|

市场调查报告书

商品编码

1665331

凝血分析仪市场机会、成长动力、产业趋势分析与 2025 - 2034 年预测Coagulation Analyzers Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

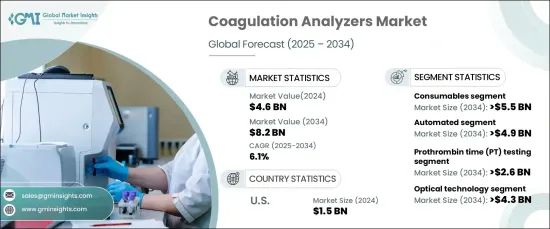

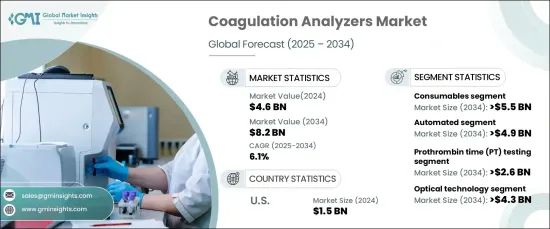

2024 年全球凝血分析仪市场规模达到 46 亿美元,预计 2025 年至 2034 年期间复合年增长率将达到 6.1%。 推动这一增长的因素包括血友病和血栓等血液疾病发病率上升,以及久坐生活方式、人口老龄化和肥胖导致的心血管并发症增加。随着预防保健意识的不断增强以及早期诊断检测的日益普及,凝血分析仪在医疗机构中的应用正在加速。

市场按产品类型细分为消耗品和仪器,预计消耗品将占主导地位。预计耗材部门的复合年增长率为 6.3%,到 2034 年将创下 55 亿美元的产值。试剂技术的进步增强了与自动化系统的兼容性,提高了高通量测试环境的效率和精确度,进一步推动了需求。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 46亿美元 |

| 预测值 | 82亿美元 |

| 复合年增长率 | 6.1% |

根据测试类型,市场涵盖凝血酶原时间 (PT) 测试、活化部分凝血活酶时间 (aPTT) 测试、D-二聚体测试、纤维蛋白原测试和其他测试。预计 PT 测试的复合年增长率将达到 6.6%,到 2034 年将达到 26 亿美元。它在常规和高级诊断程序中的关键作用凸显了其对市场成长的重大贡献。

在美国,凝血分析仪市场规模在 2024 年达到 15 亿美元,预计到 2034 年将以 5.3% 的复合年增长率稳步增长。随着有效监测抗凝血疗法变得越来越重要,对凝血测试(尤其是 PT 和 aPTT)的需求持续上升。此外,临床实验室全自动化系统的整合正在提高工作流程效率,满足大量检测的需求,并巩固该国的市场主导地位。

目录

第 1 章:方法论与范围

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 心血管和血液相关疾病盛行率不断上升

- 对即时诊断设备的需求不断增长

- 凝血分析仪的技术进步

- 提高对早期疾病诊断的认识

- 产业陷阱与挑战

- 设备审批的严格监管要求

- 缺乏操作先进分析仪的熟练专业人员

- 成长动力

- 成长潜力分析

- 监管格局

- 技术格局

- 差距分析

- 波特的分析

- PESTEL 分析

- 未来市场趋势

- 价值链分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

第 5 章:市场估计与预测:按产品类型,2021 年至 2034 年

- 主要趋势

- 耗材

- 仪器

第六章:市场估计与预测:按模式,2021 – 2034 年

- 主要趋势

- 自动化

- 半自动化

- 手动的

第 7 章:市场估计与预测:按测试类型,2021 年至 2034 年

- 主要趋势

- 凝血酶原时间(PT)检测

- 活化部分凝血活酶时间 (aPTT) 检测

- D-二聚体检测

- 纤维蛋白原检测

- 其他测试类型

第 8 章:市场估计与预测:按技术,2021 年至 2034 年

- 主要趋势

- 光学技术

- 电化学技术

- 机械技术

- 其他技术

第 9 章:市场估计与预测:依最终用途,2021 年至 2034 年

- 主要趋势

- 医院

- 诊断实验室

- 学术和研究机构

- 其他最终用户

第 10 章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第 11 章:公司简介

- Abbott

- DiaSys

- Erba Mannheim

- HELENA LABORATORIES

- HemoSonics

- HORIBA

- iLine

- mindray

- RANDOX

- Roche

- SEKISUI

- SIEMENS Healthineers

- Stago

- sysmex

- werfen

The Global Coagulation Analyzers Market reached USD 4.6 billion in 2024 and is poised to grow at a robust CAGR of 6.1% from 2025 to 2034. This growth is fueled by a rising prevalence of blood disorders such as hemophilia and thrombosis, alongside an increase in cardiovascular complications driven by sedentary lifestyles, aging populations, and obesity. As awareness of preventive healthcare expands and early diagnostic testing gains traction, the adoption of coagulation analyzers across healthcare facilities is accelerating.

The market is segmented by product type into consumables and instruments, with consumables expected to dominate. Projected to grow at a CAGR of 6.3%, the consumables segment is anticipated to generate USD 5.5 billion by 2034. The consistent demand for reagents, calibrators, and other essential consumables underpins this growth, as diagnostic centers and laboratories rely heavily on these products for routine and specialized coagulation testing. Advancements in reagent technology are enhancing compatibility with automated systems, driving efficiency and precision in high-throughput testing environments, further fueling demand.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $4.6 Billion |

| Forecast Value | $8.2 Billion |

| CAGR | 6.1% |

By test type, the market encompasses prothrombin time (PT) testing, activated partial thromboplastin time (aPTT) testing, D-dimer testing, fibrinogen testing, and other tests. PT testing is forecasted to achieve a CAGR of 6.6%, reaching USD 2.6 billion by 2034. This test is vital for diagnosing clotting disorders, monitoring anticoagulant therapies, assessing liver function, and detecting bleeding abnormalities. Its critical role in both routine and advanced diagnostic procedures underscores its significant contribution to market growth.

In the United States, the coagulation analyzers market reached USD 1.5 billion in 2024 and is projected to grow at a steady CAGR of 5.3% through 2034. The U.S. leads the North American market, benefiting from advanced healthcare infrastructure, substantial healthcare spending, and a high prevalence of chronic conditions like atrial fibrillation. The demand for coagulation tests, particularly PT and aPTT, continues to rise as effective monitoring of anticoagulant therapies becomes increasingly essential. Moreover, the integration of fully automated systems in clinical laboratories is enhancing workflow efficiency, meeting the needs of high-volume testing, and reinforcing the country's market dominance.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing prevalence of cardiovascular and blood-related disorders

- 3.2.1.2 Growing demand for point-of-care diagnostic devices

- 3.2.1.3 Technological advancements in coagulation analyzers

- 3.2.1.4 Rising awareness about early disease diagnosis

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Stringent regulatory requirements for device approval

- 3.2.2.2 Lack of skilled professionals for operating advanced analyzers

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technology landscape

- 3.6 Gap analysis

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

- 3.9 Future market trends

- 3.10 Value chain analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Consumables

- 5.3 Instruments

Chapter 6 Market Estimates and Forecast, By Mode, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Automated

- 6.3 Semi-automated

- 6.4 Manual

Chapter 7 Market Estimates and Forecast, By Test Type, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Prothrombin time (PT) testing

- 7.3 Activated partial thromboplastin time (aPTT) testing

- 7.4 D-dimer testing

- 7.5 Fibrinogen testing

- 7.6 Other test types

Chapter 8 Market Estimates and Forecast, By Technology, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Optical technology

- 8.3 Electrochemical technology

- 8.4 Mechanical technology

- 8.5 Other technologies

Chapter 9 Market Estimates and Forecast, By End Use, 2021 – 2034 ($ Mn)

- 9.1 Key trends

- 9.2 Hospitals

- 9.3 Diagnostic laboratories

- 9.4 Academic and research institutes

- 9.5 Other end users

Chapter 10 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Netherlands

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 Japan

- 10.4.3 India

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Abbott

- 11.2 DiaSys

- 11.3 Erba Mannheim

- 11.4 HELENA LABORATORIES

- 11.5 HemoSonics

- 11.6 HORIBA

- 11.7 iLine

- 11.8 mindray

- 11.9 RANDOX

- 11.10 Roche

- 11.11 SEKISUI

- 11.12 SIEMENS Healthineers

- 11.13 Stago

- 11.14 sysmex

- 11.15 werfen