|

市场调查报告书

商品编码

1665378

农业施肥机市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Agriculture Fertilizer Spreader Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

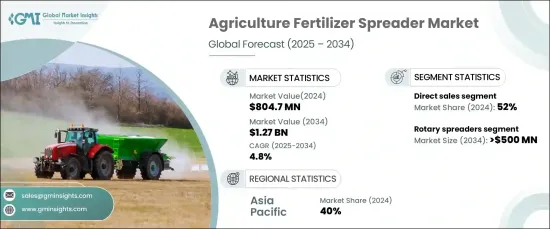

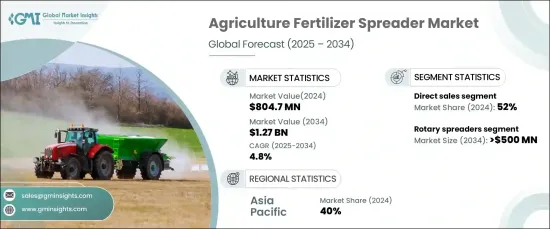

2024 年全球农业施肥机市场价值为 8.047 亿美元,预计 2025 年至 2034 年期间的复合年增长率为 4.8%。随着城市化和环境挑战导致可耕地面积减少,高效的耕作技术变得至关重要。施肥机透过精确施用养分、减少浪费和提高作物产量发挥至关重要的作用。这种效率也符合永续发展目标,在提高食品产量的同时减少对环境的影响。土壤退化、气候变迁和不良的农业实践等挑战加剧了对此类解决土壤侵蚀和养分流失问题的先进工具的需求。现代施肥机采用变数施肥和土壤监测等先进技术,对于确保全球粮食安全和优化农业产量至关重要。

政府推动农业现代化的措施进一步促进了市场成长。补贴、补助和财政诱因鼓励农民采用施肥机等先进设备。例如,农业经济体的预算中很大一部分被分配给食品和化肥补贴,强调了对农业现代化的承诺。这些财政援助不仅支持先进工具的初始投资,也帮助小规模农民克服经济障碍,促进更广泛的采用。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 8.047 亿美元 |

| 预测值 | 12.7 亿美元 |

| 复合年增长率 | 4.8% |

市场根据撒播机类型进行细分,包括旋转式撒播机、干式撒播机、跌落式撒播机、摆动式撒播机和液体撒播机。其中,旋转式撒播机在 2024 年占据了超过 40% 的市场份额,预计到 2034 年将超过 5 亿美元。这种适应性使它们适用于各种农业应用,从而增强了它们在整个农业领域的需求。

施肥机的分销透过直销、零售和线上平台进行,其中直销将在 2024 年占据 52% 的市场份额,占据市场主导地位。这些管道还提供售后服务、保固和租赁、分期付款等灵活的融资选择,使农民,特别是发展中地区的农民更容易获得产品。

到 2024 年,亚太地区将占 40% 的市场份额,其中以中国等国家为主导。该地区正在经历快速的农业机械化,以解决劳动力短缺和日益增长的粮食需求。在政府旨在实现农业现代化的政策和措施的支持下,施肥机对于提高生产力至关重要。精准农业技术和永续实践的采用进一步加速了对这些工具的需求,确保有效利用资源并减少对环境的影响。

目录

第 1 章:方法论与范围

- 研究设计

- 研究方法

- 资料收集方法

- 基础估算与计算

- 基准年计算

- 市场估计的主要趋势

- 预测模型

- 初步研究和验证

- 主要来源

- 资料探勘来源

- 市场范围和定义

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 原料及零件供应商

- 製造商

- 技术提供者

- 经销商

- 最终用户

- 供应商概况

- 利润率分析

- 技术与创新格局

- 专利分析

- 重要新闻及倡议

- 监管格局

- 定价分析

- 衝击力

- 成长动力

- 全球粮食需求不断增长,需要高效率的农业实践

- 采用精准农业技术,如支援 GPS 的播撒机

- 永续发展努力推动对高效施肥工具的需求

- 政府对现代农业装备的补贴与支持

- 产业陷阱与挑战

- 先进施肥机的初始成本较高

- 小规模农户缺乏意识与技术专长

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:依传播者划分,2021 - 2034 年

- 主要趋势

- 旋转式播撒机

- 干式撒播机

- 撒播机

- 钟摆式撒播机

- 液体播撒机

第六章:市场估计与预测:按肥料,2021 - 2034 年

- 主要趋势

- 颗粒肥料

- 液体肥料

- 有机肥料

- 化学肥料

第 7 章:市场估计与预测:按技术,2021 - 2034 年

- 主要趋势

- 手动的

- 油压

- 支援 GPS

- 可变速率技术 (VRT)

- 无线通讯系统

第 8 章:市场估计与预测:按电源分类,2021 - 2034 年

- 主要趋势

- 拖拉机悬挂

- 自走式

- 手推式

- 搭载 ATV/UTV

第 9 章:市场估计与预测:按应用,2021 - 2034 年

- 主要趋势

- 行栽作物

- 果园

- 商业草坪和花园

第 10 章:市场估计与预测:按配销通路,2021 - 2034 年

- 主要趋势

- 直接销售

- 零售

- 线上平台

第 11 章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 北欧

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 东南亚

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东及非洲

- 阿联酋

- 南非

- 沙乌地阿拉伯

第 12 章:公司简介

- AGCO

- Bogballe

- Bredal

- Claas

- CNH Industrial

- Dalton

- Fertilizer Equipment Specialists

- IRIS Spreaders

- John Deere

- Kasco Manufacturing

- Kubota

- Kuhn

- Kverneland

- Mahindra & Mahindra

- Maschio Gaspardo

- Monosem

- Rauch Landmaschinenfabrik

- Sulky Burel

- Techint

- Vicon

The Global Agriculture Fertilizer Spreader Market, valued at USD 804.7 million in 2024, is projected to grow at a 4.8% CAGR from 2025 to 2034. This expansion is driven by the rising global demand for food, necessitated by population growth. As urbanization and environmental challenges reduce arable land, efficient farming techniques become essential. Fertilizer spreaders play a critical role by applying nutrients precisely, minimizing waste, and boosting crop yields. This efficiency also aligns with sustainability objectives, reducing environmental impact while improving food production. Challenges like soil degradation, climate change, and poor agricultural practices exacerbate the need for such advanced tools, which address soil erosion and nutrient loss. Modern fertilizer spreaders, featuring advanced technologies like variable rate application and soil monitoring, are indispensable for ensuring global food security and optimizing agricultural output.

Government initiatives promoting agricultural modernization further bolster market growth. Subsidies, grants, and financial incentives encourage farmers to adopt advanced equipment like fertilizer spreaders. For instance, a significant portion of budgets in agrarian economies is allocated to food and fertilizer subsidies, underscoring the commitment to modernizing agriculture. These financial aids not only support the initial investment in advanced tools but also help small-scale farmers overcome economic barriers, fostering broader adoption.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $804.7 Million |

| Forecast Value | $1.27 Billion |

| CAGR | 4.8% |

The market is segmented based on spreader types, including rotary, dry, drop, pendulum, and liquid spreaders. Among these, rotary spreaders held a dominant market share of over 40% in 2024, with projections exceeding USD 500 million by 2034. Their popularity stems from their ability to cover large areas efficiently and handle diverse fertilizer types. This adaptability makes them suitable for various agricultural applications, enhancing their demand across the farming sector.

The distribution of fertilizer spreaders occurs through direct sales, retail, and online platforms, with direct sales leading the market at 52% in 2024. Farmers favor direct sales due to personalized consultations and tailored solutions that ensure the right equipment for their needs. These channels also facilitate after-sales services, warranties, and flexible financing options like leasing and installment plans, enabling easier access for farmers, particularly in developing regions.

Asia Pacific dominated the market with a 40% share in 2024, led by countries like China. The region is experiencing rapid agricultural mechanization to address labor shortages and increasing food demands. Fertilizer spreaders are integral to improving productivity supported by government policies and initiatives aimed at modernizing farming practices. The adoption of precision farming techniques and sustainable practices further accelerates the demand for these tools, ensuring efficient resource use and reduced environmental impact.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market scope & definition

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Raw material and component suppliers

- 3.1.2 Manufacturers

- 3.1.3 Technology providers

- 3.1.4 Distributors

- 3.1.5 End users

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Technology & innovation landscape

- 3.5 Patent analysis

- 3.6 Key news & initiatives

- 3.7 Regulatory landscape

- 3.8 Pricing analysis

- 3.9 Impact forces

- 3.9.1 Growth drivers

- 3.9.1.1 Increasing global food demand necessitates efficient agricultural practices

- 3.9.1.2 Adoption of precision agriculture technologies such as GPS-enabled spreaders

- 3.9.1.3 Sustainability efforts drive demand for efficient fertilizer application tools

- 3.9.1.4 Government subsidies and support for modern farming equipment

- 3.9.2 Industry pitfalls & challenges

- 3.9.2.1 High initial costs of advanced fertilizer spreaders

- 3.9.2.2 Lack of awareness and technical expertise among small-scale farmers

- 3.9.1 Growth drivers

- 3.10 Growth potential analysis

- 3.11 Porter’s analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Spreader, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Rotary spreaders

- 5.3 Dry spreaders

- 5.4 Drop spreaders

- 5.5 Pendulum spreaders

- 5.6 Liquid spreaders

Chapter 6 Market Estimates & Forecast, By Fertilizer, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Granular fertilizers

- 6.3 Liquid fertilizers

- 6.4 Organic fertilizers

- 6.5 Chemical fertilizers

Chapter 7 Market Estimates & Forecast, By Technology, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 Manual

- 7.3 Hydraulic

- 7.4 GPS-enabled

- 7.5 Variable rate technology (VRT)

- 7.6 Wireless communication systems

Chapter 8 Market Estimates & Forecast, By Power Source, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 Tractor-mounted

- 8.3 Self-propelled

- 8.4 Hand-pushed

- 8.5 ATV/UTV mounted

Chapter 9 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 Row crops

- 9.3 Orchards

- 9.4 Commercial lawns & gardens

Chapter 10 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034 ($Bn, Units)

- 10.1 Key trends

- 10.2 Direct sales

- 10.3 Retail

- 10.4 Online platforms

Chapter 11 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 UK

- 11.3.2 Germany

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.3.6 Russia

- 11.3.7 Nordics

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 Australia

- 11.4.5 South Korea

- 11.4.6 Southeast Asia

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.6 MEA

- 11.6.1 UAE

- 11.6.2 South Africa

- 11.6.3 Saudi Arabia

Chapter 12 Company Profiles

- 12.1 AGCO

- 12.2 Bogballe

- 12.3 Bredal

- 12.4 Claas

- 12.5 CNH Industrial

- 12.6 Dalton

- 12.7 Fertilizer Equipment Specialists

- 12.8 IRIS Spreaders

- 12.9 John Deere

- 12.10 Kasco Manufacturing

- 12.11 Kubota

- 12.12 Kuhn

- 12.13 Kverneland

- 12.14 Mahindra & Mahindra

- 12.15 Maschio Gaspardo

- 12.16 Monosem

- 12.17 Rauch Landmaschinenfabrik

- 12.18 Sulky Burel

- 12.19 Techint

- 12.20 Vicon