|

市场调查报告书

商品编码

1665402

汽车皮带起动发电机市场机会、成长动力、产业趋势分析与预测 2025 - 2034Automotive Belt Starter Generator Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

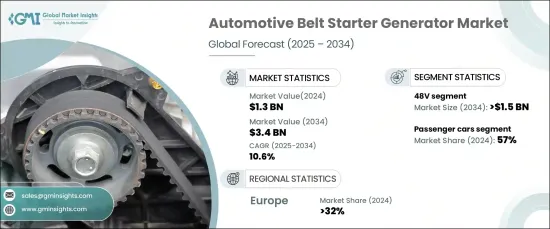

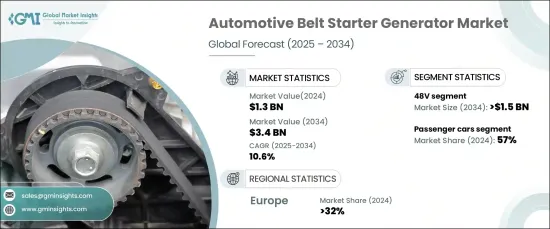

2024 年全球汽车皮带起动发电机市场价值为 13 亿美元,预计 2025 年至 2034 年的复合年增长率为 10.6%。这些系统透过提供更高的功率输出,表现优于传统的 12V 系统,从而提高了轻度混合动力系统的效率。它们还增强了再生煞车能力,在煞车过程中捕获和储存更多能量以优化燃油效率。透过减少引擎的工作负荷并实现更好的能源管理,这些系统对交通的可持续性做出了重大贡献。

向混合动力车和电动车的转变也在推动 BSG 市场发展方面发挥关键作用。汽车製造商正在整合这些系统以符合更严格的排放法规并满足对环保行动解决方案日益增长的需求。 BSG 系统结合了起动马达和发电机功能,是混合动力和电动动力系统的重要组成部分。它们提高了能源利用率,支持再生煞车并增强了车辆的整体性能,使其成为向更环保的汽车技术转型的关键创新。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 13亿美元 |

| 预测值 | 34亿美元 |

| 复合年增长率 | 10.6% |

市场按产品细分为 12V 和 48V 系统。 2024 年,48V 市场占据了 58% 以上的市场份额,预计到 2034 年将超过 15 亿美元。它们可确保更平稳的加速、更高的燃油经济性和更有效的能量回收,成为汽车製造商应对严格排放标准的理想选择。

就车辆类型而言,市场分为乘用车、非公路用车和商用车。 2024 年,乘用车约占 57% 的市场份额。启动停止功能、再生煞车和内燃机附加扭力等特性使这些系统对乘用车领域极具吸引力,进一步推动了其市场渗透。

欧洲成为领先地区,到 2024 年将占据全球 32% 以上的市场份额,其中德国贡献巨大。印度汽车产业发展强劲,主要参与者大力投资混合动力和电动车技术,支撑了其主导地位。严格的二氧化碳排放限制法规和对永续交通的关注,使得汽车製造商广泛采用 48V BSG 系统,巩固了德国在市场上的领导地位。

目录

第 1 章:方法论与范围

- 研究设计

- 研究方法

- 资料收集方法

- 基础估计和计算

- 基准年计算

- 市场估计的主要趋势

- 预测模型

- 初步研究与验证

- 主要来源

- 资料探勘来源

- 市场定义

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 供应商概况

- 汽车原厂设备製造商

- 技术提供者

- 售后市场和服务提供商

- 最终用户

- 利润率分析

- 成本明细分析

- 技术与创新格局

- 重要新闻及倡议

- 定价分析

- 监管格局

- 衝击力

- 成长动力

- 排放法规执行日益严格

- 对燃油效率的需求日益增长

- 混合动力汽车和电动车的普及率不断提高

- 成长动力

3.9.1.4.提高 48 V 系统的性能和成本效益

- 皮带起动发电机设计的技术进步

- 产业陷阱与挑战

- 技术和整合挑战

- 全混合动力和电动动力系统的竞争

- 成长潜力分析

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第 5 章:市场估计与预测:按技术,2021 - 2034 年

- 主要趋势

- 轻度混合动力

- 微混合动力

第 6 章:市场估计与预测:按产品,2021 - 2034 年

- 主要趋势

- 12伏

- 48伏

第七章:市场估计与预测:依车型,2021 - 2034 年

- 主要趋势

- 搭乘用车

- 轿车

- 越野车

- 掀背车

- 商用车

- 轻型商用车

- 丙型肝炎病毒

- 越野车

第 8 章:市场估计与预测:按组件,2021 - 2034 年

- 主要趋势

- 电动机/发电机

- 电力电子

- 机械耦合

- 控制系统

第 9 章:市场估计与预测:按冷却类型,2021 - 2034 年

- 主要趋势

- 空气冷却

- 液冷

- 混合冷却

第 10 章:市场估计与预测:按销售管道,2021 - 2034 年

- 主要趋势

- OEM

- 售后市场

第 11 章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 西班牙

- 义大利

- 俄罗斯

- 北欧

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳新银行

- 东南亚

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东及非洲

- 阿联酋

- 南非

- 沙乌地阿拉伯

第 12 章:公司简介

- Bosch

- Continental

- Dayco

- Hyundai

- Infineon

- Magneti Marelli

- MTA

- Nexteer

- Onsemi

- Schaeffler Group

- SEG Automotive

- Sona Comstar

- Syensqo

- Valeo

- Vitesco Technologies

- ZF Friedrichshafen

The Global Automotive Belt Starter Generator Market was valued at USD 1.3 billion in 2024 and is anticipated to grow at a CAGR of 10.6% from 2025 to 2034. The increasing demand for 48V systems, known for their superior performance and affordability, is propelling the adoption of BSG systems, particularly in mild-hybrid vehicles. These systems outperform traditional 12V counterparts by delivering higher power output, which boosts the efficiency of mild-hybrid powertrains. They also enhance regenerative braking capabilities, capturing and storing more energy during braking to optimize fuel efficiency. By reducing the engine's workload and enabling better energy management, these systems contribute significantly to sustainability in transportation.

The shift towards hybrid and electric vehicles also plays a critical role in driving the BSG market. Automakers are integrating these systems to align with stricter emissions regulations and meet the growing demand for eco-friendly mobility solutions. BSG systems, which combine starter motor and generator functions, are vital components in hybrid and electric powertrains. They improve energy utilization, support regenerative braking, and enhance overall vehicle performance, making them a key innovation in the transition to greener automotive technologies.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.3 Billion |

| Forecast Value | $3.4 Billion |

| CAGR | 10.6% |

The market is segmented by product into 12V and 48V systems. In 2024, the 48V segment accounted for over 58% of the market share and is projected to surpass USD 1.5 billion by 2034. These systems are preferred due to their ability to deliver additional electrical power for critical vehicle functions like electric power steering, air conditioning, and regenerative braking. They ensure smoother acceleration, improved fuel economy, and more effective energy recovery, positioning themselves as the ideal choice for automakers addressing stringent emissions standards.

In terms of vehicle type, the market is categorized into passenger cars, off-highway vehicles, and commercial vehicles. Passenger cars held approximately 57% of the market share in 2024. These vehicles leverage 48V BSG systems to achieve better fuel efficiency and reduced emissions, catering to consumers seeking cost-effective solutions without transitioning fully to electric vehicles. Features like start-stop functionality, regenerative braking, and additional torque for internal combustion engines make these systems highly attractive for the passenger car segment, further driving their market penetration.

Europe emerged as the leading region, capturing more than 32% of the global market share in 2024, with Germany being a significant contributor. The country's robust automotive sector, featuring key players heavily investing in hybrid and electric vehicle technologies, supports this dominance. Strict regulations to curb CO2 emissions and a focus on sustainable transportation have led to widespread adoption of 48V BSG systems among automakers, reinforcing Germany's leadership in the market.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 Automotive OEMs

- 3.2.2 Technology providers

- 3.2.3 Aftermarket and service providers

- 3.2.4 End users

- 3.3 Profit margin analysis

- 3.4 Cost breakdown analysis

- 3.5 Technology & innovation landscape

- 3.6 Key news & initiatives

- 3.7 Pricing analysis

- 3.8 Regulatory landscape

- 3.9 Impact forces

- 3.9.1 Growth drivers

- 3.9.1.1 Rising implementation of stringent emission regulations

- 3.9.1.2 Growing demand for fuel efficiency

- 3.9.1.3 Increasing adoption of hybrid and electric vehicles

- 3.9.1 Growth drivers

3.9.1.4. Improved performance and cost-effectiveness of 48 V systems

- 3.9.1.5 Technological advancements in belt starter generator design

- 3.9.2 Industry pitfalls & challenges

- 3.9.2.1 Technological and integration challenges

- 3.9.2.2 Competition from full hybrid and electric powertrains

- 3.10 Growth potential analysis

- 3.11 Porter’s analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Technology, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Mild hybrid

- 5.3 Micro hybrid

Chapter 6 Market Estimates & Forecast, By Product, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 12V

- 6.3 48V

Chapter 7 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 Passenger cars

- 7.2.1 Sedan

- 7.2.2 SUV

- 7.2.3 Hatchback

- 7.3 Commercial vehicle

- 7.3.1 LCV

- 7.3.2 HCV

- 7.4 Off highway vehicle

Chapter 8 Market Estimates & Forecast, By Component, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 Motor/generator

- 8.3 Power electronics

- 8.4 Mechanical coupling

- 8.5 Control systems

Chapter 9 Market Estimates & Forecast, By Cooling Type, 2021 - 2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 Air-cooled

- 9.3 Liquid-cooled

- 9.4 Hybrid-cooled

Chapter 10 Market Estimates & Forecast, By Sales Channel, 2021 - 2034 ($Bn, Units)

- 10.1 Key trends

- 10.2 OEM

- 10.3 Aftermarket

Chapter 11 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 UK

- 11.3.2 Germany

- 11.3.3 France

- 11.3.4 Spain

- 11.3.5 Italy

- 11.3.6 Russia

- 11.3.7 Nordics

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 South Korea

- 11.4.5 ANZ

- 11.4.6 Southeast Asia

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.6 MEA

- 11.6.1 UAE

- 11.6.2 South Africa

- 11.6.3 Saudi Arabia

Chapter 12 Company Profiles

- 12.1 Bosch

- 12.2 Continental

- 12.3 Dayco

- 12.4 Hyundai

- 12.5 Infineon

- 12.6 Magneti Marelli

- 12.7 MTA

- 12.8 Nexteer

- 12.9 Onsemi

- 12.10 Schaeffler Group

- 12.11 SEG Automotive

- 12.12 Sona Comstar

- 12.13 Syensqo

- 12.14 Valeo

- 12.15 Vitesco Technologies

- 12.16 ZF Friedrichshafen