|

市场调查报告书

商品编码

1665393

透过噪音测试市场机会、成长动力、产业趋势分析和 2025 - 2034 年预测Pass-By Noise Testing Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

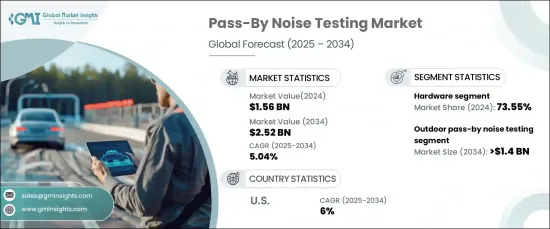

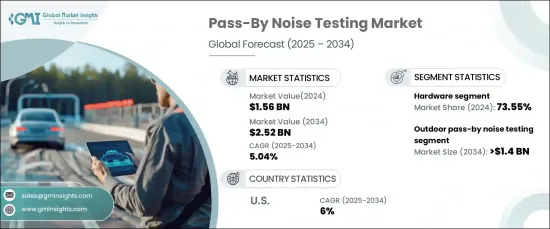

2024 年全球通过噪音测试市场价值为 15.6 亿美元,预计 2025 年至 2034 年的复合年增长率为 5.04%。汽车製造商和监管机构采用这些协议来满足更严格的噪音污染标准并确保车辆符合环境法规。该过程需要先进的测量工具、专门的测试轨道以及遵守程序指南,为车辆设计和工程产生必要的资料。随着城市化进程的加速和对安静设计的日益重视,製造商不断寻求提高车辆性能并同时最大限度地减少噪音污染,推动创新。随着汽车製造商优先考虑遵守不断变化的法规并提高其车辆的声学性能,不断扩张的汽车行业进一步推动了对通过噪音测试的需求。

不断发展的汽车产业对该市场产生了重大影响,因为它强调降低噪音并遵守严格的标准。消费者对较安静车辆的偏好迫使製造商投资于先进的测试技术。汽车产业(尤其是电动车(EV))的投资不断增加,凸显了能够满足监管要求并支持更高产量的精确噪音测试系统的重要性。这些发展强调了透过噪音测试在确保合规性和维持汽车製造品质方面的重要作用。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 15.6亿美元 |

| 预测值 | 25.2亿美元 |

| 复合年增长率 | 5.04% |

硬体部分包括声级计、感测器和资料撷取系统,在 2024 年占据市场主导地位,占总份额的 73.55%。这一领域的成长是由对高精度工具的需求推动的,用于准确测量和记录车辆噪音排放。随着全球噪音法规愈发严格,对先进硬体解决方案的需求不断上升。感测器和资料采集系统的技术进步进一步提高了测试的准确性和效率,使其成为法规遵循和产品开发不可或缺的一部分。

户外通过噪音测试主要针对真实条件下的车辆进行评估,预计到 2034 年其市场规模将超过 14 亿美元。城市化进程的加快和更严格的噪音控制法规的实施推动了户外测试的采用。製造商依靠这些方法来满足合规性要求并改善车辆音质。

在美国,到 2024 年,北美通过噪音测试市场预计将以 6% 的复合年增长率增长。

目录

第 1 章:方法论与范围

- 市场范围和定义

- 基础估算与计算

- 预测计算

- 资料来源

- 基本的

- 次要

- 付费来源

- 公共资源

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 影响价值链的因素

- 利润率分析

- 中断

- 未来展望

- 製造商

- 经销商

- 供应商概况

- 利润率分析

- 重要新闻及倡议

- 监管格局

- 衝击力

- 成长动力

- 汽车产业的快速扩张

- 提高对噪音污染影响的认识

- 监理合规要求

- 通过噪音测试在各种应用中的使用日益增多

- 测试设备的技术进步

- 产业陷阱与挑战

- 先进检测设备成本高

- 测试程序的复杂性

- 成长潜力分析

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第 5 章:市场估计与预测:按组件,2021 年至 2034 年

- 主要趋势

- 硬体

- 感应器和换能器

- 分析器

- 米

- 数据采集系统

- 讯号调节器

- 振动器和控制器

- 软体

第 6 章:市场估计与预测:按测试类型,2021-2034 年

- 主要趋势

- 室外通过噪音测试

- 室内模拟测试

第 7 章:市场估计与预测:按最终用途产业,2021 年至 2034 年

- 主要趋势

- 汽车和运输

- 航太和国防

- 发电

- 消费性电子产品

- 建造

- 工业设备

- 矿冶

- 其他的

第 8 章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 亚太其他地区

- 拉丁美洲

- 巴西

- 墨西哥

- 拉丁美洲其他地区

- 中东及非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

- MEA 其他地区

第九章:公司简介

- ACOEM

- Anthony Best Dynamics Limited

- AVL List GmbH

- Brüel & Kjær

- Dewesoft

- Endevco

- GRAS Sound & Vibration

- HBK

- HEAD acoustics GmbH

- HORIBA

- imc Test & Measurement GmbH

- Kistler Group

- Larson Davis

- m+p international

- Microflown AVISA

- Microtech Gefell

- National Instruments

- Norsonic

- Prosig Ltd.

- Siemens

- VBOX Automotive

The Global Pass-By Noise Testing Market, valued at USD 1.56 billion in 2024, is projected to grow at a CAGR of 5.04% from 2025 to 2034. This testing method captures the complete acoustic profile of vehicles, encompassing sounds from engines, drivetrains, and other mechanical components. Automakers and regulatory agencies employ these protocols to meet stricter noise pollution standards and ensure vehicles comply with environmental regulations. The process requires advanced measurement tools, specialized test tracks, and adherence to procedural guidelines, generating essential data for vehicle design and engineering. Rising urbanization and the increasing emphasis on quieter designs are driving innovation as manufacturers seek to improve vehicle performance while minimizing noise pollution. The expanding automotive industry further propels the demand for pass-by noise testing as automakers prioritize compliance with evolving regulations and enhance the acoustic performance of their vehicles.

The growing automotive sector significantly influences this market as it emphasizes noise reduction and compliance with stringent standards. Consumer preferences for quieter vehicles compel manufacturers to invest in advanced testing technologies. Rising investments in the automotive industry, particularly in electric vehicles (EVs), highlight the importance of precise noise testing systems capable of meeting regulatory demands while supporting higher production volumes. These developments underscore the essential role of pass-by noise testing in ensuring compliance and maintaining quality in vehicle manufacturing.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.56 Billion |

| Forecast Value | $2.52 Billion |

| CAGR | 5.04% |

The hardware segment, which includes sound level meters, sensors, and data acquisition systems, dominated the market in 2024, accounting for 73.55% of the total share. This segment's growth is driven by the need for high-precision tools to measure and record vehicle noise emissions accurately. As global noise regulations become more stringent, the demand for advanced hardware solutions continues to rise. Technological advancements in sensors and data acquisition systems further enhance testing accuracy and efficiency, making them indispensable for regulatory compliance and product development.

Outdoor pass-by noise testing, focused on evaluating vehicles under real-world conditions, is anticipated to exceed USD 1.4 billion by 2034. This testing method assesses external vehicle noise at varying speeds and environmental conditions, ensuring adherence to international noise emission standards. Increasing urbanization and the enforcement of stricter noise control regulations are driving the adoption of outdoor testing. Manufacturers rely on these methods to meet compliance requirements and improve vehicle acoustics.

In the US, the pass-by noise testing market is expected to grow at a CAGR of 6% within North America by 2024. The push for environmental sustainability and adherence to strict noise standards drive innovation in testing technologies, particularly as the automotive sector focuses on producing quieter and more efficient vehicles.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.7 Growth drivers

- 3.7.1 Rapid expansion of the automotive sector

- 3.7.2 Increased awareness about the impact of noise pollution

- 3.7.3 Regulatory compliance requirements

- 3.7.4 Growing use of pass-by noise testing across various applications

- 3.7.5 Technological advancements in testing equipment

- 3.8 Industry pitfalls & challenges

- 3.8.1 High cost of advanced testing equipment

- 3.8.2 Complexity of testing procedures

- 3.9 Growth potential analysis

- 3.10 Porter’s analysis

- 3.11 PESTEL analysis

Chapter 4 Competitive Landscape, 2023

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Component, 2021-2034 (USD billion)

- 5.1 Key trends

- 5.2 Hardware

- 5.2.1 Sensors & transducers

- 5.2.2 Analyzers

- 5.2.3 Meters

- 5.2.4 Data acquisition systems

- 5.2.5 Signal conditioners

- 5.2.6 Shakers & controllers

- 5.3 Software

Chapter 6 Market Estimates & Forecast, By Testing Type, 2021-2034 (USD billion)

- 6.1 Key trends

- 6.2 Outdoor pass-by noise testing

- 6.3 Indoor simulated testing

Chapter 7 Market Estimates & Forecast, By End Use Industry, 2021-2034 (USD billion)

- 7.1 Key trends

- 7.2 Automotive and transportation

- 7.3 Aerospace and defence

- 7.4 Power generation

- 7.5 Consumer electronics

- 7.6 Construction

- 7.7 Industrial equipment

- 7.8 Mining and metallurgy

- 7.9 Others

Chapter 8 Market Estimates & Forecast, By Region, 2021-2034 (USD billion)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 Germany

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Russia

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.4.5 Australia

- 8.4.6 Rest of Asia Pacific

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Rest of Latin America

- 8.6 MEA

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

- 8.6.4 Rest of MEA

Chapter 9 Company Profiles

- 9.1 ACOEM

- 9.2 Anthony Best Dynamics Limited

- 9.3 AVL List GmbH

- 9.4 Brüel & Kjær

- 9.5 Dewesoft

- 9.6 Endevco

- 9.7 GRAS Sound & Vibration

- 9.8 HBK

- 9.9 HEAD acoustics GmbH

- 9.10 HORIBA

- 9.11 imc Test & Measurement GmbH

- 9.12 Kistler Group

- 9.13 Larson Davis

- 9.14 m+p international

- 9.15 Microflown AVISA

- 9.16 Microtech Gefell

- 9.17 National Instruments

- 9.18 Norsonic

- 9.19 Prosig Ltd.

- 9.20 Siemens

- 9.21 VBOX Automotive