|

市场调查报告书

商品编码

1665351

汽车三元催化转换器市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Automotive Three-Way Catalytic Converter Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

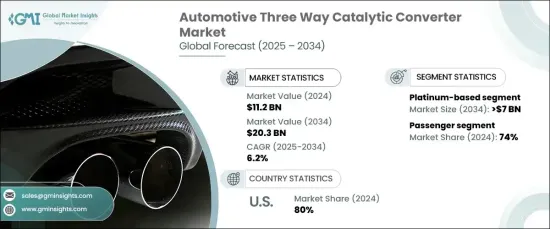

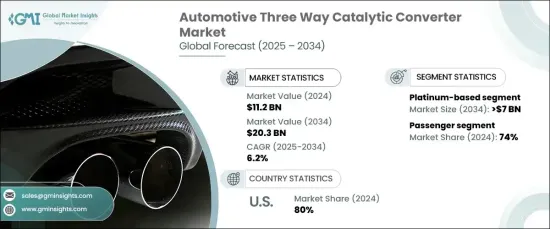

2024 年全球汽车三元触媒转换器市场价值 112 亿美元,预计将在 2025 年至 2034 年期间以 6.2% 的强劲复合年增长率扩张。内燃机(ICE)汽车的广泛使用加剧了对先进排放控制系统的需求,以满足严格的环境标准。此外,人们对个人出行和运输服务的偏好日益增长,进一步推动了市场需求。

全球严格的排放法规是市场成长的主要驱动力。各国政府正在实施更严格的政策来对抗空气污染和控制温室气体排放。这些法规要求大幅减少一氧化碳、氮氧化物和碳氢化合物等有害污染物。因此,製造商正专注于符合日益严格的性能标准的创新、高效、耐用的催化转换器。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 112亿美元 |

| 预测值 | 203亿美元 |

| 复合年增长率 | 6.2% |

根据材料类型,市场分为铂基、钯基和铑基转换器。 2024 年,铂基催化转换器占据了 40% 的份额,预计到 2034 年将产生 70 亿美元的产值。 Platinum 在处理废气方面的高性能能力以及对环境永续性的日益关注正在推动其在主要市场的应用。

就车型而言,乘用车在 2024 年占据市场主导地位,占有 74% 的份额。消费者对省油、环保汽车的需求不断增加是该领域成长的关键因素。人们对排放和永续性的认识不断提高,促使汽车製造商开发低排放技术,从而为乘用车提供更清洁、更有效率的催化转换器。

2024 年,美国汽车三元催化转换器市场占有率将达到惊人的 80%。材料、基板设计和耐热组件的创新正在提高转换器的效率和耐用性,确保符合不断发展的环境标准。联邦政府的激励措施和对清洁技术的投资进一步加速了该地区的成长。

目录

第 1 章:方法论与范围

- 研究设计

- 研究方法

- 资料收集方法

- 基础估算与计算

- 基准年计算

- 市场估计的主要趋势

- 预测模型

- 初步研究和验证

- 主要来源

- 资料探勘来源

- 市场范围和定义

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 原物料供应商

- 零件供应商

- 製造商

- 配销通路

- 最终用户

- 供应商概况

- 利润率分析

- 技术与创新格局

- 专利分析

- 重要新闻及倡议

- 监管格局

- 成本分析

- 衝击力

- 成长动力

- 快速投入研发和新产品开发

- 日益严格的环境法规

- 催化转换器的技术进步

- 对节能汽车的需求不断增长

- 新兴市场汽车需求不断成长

- 产业陷阱与挑战

- 製造成本高

- 监管障碍和合规问题

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第 5 章:市场估计与预测:按材料,2021 - 2034 年

- 主要趋势

- 铂基

- 钯基

- 铑基

第六章:市场估计与预测:依车型,2021 - 2034 年

- 主要趋势

- 搭乘用车

- 掀背车

- 轿车

- SUV

- 商用车

- 轻型商用车 (LCV)

- 重型商用车 (HCV)

第 7 章:市场估计与预测:按推进方式,2021 - 2034 年

- 主要趋势

- 汽油

- 柴油引擎

- 其他的

第 8 章:市场估计与预测:按配销通路,2021 - 2034 年

- 主要趋势

- OEM

- 售后市场

第 9 章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 北欧

- 亚太地区

- 中国

- 印度

- 日本

- 澳新银行

- 韩国

- 东南亚

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东及非洲

- 阿联酋

- 南非

- 沙乌地阿拉伯

第十章:公司简介

- BASF SE

- Benteler

- BorgWarner

- Bosal

- Calsonic

- Corning

- Delphi

- Denso

- Eberspächer

- Faurecia

- Haldex

- Johnson Matthey

- Magna

- Marelli

- Sango

- Tenneco

- Umicore

- Valeo

- Walker Exhaust Systems

- Yutaka

The Global Automotive Three-Way Catalytic Converter Market, valued at USD 11.2 billion in 2024, is set to expand at a robust CAGR of 6.2% from 2025 to 2034. This growth is fueled by increasing vehicle production and sales worldwide as demand for automotive components such as catalytic converters continues to soar. The widespread use of internal combustion engine (ICE) vehicles has intensified the need for advanced emission control systems to meet stringent environmental standards. Moreover, the rising preference for personal mobility and transportation services is further propelling market demand.

Stringent emissions regulations globally are a major driver behind market growth. Governments are implementing tougher policies to combat air pollution and curb greenhouse gas emissions. These mandates require significant reductions in harmful pollutants like carbon monoxide, nitrogen oxides, and hydrocarbons. As a result, manufacturers are focusing on innovative, efficient, and durable catalytic converters that comply with increasingly rigorous performance standards.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $11.2 Billion |

| Forecast Value | $20.3 Billion |

| CAGR | 6.2% |

By material type, the market is categorized into platinum-based, palladium-based, and rhodium-based converters. In 2024, platinum-based catalytic converters held a significant 40% share, with projections to generate USD 7 billion by 2034. The exceptional catalytic properties of platinum make it integral to effective emission control systems, enabling compliance with stringent regulatory requirements. Platinum's high-performance capabilities in treating exhaust gases and the growing focus on environmental sustainability are driving its adoption in key markets.

In terms of vehicle type, passenger vehicles dominated the market in 2024 with a commanding 74% share. Increasing consumer demand for fuel-efficient and environmentally friendly vehicles is a key factor in the segment growth. Rising awareness of emissions and sustainability is encouraging automakers to develop low-emission technologies, leading to cleaner and more efficient catalytic converters for passenger vehicles.

The U.S. market for automotive three-way catalytic converters captured an impressive 80% share in 2024. Regulatory mandates focused on reducing vehicle emissions are spurring manufacturers to adopt cutting-edge catalyst technologies. Innovations in materials, substrate designs, and heat-resistant components are enhancing the efficiency and durability of converters, ensuring compliance with evolving environmental standards. Federal incentives and investments in clean technologies are further accelerating growth in the region.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market scope & definition

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Raw material providers

- 3.1.2 Component suppliers

- 3.1.3 Manufacturers

- 3.1.4 Distribution channel

- 3.1.5 End users

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Technology & innovation landscape

- 3.5 Patent analysis

- 3.6 Key news & initiatives

- 3.7 Regulatory landscape

- 3.8 Cost analysis

- 3.9 Impact forces

- 3.9.1 Growth drivers

- 3.9.1.1 Rapid investment in R&D and new product development

- 3.9.1.2 Increasing environmental regulations

- 3.9.1.3 Technological advancements in catalytic converters

- 3.9.1.4 Rising demand for fuel-efficient vehicles

- 3.9.1.5 Growing vehicle demand in emerging markets

- 3.9.2 Industry pitfalls & challenges

- 3.9.2.1 High manufacturing costs

- 3.9.2.2 Regulatory hurdles and compliance issues

- 3.9.1 Growth drivers

- 3.10 Growth potential analysis

- 3.11 Porter’s analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Material, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Platinum-based

- 5.3 Palladium-based

- 5.4 Rhodium-based

Chapter 6 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Passenger vehicles

- 6.2.1 Hatchback

- 6.2.2 Sedan

- 6.2.3 SUVs

- 6.3 Commercial vehicles

- 6.3.1 Light Commercial Vehicles (LCVs)

- 6.3.2 Heavy Commercial Vehicles (HCVs)

Chapter 7 Market Estimates & Forecast, By Propulsion, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 Gasoline

- 7.3 Diesel

- 7.4 Others

Chapter 8 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 OEM

- 8.3 Aftermarket

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 ANZ

- 9.4.5 South Korea

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 South Africa

- 9.6.3 Saudi Arabia

Chapter 10 Company Profiles

- 10.1 BASF SE

- 10.2 Benteler

- 10.3 BorgWarner

- 10.4 Bosal

- 10.5 Calsonic

- 10.6 Corning

- 10.7 Delphi

- 10.8 Denso

- 10.9 Eberspächer

- 10.10 Faurecia

- 10.11 Haldex

- 10.12 Johnson Matthey

- 10.13 Magna

- 10.14 Marelli

- 10.15 Sango

- 10.16 Tenneco

- 10.17 Umicore

- 10.18 Valeo

- 10.19 Walker Exhaust Systems

- 10.20 Yutaka