|

市场调查报告书

商品编码

1665371

榨汁机市场机会、成长动力、产业趋势分析与 2025 - 2034 年预测Juicers Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

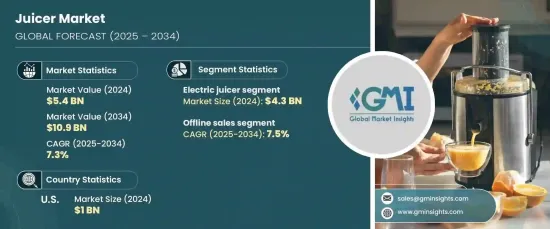

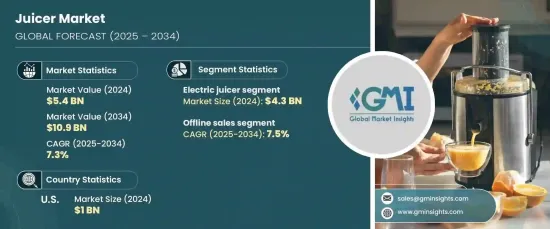

2024 年全球榨汁机市场价值为 54 亿美元,预计在 2025 年至 2034 年期间将以 7.3% 的强劲复合年增长率扩张。榨汁已成为一种方便的方式,将必需的维生素、矿物质和抗氧化剂融入日常饮食,支持排毒和体重管理等目标。尤其是城市居民和千禧世代,正在引领向更健康的生活方式的转变,从而推动了对现代榨汁解决方案的需求。

肥胖、糖尿病和心血管疾病等生活方式疾病的日益普及进一步增加了人们对榨汁机的兴趣。新鲜果汁正逐渐成为预防性保健程序中的重要部分,从而推动了先进榨汁设备越来越受欢迎。冷压果汁以其卓越的营养保留而闻名,需求量很大,推动了榨汁机技术的创新。以健康为重点的行销活动,加上用户友好的设计,正在加速市场扩大,而社交媒体和健康倡导者的影响力继续吸引更广泛的受众关注榨汁潮流。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 54亿美元 |

| 预测值 | 109亿美元 |

| 复合年增长率 | 7.3% |

市场按产品类型细分为手动和电动榨汁机,其中电动榨汁机在 2024 年占主导地位,创造 43 亿美元的收入。受电动车型效率和便利性的推动,预测期内该细分市场预计将以 7.5% 的复合年增长率成长。离心式榨汁机以其速度和咀嚼式榨汁机而闻名,并因保留营养而备受推崇,越来越受到注重健康的买家的青睐。更安静的马达、更紧凑的设计和可调节的速度设定等技术进步正在增强用户体验并提高采用率。

分销管道在市场动态中发挥关键作用,其中线下销售在 2024 年占据 68.2% 的显着份额。儘管电子商务发展势头强劲,这种个人化的购物体验仍继续吸引买家。

美国榨汁机市场在 2024 年贡献了 10 亿美元的收入,预计在预测期内的复合年增长率为 7.4%。消费者(尤其是千禧世代和 Z 世代消费者)的健康意识不断增强,推动了对天然新鲜果汁的需求。线上和线下管道都在蓬勃发展,零售店由于能够提供演示和个性化的产品见解而保持着强大的立足点。製造商正专注于开发创新、紧凑、安静的榨汁机型号,以满足城市消费者的需求,从而加剧了注重品质、技术和价格实惠的品牌之间的竞争。

目录

第 1 章:方法论与范围

- 市场范围和定义

- 基础估算与计算

- 预测参数

- 资料来源

- 基本的

- 次要

- 付费来源

- 公共资源

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 影响价值链的因素

- 利润率分析

- 中断

- 未来展望

- 製造商

- 经销商

- 供应商概况

- 利润率分析

- 重要新闻及倡议

- 监管格局

- 衝击力

- 成长动力

- 健康和保健趋势日益兴起

- 便捷家电的需求不断增加

- 榨汁机技术的进步

- 产业陷阱与挑战

- 优质榨汁机成本高

- 电子垃圾带来的环境问题

- 成长动力

- 成长潜力分析

- 消费者购买行为分析

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第 5 章:市场估计与预测:按类型,2021 年至 2034 年

- 主要趋势

- 手动榨汁机

- 电动榨汁机

- 离心式榨汁机

- 咀嚼式果汁机

- 研磨榨汁机

- 其他(蒸汽、慢速榨汁机)

第 6 章:市场估计与预测:按安装量,2021 年至 2034 年

- 主要趋势

- 便携的

- 固定的

第 7 章:市场估计与预测:按产能,2021 年至 2034 年

- 主要趋势

- 小(300-500毫升)

- 中号(500-800 毫升)

- 大号(1-1.5公升)

- 特大号(2 公升以上)

第 8 章:市场估计与预测:按价格范围,2021 年至 2034 年

- 主要趋势

- 低的

- 中等的

- 高的

第 9 章:市场估计与预测:依最终用途,2021 年至 2034 年

- 主要趋势

- 住宅

- 商业的

第 10 章:市场估计与预测:按配销通路,2021 年至 2034 年

- 主要趋势

- 在线的

- 电子商务

- 公司网站

- 离线

- 大卖场/超市

- 专卖店

- 其他零售店

第 11 章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 中东及非洲

- 沙乌地阿拉伯

- 阿联酋

- 南非

第 12 章:公司简介

- AB Electrolux

- Breville Group Ltd.

- Conair LLC

- De'Longhi SpA

- Focus Products Group International, LLC

- Hamilton Beach Brands Holding Co.

- Hurom Co., Ltd.

- Koninklijke Philips NV

- NUC Electronics Co., Ltd.

- Panasonic Holdings Corporation

- Smeg SpA

- Stanley Black & Decker, Inc.

- Sunbeam Products, Inc.

- Tribest Corporation

- Whirlpool Corporation

The Global Juicer Market was valued at USD 5.4 billion in 2024 and is poised to expand at a robust CAGR of 7.3% from 2025 to 2034. This remarkable growth is driven by the rising health consciousness among consumers who are increasingly opting for fresh, nutrient-rich beverages over processed alternatives. Juicing has emerged as a convenient way to incorporate essential vitamins, minerals, and antioxidants into daily diets, supporting goals like detoxification and weight management. Urban dwellers and millennials, in particular, are leading the shift toward healthier lifestyles, fueling the demand for modern juicing solutions.

The growing prevalence of lifestyle diseases such as obesity, diabetes, and cardiovascular issues has further amplified interest in juicers. Fresh juices are becoming a staple in preventive health routines, contributing to the rising popularity of advanced juicing appliances. Cold-pressed juices, renowned for their superior nutrient retention, are in high demand, driving innovations in juicer technology. Health-focused marketing campaigns, coupled with user-friendly designs, are accelerating market expansion, while the influence of social media and wellness advocates continues to attract a broader audience to the juicing trend.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $5.4 Billion |

| Forecast Value | $10.9 Billion |

| CAGR | 7.3% |

The market is segmented by product type into manual and electric juicers, with the electric segment dominating in 2024, generating USD 4.3 billion in revenue. This segment is projected to grow at a CAGR of 7.5% during the forecast period, driven by the efficiency and convenience offered by electric models. Centrifugal juicers, known for their speed and masticating variants, celebrated for nutrient preservation, are gaining traction among health-conscious buyers. Technological advancements such as quieter motors, compact designs, and adjustable speed settings are enhancing the user experience and boosting adoption rates.

Distribution channels play a pivotal role in market dynamics, with offline sales commanding a significant 68.2% share in 2024. This segment is expected to grow at a CAGR of 7.5% through 2034. Physical retail outlets, including supermarkets and specialty stores, remain critical for product sales by offering hands-on testing and demonstrations, which are particularly valuable for premium products. This personalized shopping experience continues to attract buyers, even as e-commerce gains momentum.

The U.S. juicer market contributed USD 1 billion in revenue in 2024 and is anticipated to grow at a CAGR of 7.4% over the forecast period. Increasing health awareness, especially among millennials and Gen Z consumers, is driving the demand for natural, fresh juices. Both online and offline channels are thriving, with retail stores maintaining a strong foothold due to their ability to provide demonstrations and personalized product insights. Manufacturers are focusing on developing innovative, compact, and quiet juicer models to cater to urban consumers, intensifying competition among brands prioritizing quality, technology, and affordability.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definition

- 1.2 Base estimates & calculations

- 1.3 Forecast parameters

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factors affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Rising health and wellness trends

- 3.6.1.2 Increasing demand for convenient home appliances

- 3.6.1.3 Advancements in juicer technology

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 High cost of premium juicers

- 3.6.2.2 Environmental concerns over electronic waste

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Consumer buying behavior analysis

- 3.9 Porter’s analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Type, 2021 – 2034, (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Manual juicer

- 5.3 Electric juicer

- 5.3.1 Centrifugal juicer

- 5.3.2 Masticating juicer

- 5.3.3 Triturating juicer

- 5.3.4 Others (steam, slow juicers)

Chapter 6 Market Estimates & Forecast, By Installation, 2021 – 2034, (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Portable

- 6.3 Fixed

Chapter 7 Market Estimates & Forecast, By Capacity, 2021 – 2034, (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 Small (300-500 ml)

- 7.3 Medium (500-800 ml)

- 7.4 Large (1-1.5 liters)

- 7.5 Extra Large (2 liters and above)

Chapter 8 Market Estimates & Forecast, By Price Range, 2021 – 2034, (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Low

- 8.3 Medium

- 8.4 High

Chapter 9 Market Estimates & Forecast, By End Use, 2021 – 2034, (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 Residential

- 9.3 Commercial

Chapter 10 Market Estimates & Forecast, By Distribution Channel, 2021 – 2034, (USD Billion) (Thousand Units)

- 10.1 Key trends

- 10.2 Online

- 10.2.1 E-commerce

- 10.2.2 Company website

- 10.3 Offline

- 10.3.1 Hypermarket/supermarkets

- 10.3.2 Specialty stores

- 10.3.3 Other retail stores

Chapter 11 Market Estimates & Forecast, By Region, 2021 – 2034, (USD Billion) (Thousand Units)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 Germany

- 11.3.2 UK

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.3.6 Russia

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 South Korea

- 11.4.5 Australia

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.6 MEA

- 11.6.1 Saudi Arabia

- 11.6.2 UAE

- 11.6.3 South Africa

Chapter 12 Company Profiles

- 12.1 AB Electrolux

- 12.2 Breville Group Ltd.

- 12.3 Conair LLC

- 12.4 De'Longhi S.p.A.

- 12.5 Focus Products Group International, LLC

- 12.6 Hamilton Beach Brands Holding Co.

- 12.7 Hurom Co., Ltd.

- 12.8 Koninklijke Philips N.V.

- 12.9 NUC Electronics Co., Ltd.

- 12.10 Panasonic Holdings Corporation

- 12.11 Smeg S.p.A.

- 12.12 Stanley Black & Decker, Inc.

- 12.13 Sunbeam Products, Inc.

- 12.14 Tribest Corporation

- 12.15 Whirlpool Corporation