次要

- 付费来源

- 公共资源

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 影响价值链的因素

- 利润率分析

- 中断

- 未来展望

- 製造商

- 经销商

- 零售商

- 供应商概况

- 技术格局

- 利润率分析

- 重要新闻及倡议

- 监管格局

- 衝击力

- 成长动力

- 增加建设和改造活动。

- 铰链技术和智慧解决方案的进步。

- 对客製化和美观硬体的需求不断增长。

- 扩大电子商务和分销网络。

- 产业陷阱与挑战

- 市场参与者竞争激烈。

- 原物料价格波动。

- 成长动力

- 消费者购买行为分析

- 人口趋势

- 影响购买决策的因素

- 消费者产品采用

- 首选配销通路

- 偏好价格范围

- 成长潜力分析

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第 5 章:市场估计与预测:按类型,2021 年至 2034 年

- 主要趋势

- 对接铰链

- 连续(钢琴)铰链

- 隐藏式铰链

- 弹簧铰链

- 滚珠轴承铰链

- 枢轴铰链

- 其他(焊接铰链、旗形铰炼等)

第六章:市场估计与预测:按材料,2021 – 2034 年

- 主要趋势

- 不銹钢

- 铝

- 黄铜

- 碳钢

- 其他(塑胶、锌合金等)

第 7 章:市场估计与预测:按价格,2021 年至 2034 年

- 主要趋势

- 低的

- 中等的

- 高的

第 8 章:市场估计与预测:按应用,2021 年至 2034 年

- 主要趋势

- 住宅

- 商业的

- 工业的

- 汽车与运输

- 航太和国防

第 9 章:市场估计与预测:按最终用途产业,2021 年至 2034 年

- 主要趋势

- 建造

- 住宅

- 商业的

- 製造和仓储

- 运输与物流

- 农业

- 其他的

第 10 章:市场估计与预测:按配销通路,2021 年至 2034 年

- 主要趋势

- 直接的

- 间接

第 11 章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 中东及非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第 12 章:公司简介

- Allegion plc

- ASSA ABLOY AB

- Blum, Inc.

- Dormakaba Holding AG

- EPOMAY Hardware

- FGV

- Godrej & Boyce Manufacturing Co. Ltd.

- Hafele Group

- Hettich Holding GmbH & Co. KG

- JMA Hardware

- Richelieu Hardware

- Roto Frank AG

- Simonswerk GmbH

- Stanley Black & Decker, Inc.

- Sugatsune Kogyo Co., Ltd.

The Global Door Hinges Market was valued at USD 9.5 billion in 2024 and is projected to grow at a robust CAGR of 4.8% from 2025 to 2034. This growth is driven by significant advancements in concealed hinges, soft-close mechanisms, and corrosion-resistant materials, addressing the increasing demand for enhanced durability, seamless aesthetics, and improved functionality in modern architectural designs.

Among the various types of door hinges, butt hinges led the market in 2024, generating USD 3.6 billion in revenue. This segment is expected to continue its growth trajectory, with a projected CAGR of 4.5% during the forecast period. Butt hinges are favored for their versatility, being suitable for residential, commercial, and industrial applications. Their durable construction and simple design make them ideal for both interior and exterior doors, securing their dominant position in the market.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $9.5 Billion |

| Forecast Value | $15.2 Billion |

| CAGR | 4.8% |

In terms of material, the door hinges market is categorized into stainless steel, aluminum, brass, carbon steel, and others, including plastic and zinc alloys. Stainless steel emerged as the leading material in 2024, capturing 40% of the market share. It is projected to grow at a CAGR of 5.3% through 2034. The material's enduring popularity can be attributed to its exceptional strength, corrosion resistance, and visual appeal. Stainless steel door hinges are especially reliable in harsh environments such as coastal and industrial areas, ensuring long-term durability with minimal maintenance, solidifying their leadership in the market.

The U.S. door hinges market, valued at USD 1.8 billion in 2024, is expected to grow at a CAGR of 5% from 2025 to 2034. The market's growth is driven by ongoing construction and renovation projects that fuel demand for high-quality hardware. Additionally, rising disposable incomes and a growing preference for premium products further contribute to the market's expansion. The U.S. market's leadership in North America is also bolstered by a robust manufacturing sector and continuous product innovation, positioning the region as a key player in the global door hinges market.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definition

- 1.2 Base estimates & calculations

- 1.3 Forecast parameters

- 1.4 Data sources

- 1.4.1 Primary

- 1.5 Secondary

- 1.5.1.1 Paid sources

- 1.5.1.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.1.7 Retailers

- 3.2 Supplier landscape

- 3.3 Technological landscape

- 3.4 Profit margin analysis

- 3.5 Key news & initiatives

- 3.6 Regulatory landscape

- 3.7 Impact forces

- 3.7.1 Growth drivers

- 3.7.1.1 Increasing construction and renovation activities.

- 3.7.1.2 Advancements in hinge technology and smart solutions.

- 3.7.1.3 Rising demand for customized and aesthetic hardware.

- 3.7.1.4 Expansion of e-commerce and distribution networks.

- 3.7.2 Industry pitfalls & challenges

- 3.7.2.1 High competition among market players.

- 3.7.2.2 Fluctuations in raw material prices.

- 3.7.1 Growth drivers

- 3.8 Consumer buying behavior analysis

- 3.8.1 Demographic trends

- 3.8.2 Factors affecting buying decision

- 3.8.3 Consumer product adoption

- 3.8.4 Preferred distribution channel

- 3.8.5 Preferred price range

- 3.9 Growth potential analysis

- 3.10 Porter’s analysis

- 3.11 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates and Forecast, By Type, 2021 – 2034 (USD Billion) (Million Units)

- 5.1 Key trends

- 5.2 Butt Hinges

- 5.3 Continuous (Piano) hinges

- 5.4 Concealed hinges

- 5.5 Spring hinges

- 5.6 Ball-Bearing hinges

- 5.7 Pivot hinges

- 5.8 Others (weld-on hinges, flag hinges, etc.)

Chapter 6 Market Estimates and Forecast, By Material, 2021 – 2034 (USD Billion) (Million Units)

- 6.1 Key trends

- 6.2 Stainless steel

- 6.3 Aluminum

- 6.4 Brass

- 6.5 Carbon steel

- 6.6 Others (plastic, zinc alloys, etc.)

Chapter 7 Market Estimates and Forecast, By Price, 2021 – 2034 (USD Billion) (Million Units)

- 7.1 Key trends

- 7.2 Low

- 7.3 Medium

- 7.4 High

Chapter 8 Market Estimates and Forecast, By Application, 2021 – 2034 (USD Billion) (Million Units)

- 8.1 Key trends

- 8.2 Residential

- 8.3 Commercial

- 8.4 Industrial

- 8.5 Automotive & transportation

- 8.6 Aerospace & defense

Chapter 9 Market Estimates and Forecast, By End Use Industry, 2021 – 2034 (USD Billion) (Million Units)

- 9.1 Key trends

- 9.2 Construction

- 9.2.1 Residential

- 9.2.2 Commercial

- 9.3 Manufacturing & warehousing

- 9.4 Transportation & logistics

- 9.5 Agriculture

- 9.6 Others

Chapter 10 Market Estimates & Forecast, By Distribution Channel, 2021 – 2034, (USD Billion) (Million Units)

- 10.1 Key trends

- 10.2 Direct

- 10.3 Indirect

Chapter 11 Market Estimates & Forecast, By Region, 2021 – 2034, (USD Billion) (Million Units)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 UK

- 11.3.2 Germany

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 Japan

- 11.4.3 India

- 11.4.4 Australia

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.6 MEA

- 11.6.1 South Africa

- 11.6.2 Saudi Arabia

- 11.6.3 UAE

Chapter 12 Company Profiles (Business Overview, Financial Data, Product Landscape, Strategic Outlook, SWOT Analysis)

- 12.1 Allegion plc

- 12.2 ASSA ABLOY AB

- 12.3 Blum, Inc.

- 12.4 Dormakaba Holding AG

- 12.5 EPOMAY Hardware

- 12.6 FGV

- 12.7 Godrej & Boyce Manufacturing Co. Ltd.

- 12.8 Hafele Group

- 12.9 Hettich Holding GmbH & Co. KG

- 12.10 JMA Hardware

- 12.11 Richelieu Hardware

- 12.12 Roto Frank AG

- 12.13 Simonswerk GmbH

- 12.14 Stanley Black & Decker, Inc.

- 12.15 Sugatsune Kogyo Co., Ltd.