|

市场调查报告书

商品编码

1665414

石油和天然气检查无人机市场机会、成长动力、产业趋势分析和 2025 - 2034 年预测Inspection Drone in Oil and Gas Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

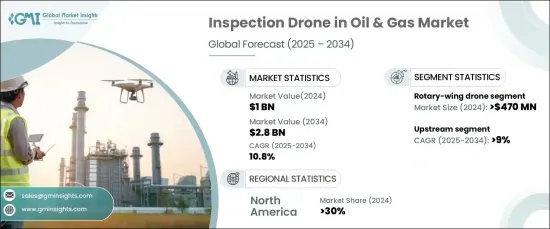

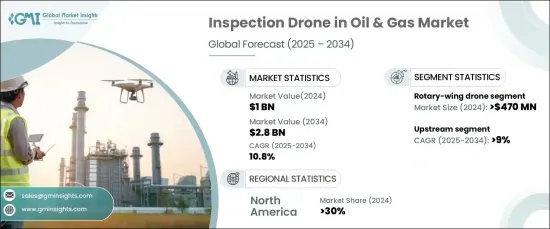

2024 年全球石油和天然气检查无人机市场价值为 10 亿美元,预计 2025 年至 2034 年期间的复合年增长率为 10.8%。公司正在优先开发创新的检查系统以改善营运、降低风险和提高安全性。无人机越来越多地用于进行例行检查、评估基础设施和监控运营,大大改变了该领域的传统检查实践。更严格的安全和环境合规监管要求也推动了无人机技术的采用,因为无人机技术比传统方法提供了更快、更可靠的替代方案。此外,将人工智慧和机器学习融入无人机系统正在彻底改变资料分析,以实现即时洞察并简化决策流程。对自动化和营运效率的关注继续影响着市场的发展轨迹。

市场依无人机类型分为旋翼无人机、固定翼无人机和混合无人机。旋翼无人机在 2024 年占据了相当大的市场份额,价值超过 4.7 亿美元。这些无人机因其能够在狭小空间内悬停和机动的能力而受到广泛青睐,使其成为检查管道和海上平台等固定资产的理想选择。它们的使用提高了安全性和效率,同时减少了传统检查方法所需的时间和成本。随着公司越来越多地融入人工智慧技术,对旋翼无人机的需求预计将进一步成长,以提供基于即时资料的更好决策能力。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 10亿美元 |

| 预测值 | 28亿美元 |

| 复合年增长率 | 10.8% |

根据营运类型,市场也分为上游、中游和下游部分。预计 2025 年至 2034 年间,上游产业将实现超过 9% 的强劲复合年增长率。无人机透过提高安全性、最大限度地减少检查时间并优化营运成本,正在成为上游运作不可或缺的工具。对勘探活动的投资增加和对永续性的关注进一步扩大了该领域对巡检无人机的需求。

2024 年,北美引领全球市场,占超过 30% 的营收份额。尤其是美国,由于重视营运效率和遵守严格的安全法规,取得了显着的成长。人工智慧和机器学习等先进技术融入无人机系统,可实现即时资料分析,帮助公司简化流程、快速识别潜在问题并减少停机时间。该地区对创新和效率的高度重视继续推动市场成长。

目录

第 1 章:方法论与范围

- 研究设计

- 研究方法

- 资料收集方法

- 基础估算与计算

- 基准年计算

- 市场估计的主要趋势

- 预测模型

- 初步研究和验证

- 主要来源

- 资料探勘来源

- 市场范围和定义

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 供应商概况

- 组件提供者

- 製造商

- 经销商

- 最终用途

- 利润率分析

- 技术与创新格局

- 专利分析

- 监管格局

- 使用案例

- 使用案例1

- 好处

- 投资报酬率

- 使用案例2

- 好处

- 投资报酬率

- 使用案例1

- 案例研究

- 案例研究 1

- 消费者姓名

- 挑战

- 解决方案

- 影响

- 案例研究 2

- 消费者姓名

- 挑战

- 解决方案

- 影响

- 案例研究 1

- 衝击力

- 成长动力

- 即时监控需求日益增加

- 无人机技术进步

- 资产管理解决方案需求不断成长

- 增强远端检查的安全协议

- 产业陷阱与挑战

- 资料整合和分析面临的挑战

- 实施先进无人机系统成本高昂

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:按无人机,2021 - 2034 年

- 主要趋势

- 固定翼无人机

- 旋翼无人机

- 混合无人机

第六章:市场估计与预测:依酬载,2021 - 2034 年

- 主要趋势

- 相机

- 光达

- 气体探测器

- 其他的

第 7 章:市场估计与预测:按运营,2021 - 2034 年

- 主要趋势

- 上游

- 中游

- 下游

第 8 章:市场估计与预测:按应用,2021 - 2034 年

- 主要趋势

- 管道检查

- 火炬塔检查

- 油罐检查

- 环境监测

- 井场检查

- 其他的

第 9 章:市场估计与预测:按最终用途,2021 - 2034 年

- 主要趋势

- 国家石油公司 (NOC)

- 独立石油公司 (IOC)

第 10 章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 北欧

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 东南亚

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东及非洲

- 阿联酋

- 南非

- 沙乌地阿拉伯

第 11 章:公司简介

- 3D Robotics

- Airobotics

- Autel Robotics

- Cyberhawk

- DJI Enterprise

- DroneBase

- DroneDeploy

- FLIR Systems

- Flyability

- GRIFF Aviation

- IdeaForge

- InspecTech Aero Services

- Kespry

- Percepto

- PrecisionHawk

- Quantum Systems

- senseFly

- Sky-Futures (ICR Group)

- Terra Drone

- Vantage Robotics

The Global Inspection Drone In Oil And Gas Market was valued at USD 1 billion in 2024 and is projected to grow at a CAGR of 10.8% from 2025 to 2034. This growth is fueled by the rising demand for efficient monitoring solutions and the rapid advancements in drone technology. Companies are prioritizing the development of innovative inspection systems to improve operations, reduce risks, and enhance safety. The increasing use of drones to conduct routine checks, assess infrastructure, and monitor operations has significantly transformed traditional inspection practices in the sector. Stricter regulatory requirements for safety and environmental compliance are also driving the adoption of drone technologies, which offer a faster and more reliable alternative to conventional methods. Additionally, incorporating AI and machine learning into drone systems is revolutionizing data analysis, enabling real-time insights and streamlined decision-making processes. The focus on automation and operational efficiency continues to shape the market's trajectory.

The market is segmented by drone type into rotary-wing, fixed-wing, and hybrid drones. Rotary-wing drones held a substantial market share in 2024, exceeding USD 470 million in value. These drones are widely preferred due to their ability to hover and maneuver in confined spaces, making them ideal for inspecting stationary assets like pipelines and offshore platforms. Their use enhances safety and efficiency while reducing the time and cost associated with traditional inspection methods. As companies increasingly integrate AI-enabled technologies, the demand for rotary-wing drones is expected to grow further, offering improved decision-making capabilities based on real-time data.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1 Billion |

| Forecast Value | $2.8 Billion |

| CAGR | 10.8% |

The market is also categorized by operation type into upstream, midstream, and downstream segments. The upstream segment is forecasted to witness a robust CAGR of over 9% between 2025 and 2034. This growth is attributed to the rising need for advanced monitoring of exploration sites, drilling operations, and pipelines, especially in remote and challenging locations. Drones are becoming an indispensable tool for upstream operations by enhancing safety, minimizing inspection times, and optimizing operational costs. Increased investments in exploration activities and a focus on sustainability further amplify the demand for inspection drones in this segment.

North America led the global market in 2024, capturing over 30% of the revenue share. The United States, in particular, has seen significant growth due to its emphasis on operational efficiency and compliance with stringent safety regulations. The integration of advanced technologies like AI and machine learning into drone systems is enabling real-time data analysis, helping companies streamline processes, identify potential issues quickly, and reduce downtime. The region's strong focus on innovation and efficiency continues to bolster market growth.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market scope & definition

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 Component providers

- 3.2.2 Manufacturer

- 3.2.3 Distributors

- 3.2.4 End use

- 3.3 Profit margin analysis

- 3.4 Technology & innovation landscape

- 3.5 Patent analysis

- 3.6 Regulatory landscape

- 3.7 Used cases

- 3.7.1 Used case 1

- 3.7.1.1 Benefits

- 3.7.1.2 ROI

- 3.7.2 Used case 2

- 3.7.2.1 Benefits

- 3.7.2.2 ROI

- 3.7.1 Used case 1

- 3.8 Case study

- 3.8.1 Case study 1

- 3.8.1.1 Consumer name

- 3.8.1.2 Challenge

- 3.8.1.3 Solution

- 3.8.1.4 Impact

- 3.8.2 Case study 2

- 3.8.2.1 Consumer name

- 3.8.2.2 Challenge

- 3.8.2.3 Solution

- 3.8.2.4 Impact

- 3.8.1 Case study 1

- 3.9 Impact forces

- 3.9.1 Growth drivers

- 3.9.1.1 Increasing demand for real-time monitoring

- 3.9.1.2 Technological advancements in drone capabilities

- 3.9.1.3 Rising demand for asset management solutions

- 3.9.1.4 Enhanced safety protocols for remote inspections

- 3.9.2 Industry pitfalls & challenges

- 3.9.2.1 Challenges in data integration and analysis

- 3.9.2.2 High costs associated with implementing advanced drone systems

- 3.9.1 Growth drivers

- 3.10 Growth potential analysis

- 3.11 Porter’s analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Drone, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Fixed-wing drone

- 5.3 Rotary-wing drone

- 5.4 Hybrid drone

Chapter 6 Market Estimates & Forecast, By Payload, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Cameras

- 6.3 LiDAR

- 6.4 Gas detectors

- 6.5 Others

Chapter 7 Market Estimates & Forecast, By Operation, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 Upstream

- 7.3 Midstream

- 7.4 Downstream

Chapter 8 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 Pipeline inspection

- 8.3 Flare stack inspection

- 8.4 Tank inspection

- 8.5 Environmental monitoring

- 8.6 Well site inspection

- 8.7 Others

Chapter 9 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 National Oil Companies (NOCs)

- 9.3 Independent Oil Companies (IOCs)

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.3.7 Nordics

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.4.6 Southeast Asia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 UAE

- 10.6.2 South Africa

- 10.6.3 Saudi Arabia

Chapter 11 Company Profiles

- 11.1 3D Robotics

- 11.2 Airobotics

- 11.3 Autel Robotics

- 11.4 Cyberhawk

- 11.5 DJI Enterprise

- 11.6 DroneBase

- 11.7 DroneDeploy

- 11.8 FLIR Systems

- 11.9 Flyability

- 11.10 GRIFF Aviation

- 11.11 IdeaForge

- 11.12 InspecTech Aero Services

- 11.13 Kespry

- 11.14 Percepto

- 11.15 PrecisionHawk

- 11.16 Quantum Systems

- 11.17 senseFly

- 11.18 Sky-Futures (ICR Group)

- 11.19 Terra Drone

- 11.20 Vantage Robotics