|

市场调查报告书

商品编码

1666629

智慧徽章市场机会、成长动力、产业趋势分析与 2025 - 2034 年预测Smart Badge Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

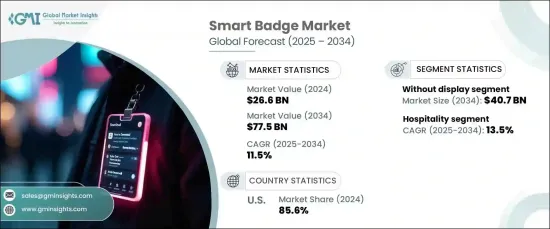

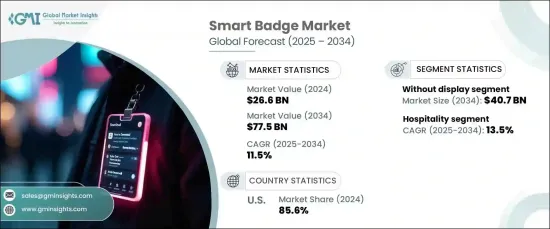

2024 年全球智慧徽章市场价值为 266 亿美元,预计 2025 年至 2034 年期间将以 11.5 %的强劲复合年增长率扩张。支援物联网的智慧徽章配有先进的侦测器和无线连接,使组织能够准确地追踪员工的活动、监控工作时间并以无与伦比的精度管理存取等级。

智慧徽章正在成为增强工作场所安全性和营运效率不可或缺的工具。透过提供管理人员存取的安全方法,他们大大降低了未经授权进入的风险。各行各业都在采用这些徽章作为存取控制、劳动力管理和遵守不断发展的安全协议的可靠解决方案。对无缝和自动化系统不断增长的需求进一步推动了市场的扩张,智慧徽章在现代化识别和追踪流程中发挥核心作用。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 266亿美元 |

| 预测值 | 775亿美元 |

| 复合年增长率 | 11.5% |

智慧徽章市场分为两种类型:带显示器的徽章和不带显示器的徽章。由于无显示徽章简单且具有成本效益,预计到 2034 年将产生 407 亿美元的收入。同时,带有显示器的徽章提供增强的功能,例如即时资讯显示、通知和用户识别。这些在医疗保健、公司办公室和活动等领域尤其有价值,因为即时沟通和资料视觉化至关重要。具有显示功能的徽章配备 LED 或电子墨水萤幕,使用户可以一目了然地查看警报、状态更新和关键资料,以支援专业环境中的互动式动态参与。

在应用方面,智慧徽章在企业、饭店、活动和会议、政府和医疗保健等各个领域越来越受欢迎。酒店业预计将实现最快的成长,2025 年至 2034 年之间的复合年增长率为 13.5%。组织正在利用智慧徽章来简化员工进入限制区域的权限,同时改善劳动力管理。透过将这些徽章整合到更广泛的安全系统中,公司可以即时监控员工位置和工作时间,从而提高效率和安全性。对营运优化和可扩展识别解决方案的日益重视推动了大型企业对智慧徽章的需求不断增长。

2024 年,美国占据了全球智慧徽章市场 85.6% 的份额,反映出先进安全和劳动力管理技术的广泛采用。由于企业、政府和教育等领域对私人门禁控制的需求强劲,生物识别和支援物联网的智慧徽章的需求持续增长。市场受益于持续的技术进步和领先技术公司的支援。然而,严格的资料隐私法规(例如 GDPR)带来了挑战,推动了对安全且合规的解决方案的需求,以有效解决这些问题。

目录

第 1 章:方法论与范围

- 市场范围和定义

- 基础估算与计算

- 预测计算

- 资料来源

- 基本的

- 次要

- 付费来源

- 公共资源

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 影响价值链的因素

- 利润率分析

- 中断

- 未来展望

- 製造商

- 经销商

- 供应商概况

- 利润率分析

- 重要新闻及倡议

- 监管格局

- 衝击力

- 成长动力

- 物联网 (IoT) 技术的应用日益广泛

- 对增强安全解决方案的需求不断增长

- 智慧徽章功能的技术进步

- 对劳动力管理解决方案的需求日益增长

- 转向非接触式和卫生解决方案

- 产业陷阱与挑战

- 初始设定和维护成本高

- 隐私和资料安全问题

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第 5 章:市场估计与预测:依通讯方式,2021 年至 2034 年

- 主要趋势

- 接触

- 非接触式

第 6 章:市场估计与预测:按类型,2021 年至 2034 年

- 主要趋势

- 带显示器的智慧徽章

- 无显示幕的智慧徽章

第 7 章:市场估计与预测:按应用,2021 年至 2034 年

- 主要趋势

- 公司的

- 饭店业

- 活动和会议

- 政府和医疗保健

- 其他的

第 8 章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 中东及非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第九章:公司简介

- Abeeway

- Aioi-Systems Co., Ltd.

- ASSA ABLOY

- Beamian

- Brady Worldwide, Inc.

- Canon Inc.

- CardLogix Corporation

- Cisco.

- Dorma+Kaba Holdings AG

- Evolis

- Giesecke+Devrient GmbH

- HID Global

- IDEMIA

- Johnson Controls

- Kaba

- Kontakt.io

- Sber

- Seiko Solutions Inc.

- Thales Group

- ThinkWill

- Xerox Corporation

- Zebra Technologies Corporation

The Global Smart Badge Market was valued at USD 26.6 billion in 2024 and is projected to expand at a robust CAGR of 11.5% from 2025 to 2034. This growth is driven by the increasing integration of the Internet of Things (IoT) into smart badge technology, transforming their capabilities to enable real-time data exchange and monitoring. IoT-enabled smart badges with advanced detectors and wireless connectivity allow organizations to accurately trace employee movements, monitor work hours, and manage access levels with unparalleled precision.

Smart badges are becoming indispensable tools for enhancing workplace security and operational efficiency. By providing secure methods for managing personnel access, they significantly reduce the risk of unauthorized entry. Industries across the board are adopting these badges as reliable solutions for access control, workforce management, and compliance with evolving security protocols. The rising demand for seamless and automated systems further fuels the market's expansion, with smart badges playing a central role in modernizing identification and tracking processes.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $26.6 Billion |

| Forecast Value | $77.5 Billion |

| CAGR | 11.5% |

The smart badge market is categorized into two types: badges with display and those without display. Badges without display are anticipated to generate USD 40.7 billion in revenue by 2034, owing to their simplicity and cost-effectiveness. Meanwhile, badges with display offer enhanced functionality, such as real-time information display, notifications, and user identification. These are particularly valuable in sectors like healthcare, corporate offices, and events, where immediate communication and data visualization are essential. Featuring LED or e-ink screens, display-enabled badges allow users to view alerts, status updates, and critical data at a glance, supporting interactive and dynamic engagement in professional environments.

In terms of application, smart badges are gaining traction across diverse sectors, including corporate, hospitality, events and conferences, government, and healthcare. The hospitality sector is poised for the fastest growth, with a CAGR of 13.5% between 2025 and 2034. In corporate environments, these badges are revolutionizing access control, attendance tracking, and user identification. Organizations are leveraging smart badges to streamline employee access to restricted areas while simultaneously improving workforce management. By integrating these badges into broader security systems, companies can monitor employee locations and working hours in real-time, enhancing both efficiency and safety. The increasing emphasis on operational optimization and scalable identification solutions drives the rising demand for smart badges in large enterprises.

In 2024, the U.S. accounted for an impressive 85.6% of the global smart badge market share, reflecting the widespread adoption of advanced security and workforce management technologies. With strong demand for private access control across sectors such as corporate, government, and education, biometric and IoT-enabled smart badges are in continuous demand. The market benefits from ongoing technological advancements and support from leading technology firms. However, stringent data privacy regulations, such as GDPR, pose challenges, driving the need for secure and compliant solutions to address these concerns effectively.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Increasing adoption of IoT (Internet of Things) technologies

- 3.6.1.2 Rising demand for enhanced security solutions

- 3.6.1.3 Technological advancements in smart badge features

- 3.6.1.4 Growing need for workforce management solutions

- 3.6.1.5 Shift toward contactless and hygienic solutions

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 High initial setup and maintenance costs

- 3.6.2.2 Privacy and data security concerns

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Communication, 2021-2034 (USD Million)

- 5.1 Key trends

- 5.2 Contact

- 5.3 Contactless

Chapter 6 Market Estimates & Forecast, By Type, 2021-2034 (USD Million)

- 6.1 Key trends

- 6.2 Smart badges with display

- 6.3 Smart badges without display

Chapter 7 Market Estimates & Forecast, By Application, 2021-2034 (USD Million)

- 7.1 Key trends

- 7.2 Corporate

- 7.3 Hospitality

- 7.4 Events and conferences

- 7.5 Government and healthcare

- 7.6 Others

Chapter 8 Market Estimates & Forecast, By Region, 2021-2034 (USD Million)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 Germany

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Russia

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.4.5 Australia

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.6 MEA

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Abeeway

- 9.2 Aioi-Systems Co., Ltd.

- 9.3 ASSA ABLOY

- 9.4 Beamian

- 9.5 Brady Worldwide, Inc.

- 9.6 Canon Inc.

- 9.7 CardLogix Corporation

- 9.8 Cisco.

- 9.9 Dorma+Kaba Holdings AG

- 9.10 Evolis

- 9.11 Giesecke+Devrient GmbH

- 9.12 HID Global

- 9.13 IDEMIA

- 9.14 Johnson Controls

- 9.15 Kaba

- 9.16 Kontakt.io

- 9.17 Sber

- 9.18 Seiko Solutions Inc.

- 9.19 Thales Group

- 9.20 ThinkWill

- 9.21 Xerox Corporation

- 9.22 Zebra Technologies Corporation