|

市场调查报告书

商品编码

1665399

搅拌机市场机会、成长动力、产业趋势分析与 2025 - 2034 年预测Mixer Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

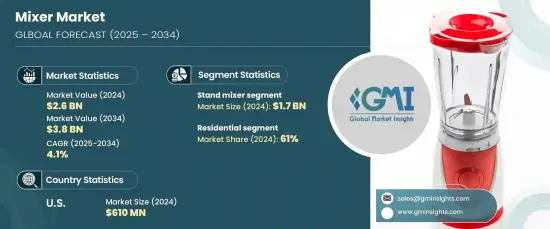

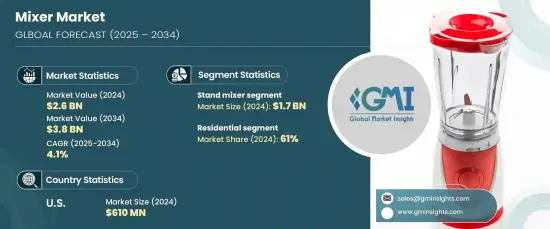

2024 年全球搅拌机市场价值为 26 亿美元,预计 2025 年至 2034 年期间的复合年增长率为 4.1%。此外,对烘焙食品的需求日益增长,以及物联网、人工智慧和智慧感测器等新技术的融合正在重塑市场格局。随着消费者越来越追求厨房用具的便利性、紧凑性和多功能性,搅拌机已经成为家庭和商业厨房中不可或缺的工具。智慧家庭技术的兴起进一步促进了这一趋势,搅拌机提供即时资料和透过数位介面进行精确控制等功能,增强了用户体验。

疫情期间,家庭烹饪和烘焙业务蓬勃发展,消费者选择更有效率、更人性化的厨房设备。现在,人们正在寻找适合忙碌生活方式的紧凑型多功能搅拌机,使搅拌、揉捏和搅打等任务变得更容易。网路购物平台的日益普及也使得消费者更容易购买这些电器,从而刺激了住宅领域的需求。在商业方面,餐厅、咖啡馆和餐饮服务越来越依赖搅拌机来确保食品生产的一致性并满足对高品质食品日益增长的需求。自动化和智慧技术对于提高效率、减少错误和降低商业厨房的劳动力成本至关重要。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 26亿美元 |

| 预测值 | 38亿美元 |

| 复合年增长率 | 4.1% |

就产品类型而言,市场分为手动搅拌机和立式搅拌机。立式搅拌机预计将继续占据市场主导地位,2024 年的价值估计为 17 亿美元,2025 年至 2034 年的复合年增长率为 4.3%。具有应用程式连接和与家庭自动化系统的兼容性等智慧功能的立式搅拌机正受到人们的青睐。更轻、更便携的手动搅拌机也很受欢迎,尤其是对于厨房较小或寻求更大灵活性的人来说。无线型号因其便利性而越来越受欢迎。

市场分为住宅终端用户和商业终端用户。预计住宅消费者将在 2024 年占据约 61% 的市场份额,并将继续推动成长。节省空间的紧凑设计,例如轻巧的手动搅拌器和较小的立式搅拌器,在城市生活环境中特别有吸引力。在商业领域,配备可程式控制、物联网连接和自动化设定的智慧搅拌机对于旨在扩大生产同时保持一致性和提高效率的企业变得至关重要。快餐店和食品配送模式的日益增长的趋势进一步推动了对能够处理批量生产的高速、大容量搅拌机的需求。

在美国,搅拌机市场预计将快速成长,这得益于家庭烘焙、技术创新以及商用搅拌机使用量激增等趋势。 2024 年美国市场价值预估为 6.1 亿美元,持续引领北美搅拌机市场。随着消费者越来越接受线上购物,对多功能、高品质搅拌机的需求预计只会上升。

目录

第 1 章:方法论与范围

- 市场范围和定义

- 基础估算与计算

- 预测计算。

- 资料来源

- 基本的

- 次要

- 付费来源

- 公共资源

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 影响价值链的因素。

- 利润率分析。

- 中断

- 未来展望

- 製造商

- 经销商

- 供应商概况

- 利润率分析。

- 重要新闻及倡议

- 监管格局

- 衝击力

- 技术概览

- 成长动力

- 家庭烘焙趋势日益流行

- 餐饮业扩张

- 产业陷阱与挑战

- 价格敏感度和竞争

- 消费者偏好的改变

- 成长动力

- 消费者购买行为分析

- 人口趋势

- 影响购买决策的因素

- 消费者产品采用

- 首选配销通路

- 偏好价格范围

- 成长潜力分析

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第 5 章:市场估计与预测:按产品类型,2021-2034 年

- 主要趋势

- 手动搅拌机

- 立式搅拌机

- 碗式升降机

- 倾斜头

第六章:市场估计与预测:依产能,2021-2034

- 主要趋势

- 3L以下

- 3 升至 5 公升

- 5 升至 7 公升

- 7L以上

第 7 章:市场估计与预测:按功率,2021 年至 2034 年

- 主要趋势

- 钢弹 300W

- 300 至 700W

- 700 至 1000W

- 100W以上

第 8 章:市场估计与预测:按价格,2021 年至 2034 年

- 主要趋势

- 低的

- 中等的

- 高的

第 9 章:市场估计与预测:依最终用途,2021 年至 2034 年

- 主要趋势

- 住宅

- 商业的

- HoReCa

- 餐饮服务

- 果汁吧

- 其他(冰淇淋店和糖果店等)

第 10 章:市场估计与预测:按配销通路,2021-2034 年

- 主要趋势

- 在线的

- 电子商务

- 公司网站

- 离线

- 大型零售商店

- 专卖店

- 其他(家居用品店、个人商店等)

第 11 章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 中东及非洲

- 阿联酋

- 沙乌地阿拉伯

- 南非

第 12 章:公司简介

- Black+Decker

- Bosch

- Braun

- Breville

- Cuisinart

- Electrolux

- Hamilton Beach

- Kenwood

- KitchenAid

- Ninja

- Philips

- Smeg

- Sunbeam

- Tefal

- Wonderchef

The Global Mixer Market was valued at USD 2.6 billion in 2024 and is expected to expand at a CAGR of 4.1% from 2025 to 2034. The surge in popularity of home baking, the ongoing expansion of the food service industry, and advancements in automation for food production are major factors fueling this growth. Additionally, there is a growing demand for baked goods, as well as the integration of new technologies like IoT, AI, and smart sensors, which are reshaping the market landscape. As consumers increasingly seek convenience, compactness, and versatility in their kitchen appliances, mixers have become indispensable tools in both home and commercial kitchens. The rise of smart home technology has further contributed to this trend, with mixers offering features like real-time data and precise control through digital interfaces, enhancing user experience.

The pandemic saw a boom in home cooking and baking, with consumers opting for more efficient and user-friendly kitchen equipment. Now, individuals are looking for compact and multipurpose mixers that cater to busy lifestyles, making tasks like mixing, kneading, and whipping easier. The growing popularity of online shopping platforms has also made it easier for consumers to purchase these appliances, boosting demand in the residential sector. On the commercial side, restaurants, cafes, and catering services are increasingly relying on mixers to ensure consistency in food production and meet the growing demand for high-quality food. Automation and smart technologies are becoming essential for improving efficiency, reducing errors, and cutting labor costs in commercial kitchens.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.6 Billion |

| Forecast Value | $3.8 Billion |

| CAGR | 4.1% |

In terms of product type, the market is divided into hand mixers and stand mixers. Stand mixers are projected to continue dominating the market, with an estimated value of USD 1.7 billion in 2024, growing at a CAGR of 4.3% from 2025 to 2034. These mixers, which handle multiple tasks, are especially popular among home bakers and culinary enthusiasts. Stand mixers with smart features, such as app connectivity and compatibility with home automation systems, are gaining traction. Hand mixers, which are lighter and more portable, are also in demand, particularly among those with smaller kitchens or those looking for more flexibility. Cordless models are becoming increasingly popular for their convenience.

The market is segmented into residential and commercial end users. Residential consumers, who held about 61% of the market share in 2024, are expected to continue driving growth. Compact designs that save space, such as lightweight hand mixers and smaller stand mixers, are particularly appealing in urban living environments. In the commercial sector, smart mixers equipped with programmable controls, IoT connectivity, and automated settings are becoming essential for businesses aiming to scale production while maintaining consistency and improving efficiency. The growing trend of quick-service restaurants and food delivery models is further fueling demand for high-speed, high-capacity mixers that can handle bulk production.

In the U.S., the mixer market is expected to grow rapidly, driven by trends like home baking, technological innovations, and a surge in commercial mixer usage. With an estimated market value of USD 610 million in 2024, the U.S. continues to lead the North American mixer market. As consumers increasingly embrace online shopping, the demand for versatile and high-quality mixers is only expected to rise.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations.

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain.

- 3.1.2 Profit margin analysis.

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis.

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.7 Technological overview

- 3.7.1 Growth drivers

- 3.7.1.1 Rising home baking trends

- 3.7.1.2 Food service industry expansion

- 3.7.2 Industry pitfalls & challenges

- 3.7.2.1 Price sensitivity and competition

- 3.7.2.2 Changing consumer preferences

- 3.7.1 Growth drivers

- 3.8 Consumer buying behavior analysis

- 3.8.1 Demographic trends

- 3.8.2 Factors affecting buying decision

- 3.8.3 Consumer product adoption

- 3.8.4 Preferred distribution channel

- 3.8.5 Preferred price range

- 3.9 Growth potential analysis

- 3.10 Porter’s analysis

- 3.11 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Product Type, 2021-2034 (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Hand mixer

- 5.3 Stand mixer

- 5.3.1 Bowl-lift

- 5.3.2 Tilt-head

Chapter 6 Market Estimates & Forecast, By Capacity, 2021-2034 (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Below 3L

- 6.3 3L to 5L

- 6.4 5L to 7L

- 6.5 Above 7L

Chapter 7 Market Estimates & Forecast, By Power, 2021-2034 (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 Up to 300W

- 7.3 300 to 700W

- 7.4 700 to 1000W

- 7.5 Above 100W

Chapter 8 Market Estimates & Forecast, By Price, 2021-2034 (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Low

- 8.3 Medium

- 8.4 High

Chapter 9 Market Estimates & Forecast, By End Use, 2021-2034 (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 Residential

- 9.3 Commercial

- 9.3.1 HoReCa

- 9.3.2 Catering services

- 9.3.3 Juice bars

- 9.3.4 Others (ice cream parlors and confectionery etc.)

Chapter 10 Market Estimates & Forecast, By Distribution Channel, 2021-2034 (USD Billion) (Thousand Units)

- 10.1 Key trends

- 10.2 Online

- 10.2.1 E-commerce

- 10.2.2 Company websites

- 10.3 Offline

- 10.3.1 Mega retail store

- 10.3.2 Specialty stores

- 10.3.3 Others (homeware store, individual store etc.)

Chapter 11 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion) (Thousand Units)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 UK

- 11.3.2 Germany

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.3.6 Russia

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 South Korea

- 11.4.5 Australia

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.6 MEA

- 11.6.1 UAE

- 11.6.2 Saudi Arabia

- 11.6.3 South Africa

Chapter 12 Company Profiles

- 12.1 Black+Decker

- 12.2 Bosch

- 12.3 Braun

- 12.4 Breville

- 12.5 Cuisinart

- 12.6 Electrolux

- 12.7 Hamilton Beach

- 12.8 Kenwood

- 12.9 KitchenAid

- 12.10 Ninja

- 12.11 Philips

- 12.12 Smeg

- 12.13 Sunbeam

- 12.14 Tefal

- 12.15 Wonderchef