|

市场调查报告书

商品编码

1666526

精密齿轮箱机械市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Precision Gearbox Machinery Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

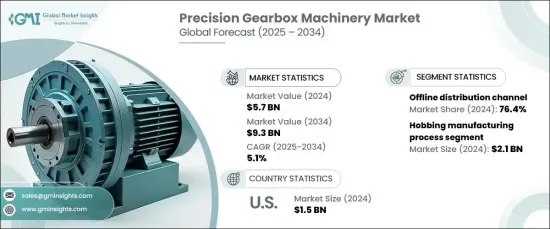

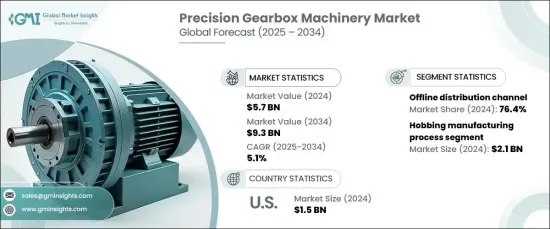

2024 年全球精密齿轮箱机械市场规模达到 57 亿美元,预计 2025 年至 2034 年期间复合年增长率为 5.1 %。随着行业技术的不断进步,对精密变速箱解决方案的需求激增,以确保复杂机械的高效可靠运作。特别是汽车和航太领域强调安全性和准确性,推动采用符合严格性能和可靠性标准的先进变速箱。

市场也受益于製造业和工业过程中自动化和机器人技术的快速应用。企业正在将物联网和智慧感测器等尖端技术整合到齿轮系统中,以实现即时监控、预测性维护和提高营运效率。这些创新不仅优化了电力传输,而且还透过减少能源损失来支持永续发展目标。人们越来越关注能源效率和减少环境影响,这进一步推动了先进变速箱解决方案的发展,强化了其作为现代工业运作基石的作用。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 57亿美元 |

| 预测值 | 93亿美元 |

| 复合年增长率 | 5.1% |

滚齿製造流程在 2024 年贡献了 21 亿美元的产值,预计未来十年将以 5.5% 的强劲复合年增长率成长。工业界青睐滚齿,因为它具有无与伦比的生产复杂形状和细齿廓齿轮的能力,这对于高性能应用至关重要。这种製造技术可确保卓越的精度、一致性和成本效率,使其成为各行业精密齿轮大规模生产的首选。

2024 年,线下分销通路占据 76.4% 的市场份额,预计在预测期内以 5% 的复合年增长率成长。由于需要个人化服务、技术咨询和直接互动,线下管道仍然是首选。这些管道对于汽车、航太和製造等行业尤其重要,这些行业中的企业优先考虑对技术规格进行实际评估,以确保购买前变速箱解决方案的可靠性。

由于美国强大的製造业基础和在自动化和机器人的领导地位,美国精密变速箱机械市场将在 2024 年创造 15 亿美元的收入。美国是领先的机械和设备製造商的所在地,它促进持续创新并确保尖端变速箱技术的稳定供应。中国对工业自动化和精密工程的重视进一步扩大了对高性能齿轮系统的需求,巩固了其作为全球市场成长关键贡献者的地位。

目录

第 1 章:方法论与范围

- 市场范围和定义

- 基础估算与计算

- 预测参数

- 资料来源

- 基本的

- 次要

- 付费来源

- 公共资源

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 影响价值链的因素

- 利润率分析

- 中断

- 未来展望

- 製造商

- 经销商

- 零售商

- 衝击力

- 成长动力

- 模组化厨房越来越受欢迎

- 创新与产品开发

- 有序厨房的需求

- 可支配所得增加

- 产业陷阱与挑战

- 低品质产品的耐用性问题

- 缺乏标准化

- 成长动力

- 技术与创新格局

- 消费者购买行为分析

- 人口趋势

- 影响购买决策的因素

- 消费者产品采用

- 首选配销通路

- 成长潜力分析

- 监管格局

- 定价分析

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第 5 章:市场估计与预测:按製造工艺,2021 年至 2034 年

- 主要趋势

- 滚齿

- 研磨

- 转向

- 珩磨

第 6 章:市场估计与预测:按产品,2021 年至 2034 年

- 主要趋势

- 行星

- 直角

- 平行线

第 7 章:市场估计与预测:按应用,2021 年至 2034 年

- 主要趋势

- 工具机

- 物料处理

- 包装

- 机器人

- 汽车

- 越野车

- 风塔

- 农业

- 铁路

- 海洋

- 其他的

第 8 章:市场估计与预测:按配销通路,2021 年至 2034 年

- 主要趋势

- 在线的

- 电子商务网站

- 离线

- OEM (原始设备製造商)

- 专卖店/陈列室

第 9 章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 马来西亚

- 印尼

- 拉丁美洲

- 巴西

- 墨西哥

- 中东及非洲

- 沙乌地阿拉伯

- 阿联酋

- 南非

第十章:公司简介

- DANOBAT

- DMG MORI

- DVS Technology Group

- EMAG

- Gleason Corporation

- Lagun Engineering

- Liebherr-International Deutschland

- Matrix Precision

- Nidec

- Reishauer

- Samputensili Cutting Tools

- JG WEISSER SOHNE

- Starrag Group

The Global Precision Gearbox Machinery Market reached USD 5.7 billion in 2024 and is projected to expand at a CAGR of 5.1% from 2025 to 2034. This growth reflects the rising demand for high-performance gear systems across key sectors, including automotive, aerospace, energy, and robotics. As industries continue to advance technologically, the need for precision gearbox solutions has surged to ensure the efficient and reliable operation of complex machinery. In particular, the automotive and aerospace sectors emphasize safety and accuracy, driving the adoption of advanced gearboxes that meet stringent performance and reliability standards.

The market is also benefiting from the rapid adoption of automation and robotics in manufacturing and industrial processes. Businesses are integrating cutting-edge technologies such as IoT and smart sensors into gear systems to enable real-time monitoring, predictive maintenance, and enhanced operational efficiency. These innovations not only optimize power transmission but also support sustainability goals by reducing energy losses. The growing focus on energy efficiency and minimizing environmental impact further fuels the development of advanced gearbox solutions, reinforcing their role as a cornerstone of modern industrial operations.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $5.7 Billion |

| Forecast Value | $9.3 Billion |

| CAGR | 5.1% |

The hobbing manufacturing process contributed USD 2.1 billion in 2024 and is forecasted to grow at a robust CAGR of 5.5% during the next decade. Industries favor hobbing for its unparalleled ability to produce gears with intricate shapes and fine-tooth profiles, which are essential for high-performance applications. This manufacturing technique ensures exceptional accuracy, consistency, and cost efficiency, making it the go-to choice for large-scale production of precision gears across industries.

In 2024, offline distribution channels accounted for 76.4% of the market share and are projected to grow at a CAGR of 5% over the forecast period. Offline channels remain a preferred choice due to the need for personalized service, technical consultations, and direct interactions. These channels are particularly vital for sectors such as automotive, aerospace, and manufacturing, where businesses prioritize hands-on evaluations of technical specifications to ensure the reliability of gearbox solutions before purchase.

The US precision gearbox machinery market generated USD 1.5 billion in 2024, driven by the country's robust manufacturing base and leadership in automation and robotics. Home to leading machinery and equipment manufacturers, the US fosters continuous innovation and ensures a steady supply of cutting-edge gearbox technologies. The nation's focus on industrial automation and precision engineering further amplifies the demand for high-performance gear systems, solidifying its position as a key contributor to global market growth.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definition

- 1.2 Base estimates & calculations

- 1.3 Forecast parameters

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factors affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.1.7 Retailers

- 3.2 Impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing preference for modular kitchens

- 3.2.1.2 Innovation and product development

- 3.2.1.3 Demand for organized kitchens

- 3.2.1.4 Rise in disposable income

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 Durability concerns in low-quality products

- 3.2.2.2 Lack of standardization

- 3.2.1 Growth drivers

- 3.3 Technology & innovation landscape

- 3.4 Consumer buying behavior analysis

- 3.4.1 Demographic trends

- 3.4.2 Factors affecting buying decision

- 3.4.3 Consumer product adoption

- 3.4.4 Preferred distribution channel

- 3.5 Growth potential analysis

- 3.6 Regulatory landscape

- 3.7 Pricing analysis

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Manufacturing Process, 2021 – 2034, (USD Billion) (Million Units)

- 5.1 Key trends

- 5.2 Hobbing

- 5.3 Grinding

- 5.4 Turning

- 5.5 Honing

Chapter 6 Market Estimates & Forecast, By Product, 2021 – 2034, (USD Billion) (Million Units)

- 6.1 Key trends

- 6.2 Planetary

- 6.3 Right angle

- 6.4 Parallel

Chapter 7 Market Estimates & Forecast, By Application, 2021 – 2034, (USD Billion) (Million Units)

- 7.1 Key trends

- 7.2 Machine tools

- 7.3 Material handling

- 7.4 Packaging

- 7.5 Robotics

- 7.6 Automobile

- 7.7 Off-road vehicles

- 7.8 Wind towers

- 7.9 Agriculture

- 7.10 Railways

- 7.11 Marine

- 7.12 Others

Chapter 8 Market Estimates & Forecast, By Distribution Channel, 2021 – 2034, (USD Billion) (Million Units)

- 8.1 Key trends

- 8.2 Online

- 8.2.1 E-commerce website

- 8.3 Offline

- 8.3.1 OEM (Original equipment manufacturer)

- 8.3.2 Specialty stores / showrooms

Chapter 9 Market Estimates & Forecast, By Region, 2021 – 2034, (USD Billion) (Million Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.4.6 Malaysia

- 9.4.7 Indonesia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.6 MEA

- 9.6.1 Saudi Arabia

- 9.6.2 UAE

- 9.6.3 South Africa

Chapter 10 Company Profiles (Business Overview, Financial Data, Product Landscape, Strategic Outlook, SWOT Analysis)

- 10.1 DANOBAT

- 10.2 DMG MORI

- 10.3 DVS Technology Group

- 10.4 EMAG

- 10.5 Gleason Corporation

- 10.6 Lagun Engineering

- 10.7 Liebherr-International Deutschland

- 10.8 Matrix Precision

- 10.9 Nidec

- 10.10 Reishauer

- 10.11 Samputensili Cutting Tools

- 10.12 J.G. WEISSER SOHNE

- 10.13 Starrag Group