|

市场调查报告书

商品编码

1666581

混凝土纤维市场机会、成长动力、产业趋势分析与 2025 - 2034 年预测Concrete Fibers Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

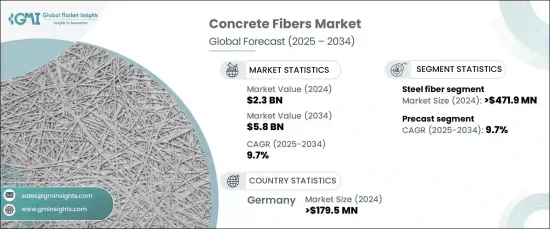

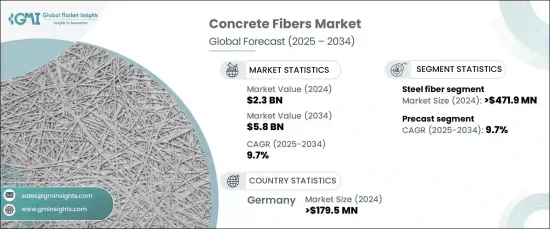

2024 年全球混凝土纤维市场价值为 23 亿美元,并有望实现强劲增长,预计 2025 年至 2034 年期间的复合年增长率为 9.7%。这些纤维,包括合成纤维、钢纤维、玻璃纤维和天然纤维,在提高混凝土的强度、耐久性和抗裂性方面发挥关键作用,使其成为现代建筑实践中不可或缺的一部分。

在建筑业,混凝土纤维被采用来提高住宅、商业和工业建筑的性能和寿命,同时降低维护成本。基础设施项目,特别是道路、桥樑和隧道等对耐久性要求较高的项目,使用纤维增强混凝土来承受重载和恶劣的环境条件。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 23亿美元 |

| 预测值 | 58亿美元 |

| 复合年增长率 | 9.7% |

人们越来越重视可持续且经济高效的建筑解决方案,这推动了对混凝土纤维的需求。这些材料减少了对钢筋等传统加固方法的依赖,符合全球推动绿色建筑实践和城市发展的趋势。发展中地区基础设施现代化和城市化措施也支持混凝土纤维的采用,从而推动了整体市场的扩张。

钢纤维领域在 2024 年创造了 4.719 亿美元的收入,预计到 2034 年的复合年增长率将达到 9%。它们能够取代传统的加固方法,这使得它们在重型建筑中至关重要。

同样,预製混凝土部分在 2024 年的规模为 7.216 亿美元,预计在 2025-2034 年期间的复合年增长率为 9.7%。在预製混凝土中使用纤维增强材料可提高其抗开裂、收缩和环境应力的能力,使其成为需要精确度和耐久性的建筑的首选。

2024 年,德国混凝土纤维市场规模达到 1.795 亿美元,预计到 2034 年复合年增长率为 8.5%。随着建筑技术的进步和对耐用、高效、环保建筑材料的需求不断增加,混凝土纤维市场将在未来几年实现显着成长。

目录

第 1 章:方法论与范围

- 市场范围和定义

- 基础估算与计算

- 预测计算

- 资料来源

- 基本的

- 次要

- 付费来源

- 公共资源

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 影响价值链的因素

- 利润率分析

- 中断

- 未来展望

- 製造商

- 经销商

- 供应商概况

- 利润率分析

- 重要新闻及倡议

- 监管格局

- 衝击力

- 成长动力

- 北美:美国商业建筑业正在復苏

- 亚太地区:建筑业蓬勃发展

- 增加亚太和中东基础建设项目

- 产业陷阱与挑战

- 原物料价格波动

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第 5 章:市场估计与预测:按产品,2021-2034 年

- 主要趋势

- 钢纤维

- 合成纤维

- 聚丙烯

- 尼龙

- 聚酯纤维

- 其他的

- 玻璃纤维

- 天然纤维

- 玄武岩纤维

第 6 章:市场估计与预测:按应用,2021 年至 2034 年

- 主要趋势

- 路面

- 喷射混凝土

- 预製

- 地面上的板坯

- 复合金属甲板

- 其他的

第 7 章:市场估计与预测:依最终用途,2021 年至 2034 年

- 主要趋势

- 住宅

- 工业和商业基础设施

- 道路和桥樑

- 其他的

第 8 章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 中东及非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第九章:公司简介

- BASF SE

- ABC Polymer Industries

- Bekaert SA

- CEMEX SAB de CV

- Fibercon International

- GCP Applied Technologies

- Nycon Corporation

- Owens Corning

- Sika AG

- The Euclid Chemical Company

The Global Concrete Fibers Market was valued at USD 2.3 billion in 2024 and is poised for robust growth, with an estimated CAGR of 9.7% during 2025 - 2034. This surge is attributed to the increasing use of concrete fibers across construction, infrastructure, and industrial applications. These fibers, including synthetic, steel, glass, and natural variants, play a critical role in enhancing the strength, durability, and crack resistance of concrete, making them indispensable in modern construction practices.

In the construction industry, concrete fibers are being adopted to improve the performance and longevity of residential, commercial, and industrial structures while reducing maintenance costs. Infrastructure projects, especially those requiring high durability, such as roads, bridges, and tunnels, use fiber-reinforced concrete to withstand heavy loads and challenging environmental conditions.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.3 Billion |

| Forecast Value | $5.8 Billion |

| CAGR | 9.7% |

A growing emphasis on sustainable and cost-efficient building solutions drives the demand for concrete fibers. These materials reduce reliance on traditional reinforcement methods like steel bars, aligning with the global push toward green construction practices and urban development. The adoption of concrete fibers is also supported by initiatives aimed at infrastructure modernization and urbanization in developing regions, fueling overall market expansion.

The steel fiber segment generated USD 471.9 million in 2024 and is projected to grow at a CAGR of 9% through 2034. Known for their exceptional mechanical properties, high tensile strength, and durability, steel fibers are widely preferred in applications requiring enhanced load-bearing capacity and impact resistance. Their ability to replace conventional reinforcement methods makes them vital in heavy-duty construction.

Similarly, the precast concrete segment accounted for USD 721.6 million in 2024 and is forecasted to grow at a 9.7% CAGR during 2025-2034. Using fiber reinforcement in precast concrete improves its resistance to cracking, shrinkage, and environmental stress, making it a preferred choice for construction requiring precision and durability.

Germany concrete fibers market recorded USD 179.5 million in 2024, with an expected CAGR of 8.5% through 2034. Its strong construction sector, focus on sustainable practices, and significant infrastructure investments contribute to its leading position. With advancements in construction technologies and increasing demand for durable, efficient, and eco-friendly building materials, the concrete fibers market is set to achieve remarkable growth in the coming years.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 North America: Recovering U.S. commercial construction industry

- 3.6.1.2 Asia Pacific: Growing construction industry

- 3.6.1.3 Increasing Asia pacific and Middle east infrastructure projects

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 Fluctuating raw material prices

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Product, 2021-2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Steel fibers

- 5.3 Synthetic fibers

- 5.3.1 Polypropylene

- 5.3.2 Nylon

- 5.3.3 Polyester

- 5.3.4 Others

- 5.4 Glass fibers

- 5.5 Natural fibers

- 5.6 Basalt fibers

Chapter 6 Market Estimates & Forecast, By Application, 2021-2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Pavement

- 6.3 Shotcrete

- 6.4 Precast

- 6.5 Slabs on grade

- 6.6 Composite metal decks

- 6.7 Others

Chapter 7 Market Estimates & Forecast, By End Use, 2021-2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Residential

- 7.3 Industrial & commercial infrastructure

- 7.4 Roads & bridges

- 7.5 Others

Chapter 8 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 Germany

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Russia

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.4.5 Australia

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.6 MEA

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 BASF SE

- 9.2 ABC Polymer Industries

- 9.3 Bekaert SA

- 9.4 CEMEX S.A.B. de C.V.

- 9.5 Fibercon International

- 9.6 GCP Applied Technologies

- 9.7 Nycon Corporation

- 9.8 Owens Corning

- 9.9 Sika AG

- 9.10 The Euclid Chemical Company