|

市场调查报告书

商品编码

1665337

医疗床垫市场机会、成长动力、产业趋势分析与 2025 - 2034 年预测Medical Mattress Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

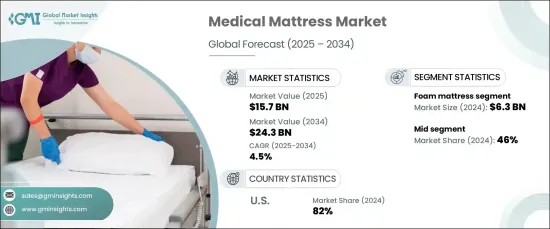

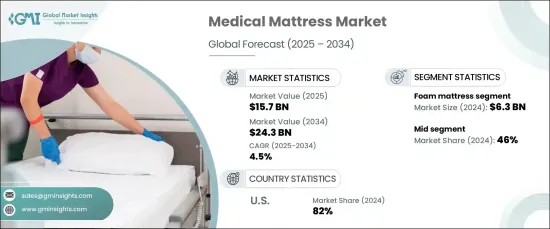

2024 年全球医疗床垫市场价值为 157 亿美元,预计 2025 年至 2034 年期间复合年增长率将达到 4.5%。

肥胖症、糖尿病和心血管疾病等慢性病的激增大大增加了对专用医疗床垫的需求。这些健康问题常常导致行动不便或长期卧床,因此需要提供卓越支撑、压力缓解和增强舒适度的床垫。此外,越来越多的老年人需要家庭护理、住院和长期护理设施,这进一步增加了对旨在改善患者治疗效果的治疗床垫的需求。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 157亿美元 |

| 预测值 | 243亿美元 |

| 复合年增长率 | 4.5% |

市场提供多种多样的产品,包括记忆泡棉床垫、弹簧床垫、交替压力床垫、低气损床垫和其他特殊类型。其中,泡棉床垫领域占据领先地位,2024 年市场规模为 63 亿美元,预计到 2035 年复合年增长率为 4.7%。它们减少压力点的能力也有助于预防褥疮,从而增强医院和家庭环境中的病患照护。

按价格范围细分时,中等价位的医用床垫脱颖而出,到 2024 年占据了 46% 的市场份额。中檔床垫透过提供舒适性、耐用性和治疗功能的完美平衡来满足广泛的消费者群体。这些床垫采用了记忆泡棉、凝胶注入层和基本交替压力系统等先进技术,非常适合手术后恢復、康復或应对轻度至中度行动不便的患者。

在美国,医疗床垫市场在北美占据主导地位,2024 年占据该地区 82% 的份额。

目录

第 1 章:方法论与范围

- 市场范围和定义

- 基础估算与计算

- 预测计算

- 资料来源

- 基本的

- 次要

- 付费来源

- 公共资源

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 影响价值链的因素

- 利润率分析

- 中断

- 未来展望

- 製造商

- 经销商

- 供应商概况

- 利润率分析

- 重要新闻及倡议

- 监管格局

- 衝击力

- 成长动力

- 提高消费者意识

- 医院和诊所数量不断增加

- 产业陷阱与挑战

- 市场饱和且竞争激烈

- 永续性问题

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第 5 章:市场估计与预测:按产品类型,2021-2034 年

- 主要趋势

- 记忆泡棉床垫

- 弹簧床垫

- 交替压力床垫

- 低气损床垫

- 其他(合成床垫等)

第六章:市场估计与预测:依价格范围,2021-2034 年

- 主要趋势

- 低的

- 中

- 高的

第 7 章:市场估计与预测:依最终用途,2021 年至 2034 年

- 主要趋势

- 医院

- 诊所

- 医务室

- 居家护理

- 疗养院

- 其他(综合诊所等)

第 8 章:市场估计与预测:按配销通路,2021-2034 年

- 主要趋势

- 在线的

- 电子商务

- 公司网站

- 离线

- 超市

- 专卖店

- 其他(个体店等)

第 9 章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 中东及非洲

- 阿联酋

- 沙乌地阿拉伯

- 南非

第十章:公司简介

- Acelity

- Arjo

- Bestcare Medical

- Drive DeVilbiss Healthcare

- Graham-Field Health Products

- Hill-Rom Holdings

- Invacare Corporation

- Invacare Supply Group

- Linet

- Malouf

- Medline Industries

- Proluxe Medical

- Serta

- Sleep Number Corporation

- Tempur-Pedic

The Global Medical Mattress Market, valued at USD 15.7 billion in 2024, is set to grow at a steady CAGR of 4.5% from 2025 to 2034. This robust growth is driven by several factors, including an aging global population, rising cases of chronic illnesses, and an increasing emphasis on patient comfort and care.

The surge in chronic conditions such as obesity, diabetes, and cardiovascular diseases has significantly bolstered demand for specialized medical mattresses. These health challenges often lead to reduced mobility or extended bed rest, creating a need for mattresses that provide superior support, pressure relief, and enhanced comfort. Moreover, the growing elderly population requiring home care, hospital stays, and long-term care facilities has further amplified the demand for therapeutic mattresses designed to improve patient outcomes.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $15.7 Billion |

| Forecast Value | $24.3 Billion |

| CAGR | 4.5% |

The market offers a diverse range of products, including memory foam mattresses, innerspring mattresses, alternating pressure mattresses, low air loss mattresses, and other specialized types. Among these, the foam mattress segment emerged as a leader, accounting for USD 6.3 billion in 2024 and expected to grow at a CAGR of 4.7% through 2035. Foam mattresses are particularly favored for their exceptional pressure-relief properties and contouring support, making them ideal for individuals with limited mobility or chronic health conditions. Their ability to reduce pressure points also helps prevent bedsores, enhancing patient care in both hospital and home settings.

When segmented by price range, the mid-priced medical mattresses stood out, capturing 46% of the market share in 2024. This segment is forecasted to grow at a CAGR of 4.8% during the forecast period. Mid-range mattresses cater to a wide consumer base by offering the perfect balance of comfort, durability, and therapeutic features. Incorporating advanced technologies like memory foam, gel-infused layers, and basic alternating pressure systems, these mattresses are well-suited for patients recovering from surgeries, undergoing rehabilitation, or managing mild to moderate mobility challenges.

In the United States, the medical mattress market dominated North America, accounting for 82% of the regional share in 2024. This impressive growth is primarily attributed to the aging baby boomer population, which has significantly increased the demand for advanced medical mattresses tailored for long-term care and rehabilitation purposes.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Increasing consumer awareness

- 3.6.1.2 Increasing number of hospitals and clinics

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 Market saturation and intense competition

- 3.6.2.2 Sustainability concerns

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Product Type, 2021-2034 (USD Million) (Thousand Units)

- 5.1 Key trends

- 5.2 Memory foam mattress

- 5.3 Innerspring mattress

- 5.4 Alternating pressure mattress

- 5.5 Low air loss mattress

- 5.6 Others (synthetic mattress, etc.)

Chapter 6 Market Estimates & Forecast, By Price Range, 2021-2034 (USD Million) (Thousand Units)

- 6.1 Key trends

- 6.2 Low

- 6.3 Mid

- 6.4 High

Chapter 7 Market Estimates & Forecast, By End Use, 2021-2034 (USD Million) (Thousand Units)

- 7.1 Key trends

- 7.2 Hospital

- 7.3 Clinic

- 7.4 Infirmary

- 7.5 Home care

- 7.6 Nursing home

- 7.7 Others (polyclinics, etc.)

Chapter 8 Market Estimates & Forecast, By Distribution Channel, 2021-2034 (USD Million) (Thousand Units)

- 8.1 Key trends

- 8.2 Online

- 8.2.1 E-commerce

- 8.2.2 Company websites

- 8.3 Offline

- 8.3.1 Supermarkets

- 8.3.2 Specialty stores

- 8.3.3 Others (individual stores, etc.)

Chapter 9 Market Estimates & Forecast, By Region, 2021-2034 (USD Million) (Thousand Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 Saudi Arabia

- 9.6.3 South Africa

Chapter 10 Company Profiles

- 10.1 Acelity

- 10.2 Arjo

- 10.3 Bestcare Medical

- 10.4 Drive DeVilbiss Healthcare

- 10.5 Graham-Field Health Products

- 10.6 Hill-Rom Holdings

- 10.7 Invacare Corporation

- 10.8 Invacare Supply Group

- 10.9 Linet

- 10.10 Malouf

- 10.11 Medline Industries

- 10.12 Proluxe Medical

- 10.13 Serta

- 10.14 Sleep Number Corporation

- 10.15 Tempur-Pedic