|

市场调查报告书

商品编码

1665310

实验室和医疗级臭氧发生器市场机会、成长动力、产业趋势分析和预测 2025 - 2034Laboratory and Medical Scale Ozone Generator Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

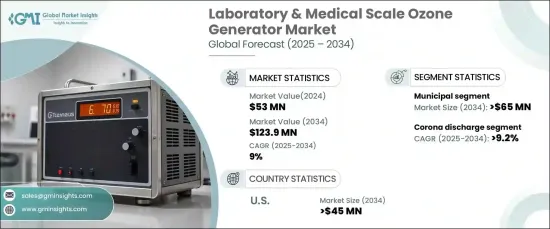

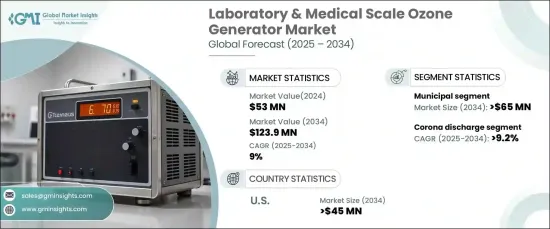

全球实验室和医疗级臭氧产生器市场预计将在 2024 年达到 5,300 万美元,预计 2025 年至 2034 年的复合年增长率为 9%。由于其强大的氧化特性,臭氧能够有效消除细菌、病毒和病原体,使其成为临床和实验室环境中设备消毒和空气净化的理想解决方案。臭氧无需依赖化学消毒剂即可维持高卫生标准,这使其成为医疗保健和研究环境中的重要工具,而传统清洁方法往往无法满足这些领域的需求。

对节能且经济高效的消毒技术的需求不断增长,预计将推动市场扩张。人们日益倾向于可持续、无化学和零废物灭菌工艺,进一步支持了实验室和医疗机构采用臭氧发生器。此外,随着产业优先考虑不留有害残留物且仍提供高效性的方法,对环保解决方案的更严格的监管要求正在推动市场成长。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 5,300万美元 |

| 预测值 | 1.239 亿美元 |

| 复合年增长率 | 9% |

到 2034 年,市政部门预计将在臭氧发生器市场创造 6,500 万美元。这种增长很大程度上是由于人们对卫生和个人卫生的日益重视,推动了臭氧发生器的应用,以对抗包括病毒、细菌和真菌在内的多种病原体。水处理和健康相关设施中更严格的消毒规定正在加速臭氧产生器的整合,以满足安全和合规标准。技术进步使得更精确的控制和即时监控成为可能,提高了系统效率和可靠性,促进了市场的持续成长。

预计到 2034 年,美国实验室和医疗级臭氧发生器市场将创收 4,500 万美元。研究和医学实验室越来越重视永续性和减少环境影响,进一步推动了对基于臭氧的解决方案的需求。随着人们对安全、高效和环保实践的关注度不断提高,这些环境中对臭氧发生器的需求持续上升。

目录

第 1 章:方法论与范围

- 市场定义

- 基础估算与计算

- 预测计算

- 初步研究与验证

- 主要来源

- 资料探勘来源

- 市场定义

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统

- 监管格局

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 成长潜力分析

- 波特的分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- PESTEL 分析

第四章:竞争格局

- 介绍

- 战略仪表板

- 创新与技术格局

第 5 章:市场规模与预测:依技术,2021 – 2034 年

- 主要趋势

- 紫外线

- 冷等离子

- 电晕放电

- 电解

第 6 章:市场规模与预测:依最终用途,2021 – 2034 年

- 主要趋势

- 商业的

- 市政

- 工业的

第 7 章:市场规模及预测:按地区,2021 – 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 俄罗斯

- 义大利

- 西班牙

- 亚太地区

- 中国

- 澳洲

- 印度

- 日本

- 韩国

- 中东和非洲

- 沙乌地阿拉伯

- 阿联酋

- 埃及

- 土耳其

- 南非

- 拉丁美洲

- 巴西

- 阿根廷

第八章:公司简介

- Aurozone

- A2Z Ozone

- Eltech Ozone

- Hansler Medical

- Jelight Company

- Medozons

- Ozone Solutions

- VWR

- Veolia Water Technologies & Solutions

- Xylem Water Solutions

The Global Laboratory And Medical Scale Ozone Generator Market is set to reach USD 53 million in 2024, with a projected CAGR of 9% from 2025 to 2034. These advanced devices generate ozone (O3) for a variety of purposes, including sterilization, disinfection, and deodorization. Thanks to its powerful oxidative properties, ozone efficiently eliminates bacteria, viruses, and pathogens, making it an ideal solution for sanitizing equipment and purifying air in clinical and laboratory environments. Ozone's ability to maintain high hygiene standards without relying on chemical disinfectants positions it as a vital tool in healthcare and research settings, where traditional cleaning methods often fall short.

The growing demand for energy-efficient and cost-effective disinfection technologies is expected to drive the market's expansion. The increasing shift toward sustainable, chemical-free, and zero-waste sterilization processes is further supporting the adoption of ozone generators in laboratories and healthcare facilities. Additionally, stricter regulatory requirements for eco-friendly solutions are fueling market growth as industries prioritize methods that leave no harmful residues while still offering high-level effectiveness.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $53 Million |

| Forecast Value | $123.9 Million |

| CAGR | 9% |

By 2034, the municipal sector is expected to generate USD 65 million in the ozone generator market. This growth is largely driven by an increased focus on sanitation and hygiene, pushing the adoption of ozone generators to combat a wide range of pathogens, including viruses, bacteria, and fungi. More stringent disinfection regulations in water treatment and health-related facilities are accelerating the integration of ozone generators to meet safety and compliance standards. Technological advancements, which enable more precise control and real-time monitoring, are enhancing system efficiency and reliability, contributing to ongoing market growth.

The U.S. laboratory and medical scale ozone generator market is expected to generate USD 45 million by 2034. The rising regulatory pressures and stringent standards set by organizations like the FDA and CDC are motivating healthcare providers to switch to chemical-free sterilization methods. A growing emphasis on sustainability and reducing environmental footprints in research and medical laboratories is further driving the demand for ozone-based solutions. As the focus on safe, efficient, and eco-friendly practices intensifies, the demand for ozone generators continues to rise in these settings.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 – 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive landscape, 2024

- 4.1 Introduction

- 4.2 Strategic dashboard

- 4.3 Innovation & technology landscape

Chapter 5 Market Size and Forecast, By Technology, 2021 – 2034 (USD Million & Units)

- 5.1 Key trends

- 5.2 Ultraviolet

- 5.3 Cold plasma

- 5.4 Corona discharge

- 5.5 Electrolytic

Chapter 6 Market Size and Forecast, By End Use, 2021 – 2034 (USD Million & Units)

- 6.1 Key trends

- 6.2 Commercial

- 6.3 Municipal

- 6.4 Industrial

Chapter 7 Market Size and Forecast, By Region, 2021 – 2034 (USD Million & Units)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 UK

- 7.3.3 France

- 7.3.4 Russia

- 7.3.5 Italy

- 7.3.6 Spain

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 Australia

- 7.4.3 India

- 7.4.4 Japan

- 7.4.5 South Korea

- 7.5 Middle East & Africa

- 7.5.1 Saudi Arabia

- 7.5.2 UAE

- 7.5.3 Egypt

- 7.5.4 Turkey

- 7.5.5 South Africa

- 7.6 Latin America

- 7.6.1 Brazil

- 7.6.2 Argentina

Chapter 8 Company Profiles

- 8.1 Aurozone

- 8.2 A2Z Ozone

- 8.3 Eltech Ozone

- 8.4 Hansler Medical

- 8.5 Jelight Company

- 8.6 Medozons

- 8.7 Ozone Solutions

- 8.8 VWR

- 8.9 Veolia Water Technologies & Solutions

- 8.10 Xylem Water Solutions