|

市场调查报告书

商品编码

1665434

替代燃料喷射系统市场机会、成长动力、产业趋势分析与 2025 - 2034 年预测Alternative Fuel Injection Systems Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

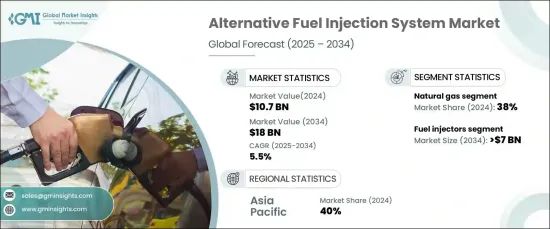

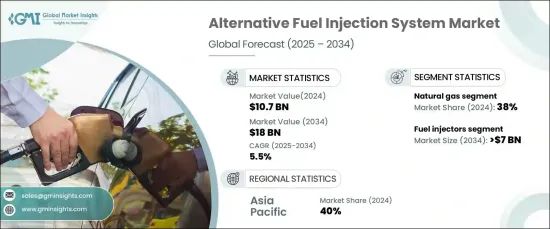

2024 年全球替代燃料喷射系统市场价值为 107 亿美元,预计 2025 年至 2034 年期间将以 5.5% 的强劲复合年增长率增长。这些燃料越来越受到公车和卡车等车队车辆的青睐,因此需要先进的喷射系统来最大程度地提高燃烧效率。

替代燃料喷射系统市场分为电子控制单元 (ECU)、燃油喷射器、燃油轨和压力调节器。其中,燃油喷射器领域在 2024 年占据主导地位,占 40% 的市场份额,预计到 2034 年将达到 70 亿美元。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 107亿美元 |

| 预测值 | 180亿美元 |

| 复合年增长率 | 5.5% |

喷油器技术的创新正在透过实现精确的燃油输送而彻底改变市场,从而提高引擎效率并减少浪费。更严格的排放法规和持续的性能优化推动了对与氢气和天然气等替代燃料相容的耐用喷油器的需求日益增长。材料科学的进步(例如高强度合金和保护涂层)正在提高喷油器的耐用性和功能性,大大促进其应用。

市场分为氢气、液化石油气、生物燃料、天然气和其他替代品。 2024年,天然气领域占最大份额,占38%的市场。它之所以受欢迎,很大程度上归因于其与传统燃料相比价格便宜且碳排放量更低,这使其成为商业车队和公共交通的有吸引力的选择。北美和亚太地区政府的支持性政策正在加速向天然气的转变,其推动力是其降低营运成本和提高永续性的潜力。为了满足日益增长的需求,目前正在开发用于优化天然气燃烧的先进燃油喷射系统。

2024 年,亚太地区将占据替代燃料喷射系统市场的 40%,其中日本、印度和韩国等国家处于向清洁能源解决方案转变的前沿。该地区各国政府正透过补贴、税收优惠和补助等各种措施推广替代燃料。防治城市污染和提高空气品质的努力进一步推动了先进燃油喷射技术的应用。由于高度重视永续性和更清洁的交通,亚太地区有望继续成为市场成长的关键驱动力。

目录

第 1 章:方法论与范围

- 研究设计

- 研究方法

- 资料收集方法

- 基础估算与计算

- 基准年计算

- 市场估计的主要趋势

- 预测模型

- 初步研究和验证

- 主要来源

- 资料探勘来源

- 市场范围和定义

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 原物料供应商

- 零件供应商

- 製造商

- 最终用户

- 供应商概况

- 利润率分析

- 技术与创新格局

- 专利分析

- 重要新闻及倡议

- 监管格局

- 定价分析

- 衝击力

- 成长动力

- 政府对排放的严格规定

- 对更清洁、可持续的交通解决方案的需求日益增长

- 天然气和氢气作为替代燃料的使用日益增多

- 燃油喷射系统的技术进步提高了性能

- 产业陷阱与挑战

- 替代燃油喷射系统的初始成本高

- 替代燃料的可用性和基础设施有限

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:按燃料,2021 - 2034 年

- 主要趋势

- 天然气

- 氢

- 液化石油气

- 生物燃料

- 其他的

第六章:市场估计与预测:按组件,2021 - 2034 年

- 主要趋势

- 燃油喷射器

- 燃油导轨

- 电子控制单元(ECU)

- 压力调节器

第 7 章:市场估计与预测:按技术,2021 - 2034 年

- 主要趋势

- 连接埠注入

- 直接喷射

- 双燃料系统

- 顺序喷射

第 8 章:市场估计与预测:按车型,2021 - 2034 年

- 主要趋势

- 搭乘用车

- 轿车

- 掀背车

- SUV

- 商用车

- 轻型商用车 (LCV)

- 重型商用车 (HCV)

- 越野车

- 建筑设备

- 采矿设备

第 9 章:市场估计与预测:按销售管道,2021 - 2034 年

- 主要趋势

- OEM

- 售后市场

第 10 章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 北欧

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 东南亚

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东及非洲

- 阿联酋

- 南非

- 沙乌地阿拉伯

第 11 章:公司简介

- Aptiv

- Bosch

- Continental

- Cummins

- Delphi (Phinia)

- Denso

- Eaton

- Honeywell

- Infineon

- Magneti Marelli

- Mitsubishi

- Pierburg

- Ricardo plc

- Schaeffler

- Tenneco

- Valeo

- Weichai

- Westport Fuel Systems

- Woodward

- Zexel

The Global Alternative Fuel Injection Systems Market was valued at USD 10.7 billion in 2024 and is anticipated to grow at a robust CAGR of 5.5% between 2025 and 2034. The rising demand for cost-effective and eco-friendly fuel options, such as natural gas in its compressed (CNG) and liquefied (LNG) forms, is driving this growth. These fuels are increasingly preferred for fleet vehicles like buses and trucks, necessitating advanced injection systems designed to maximize combustion efficiency.

The alternative fuel injection systems market is segmented into electronic control units (ECUs), fuel injectors, fuel rails, and pressure regulators. Among these, the fuel injectors segment dominated in 2024, capturing 40% of the market share, and is projected to reach USD 7 billion by 2034.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $10.7 Billion |

| Forecast Value | $18 Billion |

| CAGR | 5.5% |

Innovations in injector technology are revolutionizing the market by enabling precise fuel delivery, which improves engine efficiency and reduces waste. The growing demand for durable injectors compatible with alternative fuels like hydrogen and natural gas is further fueled by stricter emission regulations and the ongoing push for performance optimization. Advances in materials science-such as high-strength alloys and protective coatings-are enhancing injector durability and functionality, significantly boosting their adoption.

The market is categorized into hydrogen, LPG, biofuels, natural gas, and other alternatives. In 2024, the natural gas segment held the largest share, accounting for 38% of the market. Its popularity is largely attributed to its affordability and lower carbon emissions compared to traditional fuels, making it an attractive choice for commercial fleets and public transportation. Supportive government policies across North America and Asia-Pacific are accelerating the transition to natural gas, driven by its potential to reduce operational costs and improve sustainability. Advanced fuel injection systems tailored for optimized natural gas combustion are being developed to meet this surging demand.

The Asia-Pacific region accounted for 40% of the alternative fuel injection systems market in 2024, with countries like Japan, India, and South Korea at the forefront of the shift toward cleaner energy solutions. Governments in this region are promoting alternative fuels through various initiatives, including subsidies, tax benefits, and grants. Efforts to combat urban pollution and enhance air quality are further propelling the adoption of advanced fuel injection technologies. With a strong emphasis on sustainability and cleaner transportation, Asia-Pacific is poised to remain a critical driver for market growth.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market scope & definition

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Raw material suppliers

- 3.1.2 Component suppliers

- 3.1.3 Manufacturers

- 3.1.4 End users

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Technology & innovation landscape

- 3.5 Patent analysis

- 3.6 Key news & initiatives

- 3.7 Regulatory landscape

- 3.8 Pricing analysis

- 3.9 Impact forces

- 3.9.1 Growth drivers

- 3.9.1.1 Stringent government regulations on emissions

- 3.9.1.2 Growing demand for cleaner and sustainable transportation solutions

- 3.9.1.3 Rising adoption of natural gas and hydrogen as alternative fuels

- 3.9.1.4 Technological advancements in fuel injection systems for enhanced performance

- 3.9.2 Industry pitfalls & challenges

- 3.9.2.1 High initial cost of alternative fuel injection systems

- 3.9.2.2 Limited availability and infrastructure for alternative fuels

- 3.9.1 Growth drivers

- 3.10 Growth potential analysis

- 3.11 Porter’s analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Fuel, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Natural gas

- 5.3 Hydrogen

- 5.4 LPG

- 5.5 Biofuels

- 5.6 Others

Chapter 6 Market Estimates & Forecast, By Component, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Fuel injectors

- 6.3 Fuel rails

- 6.4 Electronic Control Unit (ECU)

- 6.5 Pressure regulators

Chapter 7 Market Estimates & Forecast, By Technology, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 Port injection

- 7.3 Direct injection

- 7.4 Dual fuel systems

- 7.5 Sequential injection

Chapter 8 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 Passenger cars

- 8.2.1 Sedans

- 8.2.2 Hatchbacks

- 8.2.3 SUVs

- 8.3 Commercial vehicles

- 8.3.1 Light Commercial Vehicles (LCV)

- 8.3.2 Heavy Commercial Vehicles (HCV)

- 8.4 Off-road Vehicles

- 8.4.1 Construction Equipment

- 8.4.2 Mining Equipment

Chapter 9 Market Estimates & Forecast, By Sales Channel, 2021 - 2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 OEM

- 9.3 Aftermarket

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.3.7 Nordics

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.4.6 Southeast Asia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 UAE

- 10.6.2 South Africa

- 10.6.3 Saudi Arabia

Chapter 11 Company Profiles

- 11.1 Aptiv

- 11.2 Bosch

- 11.3 Continental

- 11.4 Cummins

- 11.5 Delphi (Phinia)

- 11.6 Denso

- 11.7 Eaton

- 11.8 Honeywell

- 11.9 Infineon

- 11.10 Magneti Marelli

- 11.11 Mitsubishi

- 11.12 Pierburg

- 11.13 Ricardo plc

- 11.14 Schaeffler

- 11.15 Tenneco

- 11.16 Valeo

- 11.17 Weichai

- 11.18 Westport Fuel Systems

- 11.19 Woodward

- 11.20 Zexel