|

市场调查报告书

商品编码

1665432

酱汁、调味品和调味品市场机会、成长动力、产业趋势分析与预测 2025 - 2034Sauces, Dressings, and Condiments Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

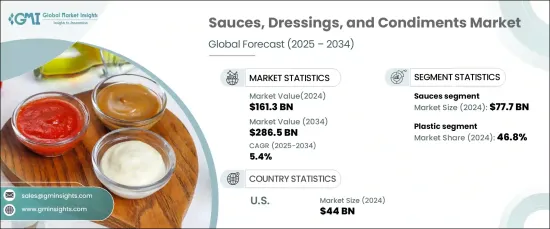

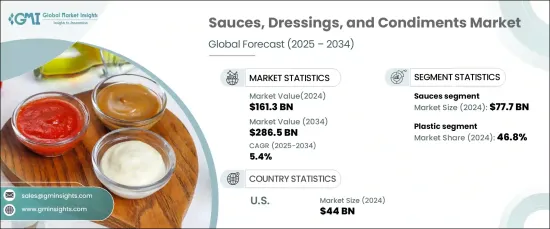

2024 年全球酱汁、调味品和调味品市场价值为 1,613 亿美元,预计 2025 年至 2034 年期间的复合年增长率为 5.4%。随着生活方式的日益忙碌,对包装物品的需求大幅增加,塑胶包装因其价格实惠、设计用户友好而成为热门选择。玻璃包装通常与高端品牌相关,保持了其吸引力,而纸盒包装通常用于较大容量的包装和食品服务目的。

随着注重健康的消费者寻求有机和天然替代品,市场正在发生变化,推动了口味组合和成分选择的创新。随着数位购物越来越受欢迎,线上平台正在成为重要的销售管道,儘管传统零售仍然占主导地位。对环保选择和永续包装解决方案的兴趣进一步支持了市场成长。儘管面临定价问题和区域偏好等挑战,该行业的韧性源于其适应新兴趋势和消费者需求的能力。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 1613亿美元 |

| 预测值 | 2865亿美元 |

| 复合年增长率 | 5.4% |

2024 年,酱料部门的营收为 777 亿美元,成为市场最大的贡献者。酱汁因其能够增强日常膳食的味道并满足人们日益增长的快餐和即食食品的流行需求而越来越受到青睐。人们对全球美食的兴趣日益浓厚,增强了它们的吸引力,而更健康和更好的配方的进步进一步刺激了需求。因此,酱料在推动整个市场成长方面发挥着至关重要的作用。

2024 年塑胶包装占了 46.8% 的市场份额,由于其轻量化设计、成本效益和适应性,成为最广泛使用的材料。可挤压的瓶子和可重新密封的袋子等特性使得塑胶在零售和食品服务用途上非常实用。透过可回收和可生物降解塑胶的创新来解决环境问题的努力继续提升了其受欢迎程度。与玻璃和纸箱包装相比,塑胶因其多功能性和便利性而脱颖而出。

随着电子商务平台的不断扩张和消费者购物习惯的不断改变,线上配销通路正在快速增长。网上购物的便利,加上产品种类繁多和送货上门,使这一领域极具吸引力。儘管传统零售仍然是主要的分销方式,但增强的物流和安全的数位支付系统进一步支持了该通路的崛起。

在美国,酱汁、调味料和调味品市场在 2024 年的产值超过 440 亿美元。此外,永续包装和数位购物解决方案的进步正在塑造市场的未来发展轨迹。

目录

第 1 章:方法论与范围

- 市场范围和定义

- 基础估算与计算

- 预测计算

- 资料来源

- 基本的

- 次要

- 付费来源

- 公共资源

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 影响价值链的因素

- 利润率分析

- 中断

- 未来展望

- 製造商

- 经销商

- 供应商概况

- 利润率分析

- 重要新闻及倡议

- 监管格局

- 衝击力

- 成长动力

- 消费者对便利性的需求不断增加

- 健康与保健趋势

- 扩大电子商务平台

- 产业陷阱与挑战

- 价格敏感度

- 口味偏好和地区差异

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第 5 章:市场估计与预测:按类型,2021 年至 2034 年

- 主要趋势

- 酱汁

- 番茄为主

- 大豆基

- 辣椒为主

- 乳霜类

- 其他的

- 敷料

- 蛋黄酱和奶油调味料

- 优格调味料

- 油性敷料

- 其他的

- 调味品

- 调味品

- 泡菜

- 其他的

第 6 章:市场估计与预测:依包装材料,2021-2034 年

- 主要趋势

- 玻璃

- 塑胶

- 纸箱

- 其他的

第 7 章:市场估计与预测:按配销通路,2021-2034 年

- 主要趋势

- 在线的

- 电子商务平台

- 品牌网站

- 离线

- 超市场

- 方便的

- 专业

- 其他的

- 在线的

第 8 章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 中东及非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第九章:公司简介

- Apis India

- Heinz

- Hellmann'S

- Kikkoman India

- Kissan

- Nestle

- Nutralite

- Orchard Lane

- Tops

- Unilever

- Veeb

The Global Sauces, Dressings, And Condiments Market was valued at USD 161.3 billion in 2024 and is projected to grow at a CAGR of 5.4% between 2025 and 2034. This growth is fueled by changing consumer preferences, including a desire for convenience, diverse flavors, and premium products. The demand for packaged items has increased significantly due to busier lifestyles, with plastic packaging emerging as a popular choice for its affordability and user-friendly design. Glass packaging, often linked to premium brands, maintains its appeal while cartons are commonly used for larger volumes, and food service purposes.

The market is evolving as health-conscious consumers seek organic and natural alternatives, driving innovations in flavor combinations and ingredient choices. Online platforms are becoming a key sales channel as digital shopping gains popularity, though traditional retail remains dominant. Interest in environmentally friendly options and sustainable packaging solutions further supports market growth. Despite challenges such as pricing concerns and regional preferences, the industry's resilience stems from its ability to adapt to emerging trends and consumer needs.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $161.3 Billion |

| Forecast Value | $286.5 Billion |

| CAGR | 5.4% |

In 2024, the sauces segment accounted for USD 77.7 billion in revenue, making it the largest contributor to the market. Sauces are increasingly favored for their ability to enhance everyday meals and cater to the growing popularity of quick-preparation and ready-to-eat foods. Rising interest in global cuisines has amplified their appeal, while advancements in healthier and premium formulations have further spurred demand. As a result, sauces play a crucial role in driving overall market growth.

Plastic packaging represented 46.8% of the market share in 2024, making it the most widely used material due to its lightweight design, cost efficiency, and adaptability. Features such as squeezable bottles and resealable pouches make plastic highly practical for both retail and food service uses. Efforts to address environmental concerns through innovations in recyclable and biodegradable plastics continue to bolster its popularity. Compared to glass and carton packaging, plastic stands out for its versatility and convenience.

The online distribution channel is witnessing rapid growth, driven by the expanding presence of e-commerce platforms and changing consumer shopping habits. The convenience of online purchasing, coupled with product variety and home delivery, has made this segment highly attractive. Enhanced logistics and secure digital payment systems further support the channel's rise, even as traditional retail remains the primary mode of distribution.

In the United States, the sauces, dressings, and condiments market generated over USD 44 billion in 2024. Consumer interest in ready-to-use food products, alongside rising demand for health-focused and innovative options, has propelled growth. Additionally, advancements in sustainable packaging and digital shopping solutions are shaping the market's future trajectory.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Rising consumer demand for convenience

- 3.6.1.2 Health and wellness trends

- 3.6.1.3 Expanding E-commerce platforms

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 Price sensitivity

- 3.6.2.2 Flavor preferences and regional differences

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Type, 2021-2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Sauces

- 5.2.1 Tomato-based

- 5.2.2 Soy-based

- 5.2.3 Chili-based

- 5.2.4 Cream-based

- 5.2.5 Others

- 5.3 Dressings

- 5.3.1 Mayonnaise and creamy dressings

- 5.3.2 Yogurt-based dressings

- 5.3.3 Oil-based dressings

- 5.3.4 Others

- 5.4 Condiments

- 5.4.1 Relishes

- 5.4.2 Pickles

- 5.4.3 Others

Chapter 6 Market Estimates & Forecast, By Packaging Material, 2021-2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Glass

- 6.3 Plastic

- 6.4 Cartons

- 6.5 Others

Chapter 7 Market Estimates & Forecast, By Distribution Channel, 2021-2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.1.1 Online

- 7.1.1.1 E-commerce platform

- 7.1.1.2 Brand websites

- 7.1.2 Offline

- 7.1.2.1 Super market

- 7.1.2.2 Convenient

- 7.1.2.3 Specialty

- 7.1.2.4 Others

- 7.1.1 Online

Chapter 8 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 Germany

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Russia

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.4.5 Australia

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.6 MEA

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Apis India

- 9.2 Heinz

- 9.3 Hellmann’S

- 9.4 Kikkoman India

- 9.5 Kissan

- 9.6 Nestle

- 9.7 Nutralite

- 9.8 Orchard Lane

- 9.9 Tops

- 9.10 Unilever

- 9.11 Veeb