|

市场调查报告书

商品编码

1665426

布艺玩具市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Fabric Toys Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

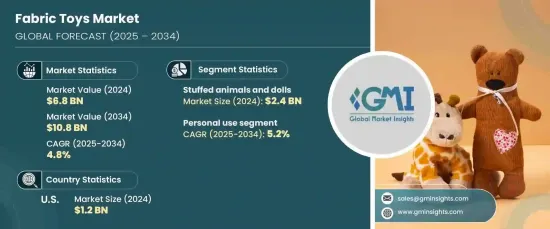

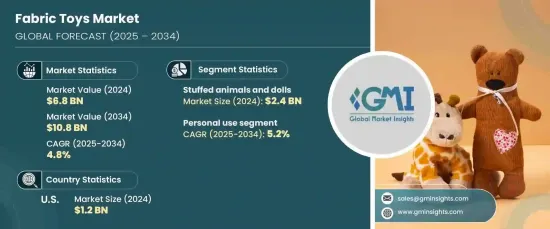

2024 年全球布艺玩具市场价值为 68 亿美元,预计 2025 年至 2034 年的复合年增长率为 4.8%。布製玩具以其柔软、互动性强的设计而闻名,尤其受到家长对年幼儿童的青睐。这些玩具通常包含各种纹理、颜色和声音等感官元素,可以刺激婴幼儿在玩耍时促进他们的发展。

布艺玩具日益受欢迎的另一个重要因素是其安全性。与可能造成受伤风险的硬塑胶玩具不同,布艺玩具由柔软的材料製成,可以减少潜在的伤害。对安全性的关注,加上其教育意义,使得布製玩具成为家长为孩子寻找既有趣又安全的玩乐选择的热门选择。然而,布艺玩具面临着来自塑胶和合成替代品的激烈竞争,因为这些替代品通常更便宜、更耐用。儘管人们逐渐转向环保产品,但塑胶玩具的价格和使用寿命限制了布质玩具的市场份额。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 68亿美元 |

| 预测值 | 108亿美元 |

| 复合年增长率 | 4.8% |

此外,布质玩具在清洁和保养方面需要更加小心。与容易擦拭干净的塑胶玩具不同,布质玩具可能需要经常清洗,这对忙碌的父母来说可能很麻烦。有些布製玩具可以机洗,但它们仍然容易积聚污垢和细菌,这可能会使它们在日常使用中不太方便。

布艺玩具市场分为多种类型,包括毛绒动物和玩偶、益智玩具、活动和游戏玩具以及软音乐玩具。毛绒动物和玩偶引领市场,在 2024 年占有相当大的份额,预计在整个预测期内都会成长。这些玩具因其舒适、养育的特性而受到珍视,并吸引着各个年龄层的儿童。他们的客製化和个人化选项进一步增强了他们的市场主导地位。

从终端用户角度来看,布艺玩具市场分为个人用途和商业用途。个人使用在 2024 年占据最大的市场份额,预计未来几年将保持稳定成长。由于父母为孩子寻求安全、柔软且具有益智性的玩具,对布製玩具的需求日益增加,这一细分市场蓬勃发展。此外,环保、无毒材料的趋势继续推动消费者的偏好,巩固了布製玩具作为个人使用的首选的地位。

在北美,美国在布艺玩具市场占有主导地位。该国市场不仅规模庞大,而且受益于日益关注永续性的消费者群体。由有机或可生物降解材料製成的布製玩具越来越受欢迎,符合环保意识的买家的偏好。随着人们对有利于儿童发展的高品质、个人化玩具的需求日益增长,预计美国将在未来几年继续引领市场。

目录

第 1 章:方法论与范围

- 市场范围和定义

- 基础估算与计算

- 预测参数

- 资料来源

- 基本的

- 次要

- 付费来源

- 公共资源

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 影响价值链的因素

- 利润率分析

- 中断

- 未来展望

- 製造商

- 经销商

- 零售商

- 衝击力

- 成长动力

- 人们对教育益处和益智玩具的认识不断提高

- 偏好柔软安全的玩具

- 手工製作和个人化玩具越来越受欢迎

- 产业陷阱与挑战

- 来自合成玩具的竞争

- 对卫生和维护的担忧

- 成长动力

- 技术与创新格局

- 消费者购买行为分析

- 人口趋势

- 影响购买决策的因素

- 消费者产品采用

- 首选配销通路

- 成长潜力分析

- 监管格局

- 定价分析

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第 5 章:市场估计与预测:按产品类型,2021 年至 2034 年

- 主要趋势

- 毛绒动物和洋娃娃

- 益智玩具

- 活动和游戏玩具

- 软音乐玩具

- 其他的

第六章:市场估计与预测:依年龄组,2021 – 2034 年

- 主要趋势

- 0~3岁

- 3-6 岁

- 6-12 岁

第 7 章:市场估计与预测:按材料,2021 年至 2034 年

- 主要趋势

- 棉布

- 聚酯纤维布料

- 有机布料

- 混纺布料

第 8 章:市场估计与预测:按价格,2021 年至 2034 年

- 主要趋势

- 低的

- 中等的

- 高的

第 9 章:市场估计与预测:依最终用途,2021 年至 2034 年

- 主要趋势

- 个人使用

- 商业用途

第 10 章:市场估计与预测:按配销通路,2021 年至 2034 年

第 11 章:

- 主要趋势

- 在线的

- 电子商务网站

- 公司自有网站

- 离线

- 超市和大卖场

- 专卖店

- 其他

第 12 章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 马来西亚

- 印尼

- 拉丁美洲

- 巴西

- 墨西哥

- 中东及非洲

- 沙乌地阿拉伯

- 阿联酋

- 南非

第 13 章:公司简介

- Aurora World

- Cloud b

- Gund

- Hasbro

- IKEA (Soft Toy Line)

- Jellycat

- LEGO

- Mary Meyer Corporation

- Mattel

- Melissa & Doug

- Spin Master

- Steiff

- The Manhattan Toy Company

- Ty

- Wild Republic

The Global Fabric Toys Market, valued at USD 6.8 billion in 2024, is projected to grow at a CAGR of 4.8% from 2025 to 2034. As parents place increasing importance on toys that promote their children's cognitive and motor development, there is a noticeable shift towards educational toys. Fabric toys, known for their soft, interactive designs, are especially favored by parents for younger children. These toys often incorporate sensory elements such as various textures, colors, and sounds, which stimulate infants and toddlers and aid in their development while they play.

Another significant factor contributing to the growing popularity of fabric toys is their safety profile. Unlike hard plastic toys, which can present injury risks, fabric toys are made from soft materials that reduce potential harm. This focus on safety, alongside the educational benefits, is making fabric toys a sought-after choice for parents looking for both fun and secure playtime options for their little ones. However, fabric toys face stiff competition from plastic and synthetic alternatives, which are typically cheaper and more durable. Although there is a shift towards eco-friendly products, the affordability and longevity of plastic toys limit fabric toys' market share.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $6.8 Billion |

| Forecast Value | $10.8 Billion |

| CAGR | 4.8% |

Additionally, fabric toys require more care in terms of cleaning and maintenance. Unlike plastic toys, which are easy to wipe clean, fabric toys may need frequent washing, and this can be a hassle for busy parents. Some fabric toys are machine washable, but they may still be prone to collecting dirt and bacteria, which could make them less convenient for everyday use.

The fabric toys market is segmented into various types, including stuffed animals and dolls, educational toys, activity and play toys, and soft musical toys. Stuffed animals and dolls lead the market, with a significant share in 2024 and expected growth throughout the forecast period. These toys are cherished for their comforting, nurturing qualities and appeal to children across a wide age range. Their customization and personalization options further contribute to their market dominance.

From an end-user perspective, the fabric toys market is divided into personal use and commercial use. Personal use accounted for the largest market share in 2024 and is projected to maintain steady growth in the coming years. This segment thrives on the increasing demand for fabric toys among parents looking for safe, soft, and educational toys for their children. Moreover, the trend toward eco-friendly, non-toxic materials continues to drive consumer preferences, solidifying fabric toys as a top choice for personal use.

In North America, the U.S. holds a dominant position in the fabric toys market. The country's market is not only large but also benefits from a consumer base that is increasingly focused on sustainability. Fabric toys made from organic or biodegradable materials are gaining traction, aligning with the preferences of eco-conscious buyers. With a growing inclination toward high-quality, personalized toys that support child development, the U.S. is expected to continue leading the market in the years to come.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definition

- 1.2 Base estimates & calculations

- 1.3 Forecast parameters

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factors affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.1.7 Retailers

- 3.2 Impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising awareness of educational benefits and developmental toys

- 3.2.1.2 Preference for soft and safe toys

- 3.2.1.3 Increasing popularity of handmade and personalized toys

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 Competition from synthetic toys

- 3.2.2.2 Concerns over hygiene and maintenance

- 3.2.1 Growth drivers

- 3.3 Technology & innovation landscape

- 3.4 Consumer buying behavior analysis

- 3.4.1 Demographic trends

- 3.4.2 Factors affecting buying decision

- 3.4.3 Consumer product adoption

- 3.4.4 Preferred distribution channel

- 3.5 Growth potential analysis

- 3.6 Regulatory landscape

- 3.7 Pricing analysis

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Product Type, 2021 – 2034, (USD Billion)

- 5.1 Key trends

- 5.2 Stuffed animals and dolls

- 5.3 Educational toys

- 5.4 Activity and play toys

- 5.5 Soft musical toys

- 5.6 Others

Chapter 6 Market Estimates & Forecast, By Age Group, 2021 – 2034, (USD Billion)

- 6.1 Key trends

- 6.2 0–3 years

- 6.3 3-6 years

- 6.4 6-12 years

Chapter 7 Market Estimates & Forecast, By Material, 2021 – 2034, (USD Billion)

- 7.1 Key trends

- 7.2 Cotton

- 7.3 Polyester fabric

- 7.4 Organic fabric

- 7.5 Blended fabrics

Chapter 8 Market Estimates & Forecast, By Price, 2021 – 2034, (USD Billion)

- 8.1 Key trends

- 8.2 Low

- 8.3 Medium

- 8.4 High

Chapter 9 Market Estimates & Forecast, By End Use, 2021 – 2034, (USD Billion)

- 9.1 Key trends

- 9.2 Personal use

- 9.3 Commercial use

Chapter 10 Market Estimates & Forecast, By Distribution Channel, 2021 – 2034, (USD Billion)

Chapter 11

- 11.1 Key trends

- 11.2 Online

- 11.2.1 E-commerce website

- 11.2.2 Company owned website

- 11.3 Offline

- 11.3.1 Supermarkets and hypermarkets

- 11.3.2 Specialty stores

- 11.3.3 Other

Chapter 12 Market Estimates & Forecast, By Region, 2021 – 2034, (USD Billion)

- 12.1 Key trends

- 12.2 North America

- 12.2.1 U.S.

- 12.2.2 Canada

- 12.3 Europe

- 12.3.1 Germany

- 12.3.2 UK

- 12.3.3 France

- 12.3.4 Italy

- 12.3.5 Spain

- 12.4 Asia Pacific

- 12.4.1 China

- 12.4.2 India

- 12.4.3 Japan

- 12.4.4 South Korea

- 12.4.5 Australia

- 12.4.6 Malaysia

- 12.4.7 Indonesia

- 12.5 Latin America

- 12.5.1 Brazil

- 12.5.2 Mexico

- 12.6 MEA

- 12.6.1 Saudi Arabia

- 12.6.2 UAE

- 12.6.3 South Africa

Chapter 13 Company Profiles (Business Overview, Financial Data, Product Landscape, Strategic Outlook, SWOT Analysis)

- 13.1 Aurora World

- 13.2 Cloud b

- 13.3 Gund

- 13.4 Hasbro

- 13.5 IKEA (Soft Toy Line)

- 13.6 Jellycat

- 13.7 LEGO

- 13.8 Mary Meyer Corporation

- 13.9 Mattel

- 13.10 Melissa & Doug

- 13.11 Spin Master

- 13.12 Steiff

- 13.13 The Manhattan Toy Company

- 13.14 Ty

- 13.15 Wild Republic