|

市场调查报告书

商品编码

1665419

交通拥堵辅助系统市场机会、成长动力、产业趋势分析与 2025 - 2034 年预测Traffic Jam Assist System Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

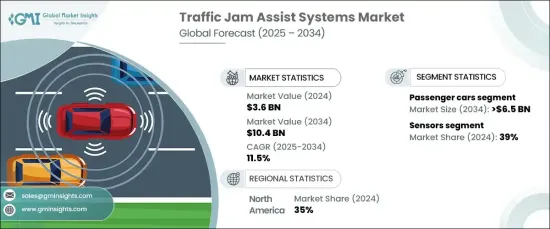

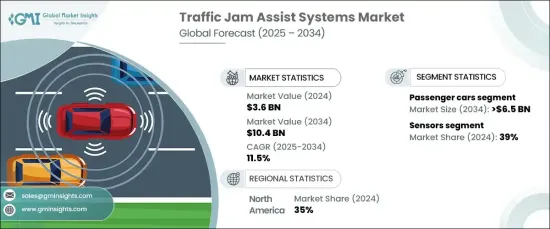

2024 年全球交通拥堵辅助系统市场价值为 36 亿美元,预计 2025 年至 2034 年期间的复合年增长率为 11.5%。车辆拥有量的增加和有限的基础设施进一步加剧了交通问题,导致通勤时间更长、压力更大。交通堵塞辅助系统旨在透过在交通拥堵时自动执行加速、煞车和转向等关键驾驶功能来缓解这种情况。这些功能不仅可以减少驾驶疲劳,还可以透过更平稳的驾驶模式提高燃油效率。对更安全、更便利的城市交通解决方案的需求日益增长,推动了其采用,特别是在面临严重交通拥堵挑战的地区。随着製造商将先进的驾驶辅助技术融入车辆,TJA 系统作为现代移动移动关键组成部分的作用变得更加明显。

汽车製造商越来越多地加入自适应巡航控制和车道维持辅助等功能,这些功能对于 TJA 功能至关重要。这些系统结合了各种技术来处理缓慢行驶的交通,同时确保驾驶者的安全。随着政府执行更严格的安全法规,先进驾驶辅助系统的采用正在加速。消费者对更聪明、半自动驾驶汽车的兴趣进一步凸显了 TJA 系统在当今市场的相关性。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 36亿美元 |

| 预测值 | 104亿美元 |

| 复合年增长率 | 11.5% |

市场按车型细分,2024 年乘用车将占据 70% 以上的市场份额。随着城市交通的日益紧张,消费者越来越重视能够提升驾驶体验的技术,这促使製造商在中檔和豪华车型中配备TJA系统。向半自动驾驶的转变使得这些功能成为许多高端汽车的标准配置,吸引了精通技术的买家。

按组件分类,感测器在 2024 年的市占率约为 39%。感测器融合技术的整合将来自多个来源的输入结合在一起,增强了即时决策能力,使得 TJA 系统更加可靠,对使用者更具吸引力。

2024 年北美将引领市场,占据全球约 35% 的份额。监管要求和消费者对具有先进功能的高檔汽车日益增长的需求推动了 TJA 系统的采用。该地区的汽车製造商正在积极将这些系统整合到豪华和中檔汽车中,以满足不断变化的安全性和便利性期望。

目录

第 1 章:方法论与范围

- 研究设计

- 研究方法

- 资料收集方法

- 基础估算与计算

- 基准年计算

- 市场估计的主要趋势

- 预测模型

- 初步研究和验证

- 主要来源

- 资料探勘来源

- 市场范围和定义

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 原物料供应商

- 零件供应商

- 软体开发者

- 技术提供者

- 售后市场供应商

- 最终用户

- 供应商概况

- 利润率分析

- 技术与创新格局

- 成本明细分析

- 价格分析

- 专利分析

- 重要新闻及倡议

- 监管格局

- 各地区交通壅塞统计数据

- 衝击力

- 成长动力

- 城市交通壅塞推动自动驾驶系统的需求

- 政府安全法规正在推动 ADAS 功能的采用

- 感测器、摄影机和人工智慧的进步正在提高 TJA 的可靠性

- 消费者更重视日常通勤的舒适性和便利性

- 产业陷阱与挑战

- 整合成本高

- 恶劣天气和复杂路况下的系统效能问题

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:按组件,2021 - 2034 年

- 主要趋势

- 感应器

- 雷达

- 光达

- 超音波

- 其他的

- ECU

- 执行器

- 相机

- 其他的

第六章:市场估计与预测:依车型,2021 - 2034 年

- 主要趋势

- 搭乘用车

- 轿车

- 掀背车

- SUV

- 商用车

- 轻型商用车 (LCV)

- 重型商用车 (HCV)

第 7 章:市场估计与预测:按自动化水平,2021 - 2034 年

- 主要趋势

- 2 级

- 3 级

- 4 级

第 8 章:市场估计与预测:按方法,2021 - 2034 年

- 主要趋势

- 车道追踪系统

- 车辆侦测及防撞系统

- 自动转向和速度控制系统

- V2X 通讯集成

- 其他的

第 9 章:市场估计与预测:按通讯方式,2021 - 2034 年

- 主要趋势

- 车对车 (V2V)

- 车辆到基础设施 (V2I)

- 基于蜂窝网络

- 专用短程通讯 (DSRC)

第 10 章:市场估计与预测:按销售管道,2021 - 2034 年

- 主要趋势

- OEM

- 售后市场

第 11 章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 北欧

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 东南亚

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东及非洲

- 阿联酋

- 南非

- 沙乌地阿拉伯

第 12 章:公司简介

- Aptiv PLC

- Bosch

- Continental

- Denso

- Harman

- Hitachi Astemo

- Hyundai Mobis

- Infineon Technologies

- Magna International

- Marelli

- Mercedes-Benz

- Mobileye

- NVIDIA

- NXP Semiconductors

- Renesas Electronics

- Texas Instruments

- Valeo

- Veoneer

- Volkswagen

- ZF Friedrichshafen

The Global Traffic Jam Assist System Market was valued at USD 3.6 billion in 2024 and is projected to grow at a CAGR of 11.5% from 2025 to 2034. This growth stems from worsening traffic congestion in urban areas due to rapid population growth and urbanization. Increasing vehicle ownership and limited infrastructure further exacerbate traffic problems, making commutes longer and more stressful. Traffic jam assist systems aim to alleviate this by automating key driving functions like acceleration, braking, and steering in heavy traffic. These features not only reduce driver fatigue but also enhance fuel efficiency through smoother driving patterns. The growing demand for safer and more convenient urban mobility solutions is driving adoption, particularly in regions facing severe congestion challenges. As manufacturers integrate advanced driver-assistance technologies into vehicles, the role of TJA systems as a key component of modern mobility is becoming more pronounced.

Automakers are increasingly incorporating features like adaptive cruise control and lane-keeping assistance, which are essential for TJA functionality. These systems combine various technologies to handle slow-moving traffic while ensuring driver safety. As governments enforce stricter safety regulations, the adoption of advanced driver-assistance systems is accelerating. Consumer interest in smarter, semi-autonomous vehicles further underscores the relevance of TJA systems in today's market.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.6 Billion |

| Forecast Value | $10.4 Billion |

| CAGR | 11.5% |

The market is segmented by vehicle type, with passenger cars accounting for over 70% of the market share in 2024. This segment is expected to exceed USD 6.5 billion by 2034, fueled by a growing preference for advanced safety and convenience features in vehicles. As urban traffic intensifies, consumers are prioritizing technologies that enhance driving experiences, prompting manufacturers to include TJA systems in mid-range and luxury models. The shift toward semi-autonomous driving has made these features standard in many high-end vehicles, appealing to tech-savvy buyers.

When categorized by components, sensors held a market share of approximately 39% in 2024. Technological advancements in radar, LiDAR, and cameras are improving system accuracy, enabling vehicles to detect objects and navigate complex traffic scenarios with precision. The integration of sensor fusion technologies, which combine inputs from multiple sources, enhances decision-making in real-time, making TJA systems more reliable and appealing to users.

North America led the market in 2024, capturing around 35% of the global share. Regulatory requirements and growing consumer demand for premium vehicles with advanced features have driven the adoption of TJA systems. Automakers in the region are actively integrating these systems into luxury and mid-range vehicles to meet evolving expectations for safety and convenience.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market scope & definition

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Raw material suppliers

- 3.1.2 Component suppliers

- 3.1.3 Software developers

- 3.1.4 Technology providers

- 3.1.5 Aftermarket providers

- 3.1.6 End users

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Technology & innovation landscape

- 3.5 Cost breakdown analysis

- 3.6 Price analysis

- 3.7 Patent analysis

- 3.8 Key news & initiatives

- 3.9 Regulatory landscape

- 3.10 Traffic congestion statistics, by region

- 3.11 Impact forces

- 3.11.1 Growth drivers

- 3.11.1.1 Urban traffic congestion is driving demand for automated driving systems

- 3.11.1.2 Government safety regulations are increasing the adoption of ADAS features

- 3.11.1.3 Advancements in sensors, cameras, and AI are improving the reliability of TJA

- 3.11.1.4 Consumers are prioritizing comfort and convenience in daily commutes

- 3.11.2 Industry pitfalls & challenges

- 3.11.2.1 High integration costs

- 3.11.2.2 System performance issues in adverse weather and complex road conditions

- 3.11.1 Growth drivers

- 3.12 Growth potential analysis

- 3.13 Porter’s analysis

- 3.14 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Component, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Sensors

- 5.2.1 Radar

- 5.2.2 LiDAR

- 5.2.3 Ultrasonic

- 5.2.4 Others

- 5.3 ECUs

- 5.4 Actuators

- 5.5 Cameras

- 5.6 Others

Chapter 6 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Passenger cars

- 6.2.1 Sedans

- 6.2.2 Hatchbacks

- 6.2.3 SUVs

- 6.3 Commercial vehicles

- 6.3.1 Light Commercial Vehicles (LCV)

- 6.3.2 Heavy Commercial Vehicles (HCV)

Chapter 7 Market Estimates & Forecast, By Level of Automation, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 Level 2

- 7.3 Level 3

- 7.4 Level 4

Chapter 8 Market Estimates & Forecast, By Method, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 Lane tracking system

- 8.3 Vehicle detection and collision avoidance system

- 8.4 Auto steering and speed control system

- 8.5 V2X communication integration

- 8.6 Others

Chapter 9 Market Estimates & Forecast, By Communication, 2021 - 2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 Vehicle-to-Vehicle (V2V)

- 9.3 Vehicle-to-Infrastructure (V2I)

- 9.4 Cellular network-based

- 9.5 Dedicated Short-Range Communication (DSRC)

Chapter 10 Market Estimates & Forecast, By Sales Channel, 2021 - 2034 ($Bn, Units)

- 10.1 Key trends

- 10.2 OEM

- 10.3 Aftermarket

Chapter 11 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 UK

- 11.3.2 Germany

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.3.6 Russia

- 11.3.7 Nordics

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 Australia

- 11.4.5 South Korea

- 11.4.6 Southeast Asia

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.6 MEA

- 11.6.1 UAE

- 11.6.2 South Africa

- 11.6.3 Saudi Arabia

Chapter 12 Company Profiles

- 12.1 Aptiv PLC

- 12.2 Bosch

- 12.3 Continental

- 12.4 Denso

- 12.5 Harman

- 12.6 Hitachi Astemo

- 12.7 Hyundai Mobis

- 12.8 Infineon Technologies

- 12.9 Magna International

- 12.10 Marelli

- 12.11 Mercedes-Benz

- 12.12 Mobileye

- 12.13 NVIDIA

- 12.14 NXP Semiconductors

- 12.15 Renesas Electronics

- 12.16 Texas Instruments

- 12.17 Valeo

- 12.18 Veoneer

- 12.19 Volkswagen

- 12.20 ZF Friedrichshafen