|

市场调查报告书

商品编码

1665364

金属加工机械市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Metalworking Machine Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

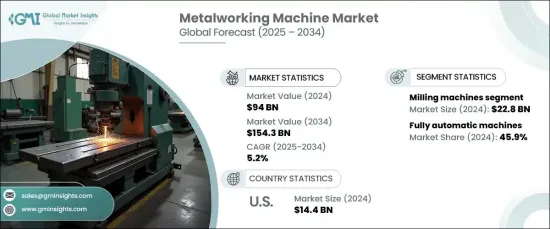

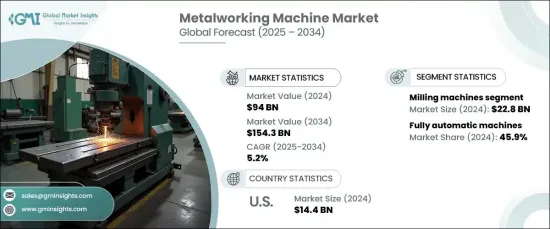

2024 年全球金属加工机械市场价值为 940 亿美元,预计将在 2025 年至 2034 年期间以 5.2% 的强劲复合年增长率成长。这些地区正在对基础设施和製造业进行大量投资,以满足不断增长的消费需求并提高生产能力,从而推动对先进金属加工机械的需求。

该市场的关键驱动因素包括汽车和航太工业。汽车产业对电动车(EV)和轻质材料的发展增加了对能够加工铝和复合材料等材料的先进机械的需求。同时,航太工业对于商业和国防应用的高性能、耐用部件的需求凸显了对符合严格品质标准的精密金属加工工具机的需求。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 940亿美元 |

| 预测值 | 1543亿美元 |

| 复合年增长率 | 5.2% |

铣床市场在 2024 年的价值为 228 亿美元,预计到 2034 年将以 5.5 %的复合年增长率强劲增长。对轻量和复杂设计组件的需求不断增加,再加上 CNC(电脑数控)技术的进步,大大提升了铣床的吸引力。 CNC 系统提供的增强速度、准确性和自动化使得这些机器在现代製造环境中不可或缺。

自动化是推动市场向前发展的另一个关键因素。全自动金属加工机床在 2024 年占据了 45.9% 的市场份额,预计从 2025 年到 2034 年的复合年增长率为 5.7%。人们越来越重视自动化,以降低营运成本并生产复杂、精密的组件,刺激了自动化的应用。此外,将这些机器整合到智慧工厂系统中可以提高营运效率并最大限度地减少劳动力成本,使其成为汽车、航太和电子等行业的关键资产。

美国金属加工机械市场价值预计 2024 年达到 144 亿美元,仍占全球领先地位。美国拥有先进的製造业基础设施和对创新的高度重视,已经掌握了尖端技术,特别是在自动化和智慧製造领域。这推动了先进金属加工机械的广泛应用,使各个领域实现了更高的生产力和无与伦比的精度。

目录

第 1 章:方法论与范围

- 市场范围和定义

- 基础估算与计算

- 预测参数

- 资料来源

- 基本的

- 次要

- 付费来源

- 公共资源

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 影响价值链的因素

- 利润率分析

- 中断

- 未来展望

- 製造商

- 经销商

- 零售商

- 衝击力

- 成长动力

- 工业化和製造业成长

- 汽车和航太工业的成长

- 工具机不断创新

- 对精度和品质的要求

- 产业陷阱与挑战

- 初期投资成本高

- 原物料价格波动

- 成长动力

- 技术与创新格局

- 消费者购买行为分析

- 人口趋势

- 影响购买决策的因素

- 消费者产品采用

- 首选配销通路

- 成长潜力分析

- 监管格局

- 定价分析

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第 5 章:市场估计与预测:按产品,2021 年至 2034 年

- 主要趋势

- 车床

- 铣床

- 钻孔机

- 钻孔机

- 其他的

第六章:市场估计与预测:依自动化水平,2021 年至 2034 年

- 主要趋势

- 手动机器

- 半自动机器

- 全自动机器

第 7 章:市场估计与预测:按应用,2021 年至 2034 年

- 主要趋势

- 汽车

- 航太和国防

- 建造

- 能源和电力

- 电子产品

- 工业设备

- 医疗设备

- 消费品

- 其他的

第 8 章:市场估计与预测:按材料,2021 年至 2034 年

- 主要趋势

- 钢

- 铝

- 铸铁

- 钛

- 其他

第 9 章:市场估计与预测:按配销通路,2021 年至 2034 年

- 主要趋势

- 直接的

- 间接

第 10 章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 马来西亚

- 印尼

- 拉丁美洲

- 巴西

- 墨西哥

- 中东及非洲

- 沙乌地阿拉伯

- 阿联酋

- 南非

第 11 章:公司简介

- Biesse Group

- CNC Masters

- DMG Mori

- Doosan Machine Tools

- Emag

- FANUC

- Haas Automation

- Hermle

- Makino

- Mazak

- Mitsubishi Heavy Industries Machine Tool

- Okuma Corporation

- Schuler Group

- Toshiba Machine

- Trumpf

The Global Metalworking Machine Market, valued at USD 94 billion in 2024, is set to expand at a robust CAGR of 5.2% between 2025 and 2034. This growth is fueled by the rapid expansion of manufacturing industries worldwide, particularly in emerging economies. These regions are making significant investments in infrastructure and manufacturing to address rising consumer demands and enhance production capacities, driving the demand for advanced metalworking machines.

Key drivers of this market include the automotive and aerospace industries. The automotive sector's push toward electric vehicles (EVs) and lightweight materials has heightened the need for advanced machinery capable of processing materials like aluminum and composites. Simultaneously, the aerospace industry's demand for high-performance, durable components for commercial and defense applications underscores the need for precision metalworking machines that meet stringent quality standards.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $94 Billion |

| Forecast Value | $154.3 Billion |

| CAGR | 5.2% |

The milling machines segment, valued at USD 22.8 billion in 2024, is poised for strong growth at a CAGR of 5.5% through 2034. These machines play a pivotal role in industries such as automotive, aerospace, and general manufacturing, where precision and versatility are crucial. The increasing demand for lightweight and intricately designed components, coupled with advancements in CNC (Computer Numerical Control) technology, has significantly boosted the appeal of milling machines. Enhanced speed, accuracy, and automation offered by CNC systems make these machines indispensable in modern manufacturing environments.

Automation is another critical factor propelling the market forward. Fully automatic metalworking machines accounted for 45.9% of the market share in 2024 and are expected to grow at a CAGR of 5.7% from 2025 to 2034. These machines, requiring minimal human intervention, excel in high-volume production while ensuring consistent quality and reducing human error. The growing emphasis on automation to cut operational costs and produce complex, precision-driven components is spurring their adoption. Moreover, the integration of these machines into smart factory systems enhances operational efficiency and minimizes labor expenses, making them a key asset in industries such as automotive, aerospace, and electronics.

The U.S. metalworking machine market, valued at USD 14.4 billion in 2024, remains a global leader in the industry. With its advanced manufacturing infrastructure and a strong focus on innovation, the U.S. has embraced cutting-edge technologies, particularly in automation and smart manufacturing. This has driven widespread adoption of advanced metalworking machines, enabling higher productivity and unmatched precision across diverse sectors.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definition

- 1.2 Base estimates & calculations

- 1.3 Forecast parameters

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factors affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.1.7 Retailers

- 3.2 Impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Industrialization and manufacturing growth

- 3.2.1.2 Growth in the automotive and aerospace industries

- 3.2.1.3 Continuous innovations in machine tools

- 3.2.1.4 Demand for precision and quality

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High initial investment costs

- 3.2.2.2 Fluctuating raw material prices

- 3.2.1 Growth drivers

- 3.3 Technology & innovation landscape

- 3.4 Consumer buying behavior analysis

- 3.4.1 Demographic trends

- 3.4.2 Factors affecting buying decision

- 3.4.3 Consumer product adoption

- 3.4.4 Preferred distribution channel

- 3.5 Growth potential analysis

- 3.6 Regulatory landscape

- 3.7 Pricing analysis

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Product, 2021 – 2034, (USD Billion)

- 5.1 Key trends

- 5.2 Lathes

- 5.3 Milling machines

- 5.4 Drilling machines

- 5.5 Boring machines

- 5.6 Others

Chapter 6 Market Estimates & Forecast, By Automation Level, 2021 – 2034, (USD Billion)

- 6.1 Key trends

- 6.2 Manual machines

- 6.3 Semi-automatic machines

- 6.4 Fully automatic machines

Chapter 7 Market Estimates & Forecast, By Application, 2021 – 2034, (USD Billion)

- 7.1 Key trends

- 7.2 Automotive

- 7.3 Aerospace and defense

- 7.4 Construction

- 7.5 Energy and power

- 7.6 Electronics

- 7.7 Industrial equipment

- 7.8 Medical devices

- 7.9 Consumer goods

- 7.10 Others

Chapter 8 Market Estimates & Forecast, By Material, 2021 – 2034, (USD Billion)

- 8.1 Key trends

- 8.2 Steel

- 8.3 Aluminum

- 8.4 Cast iron

- 8.5 Titanium

- 8.6 Other

Chapter 9 Market Estimates & Forecast, By Distribution Channel, 2021 – 2034, (USD Billion)

- 9.1 Key trends

- 9.2 Direct

- 9.3 Indirect

Chapter 10 Market Estimates & Forecast, By Region, 2021 – 2034, (USD Billion)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 Australia

- 10.4.6 Malaysia

- 10.4.7 Indonesia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.6 MEA

- 10.6.1 Saudi Arabia

- 10.6.2 UAE

- 10.6.3 South Africa

Chapter 11 Company Profiles (Business Overview, Financial Data, Product Landscape, Strategic Outlook, SWOT Analysis)

- 11.1 Biesse Group

- 11.2 CNC Masters

- 11.3 DMG Mori

- 11.4 Doosan Machine Tools

- 11.5 Emag

- 11.6 FANUC

- 11.7 Haas Automation

- 11.8 Hermle

- 11.9 Makino

- 11.10 Mazak

- 11.11 Mitsubishi Heavy Industries Machine Tool

- 11.12 Okuma Corporation

- 11.13 Schuler Group

- 11.14 Toshiba Machine

- 11.15 Trumpf