|

市场调查报告书

商品编码

1666544

物料搬运设备市场机会、成长动力、产业趋势分析与 2025 - 2034 年预测Material Handling Equipment Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

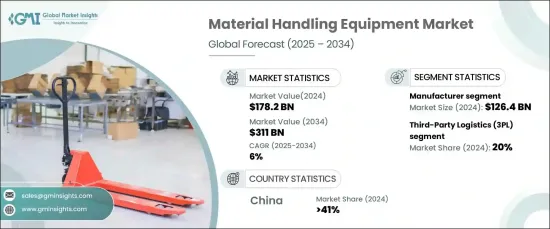

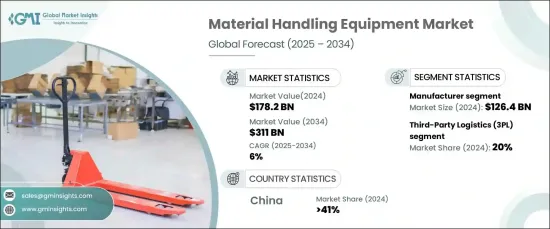

全球物料搬运设备市场预计将从 2024 年的 1,782 亿美元成长,在 2025 年至 2034 年期间的复合年增长率为 6%。机器人拾取器、传送带和自动导引车 (AGV) 等自动化系统对于满足当日和隔天送达的需求越来越重要。

仓库基础设施和配送中心的投资推动了对先进物料搬运设备的需求。为了满足日益增长的电子商务和零售需求,公司需要扩大业务规模,并采用创新的系统来有效地处理大量商品。现代仓库正在迅速向自动化转型,利用机器人解决方案、AGV 和其他先进技术来优化营运效率并跟上市场动态。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 1782亿美元 |

| 预测值 | 3110亿美元 |

| 复合年增长率 | 6% |

市场按类型分为製造商和分销商,其中製造商在 2024 年的收入为 1264 亿美元。随着供应链动态的发展,製造商越来越依赖复杂的物料处理解决方案来提高生产力和简化运营,从而强化这些系统在现代工业中的关键作用。

根据应用,市场涵盖电子商务、第三方物流、食品和饮料、製造、製药和百货商品等领域。受外包物流成长趋势的推动,3PL 领域将在 2024 年占据 20% 的市占率。专注于核心优势的企业正在转向第三方物流供应商,这增加了对先进处理系统的需求,以确保无缝且有效率的营运。

2024 年,中国物料搬运设备市场占有 41% 的份额。此外,该地区的製造业蓬勃发展,凸显出对先进物流和供应链技术满足营运需求的日益依赖。

在自动化、不断变化的消费者期望以及各行业不断扩张的推动下,物料搬运设备市场将实现大幅成长。随着企业不断追求效率和可扩展性,采用创新物料处理解决方案预计将继续成为全球市场发展的关键因素。

目录

第 1 章:方法论与范围

- 研究设计

- 研究方法

- 资料收集方法

- 基础估计和计算

- 基准年计算

- 市场估计的主要趋势

- 预测模型

- 初步研究与验证

- 主要来源

- 资料探勘来源

- 市场定义

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 供应商概况

- 原物料供应商

- 备件供应商

- 零件供应商

- 製造商

- 技术提供者

- 服务提供者

- 系统整合商

- 最终用途

- 利润率分析

- 成本明细分析

- 技术与创新格局

- 重要新闻及倡议

- 监管格局

- 衝击力

- 成长动力

- 拓展电子商务与物流业

- 劳动成本上升以及僱用体力劳动者的不便

- 增加仓库和配送中心的投资

- 增加技术创新和製造活动中的自动化采用

- 产业陷阱与挑战

- 物料搬运设备的初始成本高

- 缺乏设备操作意识

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第 5 章:市场估计与预测:按产品,2021 - 2034 年

- 主要趋势

- 储存和搬运设备

- 机架

- 堆迭框架

- 架子、储物箱和抽屉

- 夹层

- 工业卡车

- 自动导引车

- 手动、平台和托盘搬运车

- 订单拣选员

- 托盘搬运车

- 侧装式

- 步行式堆高机

- 散装物料处理设备

- 传送带

- 箱体输送机

- 托盘输送机

- 堆迭机

- 回收机

- 电梯

- 其他的

- 传送带

- 机器人

- 自主移动机器人

- 协作机器人

- Scara 机器人

- 工业机器人

- 其他的

- 自动仓储系统

- 单元负载 AS/RS

- 轻型货物自动仓储系统

第 6 章:市场估计与预测:按应用,2021 - 2034 年

- 主要趋势

- 第三方物流

- 电子商务

- 百货

- 食品零售

- 食品和饮料

- 製造业

- 耐用的

- 非耐用

- 製药/医疗保健

第 7 章:市场估计与预测:按类型,2021 - 2034 年

- 主要趋势

- 製造商

- 经销商

第 8 章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 北欧

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 东南亚

- 拉丁美洲

- 巴西

- 阿根廷

- 墨西哥

- 中东及非洲

- 阿联酋

- 沙乌地阿拉伯

- 南非

第九章:公司简介

- Beumer Group GmbH & Co. KG

- Clark Material Handling Company

- Columbus McKinnon

- Crown Equipment

- Daifuku Co.

- Dearborn Mid-West Company

- Fives Group

- Flexlink

- Godrej & Boyce Manufacturing Company

- Grenzebach Maschinenbau

- Honeywell Intelligrated

- Hyster-Yale Materials Handling

- JBT

- Jungheinrich

- Kardex

- KION GROUP

- Knapp

- KUKA

- Mecalux, SA

- Mitsubishi Caterpillar Forklift America

- Murata Machinery

- Siemens

- SSI Schaefer Group

- System Logistics

- TGW Logistics Group

- Toyota Industries

- Viastore Systems

9.28 Witron 物流 + 资讯技术

The Global Material Handling Equipment Market is projected to grow from USD 178.2 billion in 2024, expanding at a CAGR of 6% between 2025 and 2034. The rise of e-commerce is a key driver, with growing consumer expectations for rapid delivery pushing online retailers to adopt efficient solutions for inventory management, product sorting, and order fulfillment. Automated systems such as robotic pickers, conveyors, and automated guided vehicles (AGVs) are increasingly essential to meet the demand for same-day and next-day deliveries.

Investments in warehouse infrastructure and distribution centers fuel the need for advanced material handling equipment. Companies scaling their operations to meet increased e-commerce and retail demands require innovative systems to handle high volumes of goods efficiently. Modern warehouses are rapidly transitioning to automation, leveraging robotic solutions, AGVs, and other advanced technologies to optimize operational efficiency and keep pace with market dynamics.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $178.2 Billion |

| Forecast Value | $311 Billion |

| CAGR | 6% |

The market is categorized by type into manufacturers and distributors, with manufacturers generating USD 126.4 billion in revenue in 2024. The manufacturer segment's growth reflects the rising focus on automation and efficiency in production processes. As supply chain dynamics evolve, manufacturers increasingly rely on sophisticated material handling solutions to enhance productivity and streamline operations, reinforcing the critical role of these systems in modern industries.

By application, the market spans sectors including e-commerce, 3PL, food and beverage, manufacturing, pharmaceutical, and general merchandise. The 3PL segment accounted for 20% of the market in 2024, driven by the growing trend of outsourcing logistics. Businesses focusing on their core strengths are turning to third-party logistics providers, heightening the demand for advanced handling systems to ensure seamless and efficient operations.

China material handling equipment market held a 41% share in 2024. The country's robust industrialization, expanding infrastructure projects, and booming e-commerce activities are major contributors to this growth. Additionally, the region's manufacturing sector thrives, underscoring the increasing reliance on advanced logistics and supply chain technologies to meet operational demands.

The material handling equipment market is set to witness substantial growth, driven by automation, evolving consumer expectations, and the continuous expansion of industries across sectors. As companies strive for efficiency and scalability, the adoption of innovative material handling solutions is expected to remain a pivotal factor in the global market's progression.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 Raw material supplier

- 3.2.2 Spare part supplier

- 3.2.3 Component supplier

- 3.2.4 Manufacturer

- 3.2.5 Technology provider

- 3.2.6 Service provider

- 3.2.7 System Integrators

- 3.2.8 End use

- 3.3 Profit margin analysis

- 3.4 Cost breakdown analysis

- 3.5 Technology & innovation landscape

- 3.6 Key news & initiatives

- 3.7 Regulatory landscape

- 3.8 Impact forces

- 3.8.1 Growth drivers

- 3.8.1.1 Expanding e-commerce and logistics industries

- 3.8.1.2 Rising labor costs and the inconvenience of employing a manual workforce

- 3.8.1.3 Increased warehouse and distribution center investments

- 3.8.1.4 Increasing technological innovations and the adoption of automation in manufacturing activities

- 3.8.2 Industry pitfalls & challenges

- 3.8.2.1 High initial costs of material handling equipment

- 3.8.2.2 Lack of awareness of equipment operation

- 3.8.1 Growth drivers

- 3.9 Growth potential analysis

- 3.10 Porter’s analysis

- 3.11 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Product, 2021 - 2034 ($Mn)

- 5.1 Key trends

- 5.2 Storage and handling equipment

- 5.2.1 Racks

- 5.2.2 Stacking frames

- 5.2.3 Shelves, bins and drawers

- 5.2.4 Mezzanines

- 5.3 Industrial trucks

- 5.3.1 AGVs

- 5.3.2 Hand, platform and pallet trucks

- 5.3.3 Order pickers

- 5.3.4 Pallet jacks

- 5.3.5 Side-loaders

- 5.3.6 Walkie stackers

- 5.4 Bulk material handling equipment

- 5.4.1 Conveyor belts

- 5.4.1.1 Case conveyors

- 5.4.1.2 Pallet conveyors

- 5.4.2 Stackers

- 5.4.3 Reclaimers

- 5.4.4 Elevators

- 5.4.5 Others

- 5.4.1 Conveyor belts

- 5.5 Robotics

- 5.5.1 Autonomous mobile robots

- 5.5.2 Cobots

- 5.5.3 Scara robots

- 5.5.4 Industrial robots

- 5.5.5 Others

- 5.6 AS/RS

- 5.6.1 Unit-load AS/RS

- 5.6.2 Mini-load AS/RS

Chapter 6 Market Estimates & Forecast, By Application, 2021 - 2034 ($Mn)

- 6.1 Key trends

- 6.2 3PL

- 6.3 E-commerce

- 6.4 General merchandise

- 6.5 Food retail

- 6.6 Food & beverage

- 6.7 Manufacturing

- 6.7.1 Durable

- 6.7.2 Non-Durable

- 6.8 Pharmaceutical/healthcare

Chapter 7 Market Estimates & Forecast, By Type, 2021 - 2034 ($Mn)

- 7.1 Key trends

- 7.1.1 Manufacturers

- 7.1.2 Distributors

Chapter 8 Market Estimates & Forecast, By Region, 2021 - 2034 ($Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 Germany

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Nordics

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.4.5 Australia

- 8.4.6 Southeast Asia

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Argentina

- 8.5.3 Mexico

- 8.6 MEA

- 8.6.1 UAE

- 8.6.2 Saudi Arabia

- 8.6.3 South Africa

Chapter 9 Company Profiles

- 9.1 Beumer Group GmbH & Co. KG

- 9.2 Clark Material Handling Company

- 9.3 Columbus McKinnon

- 9.4 Crown Equipment

- 9.5 Daifuku Co.

- 9.6 Dearborn Mid-West Company

- 9.7 Fives Group

- 9.8 Flexlink

- 9.9 Godrej & Boyce Manufacturing Company

- 9.10 Grenzebach Maschinenbau

- 9.11 Honeywell Intelligrated

- 9.12 Hyster-Yale Materials Handling

- 9.13 JBT

- 9.14 Jungheinrich

- 9.15 Kardex

- 9.16 KION GROUP

- 9.17 Knapp

- 9.18 KUKA

- 9.19 Mecalux, S.A

- 9.20 Mitsubishi Caterpillar Forklift America

- 9.21 Murata Machinery

- 9.22 Siemens

- 9.23 SSI Schaefer Group

- 9.24 System Logistics

- 9.25 TGW Logistics Group

- 9.26 Toyota Industries

- 9.27 Viastore Systems

- 9.28 Witron Logistik + Informatik