|

市场调查报告书

商品编码

1666572

卫星地面站市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Satellite Ground Station Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

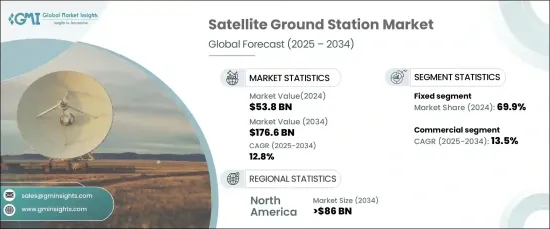

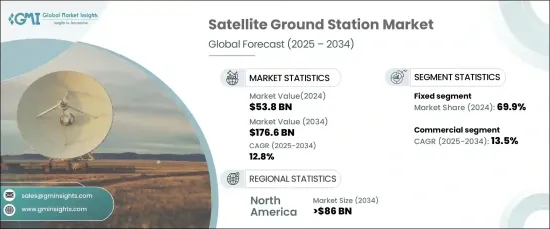

全球卫星地面站市场预计将显着成长,到 2024 年将达到 538 亿美元,预计 2025 年至 2034 年的复合年增长率将达到 12.8%。随着数位媒体的不断扩展,直接到户(DTH)服务、高清广播和 over-the-top(OTT)平台的兴起,对强大的地面站基础设施的需求巨大,以确保无缝通信和高效的资料传输。此外,市场还受益于远端通讯、天气监测和全球定位等用途对卫星系统的日益依赖,进一步推动了对尖端卫星地面站的需求。

技术进步是市场扩张的另一个关键驱动力。高通量卫星(HTS)的引入极大地提高了卫星系统的容量,实现了更快、更可靠的资料传输。除此之外,天线技术和自动化的创新也提高了地面站的性能和运作效率。软体定义网路 (SDN) 和人工智慧 (AI) 的融合彻底改变了这些站的运作方式,引入了预测性维护、即时监控和增强系统适应性等功能。这些技术进步使得卫星地面站能够更好地响应不断变化的通讯需求,并提高其处理大量资料流量的能力,同时保持服务品质。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 538亿美元 |

| 预测值 | 1766亿美元 |

| 复合年增长率 | 12.8% |

按平台类型细分的市场显示,固定地面站在 2024 年占据最大的市场份额,为 69.9%。这些站对于维持电信、广播和地球观测等各种应用领域的持续可靠的卫星通讯至关重要。固定卫星地面站提供安全、高频宽的资料传输,对于需要持续运作的政府、军事和商业用途来说,它们是必不可少的。

在功能方面,通讯领域成长最快,预测期内预期复合年增长率为 13.5%。以通讯为重点的地面站支援卫星电视、网路连线和军事通讯系统等基本服务。这些站确保卫星和地面网路之间的高频宽资料连接,这在传统基础设施有限或不可用的偏远地区尤其重要。

从区域成长来看,北美将主导卫星地面站市场,预计到 2034 年将达到 860 亿美元。先进自动化系统的发展和新卫星星座(特别是低地球轨道(LEO))的兴起进一步扩大了该地区的需求,推动了卫星地面站营运的进一步创新和效率。

目录

第 1 章:方法论与范围

- 市场范围和定义

- 基础估算与计算

- 预测计算

- 资料来源

- 基本的

- 次要

- 付费来源

- 公共资源

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 影响价值链的因素

- 利润率分析

- 中断

- 未来展望

- 製造商

- 经销商

- 供应商概况

- 利润率分析

- 重要新闻及倡议

- 监管格局

- 衝击力

- 成长动力

- 卫星广播服务普及率提高

- 卫星地面站技术不断进步

- 遥感应用对卫星服务的需求不断增长

- 政府推出支持太空研究机构的优惠倡议

- 地球观测影像和分析解决方案的激增

- 产业陷阱与挑战

- 缺乏法规和政府政策

- 持续频宽问题

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第 5 章:市场估计与预测:按解决方案,2021 年至 2034 年

- 主要趋势

- 装置

- 天线系统

- 射频系统

- 资料处理单元

- 遥测追踪与指挥(TT&C)

- 软体

- 地面站即服务 (GSaaS)

第 6 章:市场估计与预测:按平台,2021-2034 年

- 主要趋势

- 固定的

- 便携的

- 手持式

- 袋装式

- 移动的

第 7 章:市场估计与预测:按功能,2021 年至 2034 年

- 主要趋势

- 沟通

- 地球观测

- 太空研究

- 导航

- 其他的

第 8 章:市场估计与预测:按频率,2021 年至 2034 年

- 主要趋势

- L 波段(最高 1 GHz)

- 中频带(1 GHz 至 10 GHz)

- S 波段

- C波段

- X 波段

- 高频频段(10 GHz 至 30 GHz)

- Ku波段

- Ka波段

第 9 章:市场估计与预测:依最终用途,2021 年至 2034 年

- 主要趋势

- 防御

- 军队

- 空军

- 海军

- 政府

- 国土安全

- 公共行政

- 空间研究中心

- 大学和研究实验室

- 商业的

第 10 章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 中东及非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第 11 章:公司简介

- Airbus

- ESS Weathertech

- General Dynamics Mission Systems, Inc.

- Kongsberg Defence& Aerospace

- Kratos Defense & Security Solutions, Inc.

- L3Harris Technologies

- Lockheed Martin Corporation

- Mitsubishi Electric Corporation

- Orbit Communications Systems Ltd.

- Raytheon Technologies Corporation

- Safran Defense & Space, Inc.

- Swedish Space Corporation

- Telespazio SpA

- Thales

- Viasat, Inc.

The Global Satellite Ground Station Market is poised for remarkable growth, reaching USD 53.8 billion in 2024, with projections indicating a strong CAGR of 12.8% from 2025 to 2034. This growth is largely driven by the surge in demand for satellite-based services, especially in the broadcasting and communication sectors. As digital media continues to expand, the rise of direct-to-home (DTH) services, high-definition broadcasting, and over-the-top (OTT) platforms has created a significant need for robust ground station infrastructure to ensure seamless communication and efficient data transmission. Additionally, the market is benefiting from the growing reliance on satellite systems for purposes such as remote communication, weather monitoring, and global positioning, further fueling the demand for cutting-edge satellite ground stations.

Technological advancements are another key driver for market expansion. The introduction of high-throughput satellites (HTS) has dramatically improved the capacity of satellite systems, enabling faster and more reliable data transfers. Alongside this, innovations in antenna technologies and automation have boosted the performance and operational efficiency of ground stations. The integration of software-defined networks (SDN) and artificial intelligence (AI) has revolutionized how these stations operate, introducing capabilities like predictive maintenance, real-time monitoring, and enhanced system adaptability. These technological strides have made satellite ground stations more responsive to evolving communication demands, increasing their ability to handle massive data traffic while maintaining service quality.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $53.8 billion |

| Forecast Value | $176.6 billion |

| CAGR | 12.8% |

Market segmentation by platform type reveals that fixed ground stations held the largest market share in 2024, accounting for 69.9%. These stations are critical for maintaining constant and reliable satellite communications across various applications, including telecommunications, broadcasting, and Earth observation. Fixed satellite ground stations offer secure, high-bandwidth data transmission, making them indispensable for government, military, and commercial use, where continuous operations are a necessity.

On the functional side, the communication segment stands out as the fastest-growing, with a projected CAGR of 13.5% during the forecast period. Communication-focused ground stations support essential services such as satellite TV, internet connectivity, and military communication systems. These stations ensure high-bandwidth data connections between satellites and terrestrial networks, which is especially vital in remote areas where traditional infrastructure is limited or unavailable.

Looking at regional growth, North America is set to dominate the satellite ground station market, with expectations to reach USD 86 billion by 2034. The United States, in particular, is a key player, benefiting from its established space infrastructure, continuous technological advancements, and strong demand for satellite services in communication, broadcasting, and Earth observation. The demand in this region is further amplified by the development of advanced automated systems and the rise of new satellite constellations, particularly in Low Earth Orbit (LEO), driving further innovation and efficiency in satellite ground station operations.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Increased penetration of satellite-based broadcasting services

- 3.6.1.2 Continuous technological advancements in satellite ground stations

- 3.6.1.3 Rising satellite service demand for remote sensing applications

- 3.6.1.4 Favorable government initiatives to support space research agencies

- 3.6.1.5 Proliferation of Earth observation imagery and analytics solutions

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 Lack of regulations and government policies

- 3.6.2.2 Constant bandwidth issues

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Solution, 2021-2034 (USD Million)

- 5.1 Key trends

- 5.2 Equipment

- 5.2.1 Antennas systems

- 5.2.2 RF systems

- 5.2.3 Data processing units

- 5.2.4 Telemetry Tracking and Command (TT&C)

- 5.3 Software

- 5.4 Ground Station as a Service (GSaaS)

Chapter 6 Market Estimates & Forecast, By Platform, 2021-2034 (USD Million)

- 6.1 Key trends

- 6.2 Fixed

- 6.3 Portable

- 6.3.1 Hand-Held

- 6.3.2 Bag-Mounted

- 6.4 Mobile

Chapter 7 Market Estimates & Forecast, By Functions, 2021-2034 (USD Million)

- 7.1 Key trends

- 7.2 Communication

- 7.3 Earth observation

- 7.4 Space research

- 7.5 Navigation

- 7.6 Others

Chapter 8 Market Estimates & Forecast, By Frequency, 2021-2034 (USD Million)

- 8.1 Key trends

- 8.2 L-band (up to 1 GHz)

- 8.3 Medium-frequency bands (1 GHz to 10 GHz)

- 8.3.1 S-band

- 8.3.2 C-band

- 8.3.3 X-band

- 8.4 High-frequency bands (10 GHz to 30 GHz)

- 8.4.1 Ku-band

- 8.4.2 Ka-band

Chapter 9 Market Estimates & Forecast, By End Use, 2021-2034 (USD Million)

- 9.1 Key trends

- 9.2 Defense

- 9.2.1 Army

- 9.2.2 Air-Force

- 9.2.3 Navy

- 9.3 Government

- 9.3.1 Homeland security

- 9.3.2 Public administration

- 9.3.2.1 Space research centers

- 9.3.2.2 Universities and research labs

- 9.4 Commercial

Chapter 10 Market Estimates & Forecast, By Region, 2021-2034 (USD Million)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 Australia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.6 MEA

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Airbus

- 11.2 ESS Weathertech

- 11.3 General Dynamics Mission Systems, Inc.

- 11.4 Kongsberg Defence& Aerospace

- 11.5 Kratos Defense & Security Solutions, Inc.

- 11.6 L3Harris Technologies

- 11.7 Lockheed Martin Corporation

- 11.8 Mitsubishi Electric Corporation

- 11.9 Orbit Communications Systems Ltd.

- 11.10 Raytheon Technologies Corporation

- 11.11 Safran Defense & Space, Inc.

- 11.12 Swedish Space Corporation

- 11.13 Telespazio S.p.A.

- 11.14 Thales

- 11.15 Viasat, Inc.