|

市场调查报告书

商品编码

1665377

固定式锂离子电池储存市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Stationary Lithium-Ion Battery Storage Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

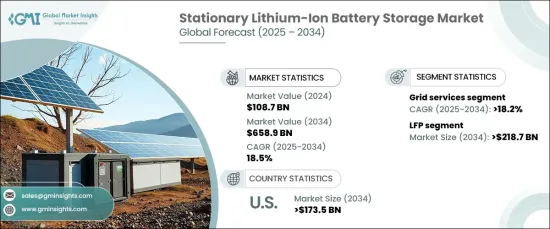

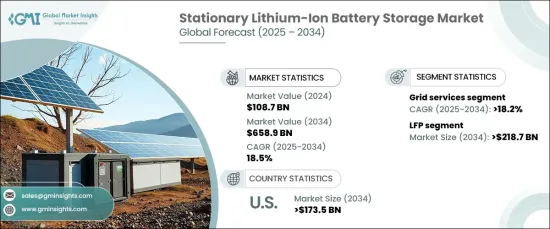

2024 年全球固定式锂离子电池储存市场价值为 1,087 亿美元,预计将经历令人瞩目的成长,2025 年至 2034 年的复合年增长率为 18.5%。锂离子电池因其高能量密度、可扩展性和效率而受到认可,使其成为电网稳定、调峰和备用电源解决方案的首选。随着风能、太阳能等再生能源的不断扩大,对可靠的能源储存解决方案的需求变得更加重要,以解决能源间歇性问题并确保稳定的电力供应。

在不同的锂离子化学材料中,磷酸铁锂 (LFP) 部分预计到 2034 年将达到 2,187 亿美元。它们的抗过热性能使其成为大规模、长时间储能係统的理想选择。此外,与其他电池化学成分相比,它们的高充电和放电效率以及较小的环境影响正在推动其在永续能源应用中的采用。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 1087亿美元 |

| 预测值 | 6589亿美元 |

| 复合年增长率 | 18.5% |

在应用方面,随着再生能源使用量的不断增加,对稳定可靠电网的需求不断增长,预计到 2034 年电网服务领域将以 18.2% 的复合年增长率增长。锂离子电池透过提供频率调节、电压稳定和峰值负载管理等服务在支援电网方面发挥着至关重要的作用。它们的快速反应时间和运作效率对于平衡能源供需波动至关重要,使其成为电网现代化和维护不可或缺的一部分。

在美国,固定式锂离子电池储存市场预计到 2034 年将创收 1,735 亿美元。锂离子电池越来越多地用于调峰、备用电源和电网稳定等应用,从而能够高效地储存再生能源产生的能量。政府的优惠政策和电池成本的下降正在推动电池的采用,使美国成为全球市场的重要参与者。

目录

第 1 章:方法论与范围

- 市场定义

- 基础估算与计算

- 预测计算

- 资料来源

- 基本的

- 次要

- 有薪资的

- 民众

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 监管格局

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 成长潜力分析

- 波特的分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- PESTEL 分析

第四章:竞争格局

- 战略仪表板

- 创新与永续发展格局

第 5 章:市场规模与预测:依化学成分,2021 – 2034 年

- 主要趋势

- 低功率电源

- 尼日利亚汽车製造商协会

- 其他的

第 6 章:市场规模与预测:按应用,2021 – 2034 年

- 主要趋势

- 电网服务

- 仪表后面

- 离网

第 7 章:市场规模与预测:按地区,2021 – 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 墨西哥

- 欧洲

- 英国

- 法国

- 德国

- 义大利

- 俄罗斯

- 西班牙

- 亚太地区

- 中国

- 澳洲

- 印度

- 日本

- 韩国

- 中东和非洲

- 沙乌地阿拉伯

- 阿联酋

- 土耳其

- 南非

- 埃及

- 拉丁美洲

- 巴西

- 阿根廷

第八章:公司简介

- BYD

- Exide

- GS Yuasa

- Hitachi

- Johnson Controls

- Leclanche

- LG Chem

- Panasonic

- Siemens

- SK Innovation

- Tesla

- Toshiba

- Varta

The Global Stationary Lithium-Ion Battery Storage Market was valued at USD 108.7 billion in 2024 and is projected to experience impressive growth, with a CAGR of 18.5% from 2025 to 2034. This growth is largely driven by the increasing focus on renewable energy integration and the modernization of power grids. Lithium-ion batteries are recognized for their high energy density, scalability, and efficiency, making them a preferred choice for grid stabilization, peak shaving, and backup power solutions. As renewable energy sources, including wind and solar, continue to expand, the demand for reliable energy storage solutions becomes even more critical to address energy intermittency and ensure a steady power supply.

Among the different lithium-ion chemistries, the lithium iron phosphate (LFP) segment is expected to reach USD 218.7 billion by 2034. LFP batteries are becoming increasingly popular due to their exceptional safety features, extended cycle life, and impressive thermal stability. Their resistance to overheating makes them ideal for large-scale, long-duration energy storage systems. Furthermore, their high charge and discharge efficiency, along with a lower environmental impact compared to other battery chemistries, is driving their adoption in sustainable energy applications.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $108.7 Billion |

| Forecast Value | $658.9 Billion |

| CAGR | 18.5% |

In terms of application, the grid services segment is anticipated to grow at a CAGR of 18.2% through 2034, spurred by the growing demand for stable and reliable power grids as renewable energy use continues to rise. Lithium-ion batteries play a vital role in supporting the grid by providing services like frequency regulation, voltage stabilization, and peak load management. Their rapid response times and operational efficiency are essential for balancing fluctuations in energy supply and demand, making them an integral part of modernizing and maintaining power grids.

In the United States, the stationary lithium-ion battery storage market is expected to generate USD 173.5 billion by 2034. This growth is supported by the increased adoption of renewable energy and ongoing grid modernization efforts. Lithium-ion batteries are increasingly being used for applications such as peak shaving, backup power, and grid stabilization, enabling the efficient storage of energy generated from renewable sources. Favorable government policies and falling battery costs are boosting adoption, positioning the U.S. as a key player in the global market.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 – 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive landscape, 2024

- 4.1 Strategic dashboard

- 4.2 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Chemistry, 2021 – 2034 (USD Million & MW)

- 5.1 Key trends

- 5.2 LFP

- 5.3 NMC

- 5.4 Others

Chapter 6 Market Size and Forecast, By Application, 2021 – 2034 (USD Million & MW)

- 6.1 Key trends

- 6.2 Grid services

- 6.3 Behind the meter

- 6.4 Off grid

Chapter 7 Market Size and Forecast, By Region, 2021 – 2034 (USD Million & MW)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.2.3 Mexico

- 7.3 Europe

- 7.3.1 UK

- 7.3.2 France

- 7.3.3 Germany

- 7.3.4 Italy

- 7.3.5 Russia

- 7.3.6 Spain

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 Australia

- 7.4.3 India

- 7.4.4 Japan

- 7.4.5 South Korea

- 7.5 Middle East & Africa

- 7.5.1 Saudi Arabia

- 7.5.2 UAE

- 7.5.3 Turkey

- 7.5.4 South Africa

- 7.5.5 Egypt

- 7.6 Latin America

- 7.6.1 Brazil

- 7.6.2 Argentina

Chapter 8 Company Profiles

- 8.1 BYD

- 8.2 Exide

- 8.3 GS Yuasa

- 8.4 Hitachi

- 8.5 Johnson Controls

- 8.6 Leclanche

- 8.7 LG Chem

- 8.8 Panasonic

- 8.9 Siemens

- 8.10 SK Innovation

- 8.11 Tesla

- 8.12 Toshiba

- 8.13 Varta