|

市场调查报告书

商品编码

1666567

风味乳液市场机会、成长动力、产业趋势分析与 2025 - 2034 年预测Flavor Emulsion Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

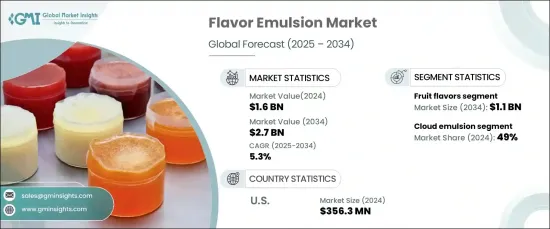

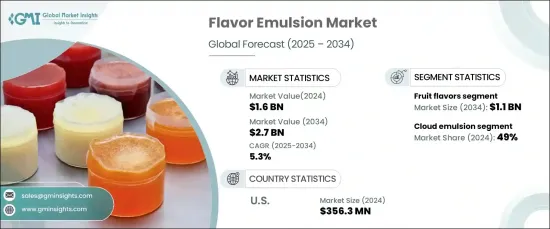

2024 年全球风味乳液市场价值为 16 亿美元,预计 2025 年至 2034 年的复合年增长率为 5.3%。消费者对独特和异国风味的需求不断增长,以及对天然和清洁标籤成分的偏好日益增加,正在推动市场扩张。随着注重健康的消费者寻求更健康的替代品,人们明显转向不含人工添加剂和过敏原的乳剂。植物性饮食日益流行,加上口味组合的创新,进一步推动了市场的发展。

随着消费者在选择食品时优先考虑更健康、更天然的选择,调味乳液对于创造新的美味产品至关重要。它们不仅可以增强食品和饮料的感官吸引力,还可以保持最终产品的稳定性和一致性。植物性食品和清洁标籤食品的日益普及推动了这个市场的发展,吸引了越来越多注重健康的消费者。此外,随着食品製造商寻求满足新口味需求的方法,他们正在转向乳液来提供风味和视觉吸引力,从而在拥挤的市场中提供竞争优势。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 16亿美元 |

| 预测值 | 27亿美元 |

| 复合年增长率 | 5.3% |

市场依口味类型划分,如水果味、乳製品品味、咸味等。 2024 年,水果口味市场占据主导地位,创造 7.149 亿美元的收入。预计到 2034 年该细分市场的规模将达到 11 亿美元,反映出消费者对各种用途的新鲜天然水果口味的需求日益增长。这些口味符合人们对更健康、更正宗的食品和饮料日益增长的需求。乳製品口味以其浓郁、舒适和令人愉悦的口味而闻名,也占据了相当大的市场份额,吸引了寻求熟悉口味的消费者,同时也为创新产品开发提供了空间。

就功能而言,市场分为云乳液、油乳液和其他类型。云状乳液在 2024 年占据了 49% 的最大市场份额。它们透过提供独特的视觉元素来增强整体消费者体验,使其成为饮料创新的一个主要趋势。

在美国,风味乳液市场规模将在 2024 年达到 3.563 亿美元。饮料业,尤其是碳酸饮料、果汁和功能性饮料,正在推动市场向前发展。随着消费者继续优先考虑更健康、更天然的替代品,对高品质、创新风味乳液的需求预计将上升,进一步影响产业前景。

目录

第 1 章:方法论与范围

- 市场范围和定义

- 基础估算与计算

- 预测计算

- 资料来源

- 基本的

- 次要

- 付费来源

- 公共资源

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 影响价值链的因素

- 利润率分析

- 中断

- 未来展望

- 製造商

- 经销商

- 供应商概况

- 利润率分析

- 重要新闻及倡议

- 监管格局

- 衝击力

- 成长动力

- 消费者对独特和异国风味的需求日益增加

- 方便食品和加工食品需求激增

- 风味乳剂在各种美食中的应用

- 产业陷阱与挑战

- 原物料价格波动

- 消费者对人工添加剂的担忧

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第 5 章:市场规模及预测:依口味类型,2021-2034 年

- 主要趋势

- 水果口味

- 乳製品风味

- 咸味

- 其他的

第 6 章:市场规模与预测:按功能,2021-2034 年

- 主要趋势

- 云状乳剂

- 油性乳化剂

- 其他的

第 7 章:市场规模与预测:按应用,2021-2034 年

- 主要趋势

- 麵包和糖果

- 乳製品

- 酱汁和调味品

- 饮料

- 营养保健品

- 其他的

第 8 章:市场规模与预测:按地区,2021-2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 中东及非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第九章:公司简介

- Cape Food Ingredients

- Cargill Incorporated

- Firmenich

- Flavorcon Corporation

- Flavaroma

- Gold Coast Ingredients

- Jamsons Industries

- Keva Flavours

- LorAnn Oils

- M&N Flavor

- Panteley Toshev

The Global Flavor Emulsion Market, valued at USD 1.6 billion in 2024, is projected to expand at a CAGR of 5.3% from 2025 to 2034. Flavor emulsions play a pivotal role in the food and beverage industry by dispersing flavor compounds in oil or water, enhancing the taste and aroma of various products. The increasing consumer demand for unique and exotic flavors, as well as a rising preference for natural and clean-label ingredients, is driving the market's expansion. With health-conscious consumers seeking healthier alternatives, there has been a notable shift toward emulsions free from artificial additives and allergens. The growing popularity of plant-based diets, along with innovations in flavor combinations, is further fueling the market's development.

As consumers prioritize healthier, more natural options in their food choices, flavor emulsions have become essential in the creation of new, flavorful products. They serve not only to enhance the sensory appeal of food and beverages but also to maintain the stability and consistency of the final product. This market is being driven by the increasing popularity of plant-based and clean-label foods, which appeal to the rising number of health-conscious consumers. Additionally, as food manufacturers seek ways to cater to the demand for novel flavors, they are turning to emulsions to deliver both taste and visual appeal, providing a competitive edge in the crowded market.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.6 Billion |

| Forecast Value | $2.7 Billion |

| CAGR | 5.3% |

The market is divided by flavor types, such as fruit, dairy, savory, and others. In 2024, the fruit flavor segment dominated, generating USD 714.9 million in revenue. This segment is expected to reach USD 1.1 billion by 2034, reflecting consumers' growing desire for fresh, natural fruit flavors in various applications. These flavors align with the increasing demand for healthier, more authentic food and beverage options. Dairy flavors, known for their rich, comforting, and indulgent profiles, also hold a significant share of the market, appealing to consumers seeking familiar flavors while offering space for innovative product development.

In terms of functionality, the market is segmented into cloud emulsions, oil emulsions, and other types. Cloud emulsions captured the largest market share of 49% in 2024. Known for their ability to create a visually appealing cloud-like effect in beverages, these emulsions have gained significant popularity, especially in the beverage sector. They enhance the overall consumer experience by providing a unique visual element, making them a key trend in beverage innovation.

In the U.S., the flavor emulsion market reached USD 356.3 million in 2024. This growth is driven by the increasing demand for natural, plant-based, and clean-label food and beverage products. The beverage industry, particularly carbonated drinks, juices, and functional beverages, is helping propel the market forward. As consumers continue to prioritize healthier and more natural alternatives, the demand for high-quality, innovative flavor emulsions is expected to rise, further shaping the industry outlook.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definition

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Increasing consumer demand for unique and exotic flavors

- 3.6.1.2 Surge in demand for convenience and processed foods

- 3.6.1.3 Adoption of flavor emulsions in diverse cuisines

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 Fluctuating prices of raw materials

- 3.6.2.2 Consumer concerns about artificial additives

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Size and Forecast, By Type of Flavor, 2021-2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Fruit flavors

- 5.3 Dairy flavors

- 5.4 Savory flavors

- 5.5 Others

Chapter 6 Market Size and Forecast, By Functionality, 2021-2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Cloud emulsions

- 6.3 Oil emulsions

- 6.4 Others

Chapter 7 Market Size and Forecast, By Application, 2021-2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Bakery and confectionery

- 7.3 Dairy products

- 7.4 Sauces and dressings

- 7.5 Beverages

- 7.6 Nutraceuticals

- 7.7 Others

Chapter 8 Market Size and Forecast, By Region, 2021-2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 Germany

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Russia

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.4.5 Australia

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.6 MEA

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Cape Food Ingredients

- 9.2 Cargill Incorporated

- 9.3 Firmenich

- 9.4 Flavorcon Corporation

- 9.5 Flavaroma

- 9.6 Gold Coast Ingredients

- 9.7 Jamsons Industries

- 9.8 Keva Flavours

- 9.9 LorAnn Oils

- 9.10 M&N Flavor

- 9.11 Panteley Toshev